Saleyard throughput lifts

Market Morsel

The Australian sheep and lamb sector has emerged from the disrupted trading conditions of April, marked by the Easter and Anzac Day holiday breaks, into a more stable operating environment.

As processors and saleyards return to full schedules, the most recent saleyard throughput data from the first two weeks of May show significant increases in yardings across both sheep and lamb categories, particularly in New South Wales and Western Australia, highlighting a resumption in market activity. However, the broader picture remains one of varied supply across states, with emerging indications that recent price strength may be tested if turnoff volumes continue to lift.

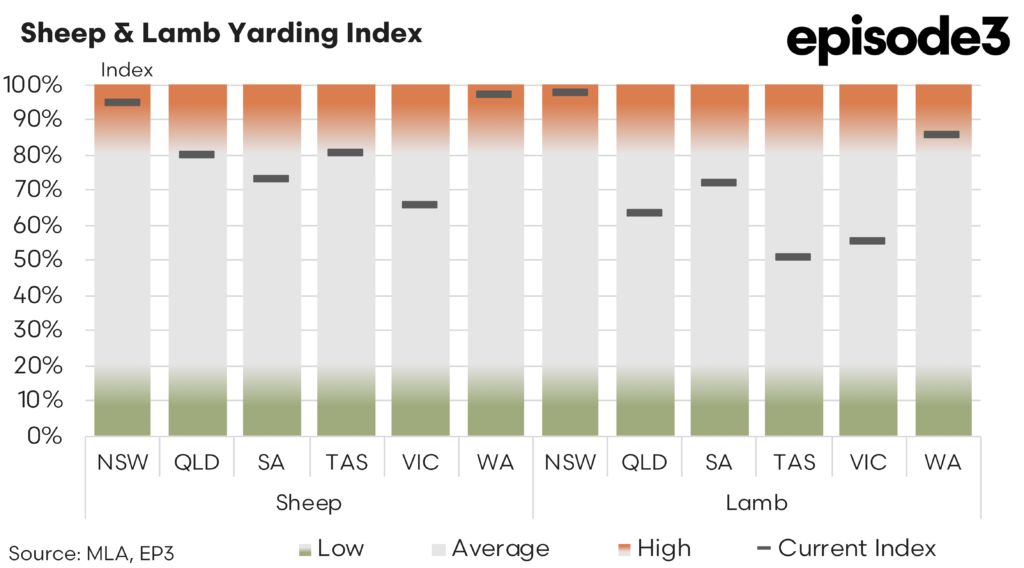

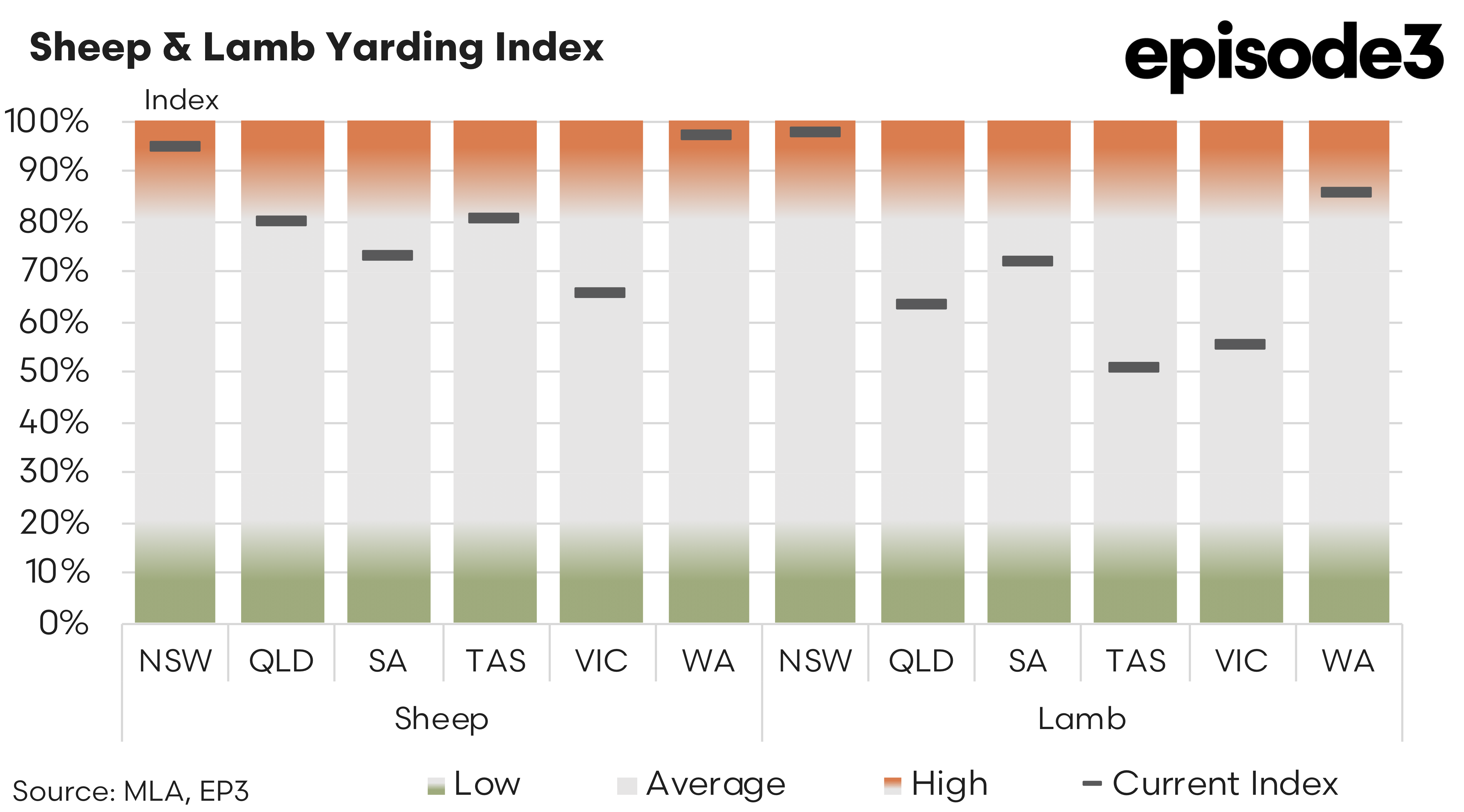

For sheep, the most notable change has come from NSW, where the saleyard yarding index surged from 62% in April to 95% in May. This is a dramatic increase, possibly reflecting both a catch-up in deferred turnoff post-holidays and the continuation of strong processor demand. WA similarly jumped from 64% to 97%, a figure that may also point to producers continuing to exit the sector in droves given the recent federal election result.

Queensland and South Australia also posted strong gains, with sheep yarding indices climbing from 58% to 80% in QLD and from 63% to 73% in SA. Tasmania saw a solid lift to 81% (up from 56%), while Victoria rose from 46% to 66%, a welcome turnaround from recent months of constrained supply.

The updated lamb saleyard throughput index from April to May 2025 reveals a significant rebound in lamb yardings across all Australian states, following the subdued activity observed during the holiday-disrupted April period. New South Wales recorded the most dramatic increase, surging from 41% to 98%, suggesting a substantial return of lamb volumes to the market.

Queensland and Western Australia also experienced strong recoveries, lifting from 42% to 64% and from 43% to 86%, respectively, indicating a re-engagement from producers and improved processing capacity. South Australia and Victoria followed suit, with SA rising from 37% to 72% and Victoria from 42% to 55%, both pointing to more active turnoff in May.

In contrast, Tasmania was the only state to post a decline, slipping from 60% to 55%, suggesting ongoing tightness in lamb supply, potentially reflecting regional seasonal limitations or a lag in finishing lambs. Overall, the national picture shows a strong recovery in lamb throughput after April’s interruptions, though state-by-state variation remains pronounced.

Market Prices

On the pricing front, the market continues to reflect a firm underlying demand base, even as some categories show recent signs of softening under increased supply pressure. Over the past four weeks, most lamb and mutton categories have seen moderate to strong gains, although the most recent week’s data has flagged some easing.

The Heavy Lamb Indicator currently sits at 870c/kg cwt, up 42c/kg over the past month, signalling robust demand for heavier stock. However, the category experienced a 9,839 head drop in yardings week-on-week, a clear indication that supply is not keeping pace with demand in this space. Despite this, the past week did see a slight upward price move of 20c/kg, suggesting ongoing processor appetite.

Light Lambs are trading at 746c/kg, having increased by nearly 41c/kg over the last four weeks. This notable uplift may reflect restocker interest or shorter turnoff cycles.

The Merino Lamb Indicator has risen by 100c/kg in the past month, now reaching 728c/kg. As with the broader lamb market, this price strength may be reflecting some processor value buying relative to other lamb categories.

Perhaps the most compelling price movement has been in the Mutton Indicator, which has lifted by 61c/kg over the last four weeks to reach 529c/kg. This sharp increase, supported by strong export market interest, is especially impressive.

Other categories such as Restocker Lambs (up 38c/kg over four weeks to 756c/kg) and Trade Lambs (up 9c/kg to 840c/kg) also demonstrate underlying demand strength. Yet Trade Lambs have seen week-on-week price drops, by 4c/kg, suggesting some mild caution maybe emerging among buyers as more stock enters the market.

The easing of April’s public holiday disruptions has led to a rebound in sheep and lamb saleyard volumes, most markedly in NSW and WA. The lamb market is yet to experience a similar saleyard throughput gains in Tasmania and Victoria.