Big drop

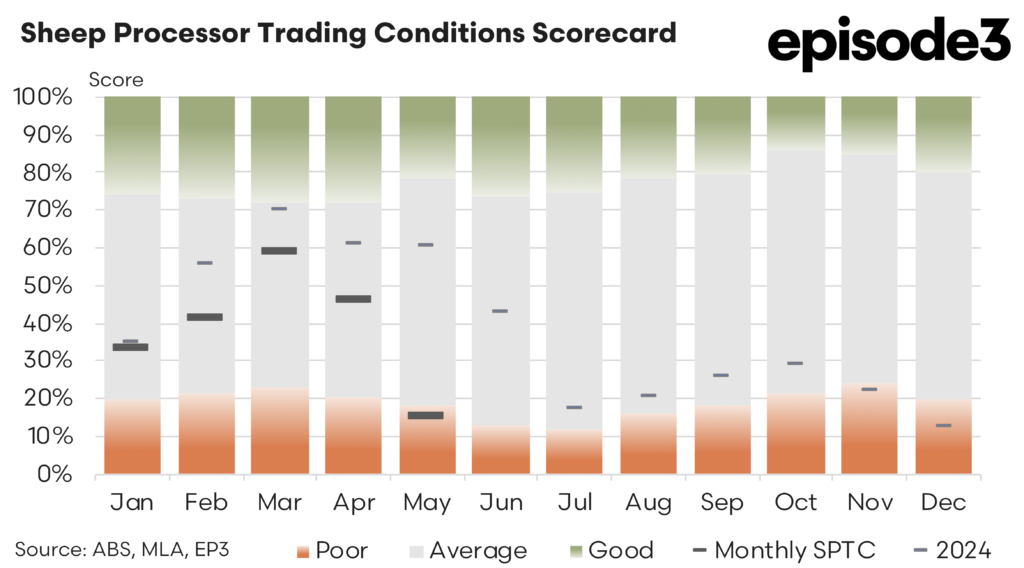

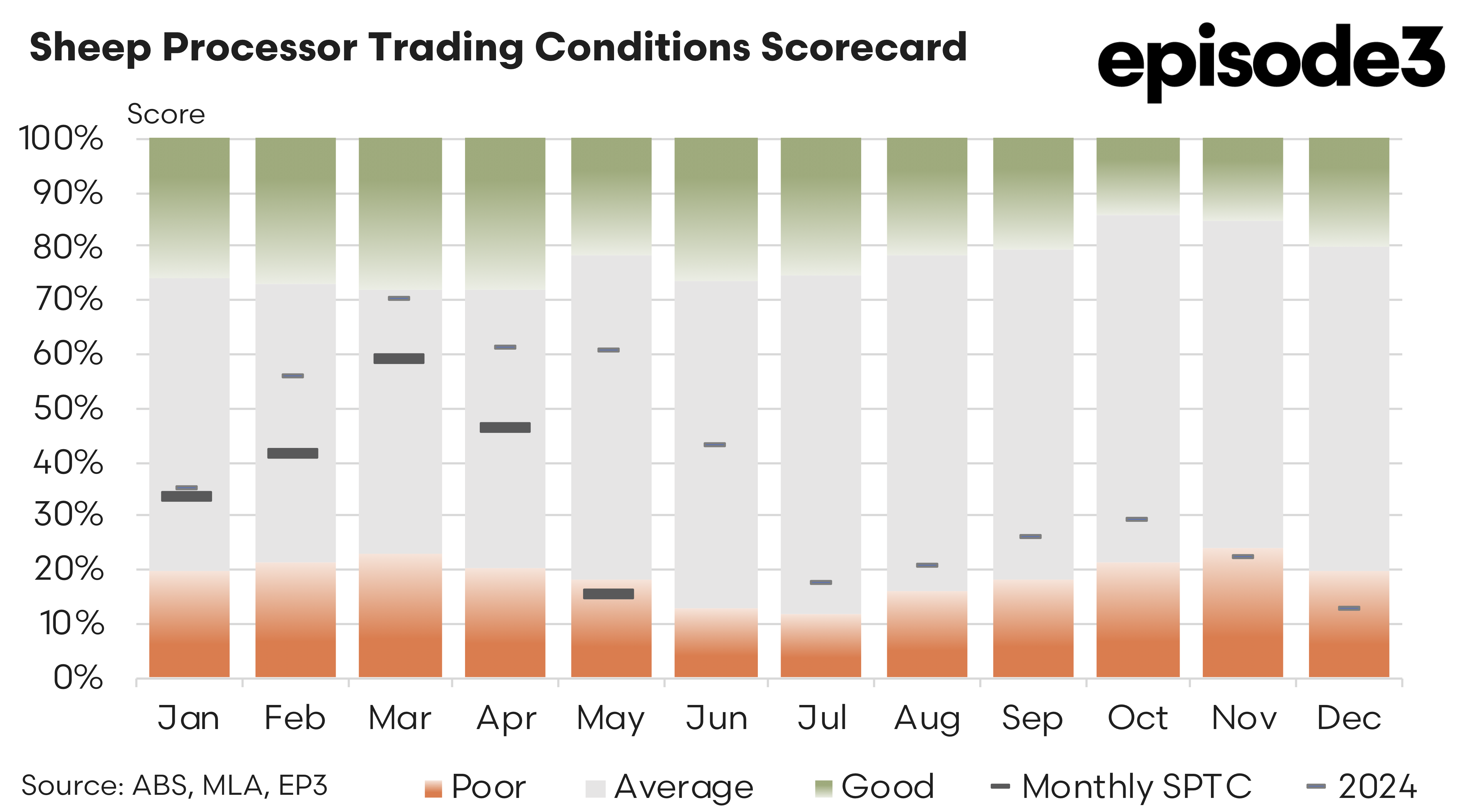

Sheep Processor Trading Conditions Model

After a short-lived improvement in trading margins for Australian sheep processors during March and April, conditions deteriorated sharply in May 2025, with the Sheep Processor Trading Conditions (SPTC) Index slumping to just 15%. This decline represents one of the steepest month-on-month falls recorded in the past 18 months and signals renewed pressure on processor profitability heading into winter.

The updated SPTC chart now paints a more volatile picture than previously reported, following the inclusion of fresh co-product and rendered product pricing data that was delayed earlier in the year. While March had been reported in analysis released previously at a modest 33%, the revised inputs, lifted the final March index to a much stronger 59%. Similarly, April’s score was upgraded from 24% to 46%, underpinned by continued strength in co-product values. However, these positive revisions now serve only to emphasise the severity of the subsequent drop recorded in May.

The early autumn bounce in processor conditions was largely driven by strong demand and pricing for co-products, especially tallow, which had been overlooked in earlier estimates due to data delays. Tallow prices surged by around 40% from February to March, with sustained pricing through April, offering a much-needed buffer to processors who were already contending with tightening livestock supplies and uneven export demand.

Co-product income plays a critical role in sheep processor profitability. When prices for tallow, meat and bone meal, and skins rise, they can help offset elevated procurement costs for lamb and mutton. In March and April, this secondary income stream worked in favour of processors, improving overall conditions despite subdued movements in export prices and retail demand.

That brief period of margin relief came to an abrupt end in May. Procurement costs for both lamb and mutton surged over the month, forcing processors to pay significantly more to secure supply. Average lamb prices jumped 7.6%, while mutton prices climbed by nearly 12%. These increases outpaced any gains in co-product returns or export values.

Export demand remained lukewarm in May, with the value of Australian sheepmeat exports rising by just 1.2% overall. Some key markets performed worse than average, notably the United States and Malaysia, where prices slipped 1.4% and 0.6% respectively. These declines weighed on processor revenue at a time when their input costs were moving sharply higher.

Further compounding the problem was a downturn in rendered product prices during May. While co-product prices such as sheep offals posted modest gains of nearly 10%, rendered product values slumped by around 15%. The result was a significant net decline in overall by-product revenue, just as livestock procurement costs were peaking.

With the balance of revenue and costs tipping heavily in the wrong direction, the May SPTC Index plunged to 15%, dragging processor conditions back into what EP3 classifies as “Poor” territory. This sits just a few points above the lowest scores recorded during the tail end of 2024.

The May figures mark a worrying shift in the outlook for sheep processors. With livestock prices on the rise and limited ability to pass costs downstream, either to domestic retail markets or export buyers, processors find themselves caught once again in a classic cost-price squeeze. Further increases in procurement prices, particularly for mutton, could worsen the situation.

In the face of these renewed pressures, sheep processors will need to focus sharply on operational efficiency, supply chain alignment, and product diversification. Some may look to add value to target supply toward higher value markets. However, there remains concerns across the processing sector that the supply of heavy and trade lambs into August will remain problematic and while we have seen lamb prices top out recently margins will remain under strain, particularly if we see a further price peak for livestock before the spring flush appears.

The revised SPTC chart underscores the precariousness of current conditions. From a high near 60% in March to just 15% in May, the fall is both sharp and sobering, and it’s a reminder that processor fortunes remain highly exposed to the fine balance of livestock input costs and co-product support. Unless market dynamics shift again in favour of processors, winter 2025 could be a long, tough stretch for an industry that had only just begun to find its footing again.