On the mend

Sheep Processor Trading Conditions Model

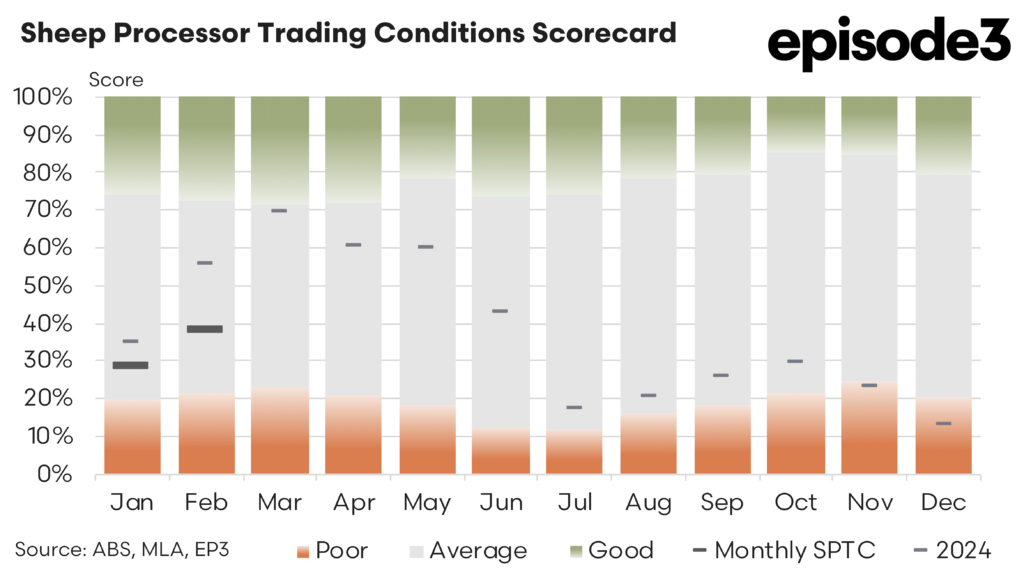

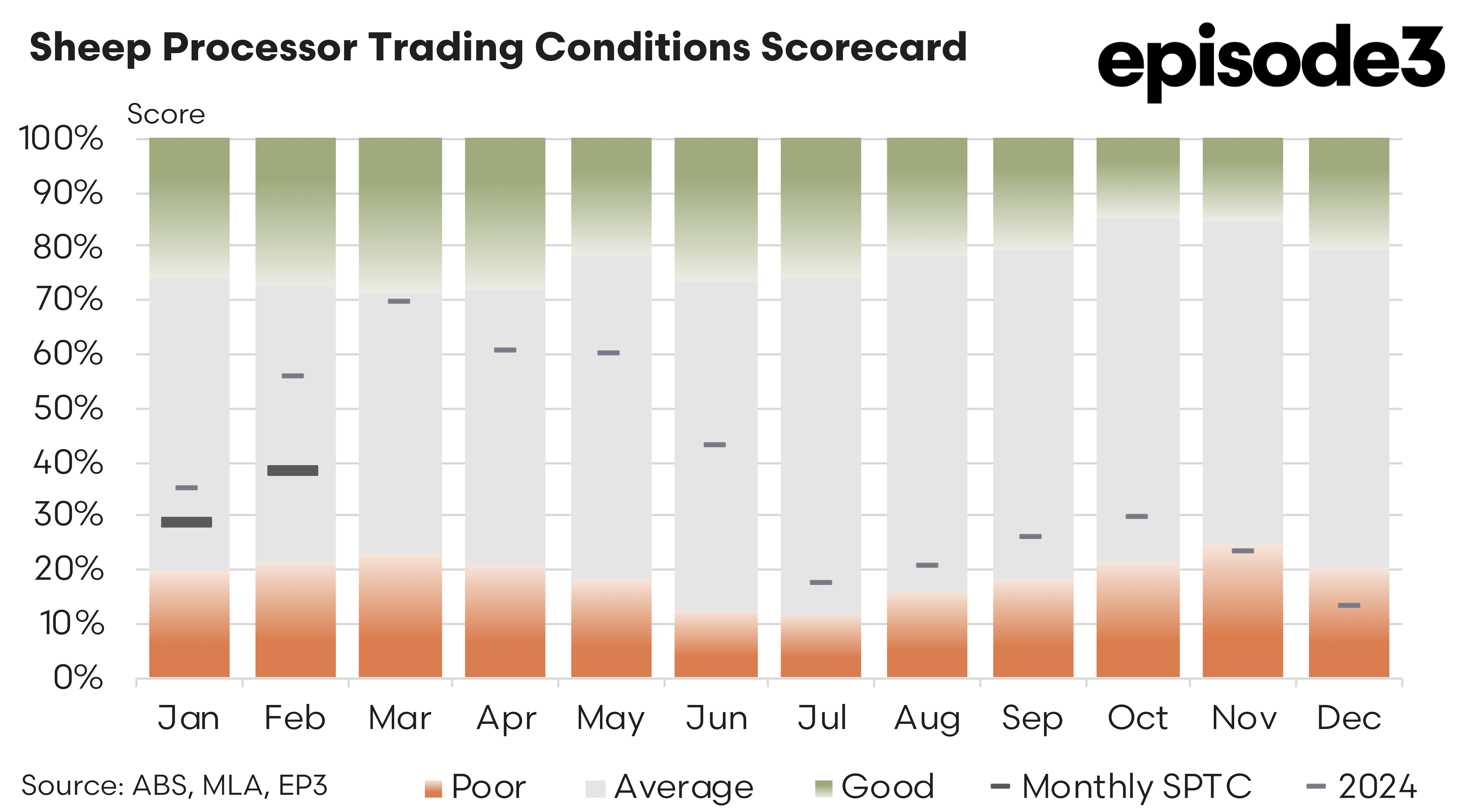

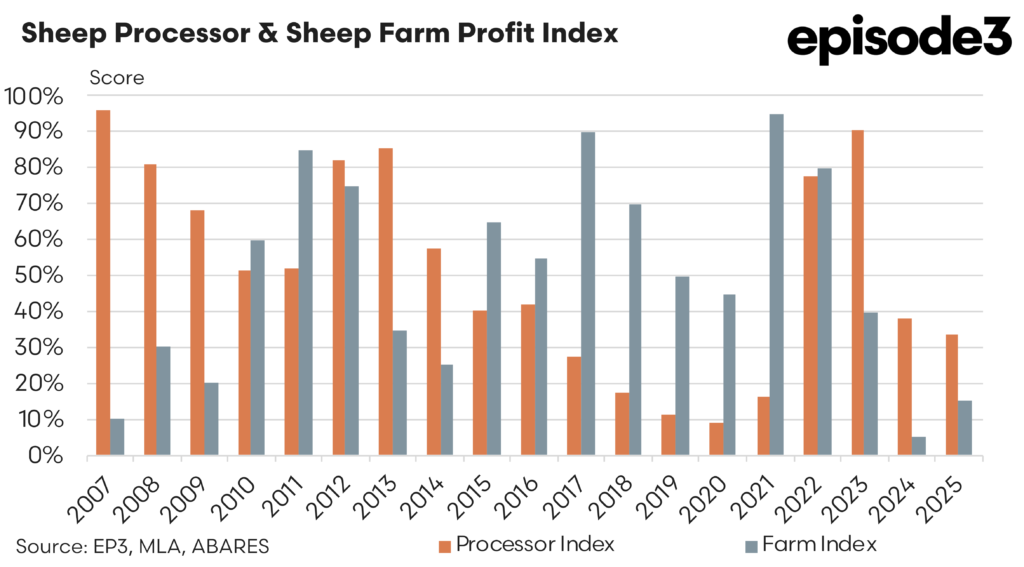

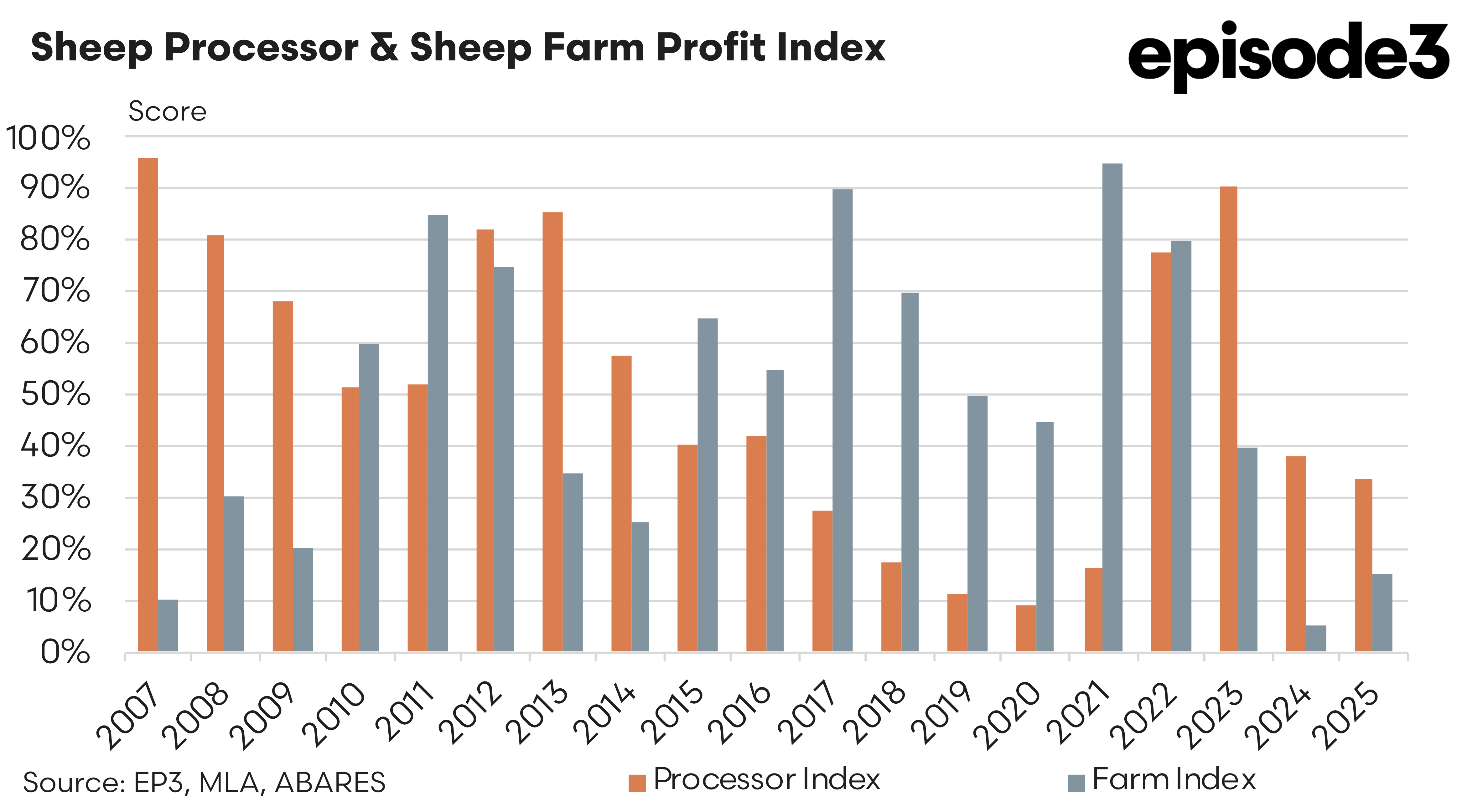

Early 2025 has brought cautious optimism for Australia’s sheep processing industry, following a particularly difficult finish in late 2024. The Sheep Processor Trading Conditions (SPTC) Index, a key barometer of profitability and economic conditions within the sheep processing sector, has begun to show early signs of recovery.

After concluding December 2024 at a concerningly low level of just 13%, January 2025 saw the index improve to 29%, followed by a further increase to 38% in February. This improvement has nudged the annual average so far for 2025 up to 34%, suggesting conditions are steadily moving away from the severe pressure processors experienced in late 2024.

However, placing these figures into broader context reveals that trading conditions remain somewhat subdued compared to early 2024. At this point last year, processors were experiencing more robust conditions, with the index peaking notably higher early in the year (for example, reaching 70% in March 2024).

To interpret the significance of these numbers, it’s helpful to view the SPTC Index as akin to a rainfall decile gauge: a score near 90% signals conditions are thriving, with strong margins and profitability, similar to plentiful rainfall in agriculture. In contrast, scores closer to 10-20% represent tight and challenging conditions, comparable to severe drought. Thus, while recent improvements from 13% to 38% represent welcome relief, conditions remain relatively fragile, and caution among processors continues.

An examination of recent export market developments helps explain why sheep processing conditions have not fully recovered. Updated data from late 2024 to early 2025 demonstrates a concerning weakening in key export markets for Australian sheep meat. Most notably, US export prices for sheep meat dropped sharply by 11.6% from the fourth quarter of 2024 to the first quarter of 2025. Easing export values were also recorded for the United Arab Emirates (UAE) posting a decline of 8.9% and Malaysian sheep meat export prices 8.3% lower, with only China remaining relatively stable at -0.7%.

The marked deterioration of US sheep meat pricing is particularly concerning. It appears partly attributable to market apprehension regarding a proposed US tariff targeting imported red meat, including Australian lamb and mutton. Proposed by certain American livestock producer groups, the tariff could reportedly be as high as 30%, significantly increasing the cost of imported Australian sheep meat for American consumers.

Such a move holds historical echoes of the US lamb tariffs imposed in 1999-2001, which adversely impacted consumer demand in America. Back then, the tariff not only raised prices for consumers, thereby reducing sheep meat consumption, but also negatively affected US domestic sheepmeat demand. This scenario eventually culminated in a successful World Trade Organization (WTO) challenge, leading the US to rescind the tariff. A repeat of such tariffs could again see US consumers pivot away from Australian sheep meat towards cheaper alternative proteins, exacerbating challenges for Australian sheep processors.

Domestic livestock cost movements have also shown mixed trends heading into early 2025. Lamb procurement costs have fallen by an average of 4.0%, offering processors some welcome relief through reduced input expenses. In contrast, mutton acquisition costs rose by 9.3%, placing additional financial pressure on processors handling mutton. This divergence indicates improved margins on lamb processing, yet tighter conditions for mutton.

However, ongoing softness in export price, especially into the US, could quickly offset these gains, particularly if the proposed tariff materialises. Any resulting fall in US demand would pressure Australian processors to swiftly adapt by seeking alternative markets or potentially face increased domestic supply, possibly driving local prices downward for the retail consumer and also at the saleyard, particularly for the US focused heavy export lamb.

Given the historical precedent and current uncertainty, it’s crucial that Australian sheep meat processors and sheep producers closely monitor developments over the coming months. The US government’s tariff decision, with a scheduled announcement for early April, could be pivotal, potentially reshaping export market dynamics. Processors should prepare for various scenarios, including possible shifts in consumer demand, price volatility, and intensified international competition.

Although early 2025 shows signs of recovery for sheep processor trading conditions, risks persist. The initial upward movement of the SPTC Index from December’s lows is certainly promising, but conditions remain weaker relative to early 2024. Challenges in critical export markets, particularly the USA, and looming trade uncertainties mean processors must remain vigilant, flexible, and proactive. The coming months will likely prove crucial, requiring strategic foresight and readiness to adapt to unfolding international developments.