Reality cheque

Sheep Processor Trading Conditions Model

Early 2025 had delivered cautious optimism for Australia’s sheep processing sector, with signs of recovery emerging after the difficult trading conditions of late 2024. However, the most recent data for March 2025 has brought a reality check, showing that while improvement remains underway, the sector is far from out of the woods.

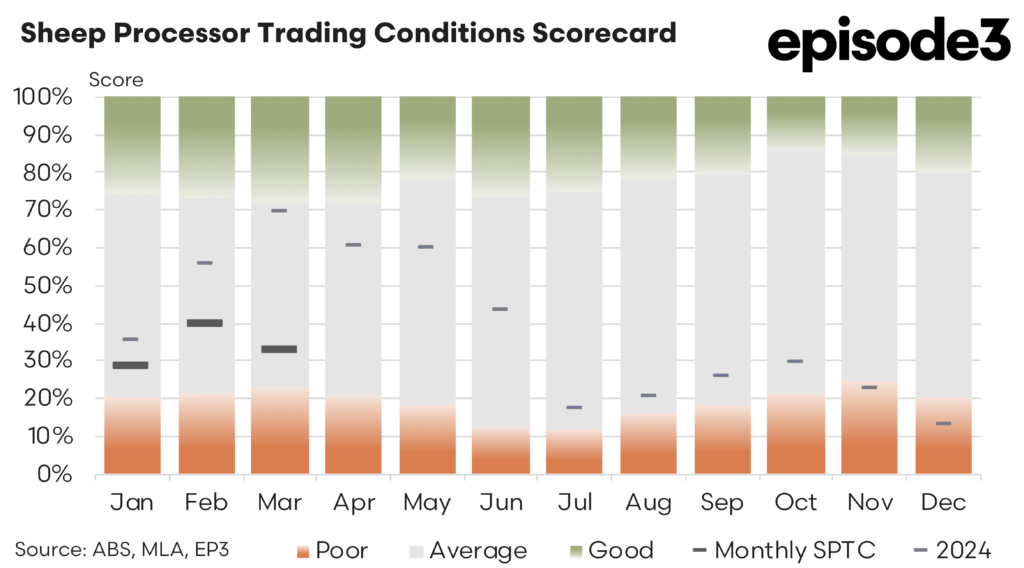

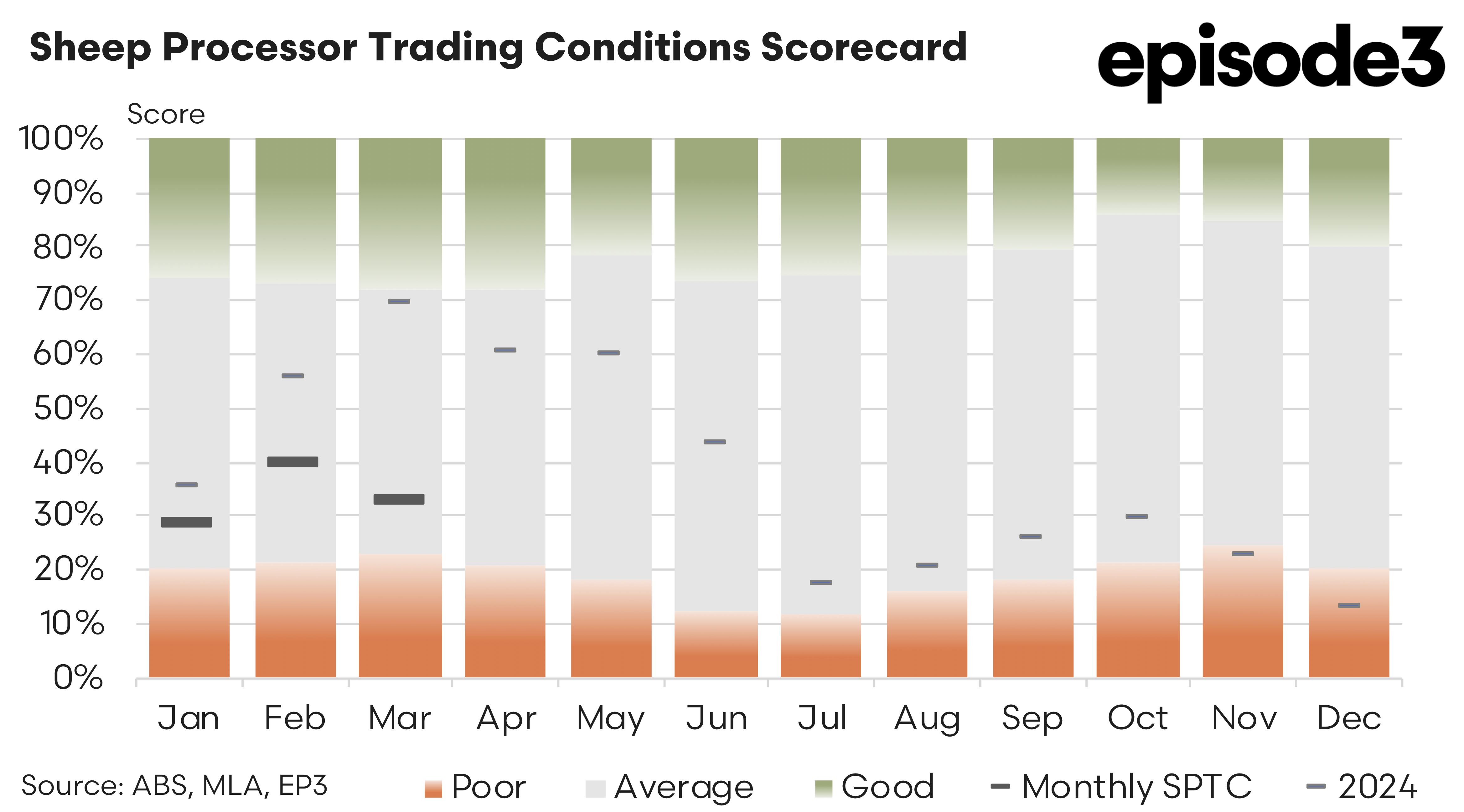

The Sheep Processor Trading Conditions (SPTC) Index, the key indicator for processor profitability and economic health, has edged lower through March. After lifting from just 13% in December 2024 to 29% in January and then nearer to 40% in February, the index slipped back to 33% in March. Although still a substantial improvement on the dire levels seen at the end of last year, a reading of 33% remains firmly in “below average” territory.

As a reminder, the SPTC is best understood in the same way farmers think about a rainfall decile chart. An SPTC score near 90% would indicate booming processing conditions, strong profitability, and healthy operating margins, akin to a bumper season after excellent rainfall. In contrast, a score around 30% reflects a patchy and uncertain environment, much like a light drought. Margins are thin, conditions are volatile, and caution dominates decision-making.

A closer look at the domestic livestock pricing trends during March helps explain the easing in trading conditions. Heavy lamb prices held steady around 800 cents per kilogram carcass weight (cwt), offering processors some much-needed stability in one of their key product lines. Light lamb values lifted slightly, posting a 3% monthly increase to reach 711c/kg cwt, while trade lambs also remained relatively stable at 780c/kg cwt.

hen combining movements across the three major lamb categories, the overall lamb price increased by around 1.3% for the month. However, mutton prices told a very different story. Mutton surged by an impressive 12% over March to sit at 405c/kg cwt at the end of March. This sharp lift in mutton procurement costs placed renewed pressure on processors, particularly those heavily exposed to mutton throughput.

On the export front, developments were slightly more encouraging but still mixed. Export sheepmeat prices to China, one of Australia’s key sheep meat export destinations, slipped by 5.5% over the month, while the United Arab Emirates (UAE) also recorded a fall, down by 6.3%. However, these declines were partially offset by a 3.9% increase in Malaysia’s pricing and a notable 7.9% lift in sheepmeat export prices to the United States.

Across these four key markets, China, UAE, Malaysia, and the USA, the net result was a 1.3% increase in average export pricing for Australian sheepmeat during March. This marginal improvement in offshore returns has been helpful, but not sufficient to fully offset the rising input costs from domestic livestock procurement, particularly on the mutton side.

The combined impact of stable to slightly higher lamb prices, sharply higher mutton costs, and only modest gains in export receipts has ultimately squeezed processor margins once again. Hence the SPTC Index’s drop to 33% in March. This shift underlines the fragility of the recovery underway in the sheep processing sector, with profitability still running below historical averages and vulnerable to further adverse market developments.

The surge in mutton costs presents a particular challenge. Processors handling heavier volumes of mutton are seeing their input costs rise sharply at a time when global markets, especially China, are showing signs of softening demand due to a flagging economy. Adding further complexity is the uncertainty around the US tariff on imported red meat, including Australian lamb and mutton. While March saw US sheepmeat prices strengthening, the threat of a !0% tariff could see American demand ease over the coming months.

The March performance of the SPTC serves as a timely reminder that although early 2025 has seen meaningful improvement from late 2024 lows, the recovery is precarious. Conditions remain significantly weaker than those experienced in early 2024, when the SPTC was running at much healthier levels circa 60–70%.

Processors must therefore continue to adopt a cautious and flexible approach. Strategic management of livestock procurement, cost control, and export market diversification will be critical to navigating the volatile months ahead. March’s results show that gains can quickly be eroded by a few adverse shifts in domestic and global markets.

While the sheep processing sector is still on the mend, the drop in the SPTC through March highlights that challenges remain. Processors are facing a “light drought” in profitability terms, not a crisis, but far from smooth sailing. The coming months will be crucial in determining whether the tentative recovery seen early in the year can be sustained or whether fresh headwinds will push the sector back onto more precarious ground.