Heavies Still in Demand

Market Morsel

The first two weeks of April has revealed sharp shifts in slaughter patterns across Australia’s sheep and lamb sectors, as the industry continues to balance seasonal processing flows with persistent limitations in supply quality.

With slaughter index scores now available for both March and early April, a clearer picture has emerged: sheep throughput has declined in many key states, while lamb volumes have surged. Yet despite this lift in lamb kills, processors are still grappling with a noticeable absence of heavier carcases—an issue that continues to shape market pricing and sentiment.

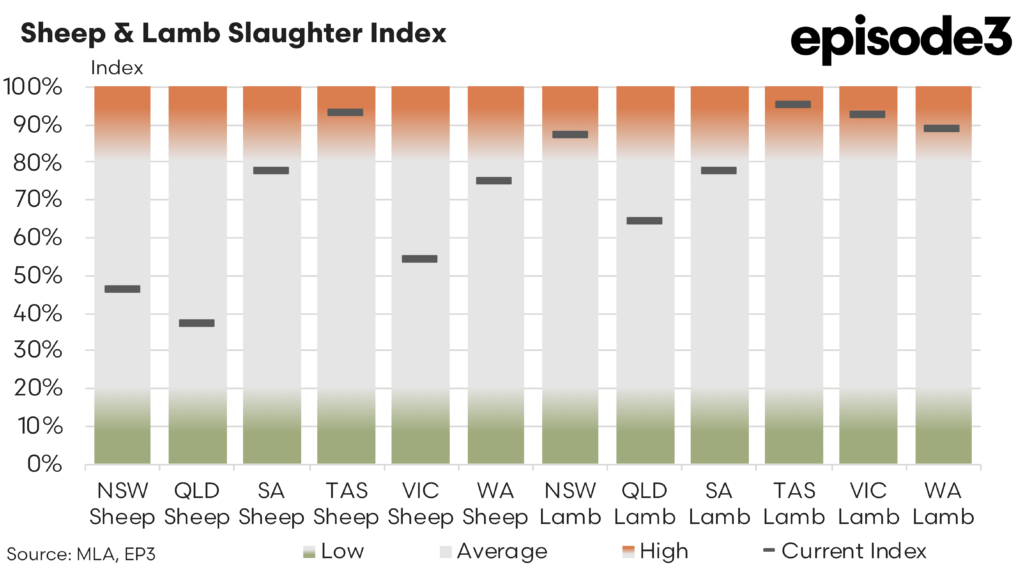

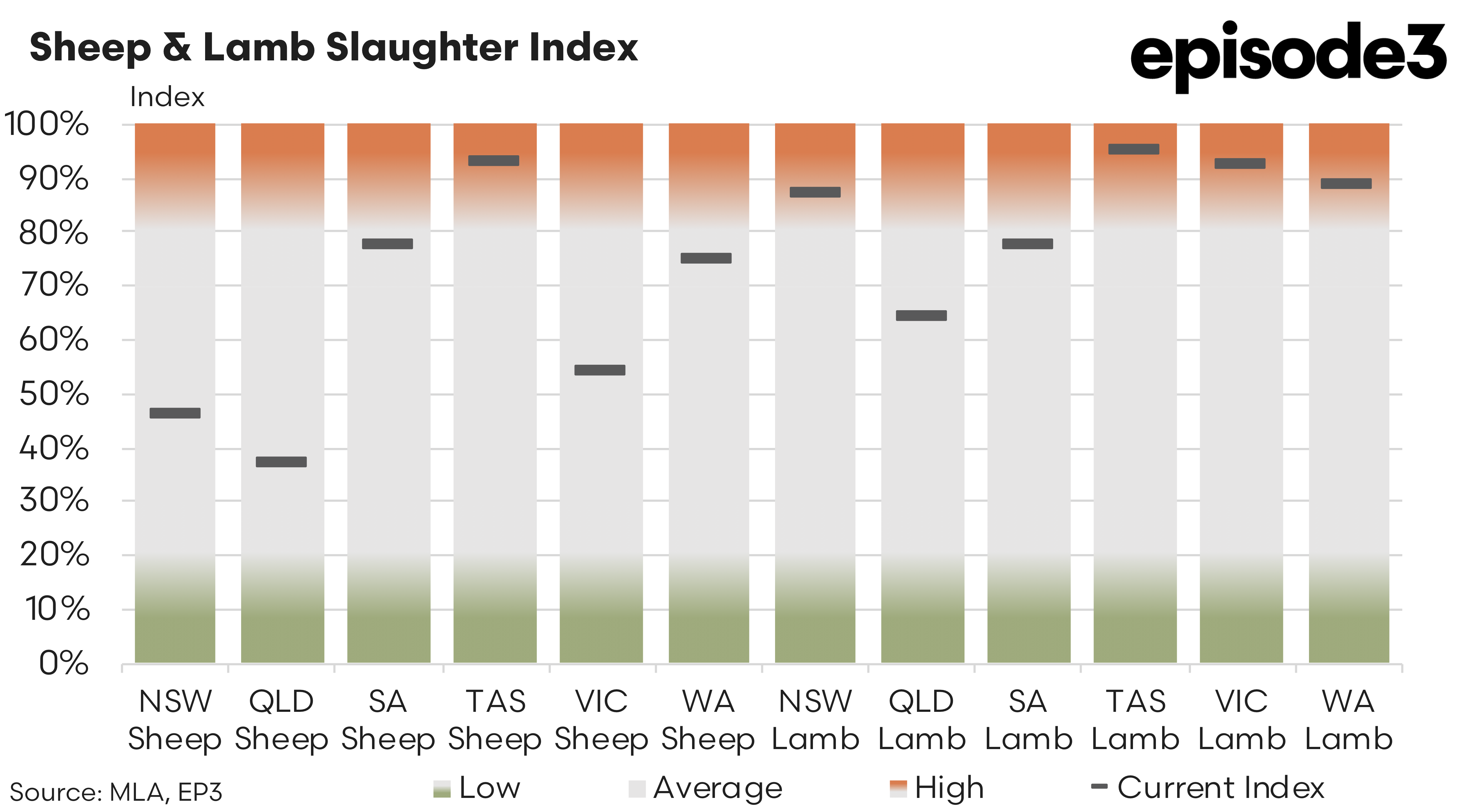

Sheep processing volumes have pulled back sharply in several states. In New South Wales, the sheep slaughter index dipped from 86% in March to just 46% in April. Queensland also saw a significant drop from 72% to 37%. South Australia lifted from 73% to 78%, recording only a modest increase. Western Australia declined slightly from 79% to 75%, while Victoria actually lifted from 42% to 54%. Tasmania recorded the most substantial increase, with its sheep slaughter index jumping from 80% to 93%, suggesting strong end-of-season clearance in the state with processors there potentially getting ahead of Easter/Anzac holiday closures.

These shifts reflect the evolving seasonal dynamics: while some regions are winding down sheep throughput in preparation for winter, others are pushing hard to process remaining stock while conditions allow. The easing in slaughter activity has coincided with a stabilisation in mutton prices, which remain well supported by export demand.

In contrast, lamb slaughter activity has accelerated across nearly all states. Victoria and Western Australia posted strong average index scores for April, at 92% and 89% respectively, up from 82% and 55% in March. Tasmania continued to lead the charge, jumping from 75% to 95%. Queensland lifted strongly from 57% to 64%, while New South Wales climbed from 68% to 87%, and South Australia from 65% to 77%.

This broad-based increase in lamb throughput aligns with seasonal expectations. As autumn progresses, ongoing dry conditions across southern Australia have brought a run of lambs to market. However, reports from processors indicate that this increase has been dominated by lighter and trade-weight lambs, while heavy lambs remain difficult to source. This shortfall in heavier carcases is now a defining feature of the April market landscape.

The latest price data reinforces this tension between volume and quality. Over the past four weeks, the Heavy Lamb Indicator has edged up 45 cents, now averaging 842c/kg cwt. The Trade Lamb Indicator, which lifted by 59 cents over the same period to reach 831c/kg cwt. The limited supply of Heavy Lambs have seen a rush of buying for “the next best option” pushing Trade Lamb prices towards similar cent per kilogram values as Heavy Lambs.

The Restocker Lamb Indicator has also firmed, up 96 cents for the month to 810c/kg cwt, suggesting renewed confidence among buyers preparing for autumn/winter rain. Light Lambs lifted a substantial 62 cents to 755c/kg cwt. Merino lamb saw solid gains, increasing 64 cents to 725c/kg cwt.

Meanwhile, mutton prices have remained surprisingly robust. The Mutton Indicator lifted 122 cents over the past month to sit at 562c/kg cwt. This strength is particularly notable given the reduction in slaughter volumes across several states. Export demand from China, Malaysia and the Middle East appears to be absorbing much of the supply, as buyers continue to seek value cuts in the face of cost-of-living pressures.

With lamb slaughter volumes rising but skewing lighter, the focus now turns to whether producers can hold lambs any longer to achieve heavier weights. A favourable autumn break could support this, but poor feed or early cold snaps may force early turnoff, worsening the shortage of heavy lambs. As processors compete for limited finished stock, heavy lamb prices could strengthen, while only well-finished lambs in trade and restocker categories are likely to attract sustained premiums.

The April slaughter and pricing data reinforce a now-familiar narrative: more lambs are being processed, but not enough of them are heavy. Mutton remains a bright spot, and trade lambs are now outperforming heavyweights in price. With Merino and light lamb values falling sharply, and restocker confidence lifting, the market is entering winter on uneven footing. Whether the imbalance in lamb weights corrects will determine the tone of the coming months.