The ebbs and flows of grain and grass

Market Morsel

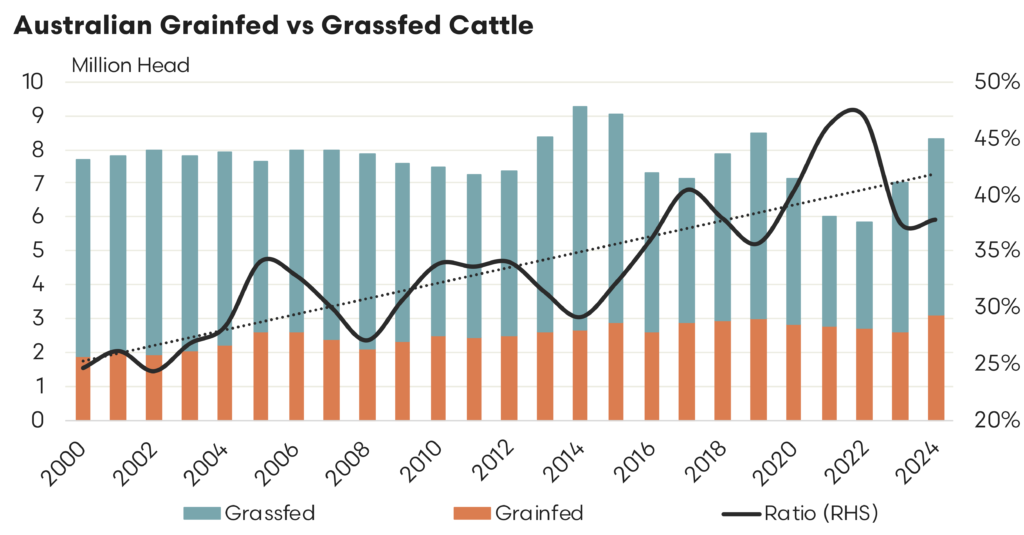

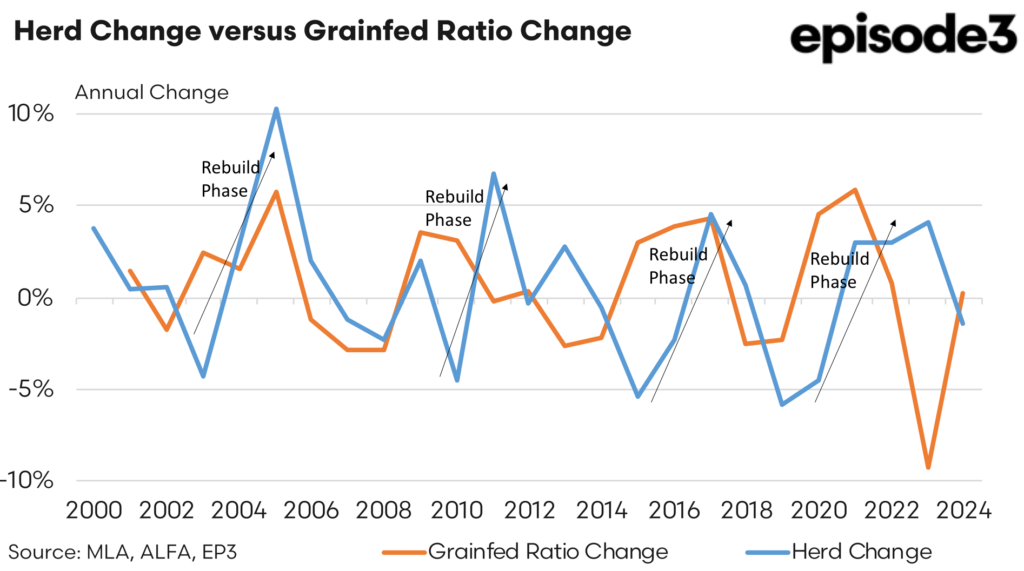

Often when we update the cattle on feed analysis each quarter we finish with the chart below that shows the proportion of cattle turned off annually that are grass finished versus those that are grain finished. As the chart highlights we also include a ratio calculation of the percentage proportion of grain-fed turnoff.

One clear take away from the grain-fed ratio is the clear growth in the cattle on feed sector and the increased promotion of grain finished cattle over time, rising from around 25% in the early 2000s to about 38% presently. However, a more nuanced look at the ratio shows that there is also somewhat of a boom/bust cycle of peaks and troughs in the ratio as the trend increases over time. Indeed, back in the depths of the last herd rebuild in 2021/22 we saw the ratio extend towards 46% as (relatively speaking) more grass-fed cattle were held onto during the rebuild phase.

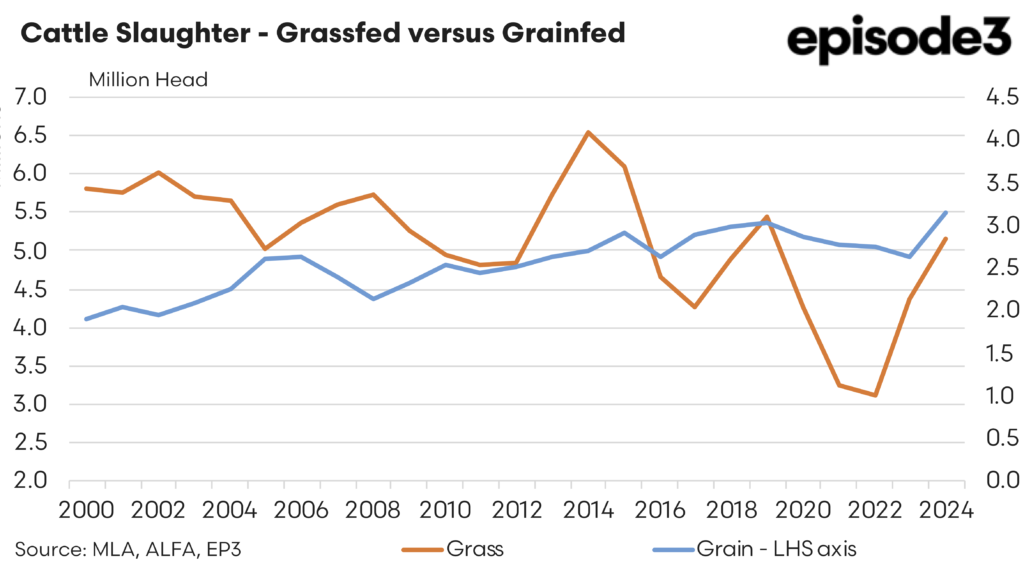

Analysis of the annual turnoff of grain-fed versus grass-fed since 2000 highlights this phenomena very clearly as seen in the chart above. We can see that over time the amount of grain-fed turnoff has risen steadily from around 2 million head per annum to 3 million head in more recent times. The growth in the cattle of feed sector over time has seen the numbers increase, but they are relatively stable when compared to the annual variation seen in grass-fed slaughter numbers. Indeed, since 2000 the grass-fed annual turnoff has ranged between 3 million to 6.5 million head, depending on where we are in the cattle cycle and how good or bad seasonal conditions are in cattle rearing regions of the country.

For example, the 2014/15 drought saw grass-fed slaughter peak at 6.5 million head and the 2016/17 rebuild phase saw it drop to just below 4.5 million head. The legacy of the millennial drought (particularly bad in 2001/02) saw elevated grassfed slaughter for the early 2000s and a very dry phase impacting SA/VIC/NSW and southern QLD in 2006/07 saw grass fed slaughter elevated once again. Meanwhile a much wetter 2010/11 period and a wetter 2021/2022 saw the grass fed slaughter dip to a low ebb in response to herd rebuild activity.

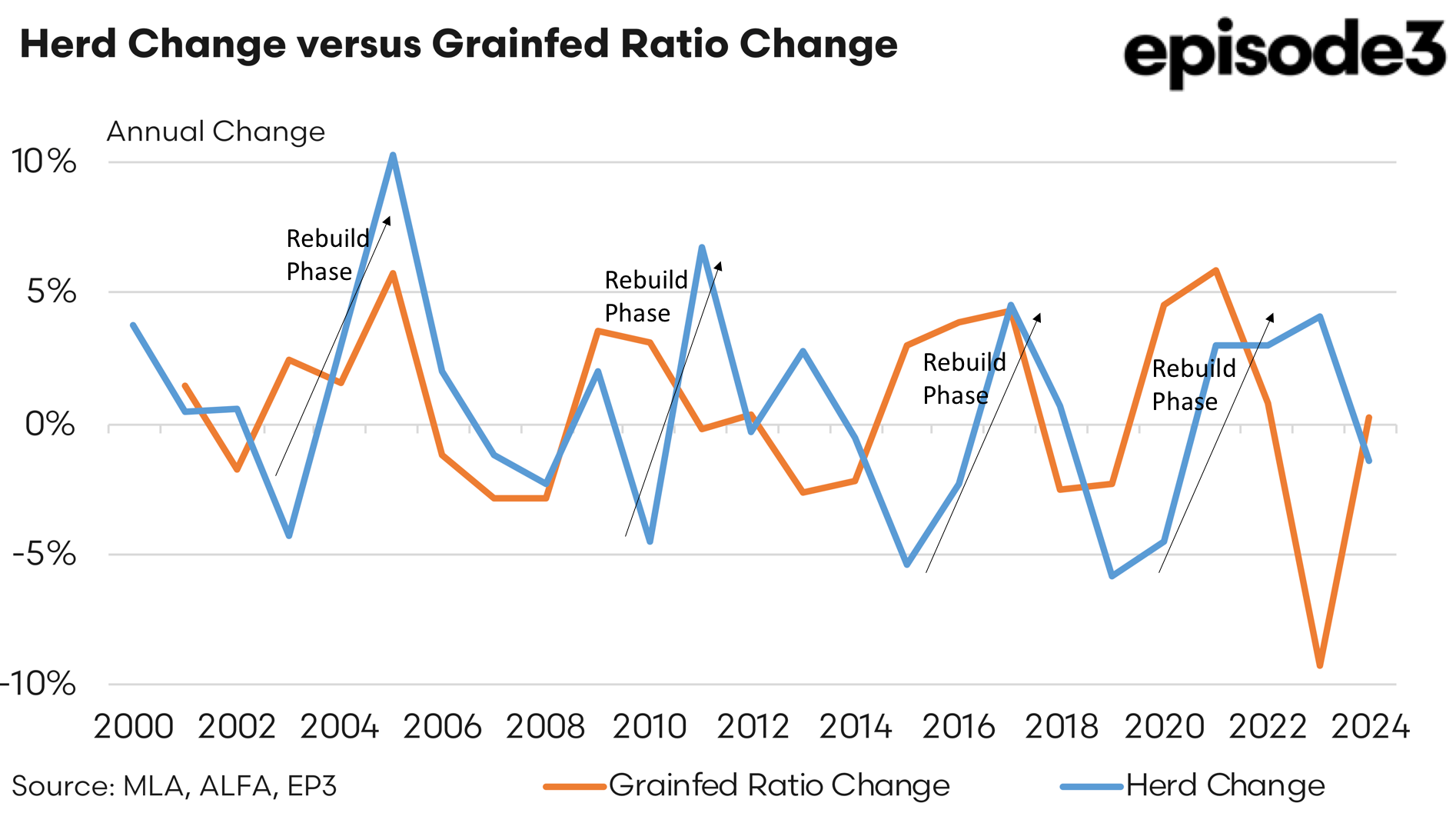

The ebbs and flows of grass versus grain cattle sector is something we have seen at least since the 2000s. It is not a new cycle or some kind of industry restructure that has occurred just in the last decade. As the chart below demonstrates reasonably clearly when comparing the change in the grainfed-ratio each year versus the change in the Australian herd numbers. A move to herd rebuild, due to more favourable seasonal conditions, promotes higher retention of cattle (particularly those that are grass finished when compared to the reasonably steady grain-fed turnoff numbers each year). So it stands to reason that the grainfed ratio will begin to rise as the herd swings into a rebuild phase and the ratio will tend to decrease somewhat as the herd goes into a liquidation phase.

The cattle feedlot sector has done a fabulous job of growth over the last 25 years and the steady increase in this method of cattle finishing is incredibly useful as it highlights how we can, as an industry, take more control over our beef production and cattle supply trends. Premium grain finished beef are a key component to our huge export markets in prominent markets like Japan, South Korea and China.

But the grass fed sector of the Australian cattle industry is an integral part of the system, and as this article outlines from September 2024, as a cattle sector we can focus on more than one growth opportunity at a time. I’d like to think we can chew gum and walk.