Market Morsel: Keep an eye on horizon for wheat pricing.

Market Morsel

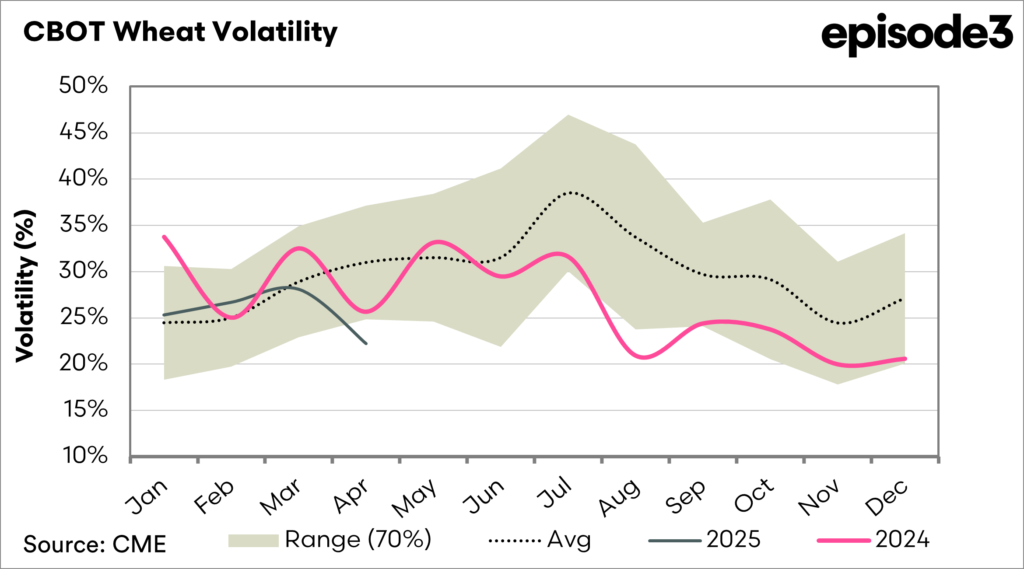

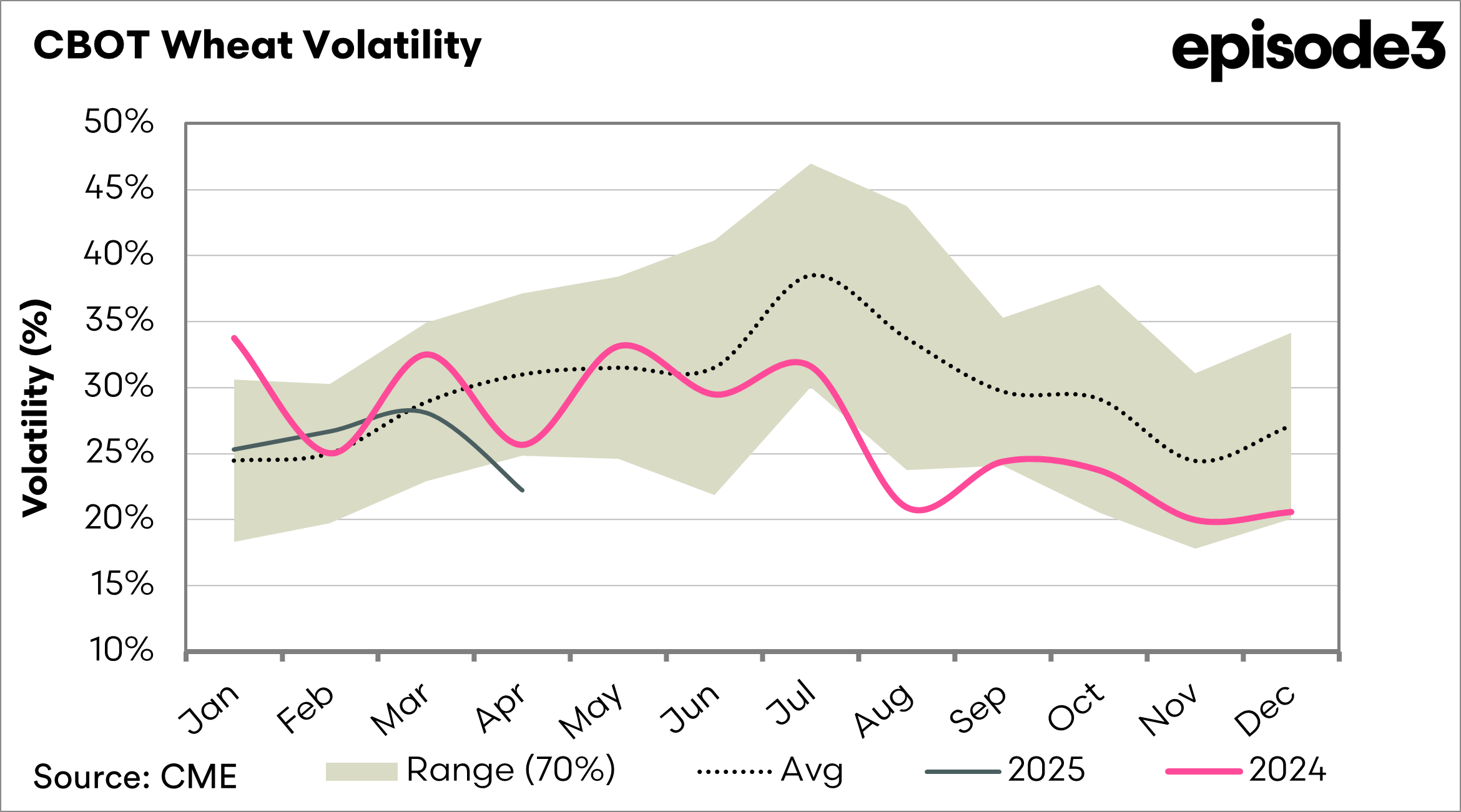

The world news cycle has been full of news of tariffs, but when it comes to wheat, it has actually been quite boring. In the first chart below, you can see the volatility of the wheat market. The volatility in April is lower than normal, whatever normal is in these times.

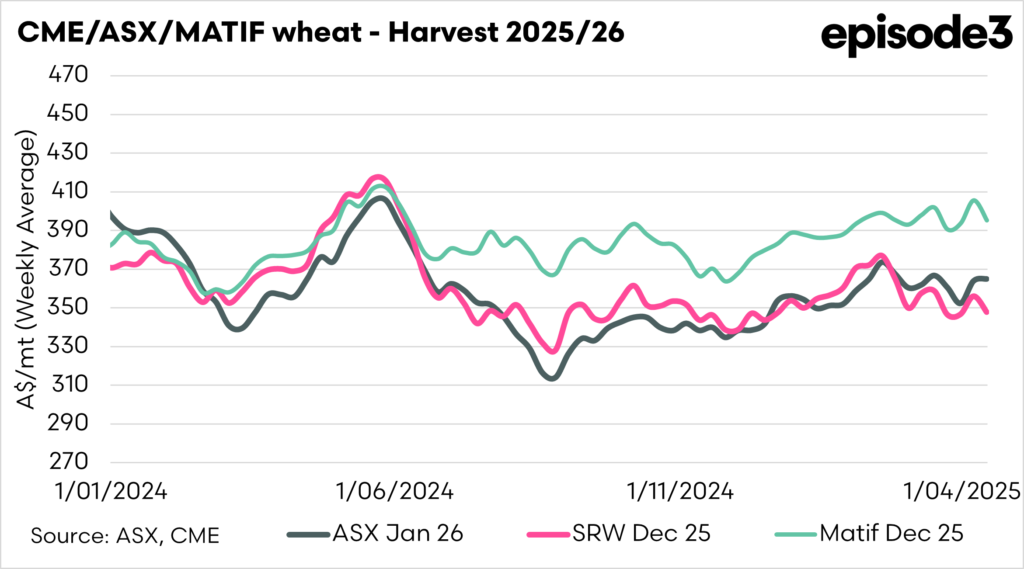

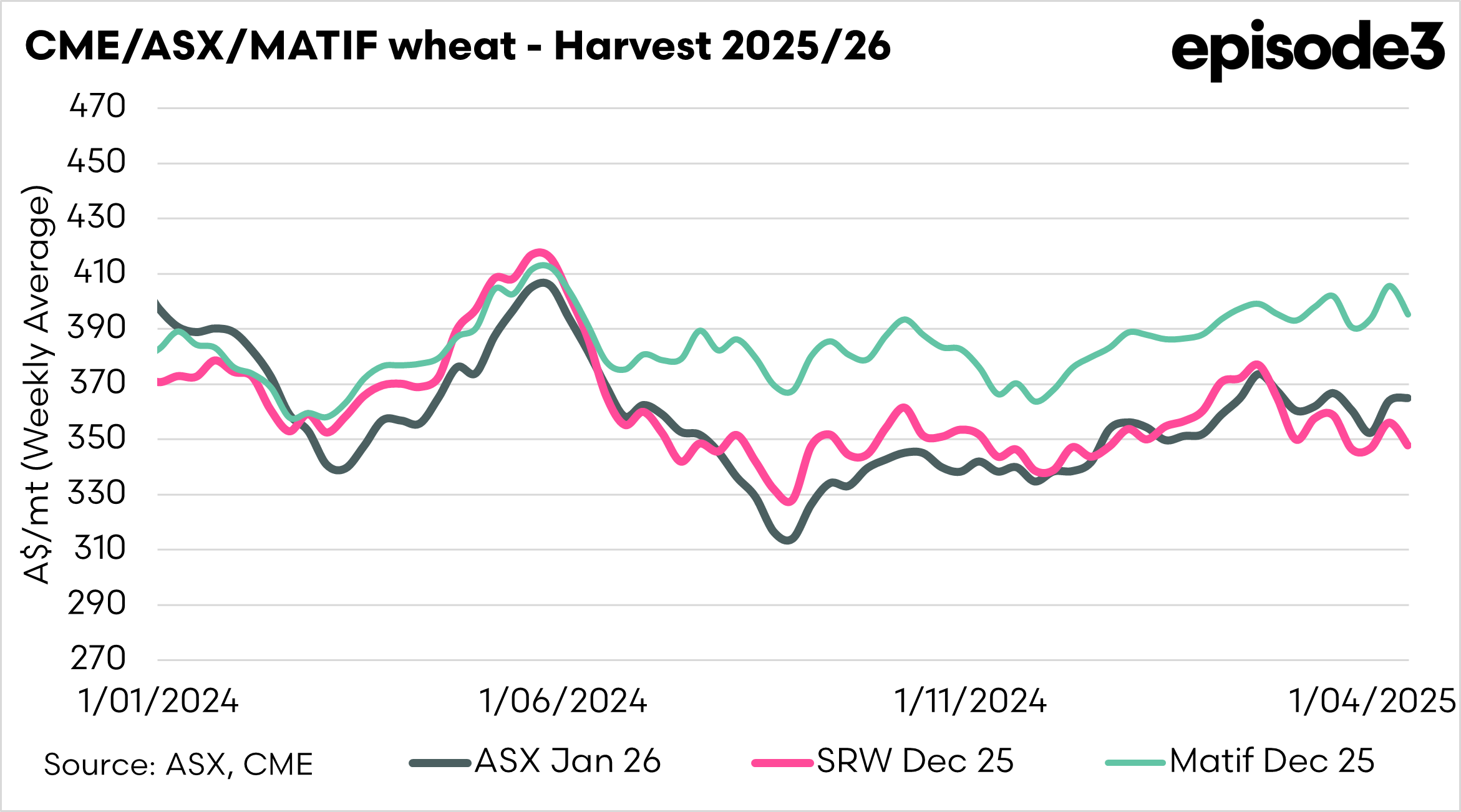

Volatility does tend to increase on average as we move into the northern hemisphere during the growing season. If you look at the second chart below, wheat prices have largely been following quite a narrow band in recent months (when converted into A$).

The market needs information to get things moving, and there is very little to drive the market in recent times.

- Prices in Europe have been falling as Russia’s expectations improve

- Rainfall due to hit US wheat belt

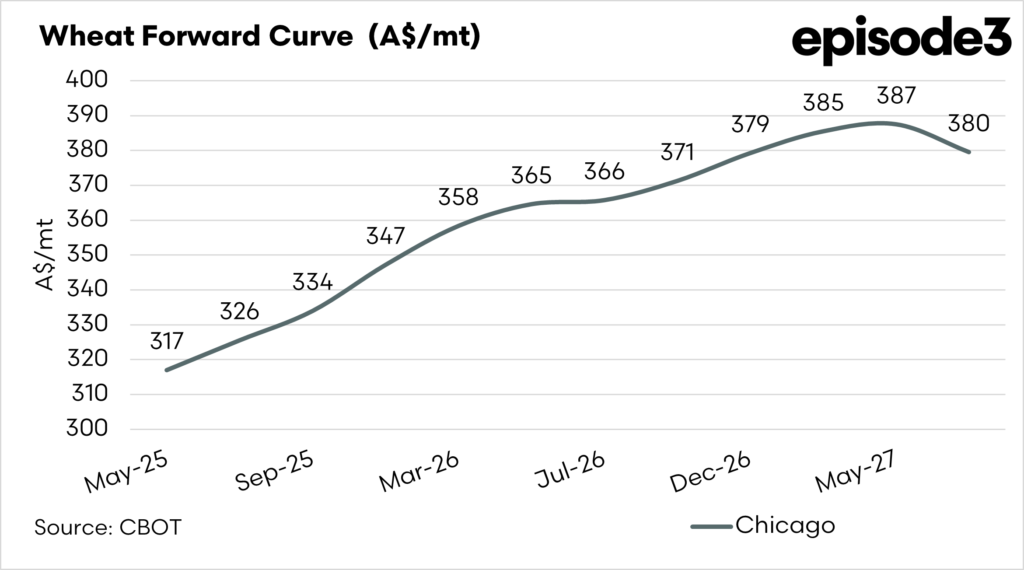

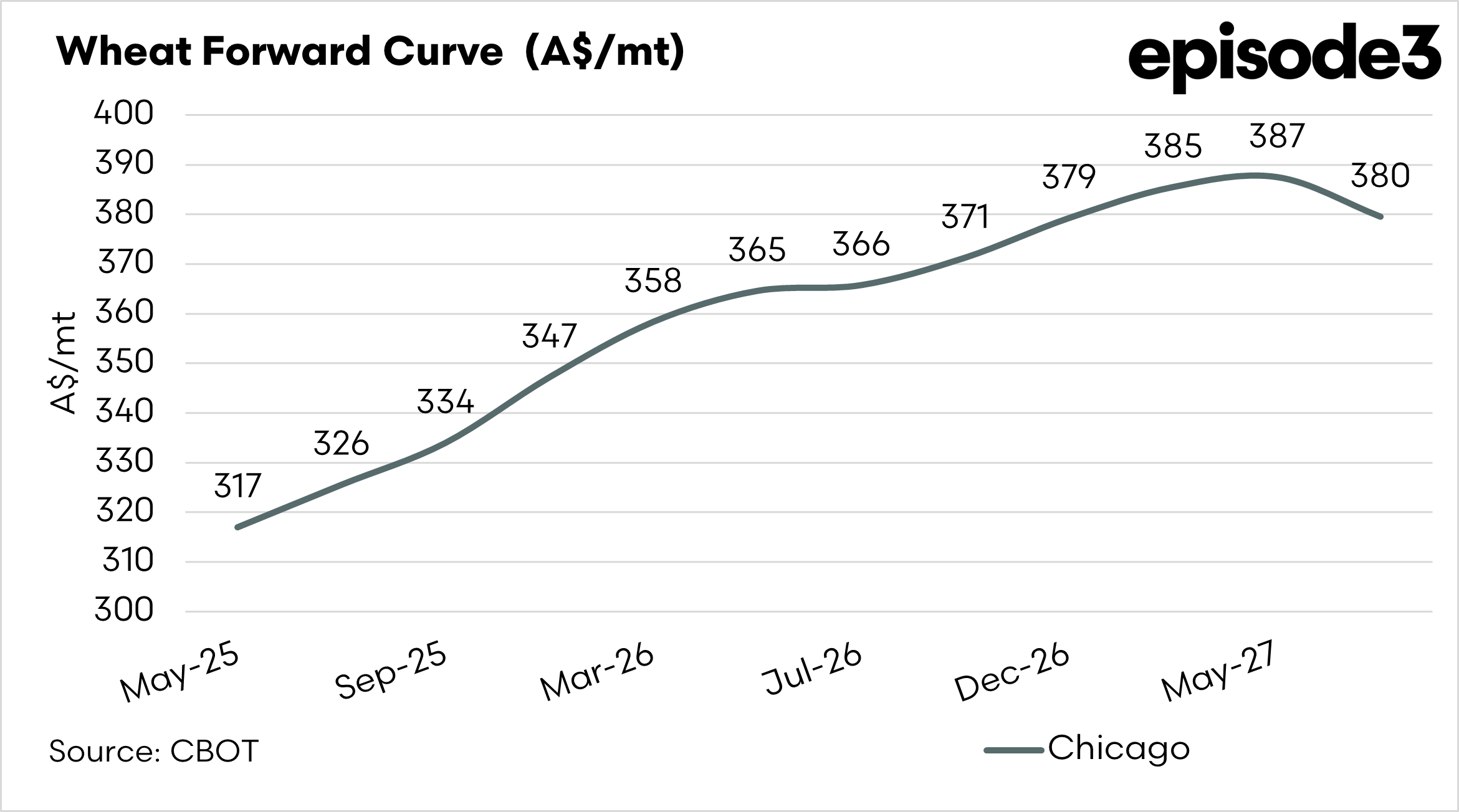

At the moment, the wheat forward curve does offer some opportunity. A forward curve shows the price of wheat for delivery at different times in the future, and the market can either be in contango or backwardation.

Contango is where the future price is at a premium to the spot market. This can happen when there’s plenty of wheat now and storage costs make future wheat more expensive.

If future wheat prices are lower than today’s, that’s called backwardation. This often means wheat is in short supply now, so buyers pay more to get it immediately.

Imagine wheat costs $300 a tonne today, but $320 in three months — that’s contango. If it’s $280 in three months, that’s backwardation.

The current futures value is A$317, but for the coming harvest is A$347. It is important to remember that this doesn’t include a basis. As explained in my other article today, this basis could be either negative or positive depending on how the crop in Australia performs.

This provides a starting point for pricing. We still have the northern hemisphere weather market to go through but keep an eye on the horizon, and if it is attractive for your budget, lock it in.