Why is China hoarding grains and other commodities?

The Snapshot

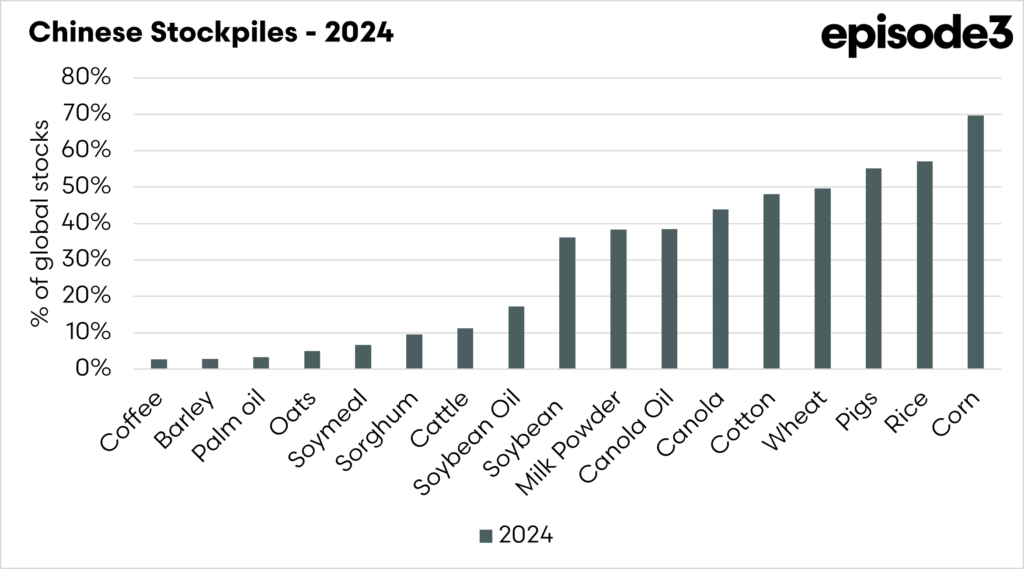

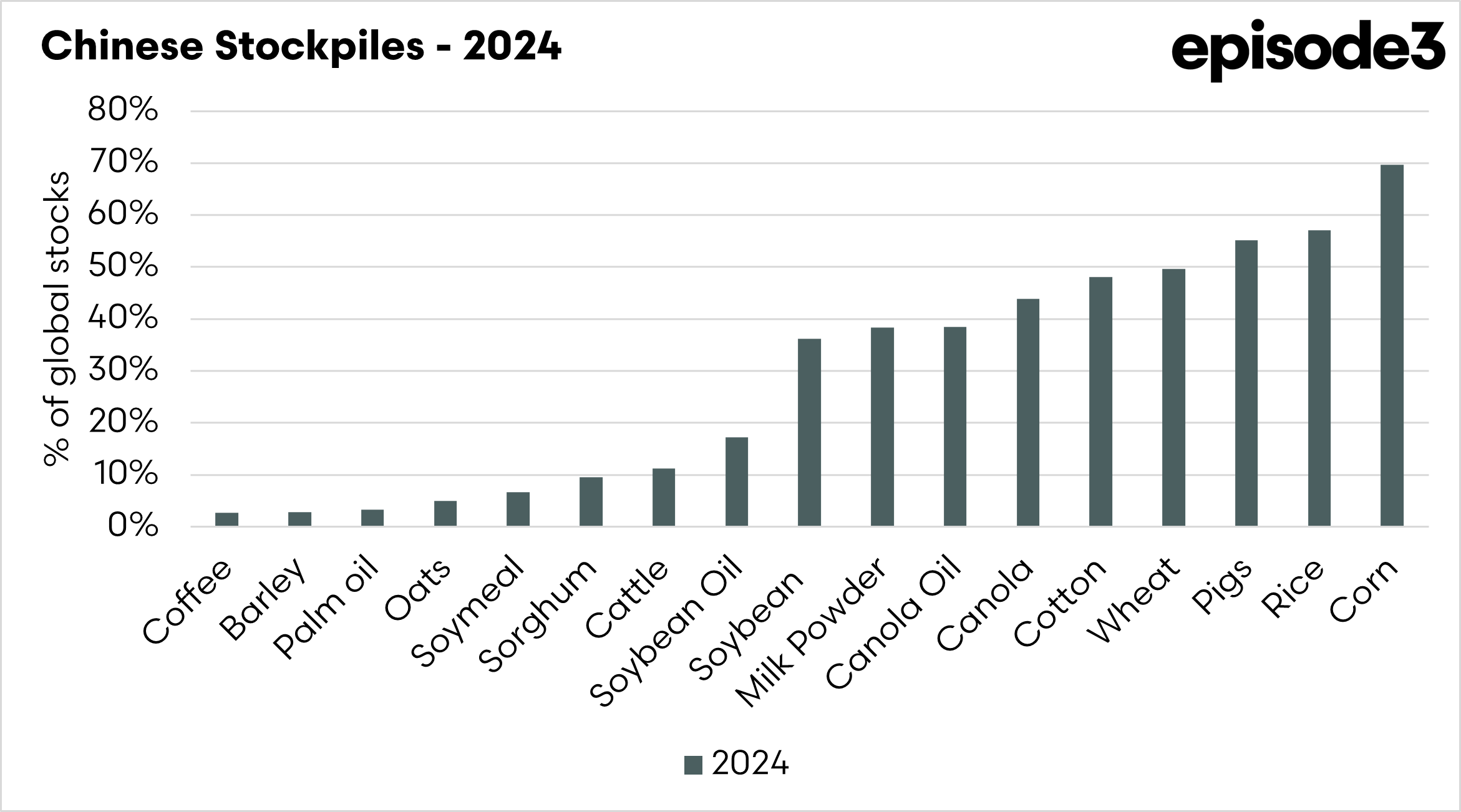

- China is hoarding key commodities like grain, soybeans, pork, and seed oils for stability.

- Food security is a priority, shaped by past famines.

- China holds 50%+ of global wheat and rice, 70% of corn reserves.

- China can use these stockpiles to influence pricing.

- When prices get too high they release stockpiles onto the domestic market.

The Detail

China’s enormous stockpiles of agricultural commodities—from grain and soybeans to pork and cooking oil—have become a defining feature of the global food trade. While much of the world operates on a just-in-time supply model, China takes a different approach, hoarding vast reserves to protect against price swings, geopolitical tensions, and climate shocks.

As the world’s largest importer of food and agricultural products, China’s buying and hoarding habits influence global prices, creating ripple effects for farmers and consumers worldwide. But what drives this strategy, and how does it shape global markets?

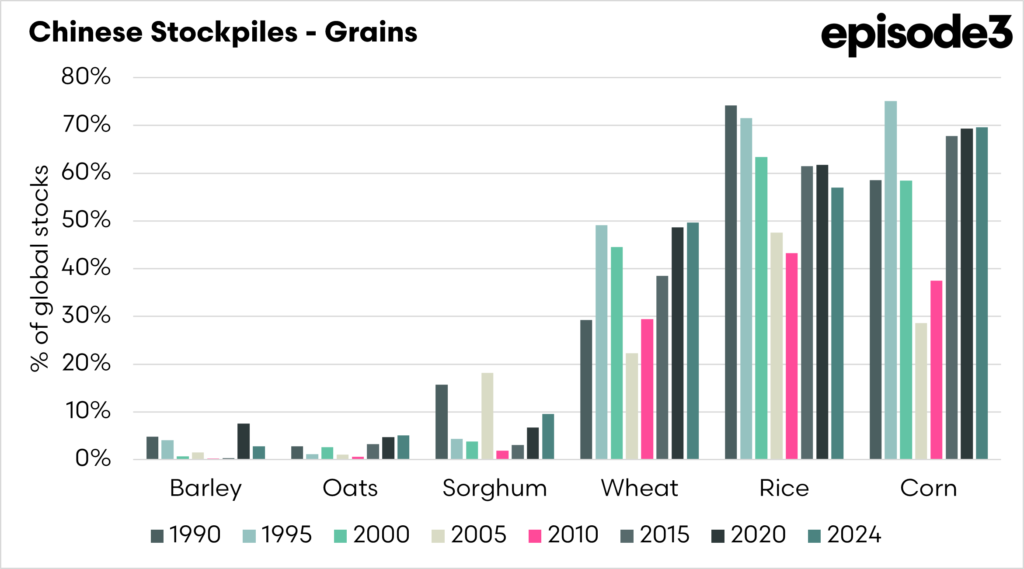

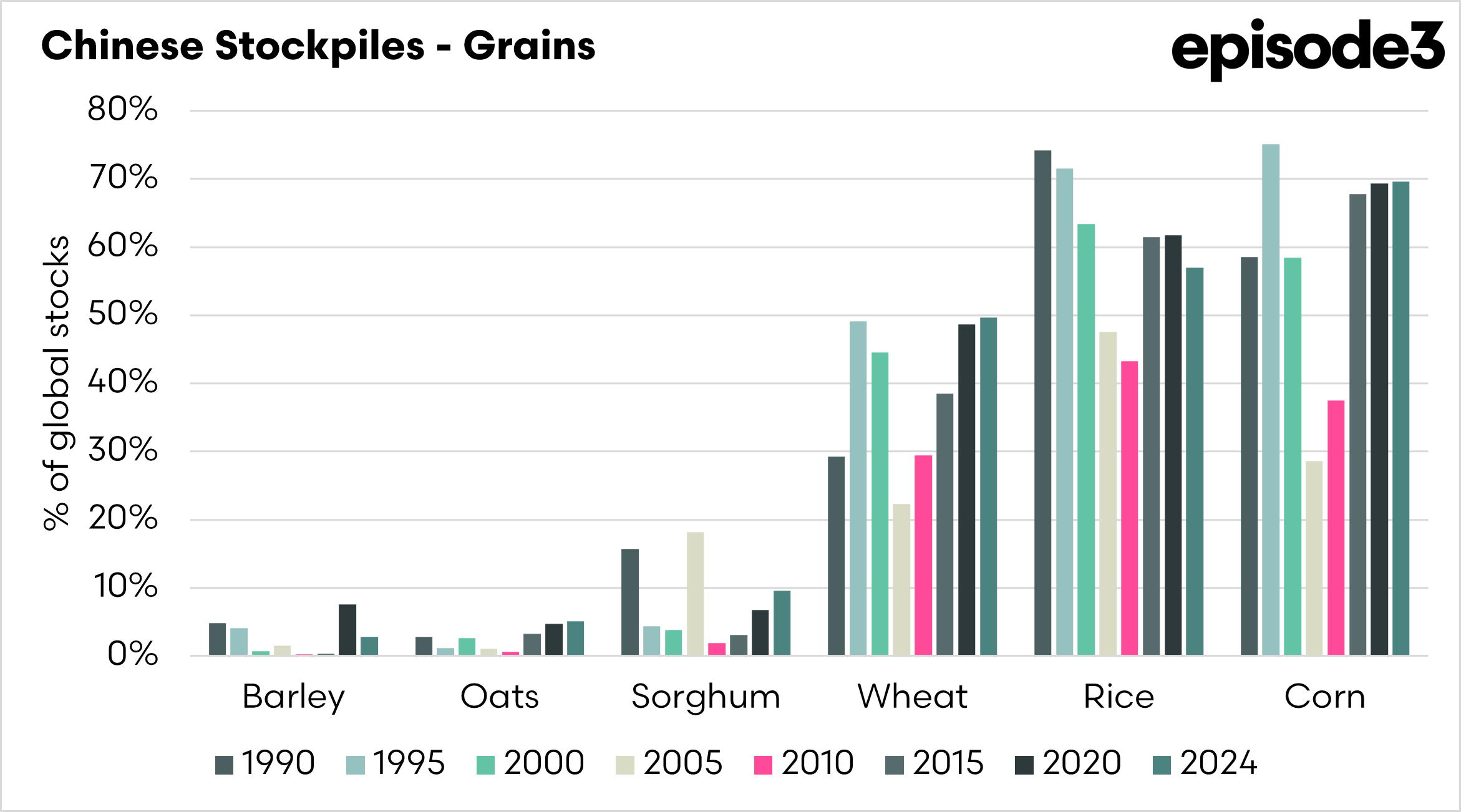

China’s approach to food security is shaped by its past. The country has faced devastating famines, most notably during the Great Leap Forward in the late 1950s and early 1960s, when millions died due to food shortages. Since then, the government has made food security a top priority, ensuring that supplies remain stable regardless of external disruptions.

This is something that is easily achievable in what is a democratic dictatorship.

At the heart of this effort is the National Grain and Material Reserve Bureau, which oversees massive wheat, corn, and rice stockpiles. China, on paper, holds more than 50% of the world’s wheat and rice reserves and nearly 70% of the global corn supply. These reserves act as a buffer against crop failures, trade disputes, and price spikes, ensuring that domestic markets remain stable even when global supplies are tight.

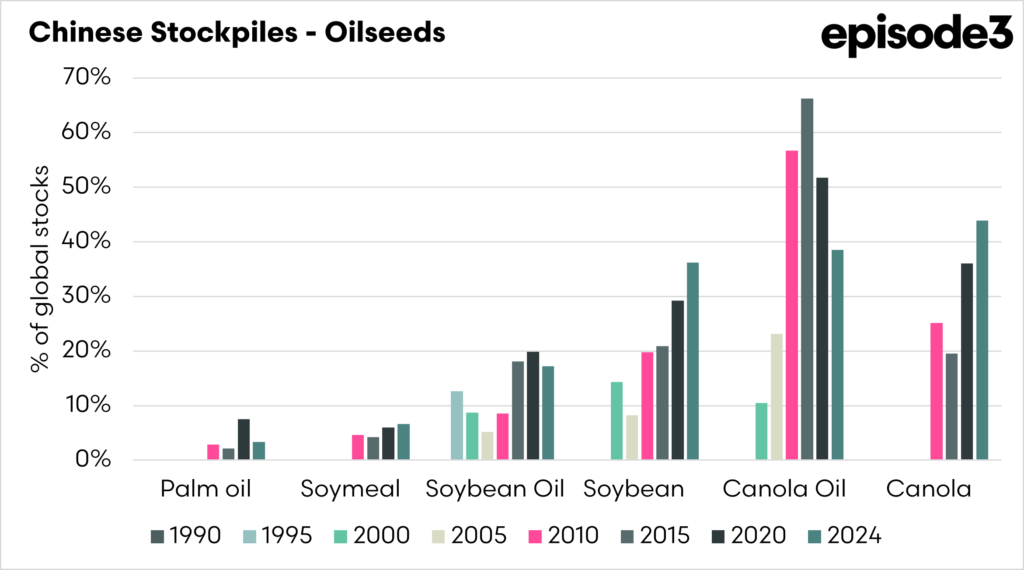

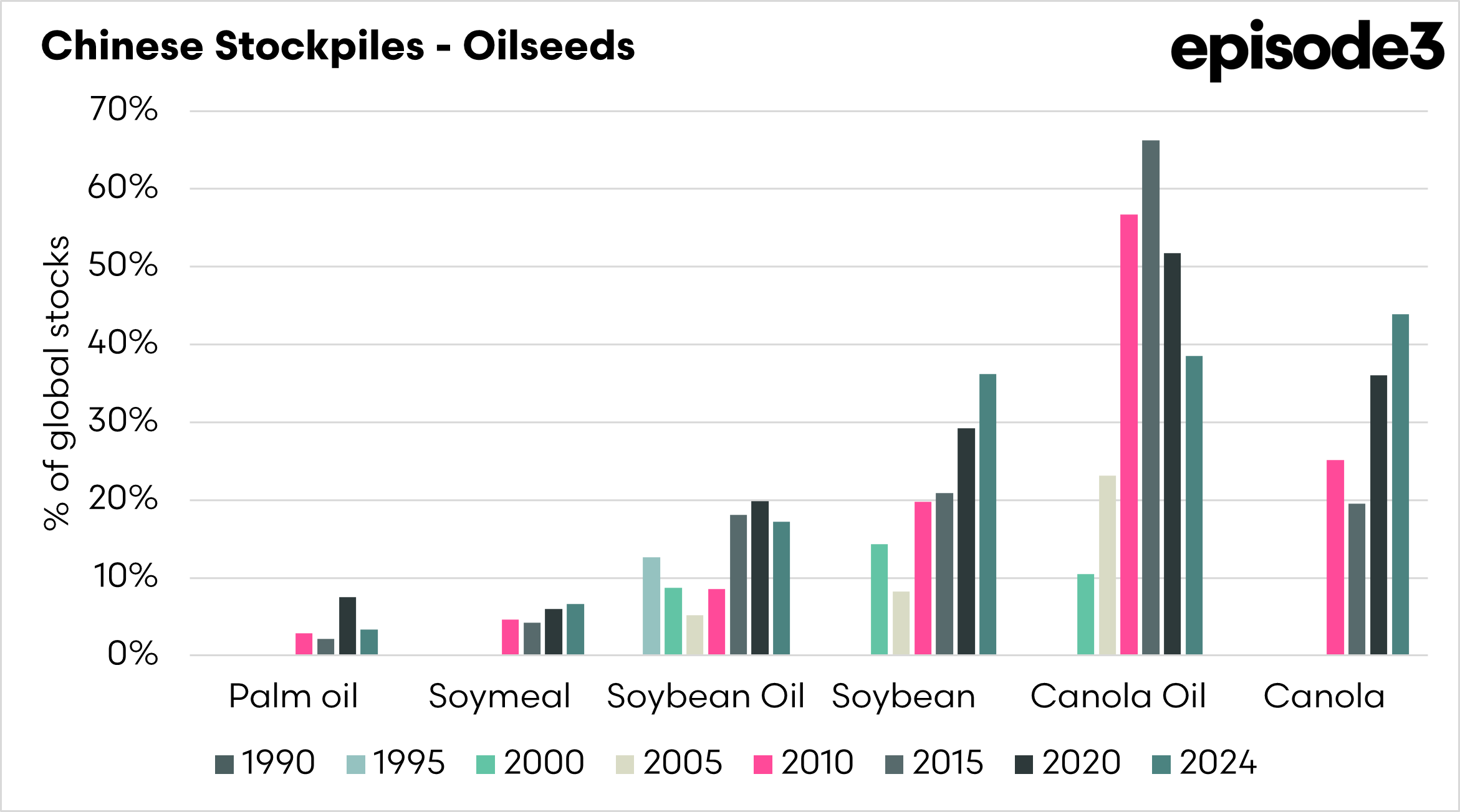

China’s hoarding habits extend beyond grains to soybeans, a critical ingredient in animal feed and cooking oil. As the world’s largest soybean importer, China sources most of its supply from Brazil and the United States, making it vulnerable to trade tensions and weather disruptions in these regions.

During the U.S.-China trade war, Beijing dramatically increased its soybean reserves, fearing potential supply cuts. At the same time, the government pushed for greater domestic soybean production to reduce dependence on imports. Despite these efforts, China still relies heavily on foreign soybeans and maintains large reserves to hedge against supply risks.

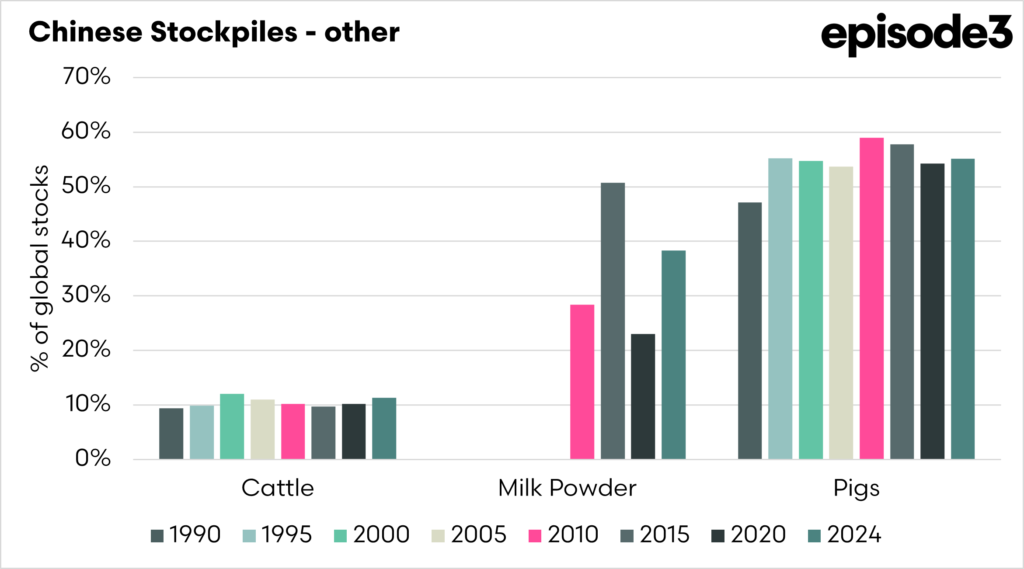

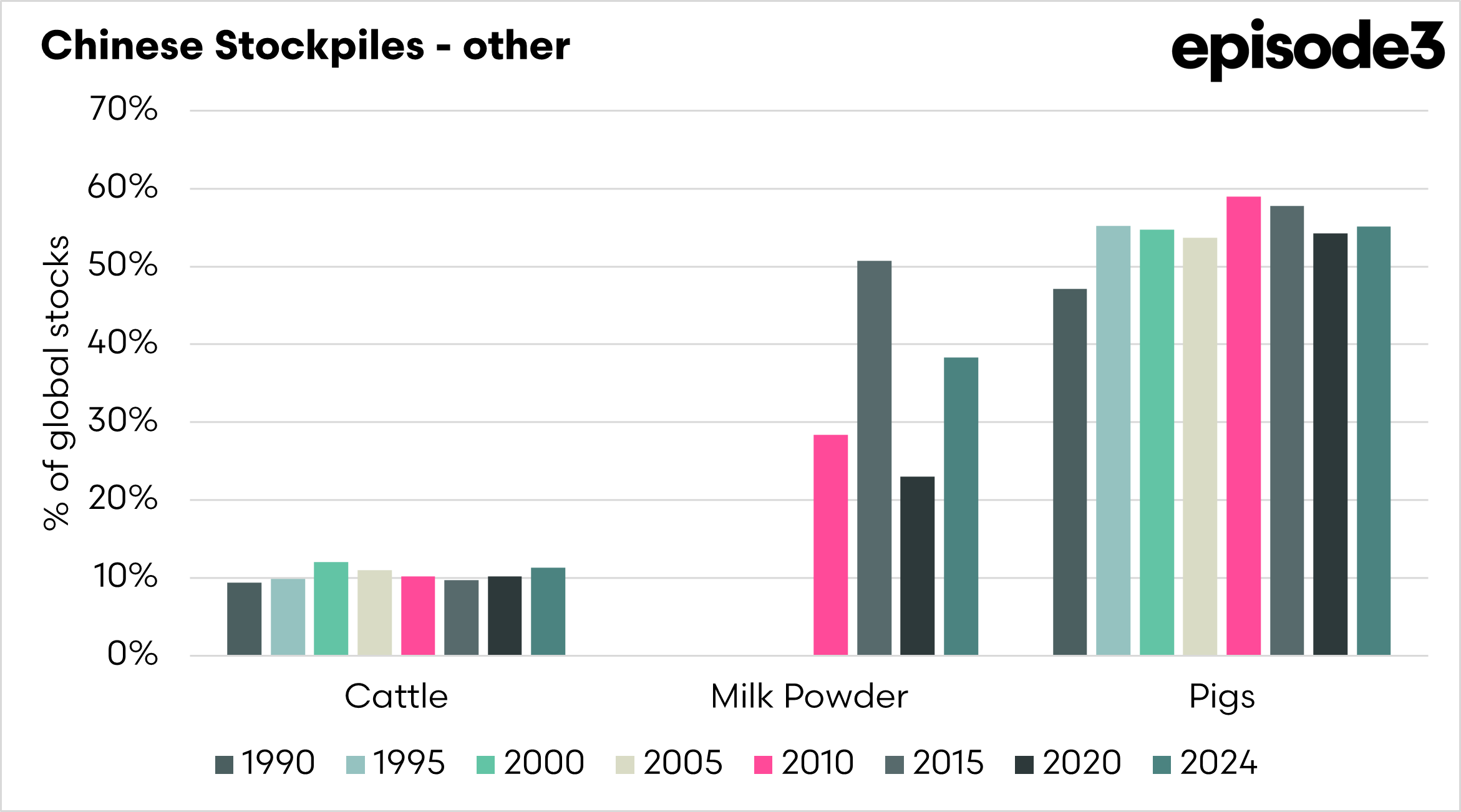

Pork is also safeguarded from global shocks. Pork is a staple of the Chinese diet, and the country consumes more of it than any other nation. However, China’s pork industry has been rocked by major disruptions, particularly African Swine Fever (ASF), which wiped out nearly half of its pig population in 2018-2019.

To counter such shocks, China maintains a strategic pork reserve, a government-controlled stockpile of frozen meat that can be released into the market during shortages. This reserve system allows authorities to stabilise prices and prevent food inflation from spiralling out of control.

It’s not just limited to agricultural commodities. China’s stockpiling of iron ore is a key part of its strategy to secure raw materials for its massive steel industry, which underpins the country’s infrastructure and manufacturing sectors. As the world’s largest steel producer, China relies heavily on iron ore imports, particularly from Australia and Brazil.

To mitigate supply risks and price volatility, state-owned enterprises and steel mills accumulate large reserves when prices are low, ensuring a steady supply during market disruptions or geopolitical tensions. This strategy stabilises domestic production and gives China leverage in negotiations with major suppliers. In times of slowing demand, Beijing has also used its stockpiles to curb price spikes, releasing reserves to cool overheating markets and maintain control over industrial costs.

What does it mean?

China maintains huge reserves of various commodities to allow the nation to weather storms, which could be the economic impact of tariffs or conflict.

These reserves also have the capacity to be used to drive markets by opening the valve on reserves when prices get too high, allowing some level of market manipulation.

Due to these large stockpiles, China is much better prepared than most other countries to weather the uncertainty of the coming years. This compares to Australia, which only had 27 days of diesel on hand at the most recent update.

The real worst-case scenario is that this stockpiling is a sign of war preparation. In a conflict, trade routes may be blocked or embargoes imposed. Stockpiling ensures a nation has enough food, fuel, and industrial materials to sustain its economy and military. Stockpiles act as a buffer to this. China

China has consistently and repeatedly stated that reunification with Taiwan is inevitable. The US has never guaranteed they will defend Taiwan, and I would bet that the Trump administration would not step in to protect them.

In the end, their hoarding can protect them from famine, market forces, tariff wars and actual conflicts.