Cattle supply shifts north as cow price lifts

Market Morsel

Australia’s cattle market pivoted northward during June 2025 as the final month of the financial year brought a realignment in both supply and processing dynamics when compared with May.

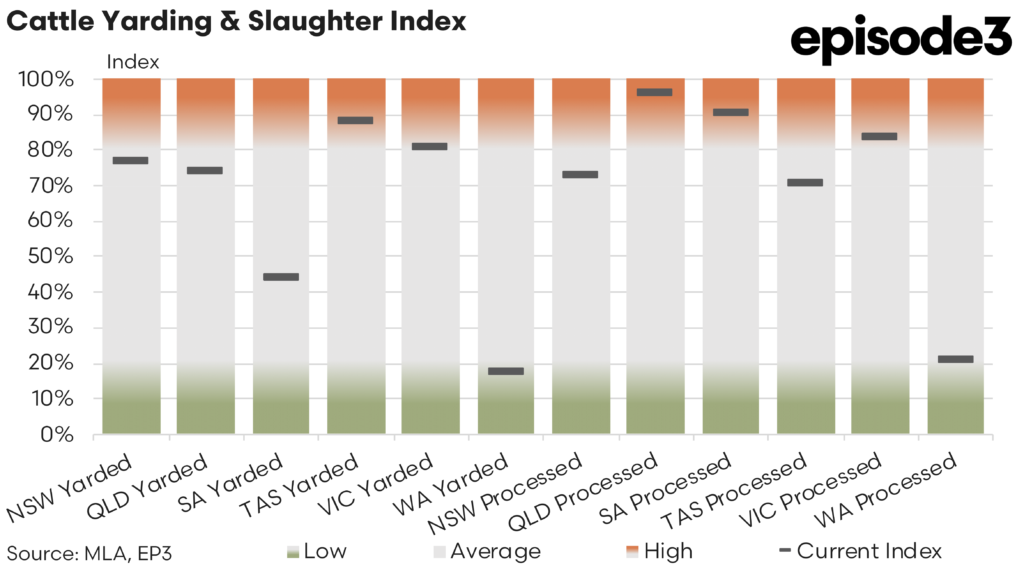

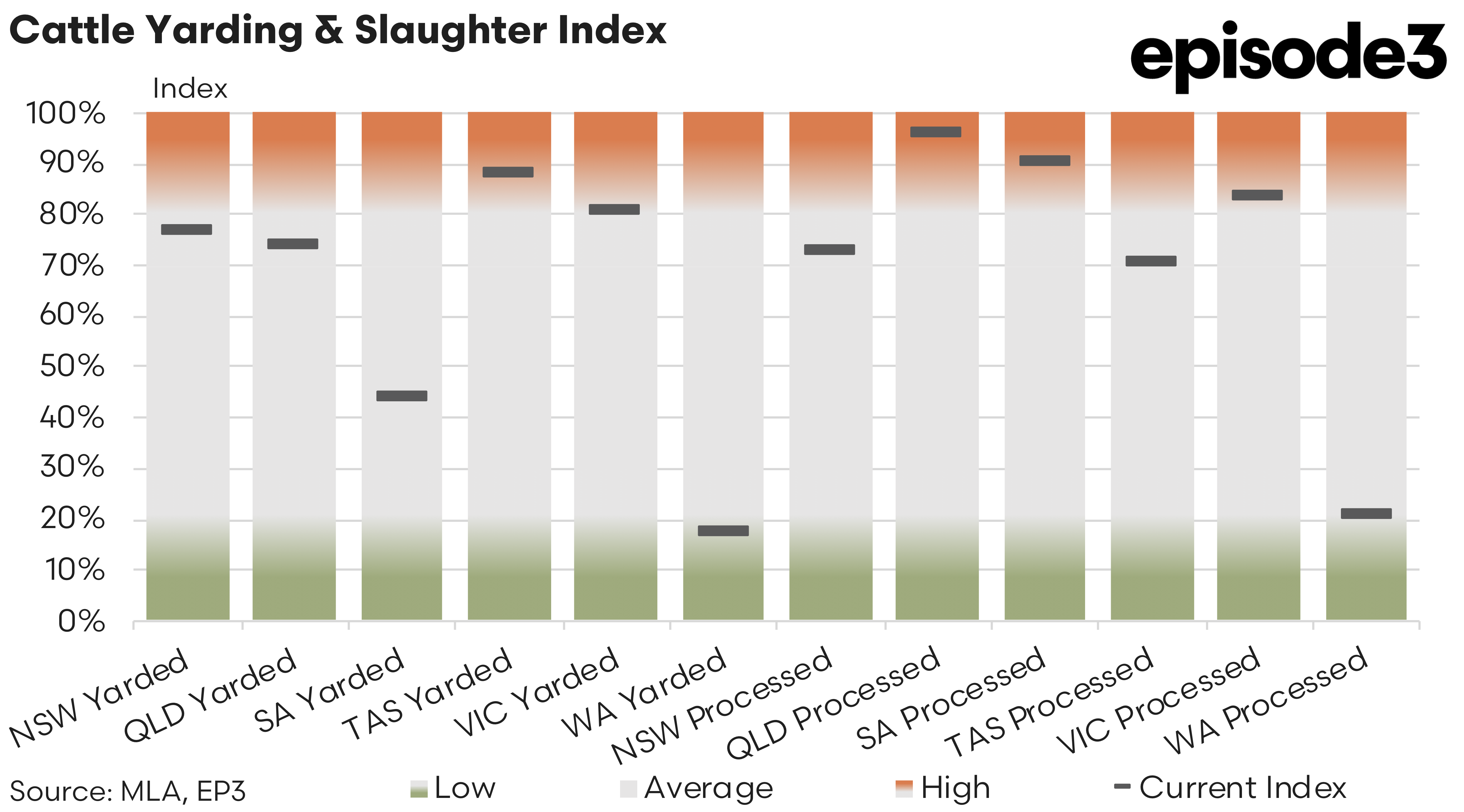

Fresh statistics show that cattle yardings index score in New South Wales slipped from 89% in May to 77% in June, while Victoria’s tally fell from 91% to 81% and South Australia plunged from 77% to just 44%. This southern easing contrasted with a seven-percentage-point rise in Queensland, where yardings lifted to 74%, reflecting the delayed release of cattle that northern producers had been holding back. Tasmania managed only a marginal two-percentage point decline, signalling relatively steady supplies, yet Western Australia again underscored its chronic capacity issues as yardings halved from 40% to a paltry 17%.

The yarding swings naturally flowed into processing volumes. Queensland’s works accelerated, pushing plant utilisation from 85% in May to an impressive 96% in June, effectively pressing against the state’s post-pandemic labour ceiling. South Australian processors nudged one point higher to 90% and, although modest, that gain was sufficient to keep them active buyers of cows and finished steers out of Central Australia and parts of western Queensland.

The larger story, however, lay in performance south of the Murray. Victoria’s utilisation slid from 97% to 84% percent as several major plants used the King’s Birthday week to undertake annual maintenance shutdowns. New South Wales followed suit, dropping to 73%, a fifteen-percentage point retreat from May. Tasmania also drifted ten points lower to 71%, while Western Australia dipped a further two points to 21%, leaving the west increasingly dependent on live export pathways that have struggled for consistency since late 2024.

These shifts in physical throughput are filtering into price behaviour. Heavy steers, which had rallied strongly through April and May, have begun to soften under the twin pressures of abundant grain-fed turn-off in Queensland and more careful processor bids. The MLA Heavy Steer Indicator finished June at 347 cents a kilogram liveweight, a 3 cent correction across the month, yet still 47 cents higher than the corresponding point last year.

In contrast, processor cow values continue their own quiet bull run. The indicator for cows rose a further 11 cents over the four weeks to hit 293 cents, extending a rally that has added more than 73 cents in the past twelve months. The divergence captures the current fundamentals with global demand for lean grinding beef, especially from the United States where domestic cow numbers remain tight, is underpinning returns for manufacturing beef, while market appetite for higher-value chilled cuts is constrained by slower consumer spending in parts of Asia and Europe.

Such price spreads, coupled with the feed and freight economics of winter, are reshaping interstate cattle flows. Competitive bids from Victorian, South Australian and southern New South Wales processors for northern cull females had already been evident in May. In June they persisted, though the southern volumes thinned. Simultaneously, Queensland processors are drawing more heavily on their own backyard, turning to grain-fed bullocks to fill kill sheets and easing the pressure on grass-fed steer grids.

The shifting female slaughter ratio underscores the regional contrasts. Queensland, remains below liquidation territory signalling that many northern producers are at least maintaining breeder numbers. Victoria, by contrast, continues to liquidate at pace with sustained elevated female cattle slaughter ratios noted during the first quarter of the season. These figures imply that breeding herds in the south will enter spring with a smaller base, potentially tightening local availability of replacement heifers and first-calving cows in 2026 if pasture conditions recover.

While the June utilisation lift has helped the industry climb to its highest weekly kills in several years, the processing ceiling of around 160,000 head per week remains immovable until more plant labour is secured or additional shifts are added. Plants running near capacity must juggle rising livestock costs at a time when average beef export prices have mostly trekked sideways. Processors have limited latitude to pass those higher costs down the chain, with domestic retail beef prices almost unchanged over the same period. The result was a margin squeeze into April, which was especially acute for operators relying on heavy steer throughput.

Looking into July, southern processors will hope to reopen at higher speeds, yet lingering winter feed gaps may keep cow weights light and prompt another round of paddock acquisitions from farther north. Processor cows continue to enjoy a more bullish backdrop with US lean beef demand, firm tallow values and shrinking South American quota availability each hint at steady offshore demand for Australian 90CL product through to the third quarter of this year.