The Grain Bullets

5 main drivers of the grain market

- Black Sea Crop Prospects and Upward Revisions

The week was marked by a series of upward revisions to crop forecasts across the Black Sea region. SovEcon lifted its 2025 wheat production outlook for Russia by 1.8 million tonnes to 82.8 million tonnes, citing improved weather in key southern areas, although output in the top region of Rostov remains under pressure. Ukraine’s crop outlook also improved, with SovEcon raising forecasts for corn, wheat, and barley on the back of good planting progress and May rains. These revisions underpin expectations for robust Black Sea grain supplies for the 2025/26 season, shaping global price sentiment and export competition.

- Currency Moves and Export Competitiveness

Currency fluctuations played a critical role this week, particularly as the US dollar dropped to a multi-year low against the sterling and euro following disappointing US employment data. This weakened the competitiveness of European wheat exports, causing prices for London and Paris wheat futures to underperform relative to US markets. As a result, European grain exporters faced greater challenges in global markets, while US futures saw some support from the more favourable currency environment.

- Market Positioning and Upcoming WASDE Report

Market participants turned cautious ahead of the upcoming USDA WASDE crop report, with many traders taking fresh short positions in wheat futures. This positioning was compounded by easing fears over Russian crop losses and a recent improvement in US crop ratings. As anticipation builds for the WASDE release, expectations are that the forecast for US wheat production will be raised, adding further pressure to futures prices, which lost ground late in the week. Additionally, US wheat export sales weakened sharply, nearly halving from the previous week.

- Volatility in Oilseeds and Energy-Linked Support

Oilseed markets experienced swings driven by external factors and technical moves. Paris rapeseed futures bounced midweek, helped by concerns over Canadian canola sowings and support from higher crude oil prices amid Black Sea tensions. Soyoil and soybeans were affected by uncertainty around US biofuel policy but found late support on improved export sales and signs of easing US-China trade tensions. Overall, oilseed prices were volatile but saw periods of support on both fundamental and technical grounds

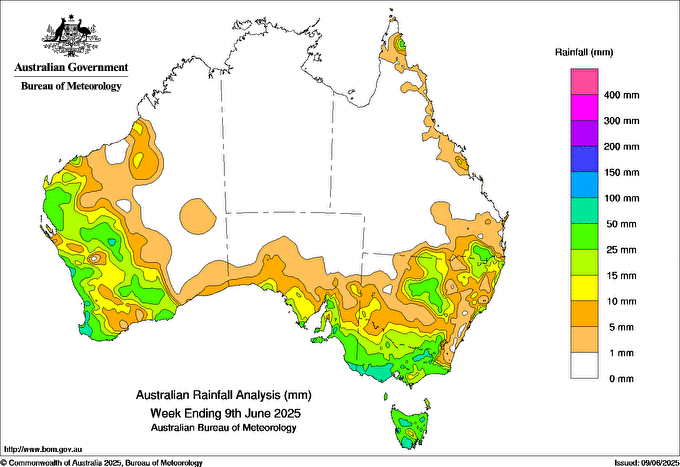

- Australian rain

Australian farmers had their eyes on the weather forecasts, and some beneficial rain has hit parts of Australia. The rain was not as widespread in Western Australia as expected, but South Australia and Victoria got some much-needed rainfall. A little more will be needed though, the drought in those areas is not over yet.