Market Morsel: Are American farmers tired of winning yet?

Market Morsel

China has been hit with a 34% tariff, which stacks on top of the existing tariffs, giving them an overall 54% tariff on Chinese goods in the United States. As expected, China has retaliated and will now place a 34% tariff on top of the existing 15% tariff on soybeans.

This is not a great move from Trump, as it will make exports from the USA uncompetitive versus other origins, namely Brazil.

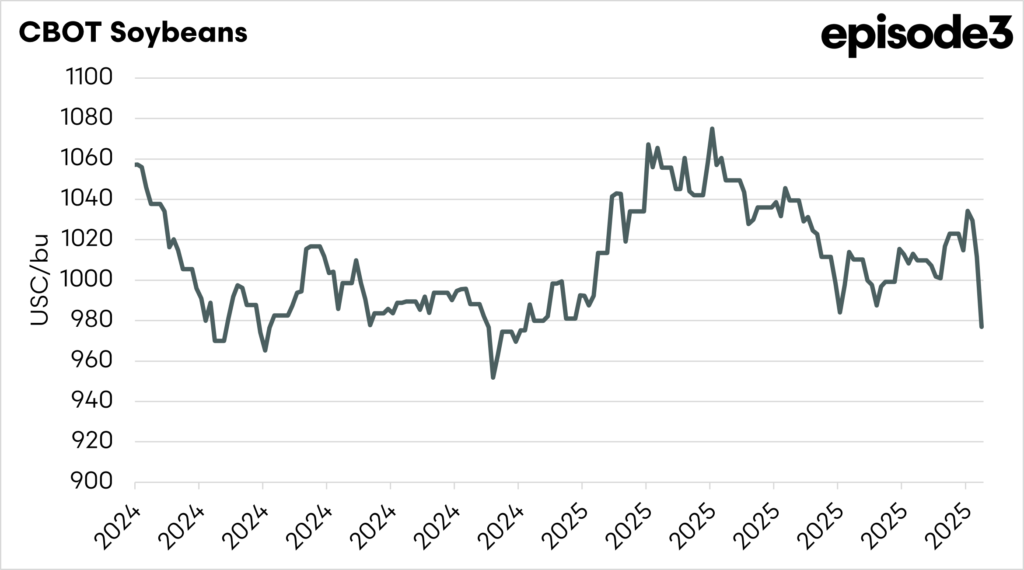

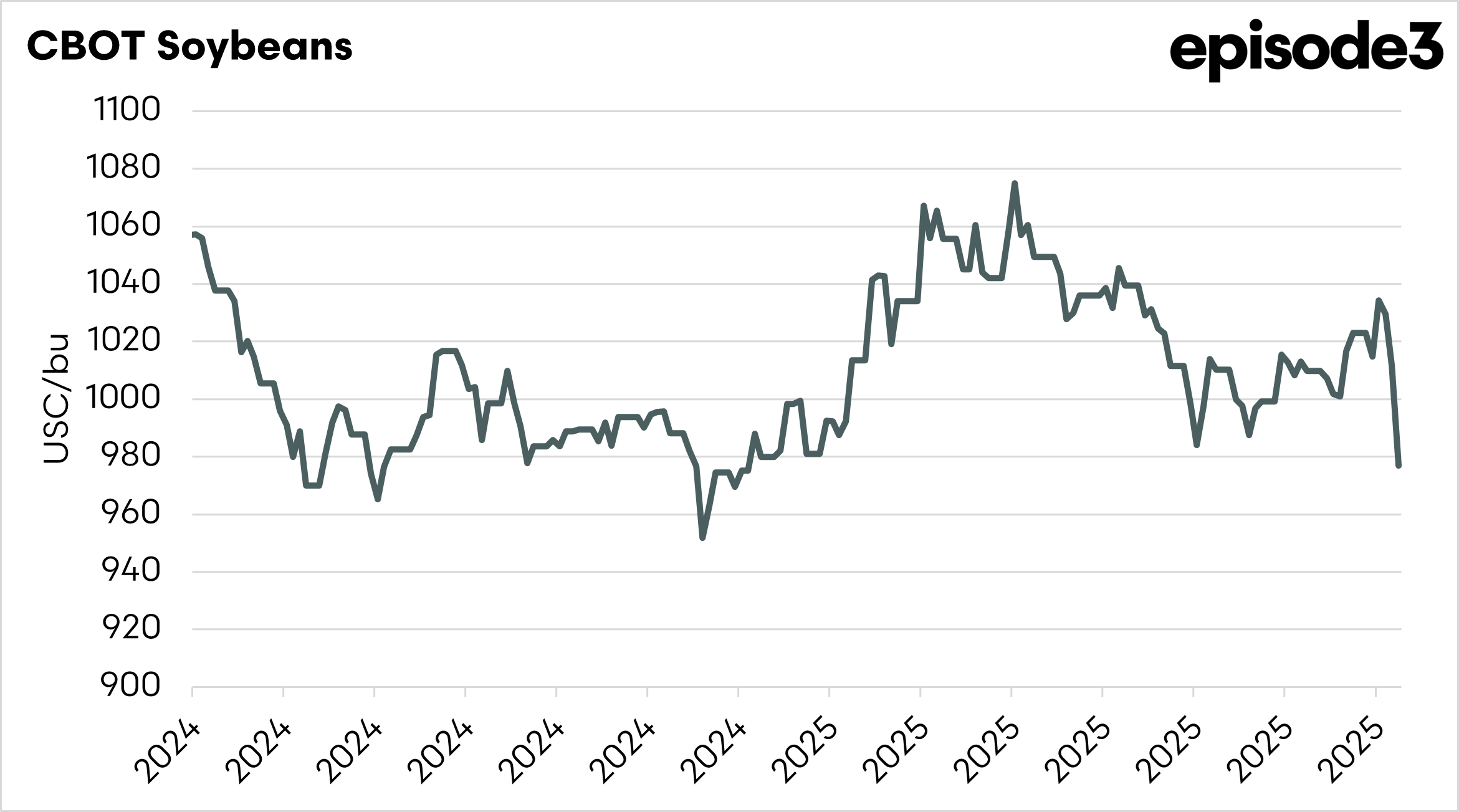

The CBOT soybean futures market crashed on the back of the news of the Chinese tariffs, as seen in the first chart below. The first Trump presidency took similar tariff actions, which led to huge changes in trade flows. |

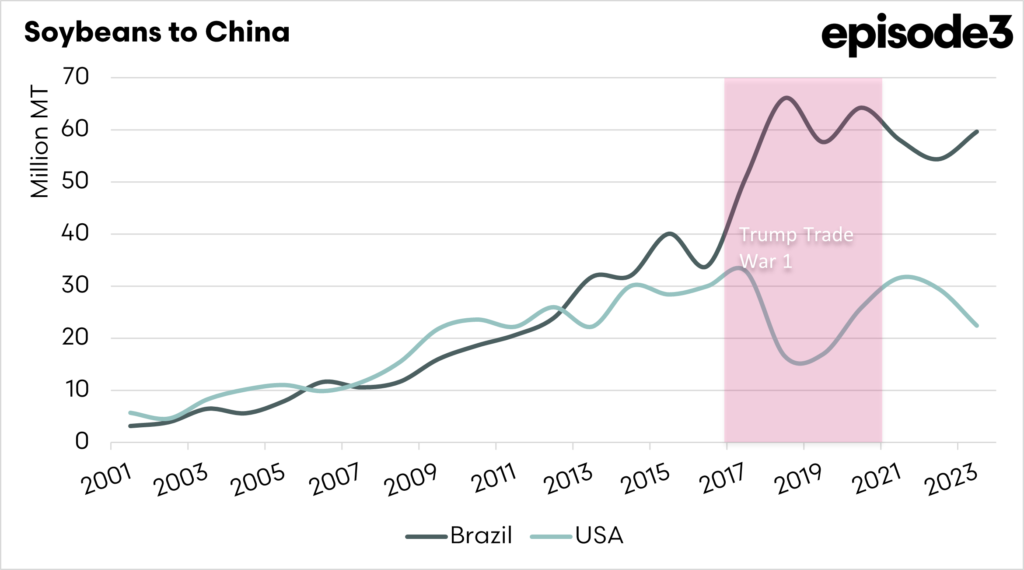

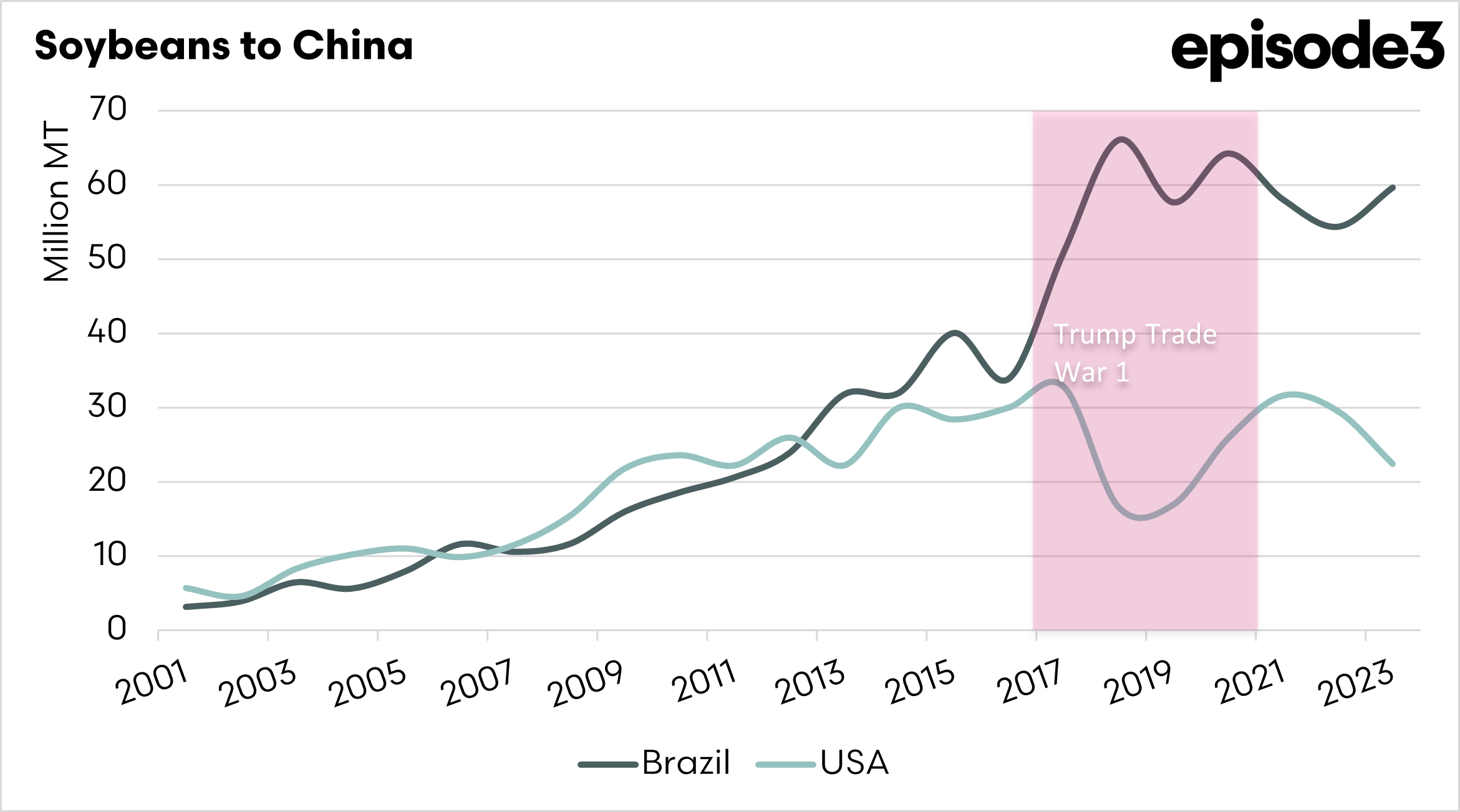

When China imposed tariffs on US soybeans in 2018 during the height of the US-China trade war, it significantly disrupted traditional trade flows. It opened up a major opportunity for Brazil. With US soybeans suddenly becoming more expensive for Chinese buyers due to tariffs, China turned to Brazil to meet its demand for soybeans. This led to a sharp increase in Brazilian soybean exports to China, boosting Brazil’s share of the Chinese market and strengthening trade ties between the two countries. As a result, Brazilian farmers enjoyed higher prices and increased production incentives, while Brazil solidified its position as the world’s top soybean exporter.

Brazil has remained the top supplier of beans to China, even after the first trade war ended. This tariff move will either see China reduce import demand or import higher volumes from Brazil.

Alternatively, they may work through their stockpiles (see here)