Weather splits the nation

Market Morsel

As April begins, Australia’s cattle sector continues to navigate the challenges of contrasting weather patterns, with northern regions soaked by tropical rainfall and the south grappling with tightening feed conditions.

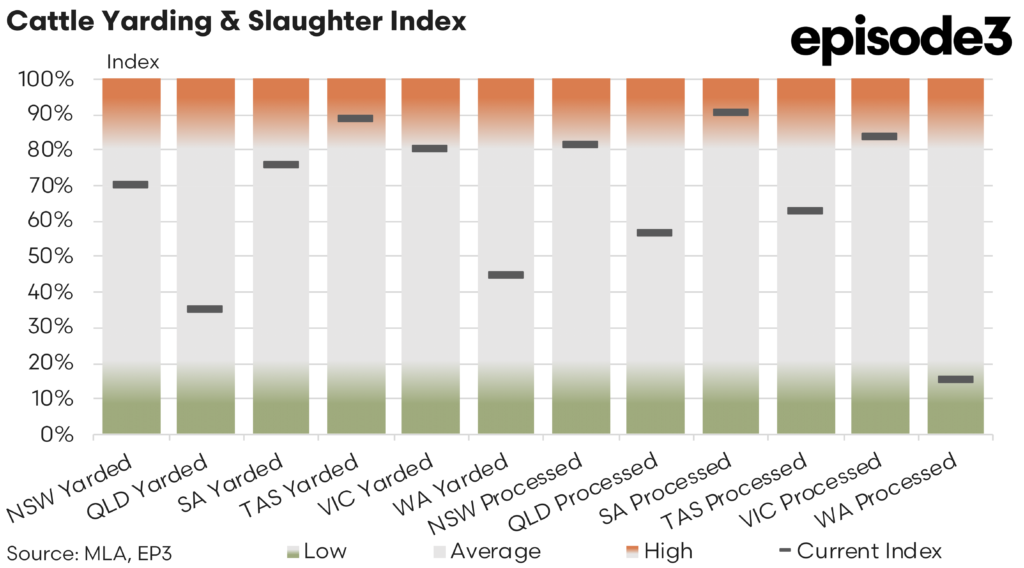

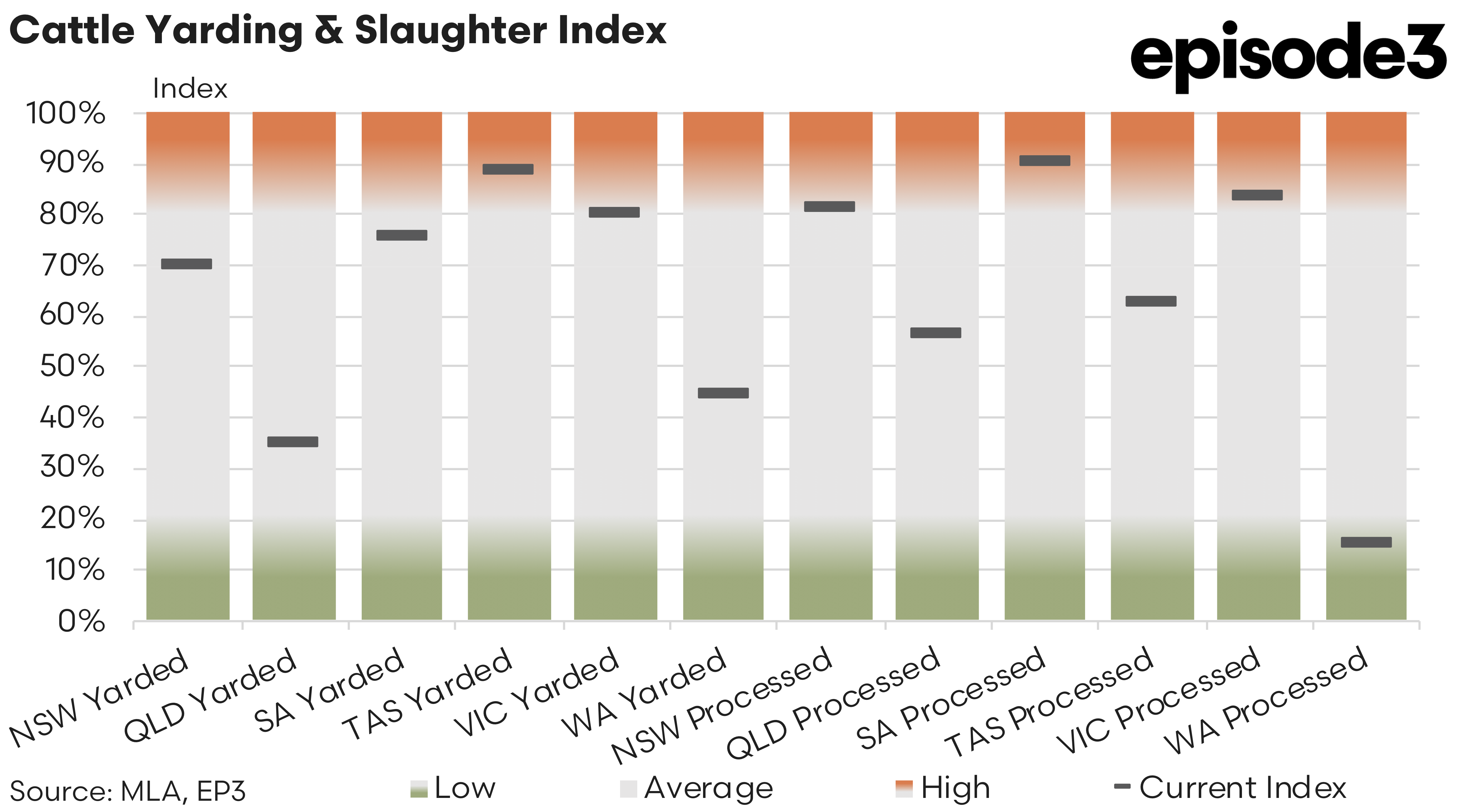

In the north, particularly Queensland and parts of the Northern Territory, forecast rainfall from a monsoonal trough has disrupted cattle logistics and slowed the supply pipeline. The prospect of more than 100mm of rain across widespread regions has already reduced accessibility for stock movements, leading many producers to hold cattle back in anticipation of pasture recovery and weight gain opportunities. Processing facilities in Queensland, which had ramped up throughput in February, have since seen a notable slowdown, with slaughter activity falling from 79% in February to just 56% in March—a significant drop that reflects weather-induced delays and reduced immediate supply.

Conversely, southern states such as South Australia and Victoria are contending with persistent dry conditions. With dwindling water availability and declining pasture quality, producers in these regions have continued to move stock aggressively. South Australian yardings, while easing slightly from February (down from 90% to 76%), remain elevated in the context of seasonal norms. Victorian yardings held steady at 80%, showing continued strong market engagement from producers looking to offload stock before conditions deteriorate further.

State-based processing data reveals how these climatic pressures are reshaping slaughter dynamics. New South Wales saw a retreat in both yardings and processor activity in March, with yardings down from 73% to 70%, and processing rates easing from 91% to 81%. Despite the drop, NSW continues to play a crucial role in supporting national slaughter volumes, particularly as Queensland faces weather disruptions.

Victoria remains a key stabiliser in the system, with processing at 84% in March—down from February’s high of 96% but still reflecting strong capacity utilisation. South Australia’s processor activity actually edged higher, rising from 88% to 90%, reinforcing the state’s role as a critical contributor amid growing southern turnoff.

Tasmania also continued to provide consistent throughput, with yardings largely unchanged (89% vs. 88% in February), although processing fell from 75% to 63%. Western Australia experienced one of the more pronounced declines, with yardings falling from 62% to 44%, and processing slipping from 21% to 15%, suggesting continued structural and logistical challenges in that region.

Despite the regional volatility in yardings and slaughter, national price indicators for key cattle categories remain broadly supportive of strong processor demand. The Heavy Steer Indicator, a reliable barometer for finished cattle, currently sits at 365c/kg liveweight, having gained 16c/kg over the past four weeks.

The Feeder Steer Indicator also shows continued strength, particularly given the volume pressures observed in southern regions. At 377c/kg, prices are up 17c/kg over the last month, as dry conditions force more cattle into containment feeding. This trend aligns with anecdotal reports of stronger feedlot placements and steady feed demand, especially in the Riverina and northern Victoria.

Meanwhile, the Processor Cow Indicator firmed over the past month, up 23c/kg to 294c/kg liveweight. This steady monthly increase reflects the strategic repositioning of processors aiming to lock in lean manufacturing beef supply ahead of potential disruptions. The category’s strength is particularly notable given the recent reduction in headcount week-on-week, which signals that processors are competing for reduced volumes amid weather delays and pre-winter strategic kills.

As 2025 progresses, the Australian cattle sector remains at the mercy of the weather. In the north, rainfall is a double-edged sword—delaying turnoff and processor throughput in the short term but potentially setting the stage for improved weight gains and marketing opportunities later in the season. The challenge for Queensland processors will be navigating reduced volumes in the coming weeks, with some facilities reportedly booked well in advance and facing backlog pressures.

In contrast, the southern market remains active, driven by the urgency of dry conditions and diminishing pasture resources. The consistent performance from processors in South Australia and Victoria continues to underpin national slaughter numbers, but if the dry spell extends, carcass weights and condition could begin to decline. All eyes remain on the prospect of the autumn break providing some well-earned relief.

Market participants in the south will be closely watching April forecasts, particularly in regions like southern NSW, western Victoria and southeast SA, where rainfall—or the lack of it—could shift the momentum significantly.

For now, price signals remain broadly positive. The announcement of Trump tariffs on Australian beef exports remain a concern, particularly the misrepresented comments on a ban on Australian beef which was quickly corrected. The tariff of 10% on Aussie beef imported into the USA shouldn’t cause too much backlash from US consumers, particularly given their current tight supplies and very high beef/cattle prices. There is potential too for Australia to build market share in key destinations it competes with the USA into Asia as those countries have higher tariffs imposed on their exports to the USA and consumers there may decide to favour Australian beef over the US equivalent in the coming months.