Market Morsel: Depressed wheat market

Market Morsel

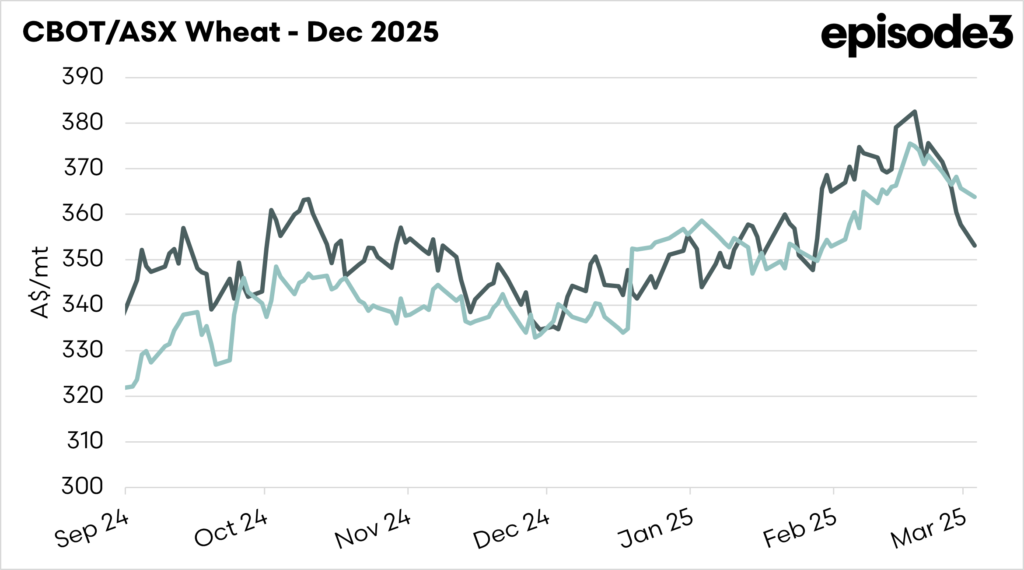

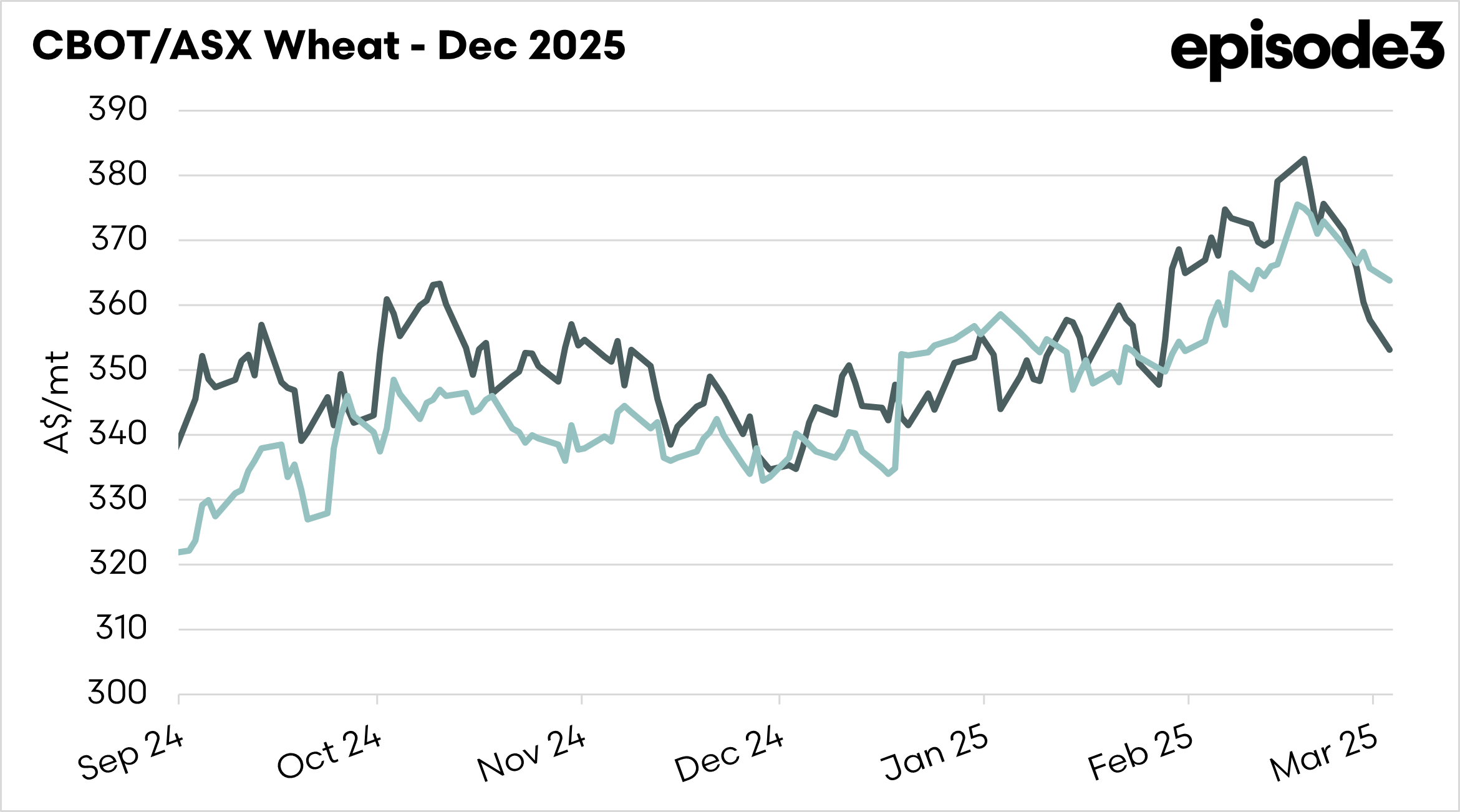

The wheat market has been coming under pressure in recent times. On the 18th of February, CBOT wheat for our coming harvest was trading at A$382, it is now back to A$353, a A$29 drop.

There has been very little fundamental news in the wheat market to drive it either way.

A large chunk of the move has been concerned about trade tensions, which has put traders on a somewhat risk-off approach. The potential of a North American trade war between US, Canada and Mexico, along with retaliatory tariffs from China to the US has many spooked. Trade flows are changing, and that leaves concerns.

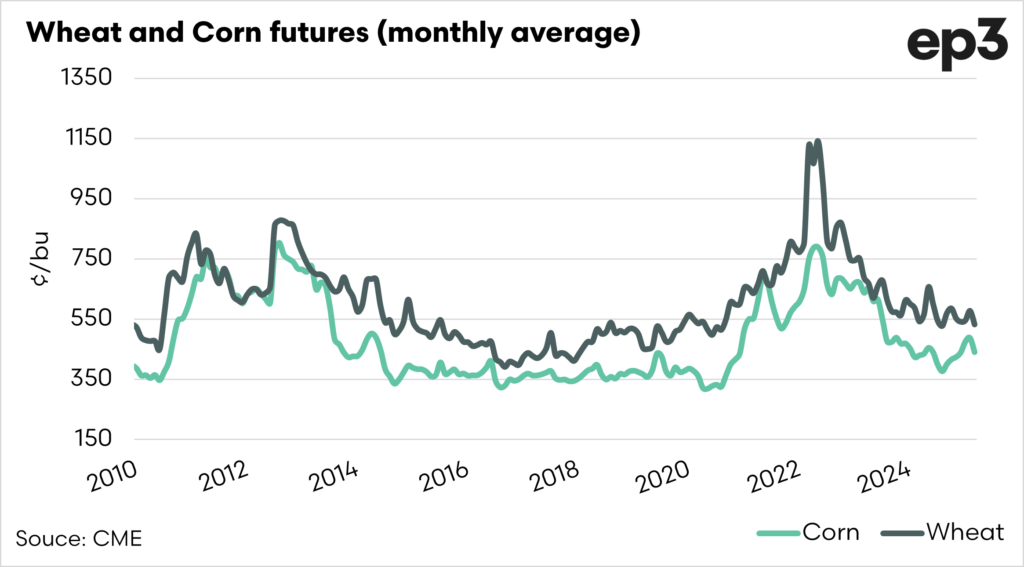

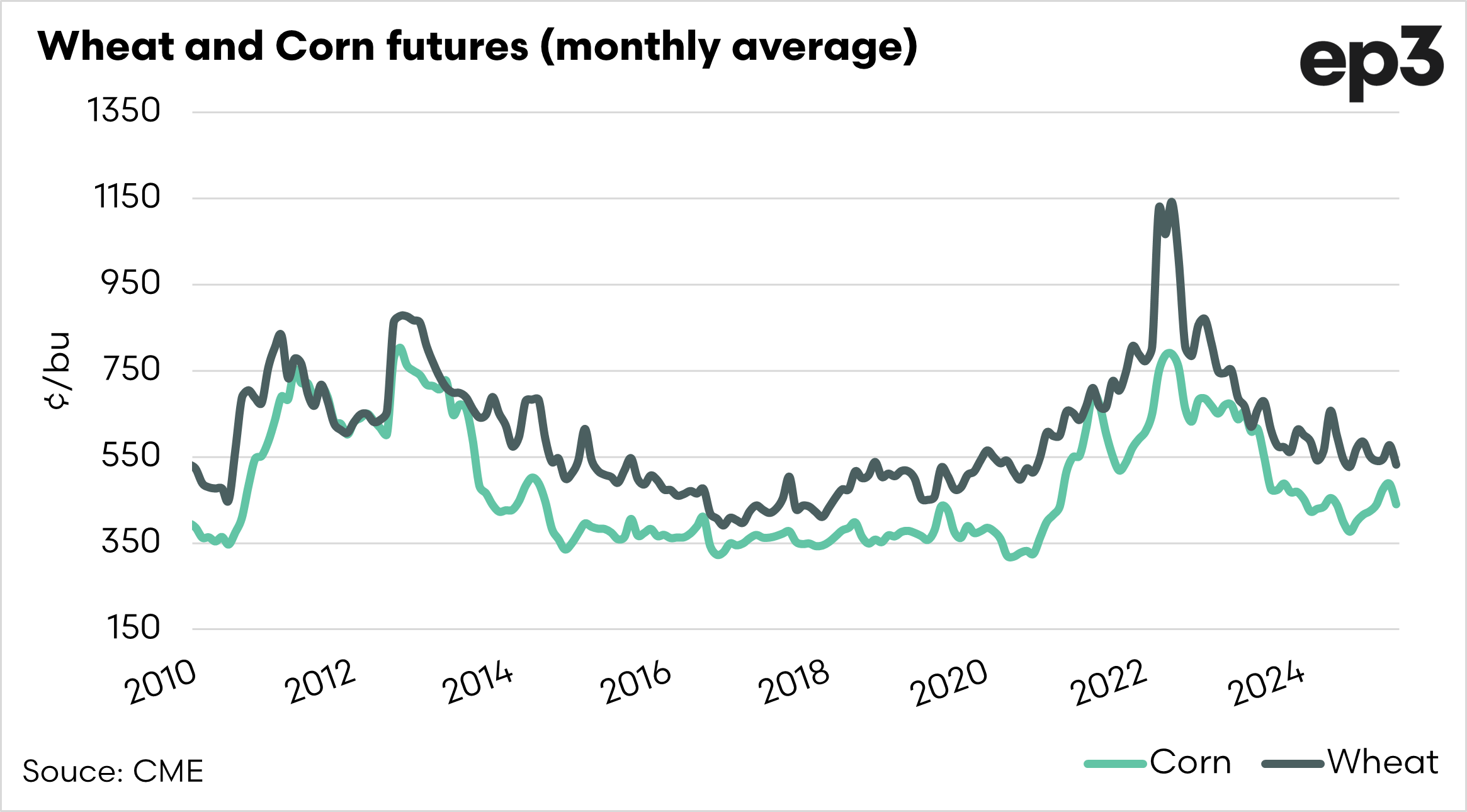

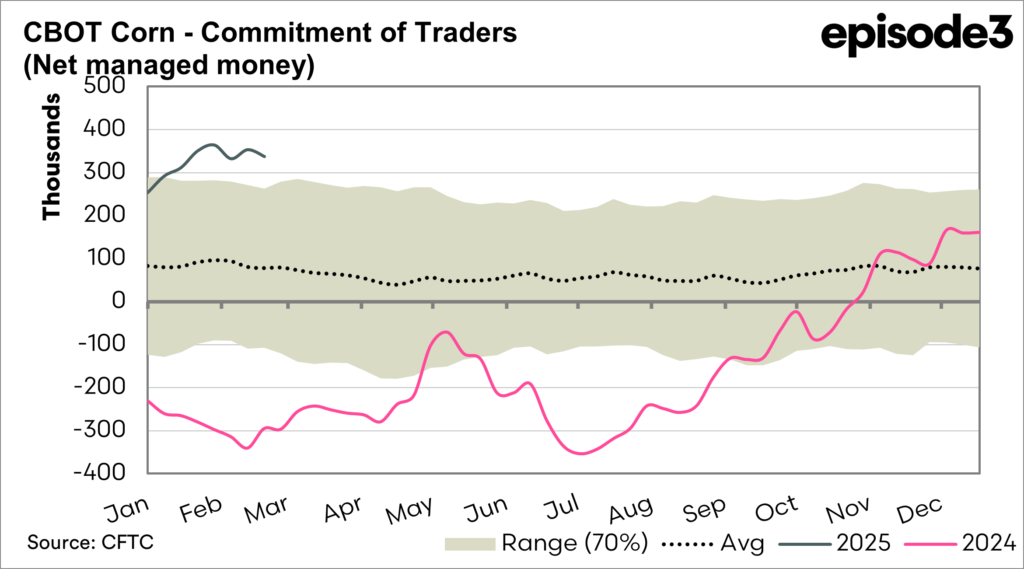

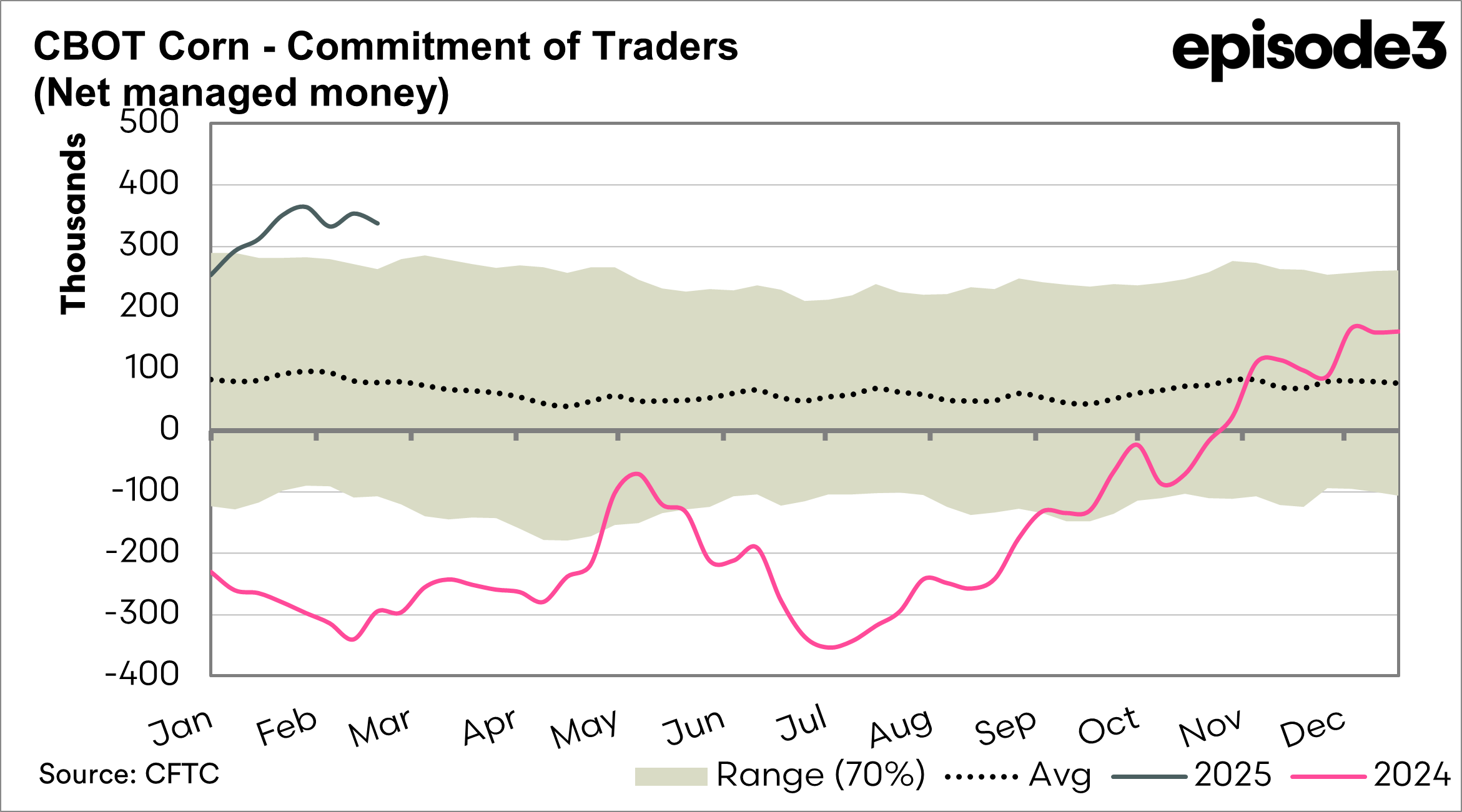

Corn is one of the other concerns. Corn and wheat follow each other with a strong correlation. This is due to the fact that in many applications, they can replace each other.

Brazil is on track to produce a record-breaking crop, which will weigh heavily on pricing. At the same time, speculators have been buying contracts for corn with the view that the market would rally further.

We often talk about short covering, where a speculator needs to buy into the market to cover their short positions. This can cause the market to rally quickly. At the moment, long liquidation is the risk.

Long liquidation occurs when traders sell off their previously purchased assets to exit their positions, often due to falling prices, margin calls, or shifting market sentiment. This selling pressure can accelerate price declines.

In this very uncertain market, volatility may start to increase.