The Fert Bullets

New Updates

Episode 3 has been reporting on Australian fertiliser markets for a long time, and in this update, we are changing the format slightly, to become our weekly updates. Our format will cover the main points impacting the fertilizer market, along with updates on local pricing and imports.

Our fair value model for pricing, which has recently been revised and improved after the you all filled in our fertilizer census, which you can continue to fill in here

Market Drivers

War and Ceasefire Triggered Wild Swings in Urea Prices

The escalation of war in the Middle East, with fears that Iran would close the Strait of Hormuz and the US might enter the conflict, drove urea prices to panic highs. Oman reportedly sold at A$808 at its peak. A sudden ceasefire on 24 June ended the immediate threat, and urea prices dropped but still closed the week significantly higher than before, reflecting lingering supply risks.

Production Resumes in Egypt and Iran, Easing Supply Fears

The ceasefire allowed Israel to restart gas supplies to Egypt, quickly bringing Egyptian urea plants back online. Iran also began restarting its seven urea plants by 28 June. These moves reassured the global market, that volume would return soon.

Prices Retraced but Stayed Elevated Above Pre-war Levels

After the ceasefire, Middle East urea offers dropped to A$669 for July shipments. In Brazil, urea traded at A$792 early in the week, and Chinese urea was available at A$660. Despite these corrections, all prices remained well above pre-conflict levels as buyers continued to secure supply.

China’s Export Policy Remains Uncertain and Market-moving

China remained a key wildcard, with ongoing discussions to approve another 2mmt of urea export quota. An increase in exports from China will allow some breathing room for the supply chain.

India and Brazil Step Back In, Providing Price Support

With supply disruptions easing, India quickly announced a new 2 million metric tons (mmt) urea tender for early July, while Brazil resumed buying as Iranian and Egyptian exports looked set to restart. This renewed activity by major importers will hold prices up high in the short to medium term.

Pricing

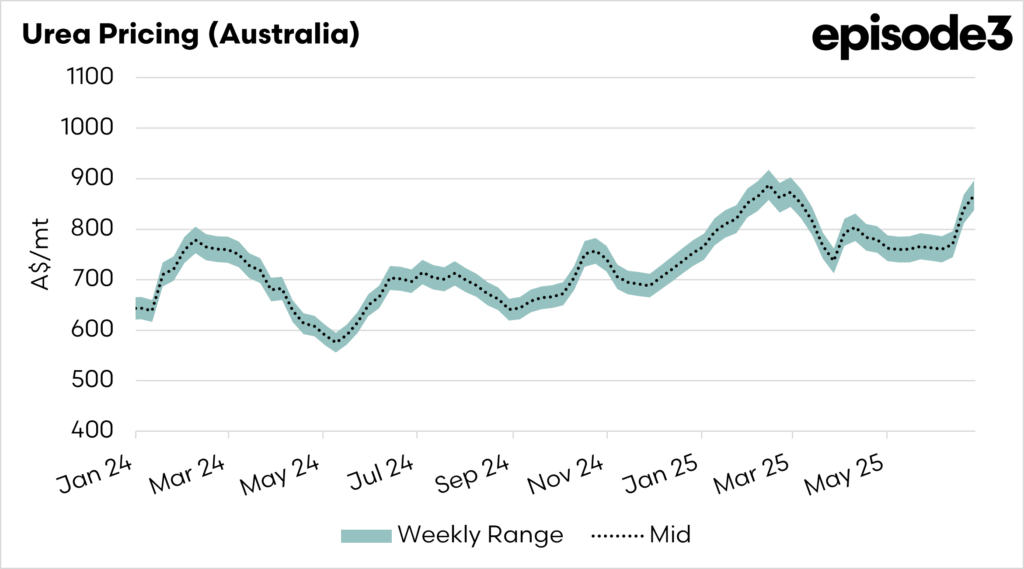

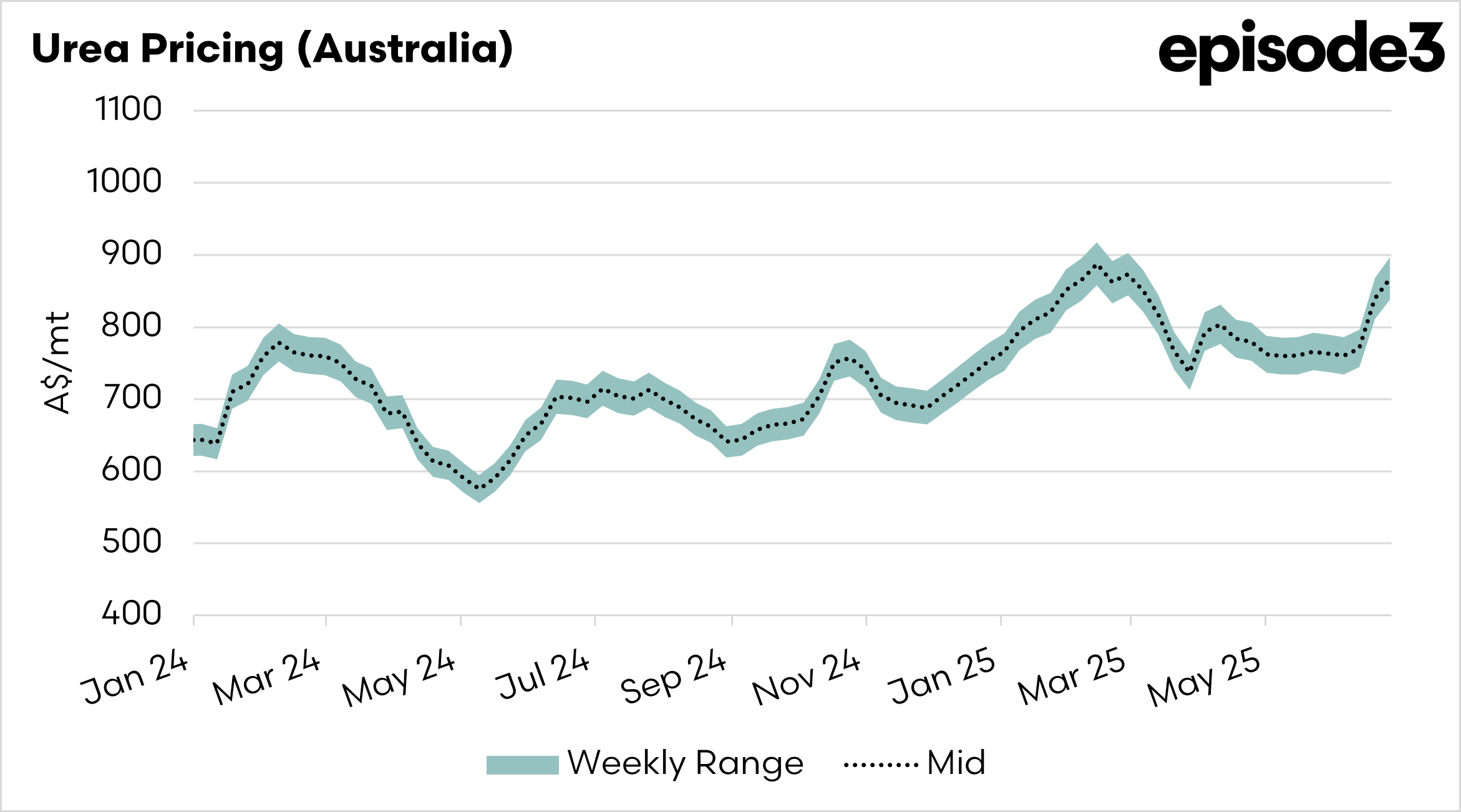

The fair value model, which we have been producing on a monthly basis for years, has now been updated to a weekly model. This model calculates the fair value cost of urea imports into the country. The first chart below shows our new weekly urea pricing model, which we will be producing (and continuing to improve). This gives an indicator of where the market should roughly be for urea, which the grower pays, the second chart just zooms in on this year for clarity.

In developing this fair value pricing model, we utilise overseas values and freight costs to Australia. This update uses last week’s pricing data, which started off very high, and has fallen. We expect that we should see further downward revisions this week, as the ceasefire holds.

Census

Thanks to everyone who helped by filling in our census (click here to complete it), it has allowed us to continue reviewing our modelled fair value pricing. It has also given us some interesting insights into the supply chain in Australia. We will gradually release insights from this census, which will start below.

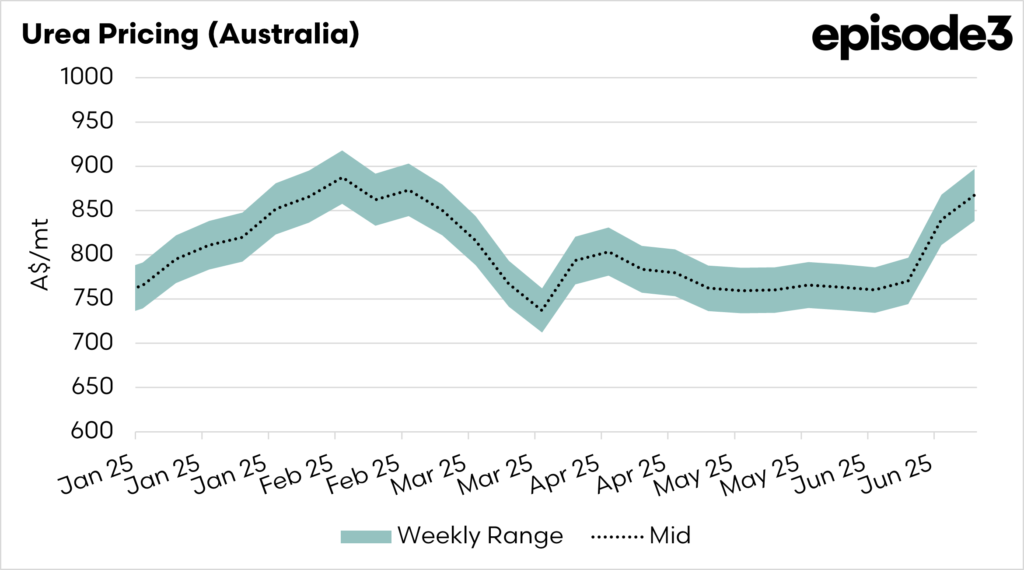

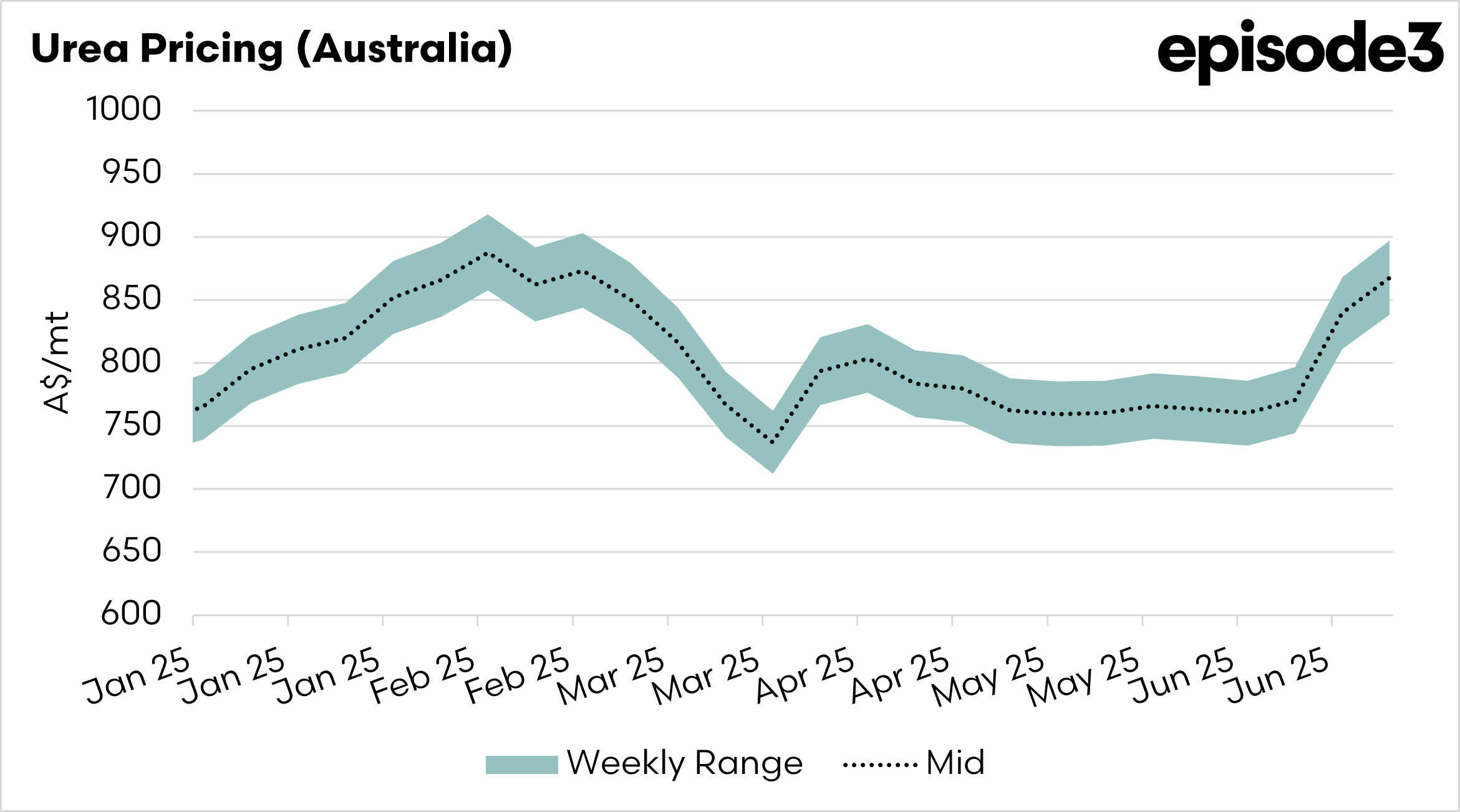

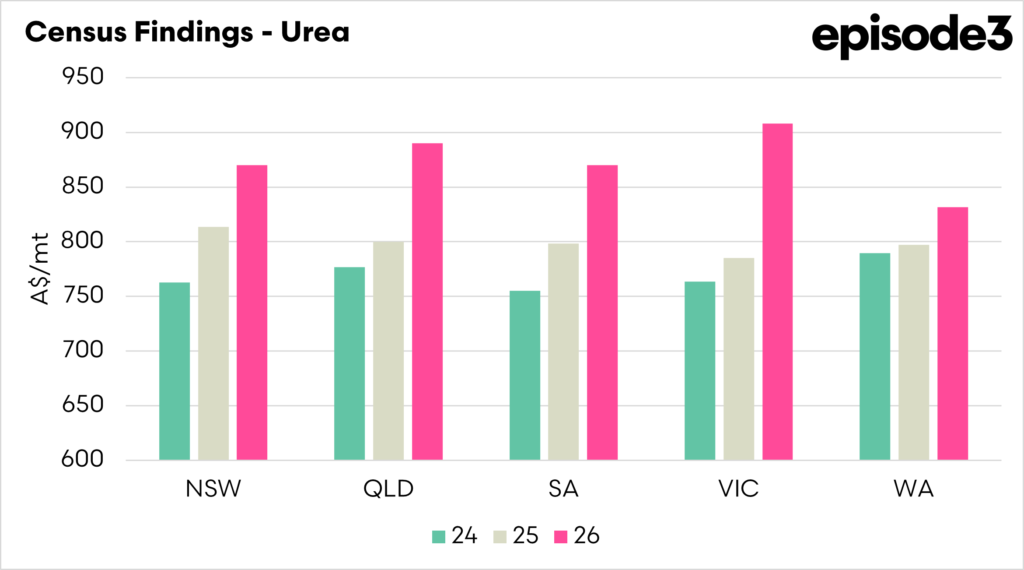

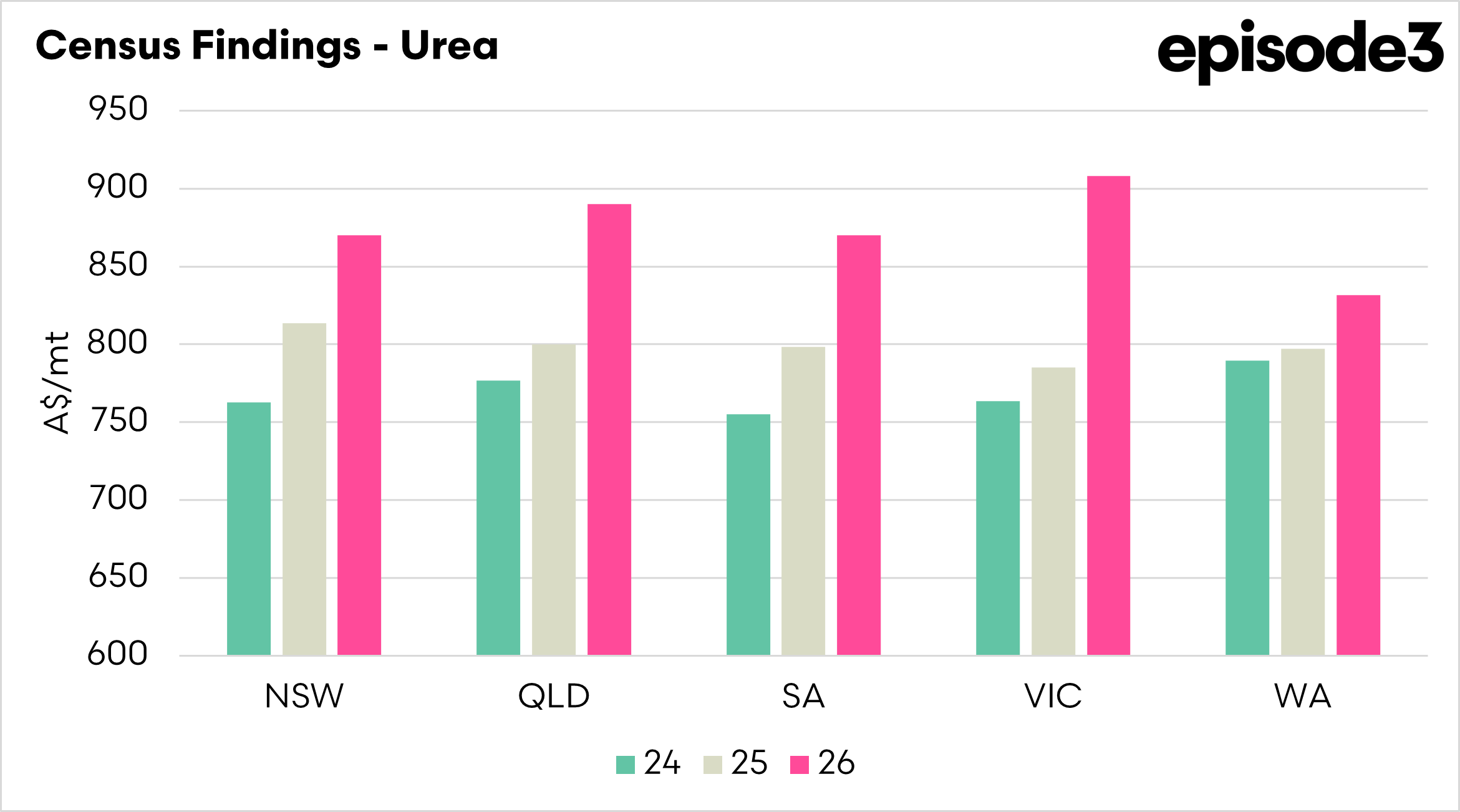

The first chart displays the pricing for the last three weeks from this census. We can see that the pricing has increased significantly in the Eastern States, whereas WA did not have as much of a rise, albeit they were starting at a higher level. CBH the grower co-operative, seemed to keep its prices the most steady, with next to no rise from our census participants between the weeks. Reflecting that they are charging a level at which they brought the product into the country, and not increasing because of global levels.

If any fertiliser companies in Australia, want to be involved in this process, and would like to contribute their pricing, then please get in touch by emailing me on andrew@episode3.net