Unpredictable certainty

“I know I am unpredictable. That’s the only thing I’m sure of” – Sylvester Stallone

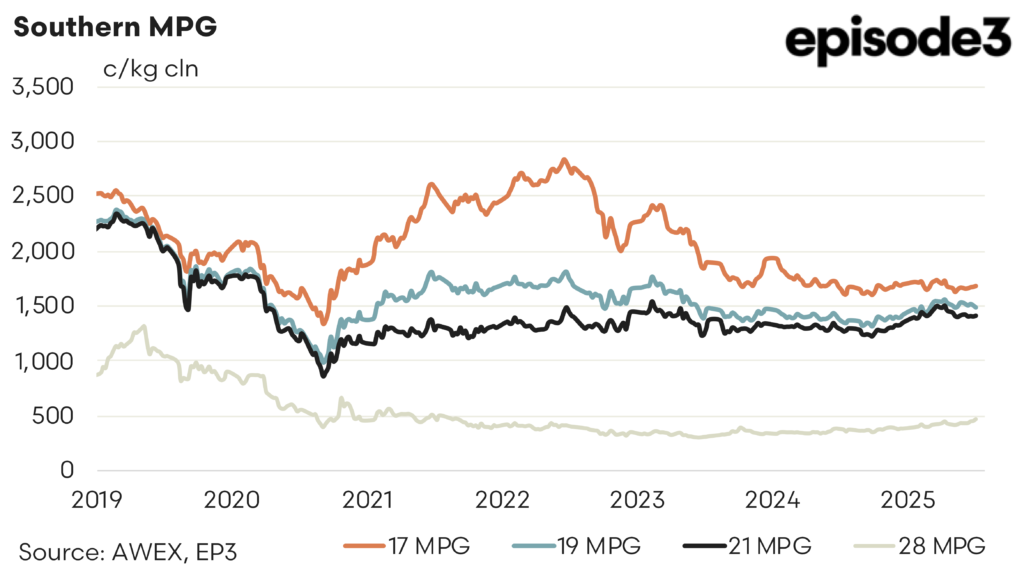

Another week of meandering prices. Tight supply and intermittent demand saw prices fluctuate across the micron ranges. Super fine wools tended dearer, 18-to-20-micron wools were 10 to 15 cents cheaper whilst broader merinos and crossbreds 10 cents dearer. The wash up was and unchanged EMI in a week when the Australian Dollar lifted against most of the exporting currencies.

The forward market remains becalmed. The lack of substantial forward demand leaves buyers with sporadic requirement of risk cover. A good example of this was the only trade late this week of 19.5 in October. It was executed at 1475 (a 27-cent premium to cash). The buyer was looking to cover some exposure in the spring and willing to pay a premium. General bidding remains at a slight discount to spot reflecting the difficulty of exporters to find business in the spring/summer window. The lack of depth of offering from growers across the board adds to the problem. That lack of depth is understandable from a price point of view in the finer wools. The medium merino wools, although coming of their pre easter highs, still present an opportunity for fair value hedging.

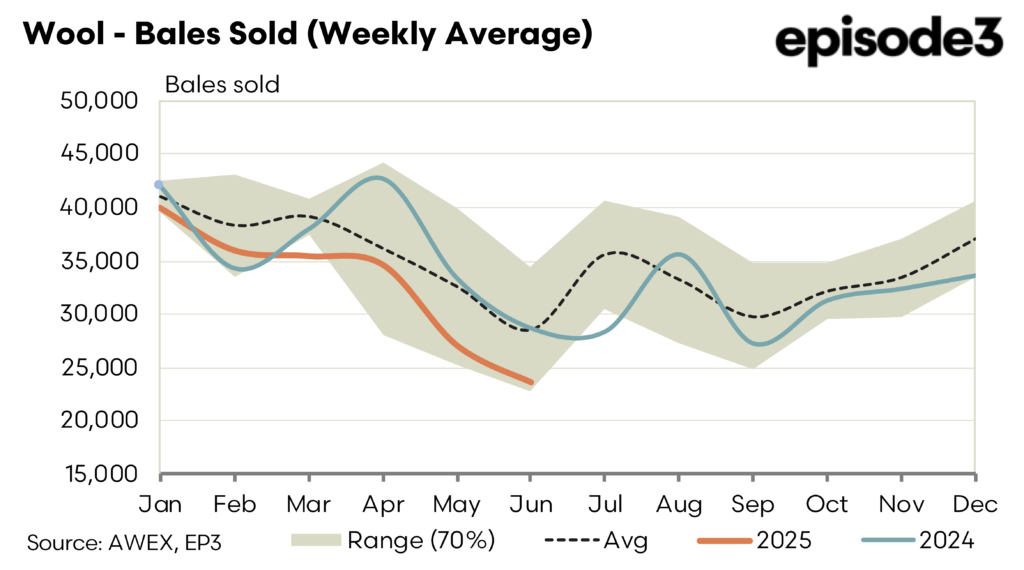

We go into the last three weeks prior to the recess with supply and demand evenly balanced. External factors will decide any major change in direction. With Mr Trump once again taking markets to the cliff on July 9th Tariff Day it is anyone’s guess how the chips will fall.

Trade this week

19.5 Oct 1475 5t

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.