Sheepish finish to 2024 for processors

Sheep Processor Trading Conditions Model

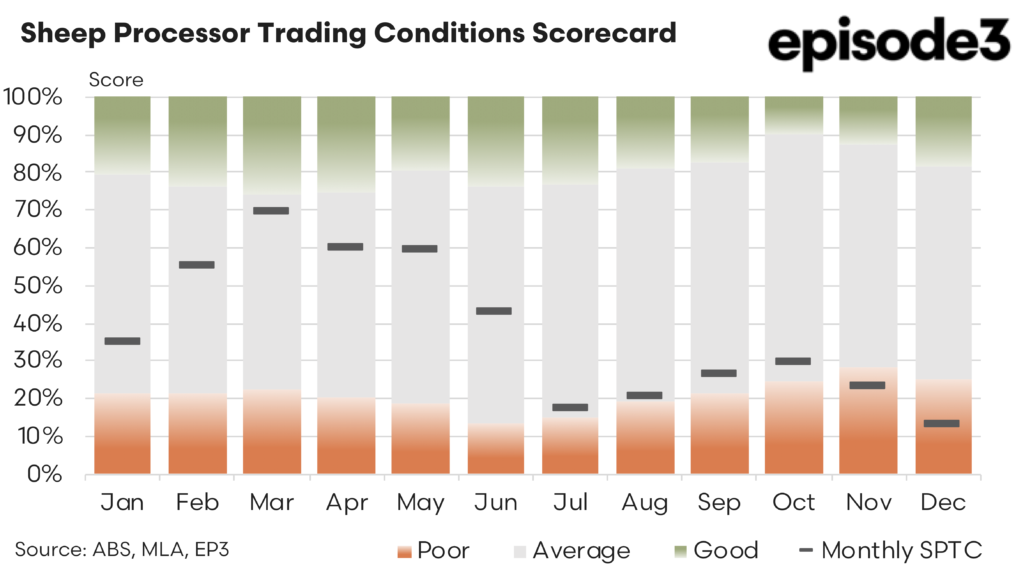

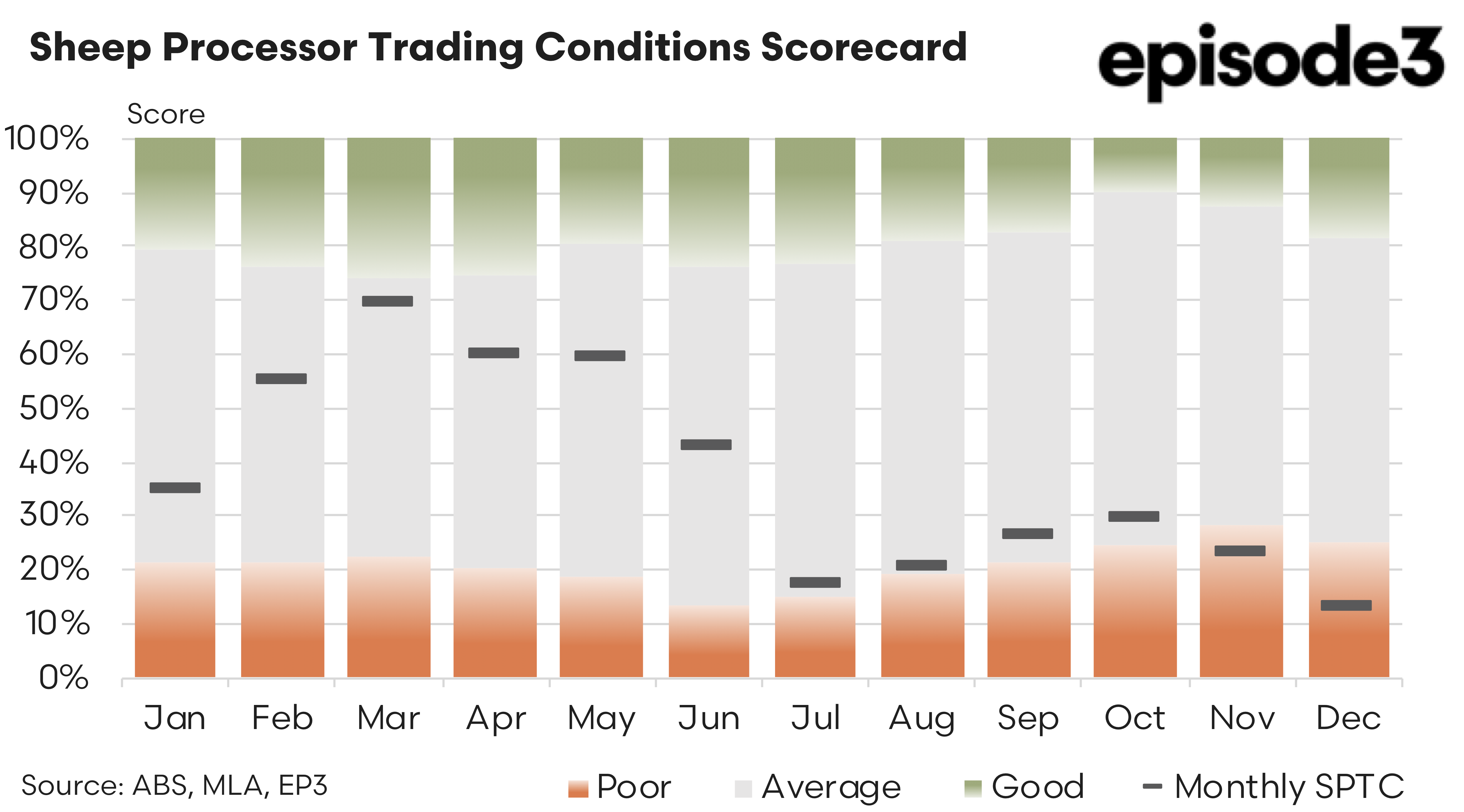

The Sheep Processor Trading Conditions (SPTC) Index concluded 2024 at a significantly low level, recording a score of just 13% in December, a further decline from 23% in November. This marks a considerable downturn compared to the annual average for 2024, which stood at 38%.

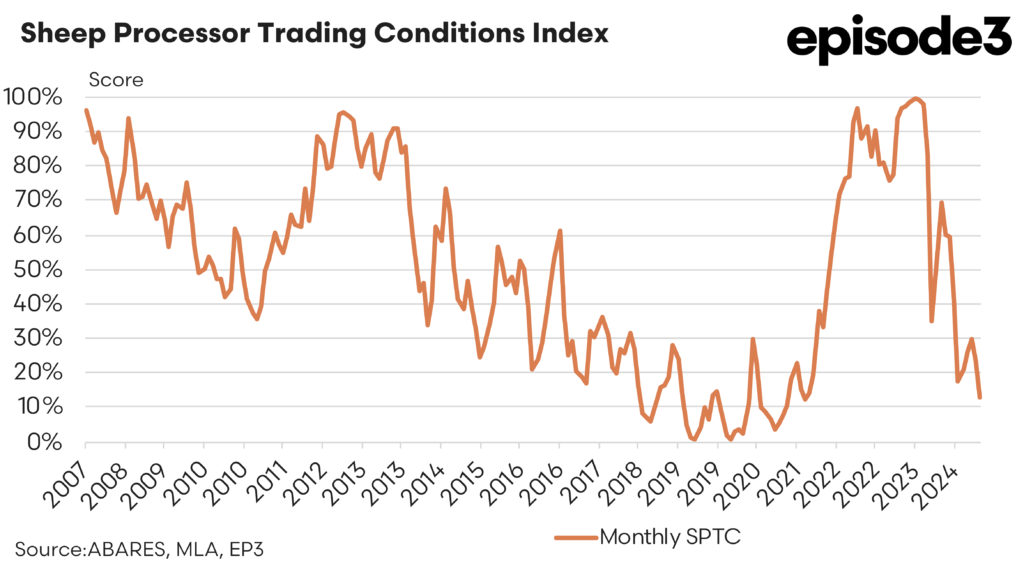

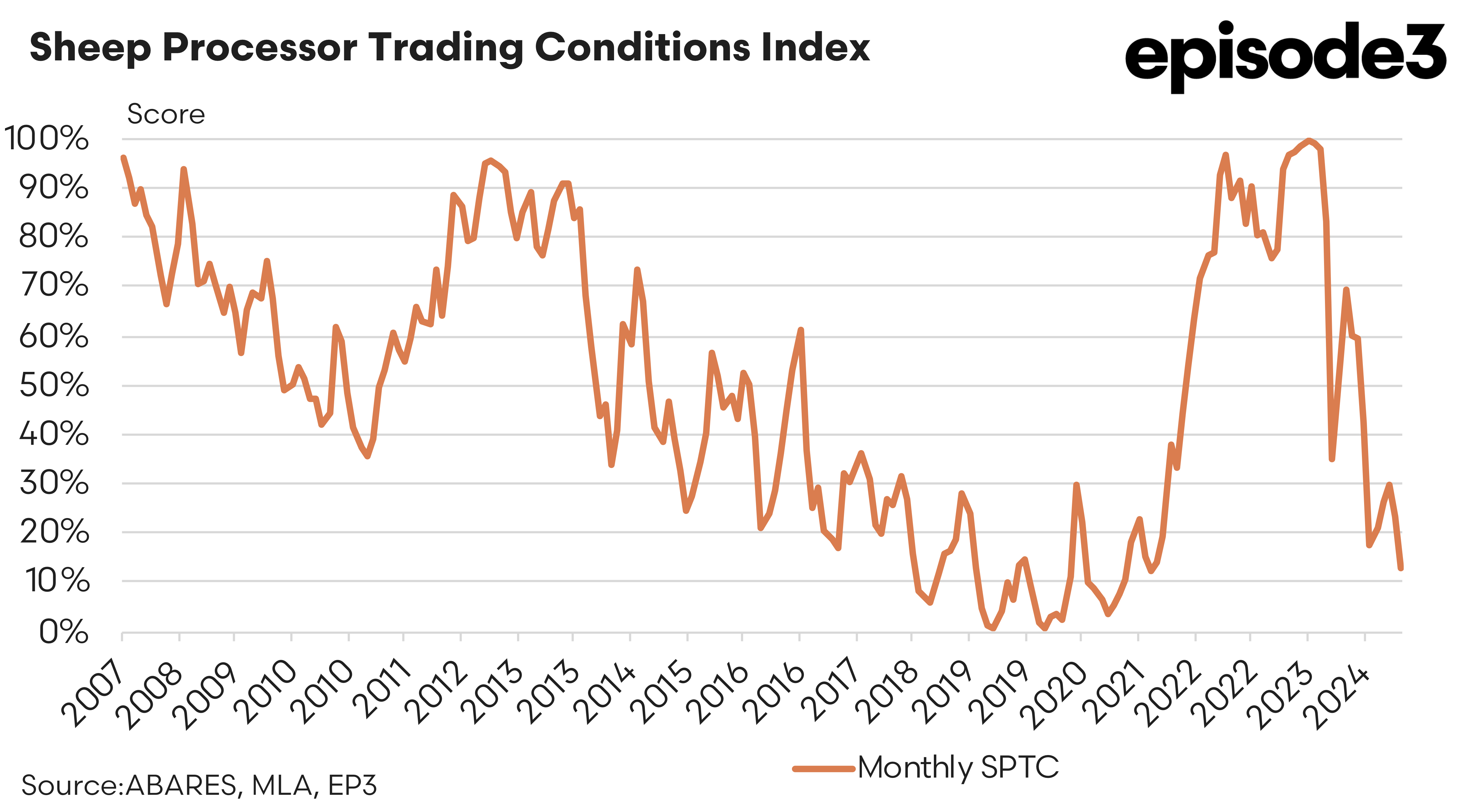

The contrast with 2023 is stark, where the SPTC Index averaged a robust 90%, reflecting a period of exceptionally favourable conditions for processors. Given that the SPTC operates similarly to a rainfall decile system, the shift from 90% to 38% is akin to moving from an extremely wet decile 9 season to a much drier, below-average decile 4 event. This decline underscores the extent of the deterioration in trading conditions for sheep processors over the past year.

The transition from 2023 to 2024 saw a significant reversal in processor fortunes. The previous year had provided processors with strong trading conditions, supported by lower input costs and buoyant export demand. This was particularly evident in the last quarter of 2023 when livestock prices for sheep and lamb at the saleyard tumbled to uncharacteristically low levels as producer fears over a potential El Nino spooked the local livestock market.

However, 2024 presented a much different scenario, where mounting costs and stagnating returns squeezed processor margins considerably. While the year began with relative stability, with the SPTC score peaking in March at 70%, the trading environment worsened steadily from July onwards. By the latter half of the year, conditions had declined to such an extent that processors found themselves grappling with severely diminished profitability.

An examination of key input variables that influence the SPTC Index provides insight into the downturn. Between March and December 2024, the cost of purchasing lamb and sheep for processing surged by 47%, on average, according to the key Meat & Livestock Australia (MLA) indicators.

This sharp rise in input costs outpaced the growth in revenue sources, creating a substantial financial strain. During the same period, export earnings from key trading partners, such as China, the United States, Malaysia, and the UAE, rose by only 17%, failing to keep pace with escalating livestock costs. Similarly, average co-product price values, which provide additional revenue streams for processors, increased by a meagre 4%. Even within the domestic market, the retail price of lamb grew by 18%, a positive movement but insufficient to offset the rapidly rising acquisition costs for sheep meat processors.

The fundamental issue in 2024 was the significant erosion of processor margins. With procurement costs rising at a far greater rate than revenue streams, processors struggled to maintain profitability. The disparity between rising input costs and relatively modest revenue increases meant that processors had little room to manoeuvre. This financial pressure was exacerbated by broader economic challenges, including increased operating expenses in energy and labour, further constraining processor profitability. The rising operational costs also limited investment in technology and efficiency improvements, which could have otherwise helped processors mitigate losses.

The trend observed throughout 2024 also aligns with the historical inverse relationship between sheep processor trading conditions and farm profitability. When processor conditions are strong, it is often a sign that livestock prices are subdued, benefiting processors but presenting challenges for producers. Conversely, when processor conditions weaken, it usually signals that livestock prices have strengthened, improving farm profitability but creating difficulties for processors. The 2024 experience reflected this dynamic, with high livestock prices translating to improving farmgate returns in the second half of the year, but leaving processors with minimal margins. Indeed, December 2024 saw an uncharacteristic rally in the National Trade Lamb Indicator to well over 900 cents before the markets closed for the Christmas break.

Looking ahead, the outlook for 2025 will depend on how these key variables shift. If livestock prices stabilise or ease slightly while export and domestic market returns improve, processors may find some relief. However, if input costs remain elevated and revenue streams do not see substantial gains, the sector may continue to face challenging trading conditions. The SPTC Index serves as a crucial tool in tracking these dynamics, providing valuable insights into the evolving landscape of sheep meat processing in Australia.

It is also worth considering how global economic conditions will impact the industry in 2025. Inflationary pressures, trade policies, and shifting consumer preferences in key markets may influence demand for Australian sheep meat exports. Processors may need to explore diversification strategies, including alternative revenue streams and efficiency improvements, to navigate another potentially difficult year.