Market Morsel: Wheat pricing opportunities to come

Market Morsel

We are fast approaching the middle of the year, and despite all the talk of geopolitics, the wheat price has been relatively flat. The market volatility has not been as high as it has been in recent years.

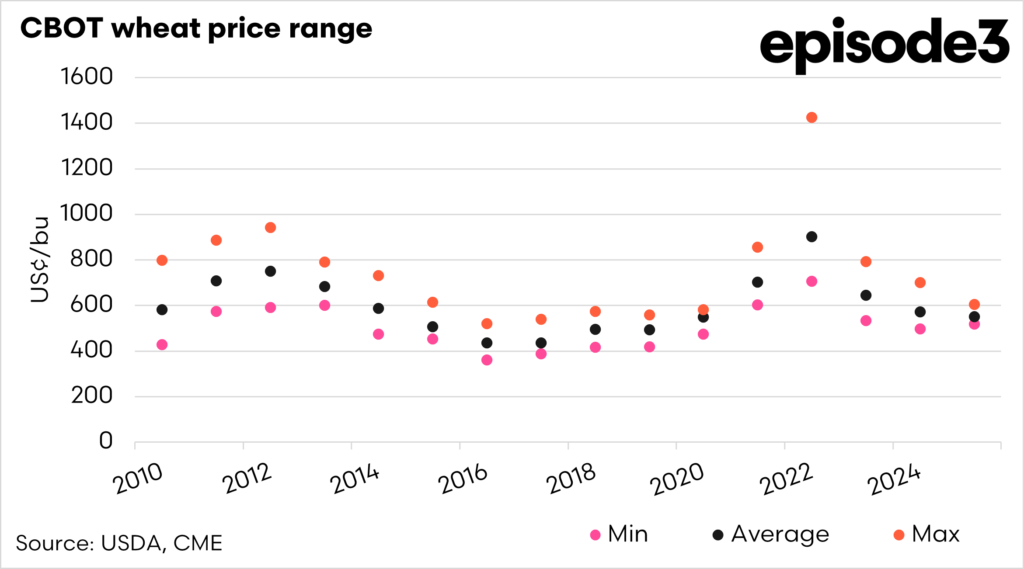

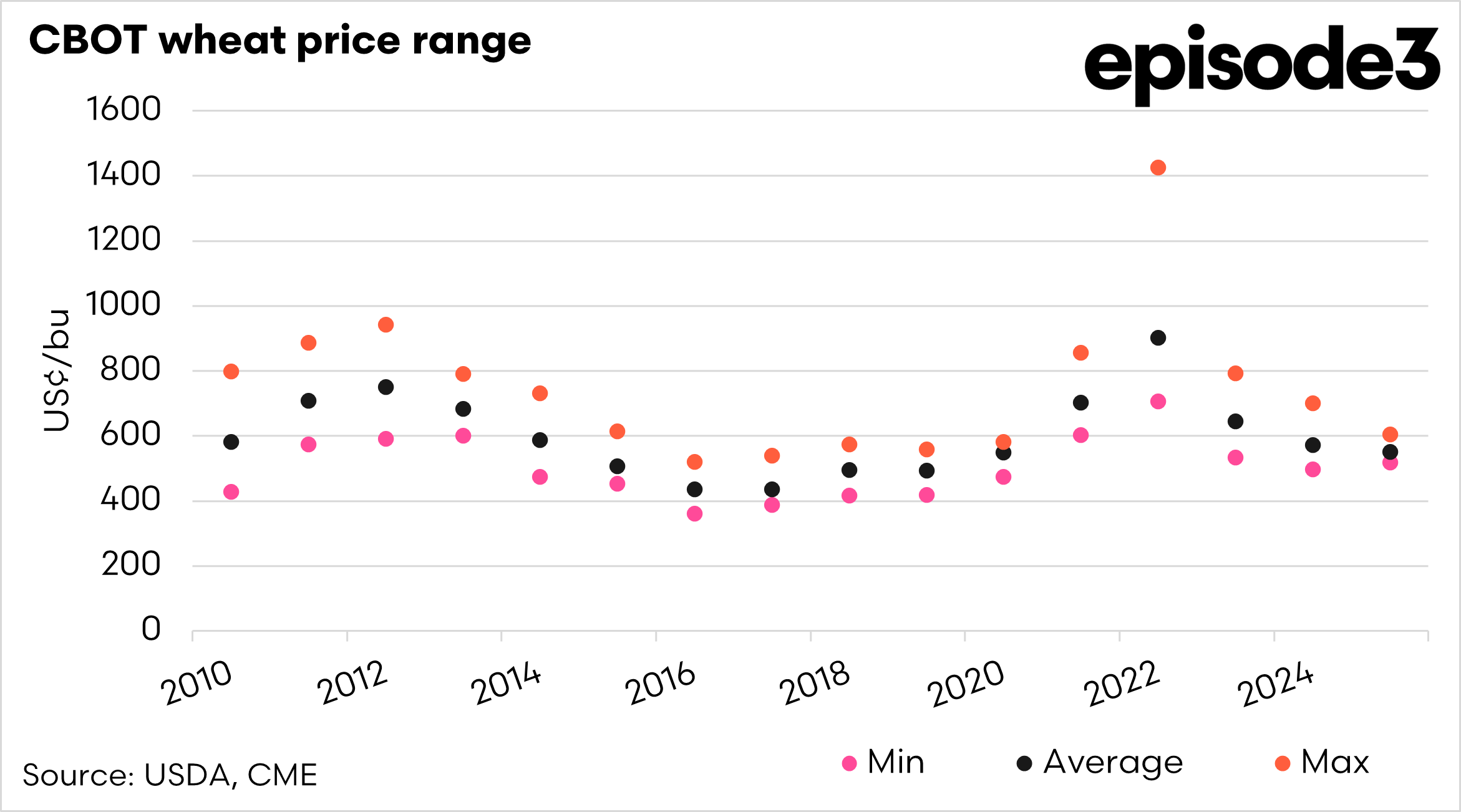

The gap between the market’s high and low has been very close in 2025, as can be seen in the first chart below.

We are about to hit the northern hemisphere weather window, and it is expected that we will see an increase in volatility. Based on previous years, this is the period of typically higher average volatility.

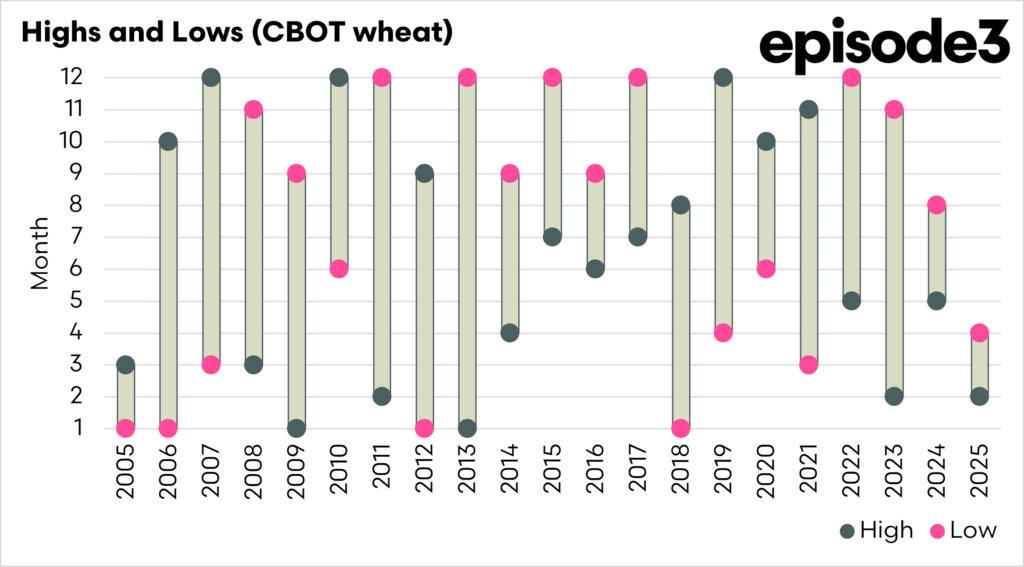

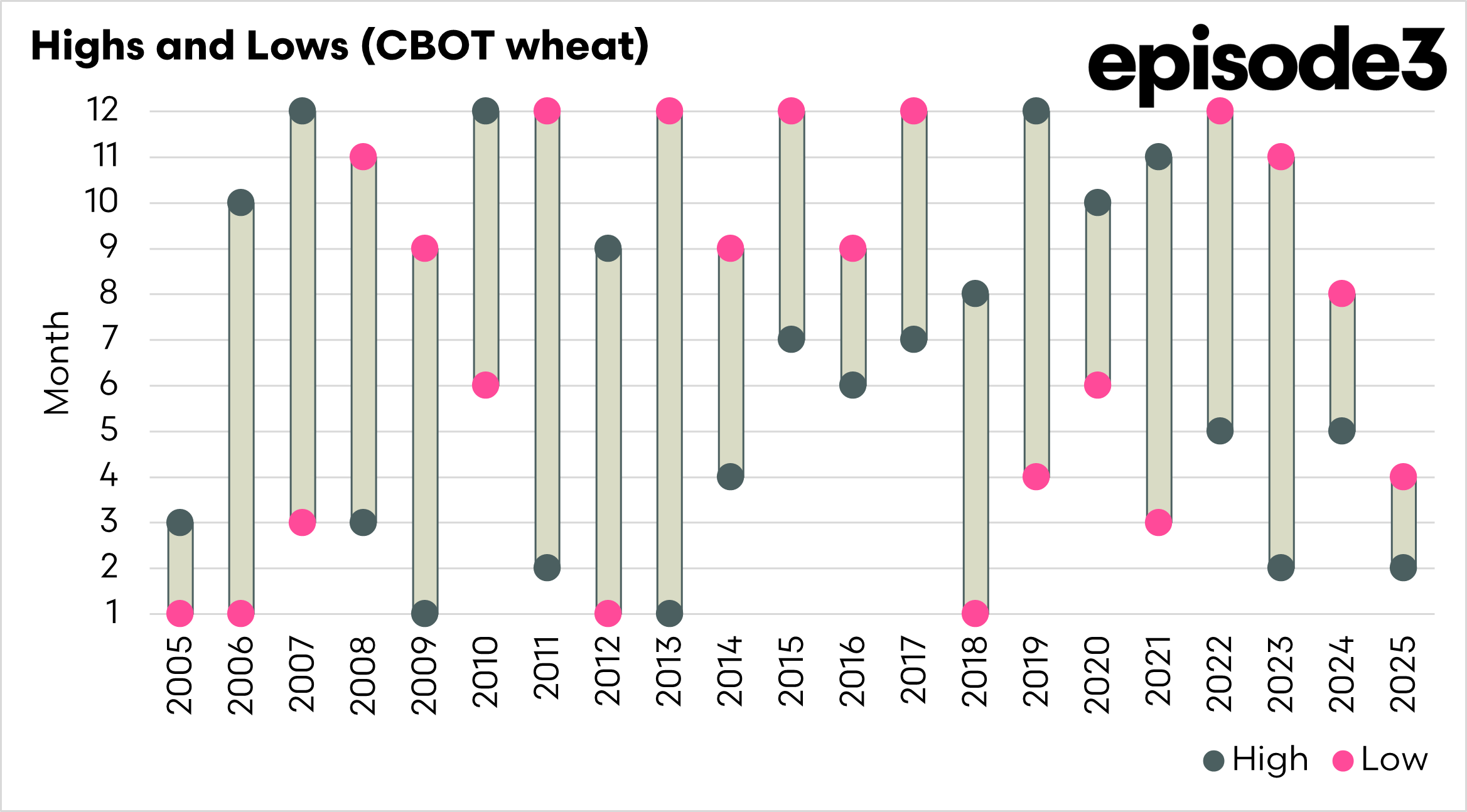

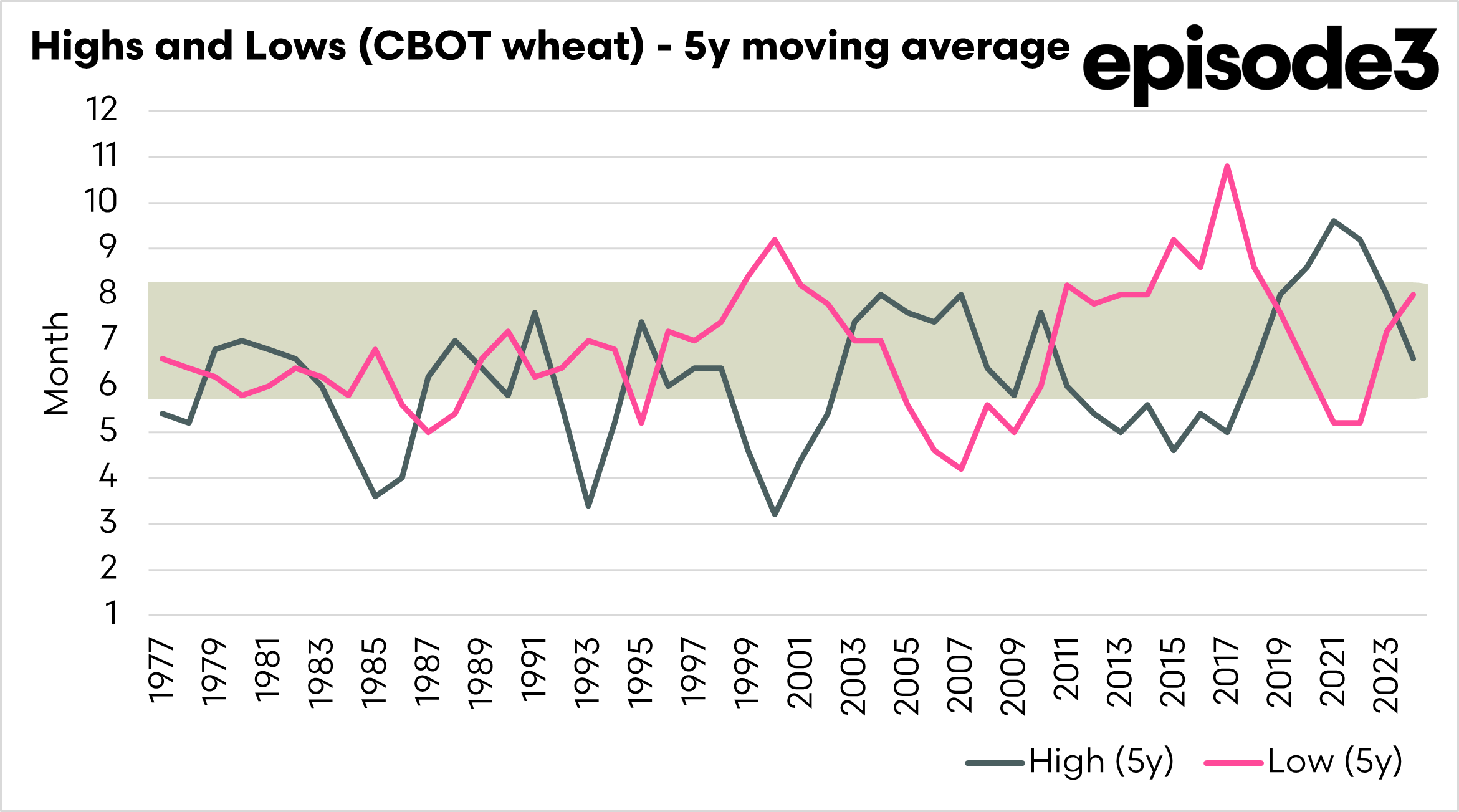

If we look at the second chart below, this displays the high and low points of the year for pricing (CBOT wheat), as the monthly average. The third chart shows the five-year moving average months for the lows and highs.

This year, there are concerns about the wheat crop being below average in several regions.

We can expect volatility to increase in the middle of the year, and this may present some opportunities for Australian producers.

April has been the low so far for 2025, but let’s keep a close eye!