A handy competitive landscape

Market Morsel

Australia’s beef export industry is shaped by its performance in a handful of key international markets. Among these, the United States, China, Japan, South Korea and Indonesia stand out as critical destinations, accounting for the bulk of Australian beef exports. Within each of these markets, Australia faces a distinct set of competitors, each with different strengths and strategies. While trade access, historical relationships and supply reliability all matter, pricing remains a major lever.

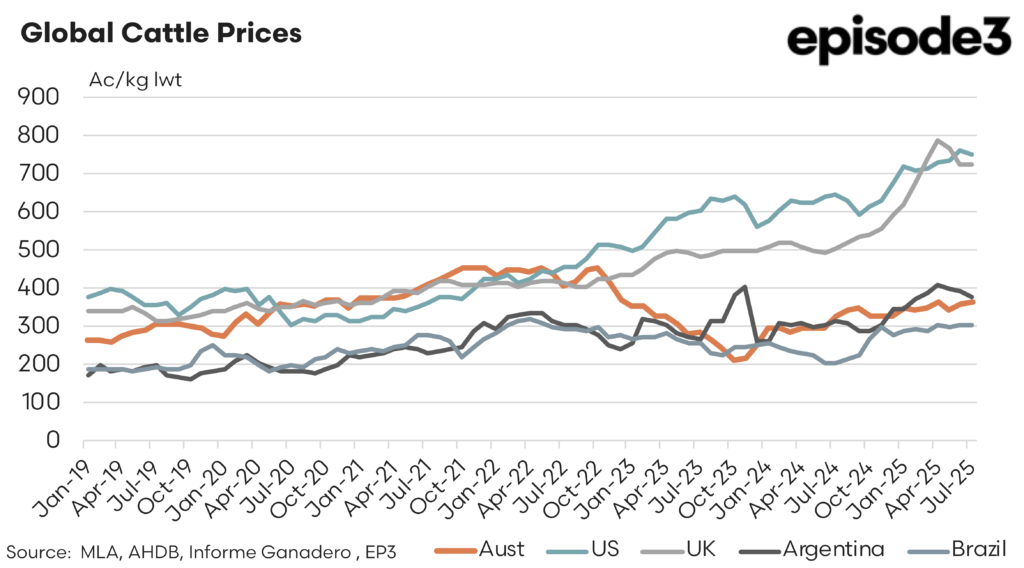

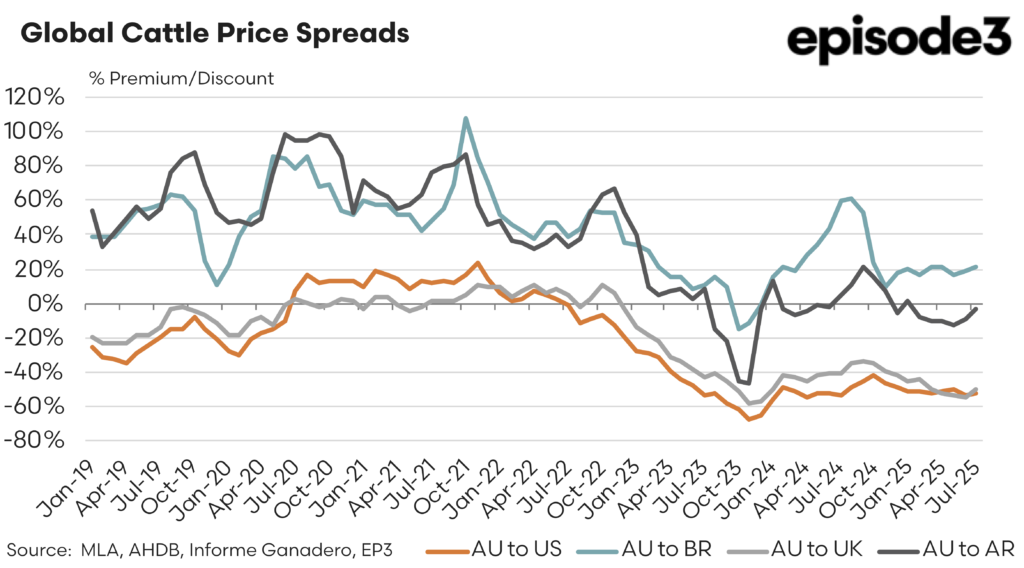

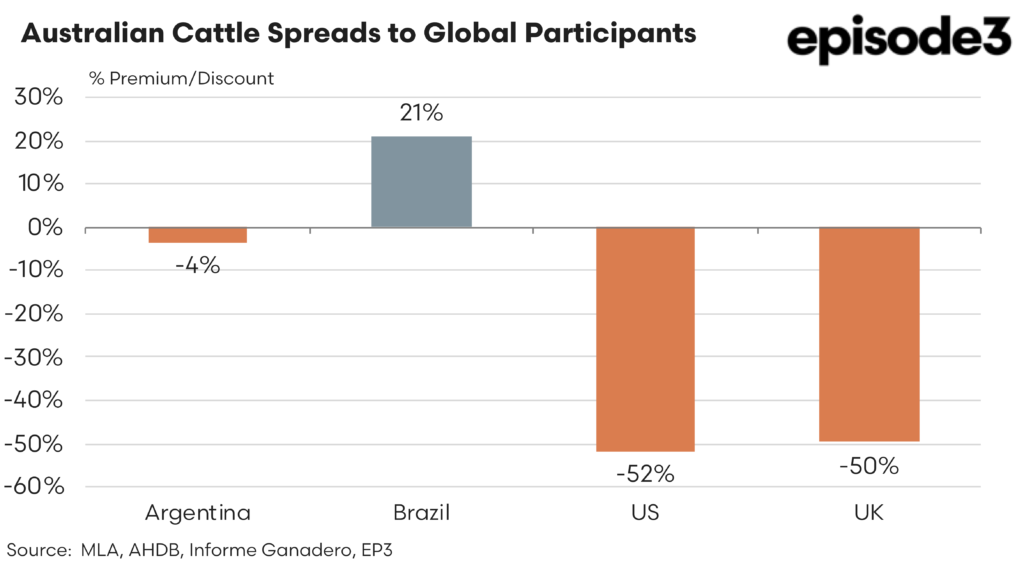

Australian cattle are currently trading at a significant discount to their US and UK counterparts, on par with Argentina and only marginally higher than Brazilian suppliers compared to recent historic trends. These price differentials, and how they align with market access and segmentation, reveal both challenges and opportunities for the Australian beef sector.

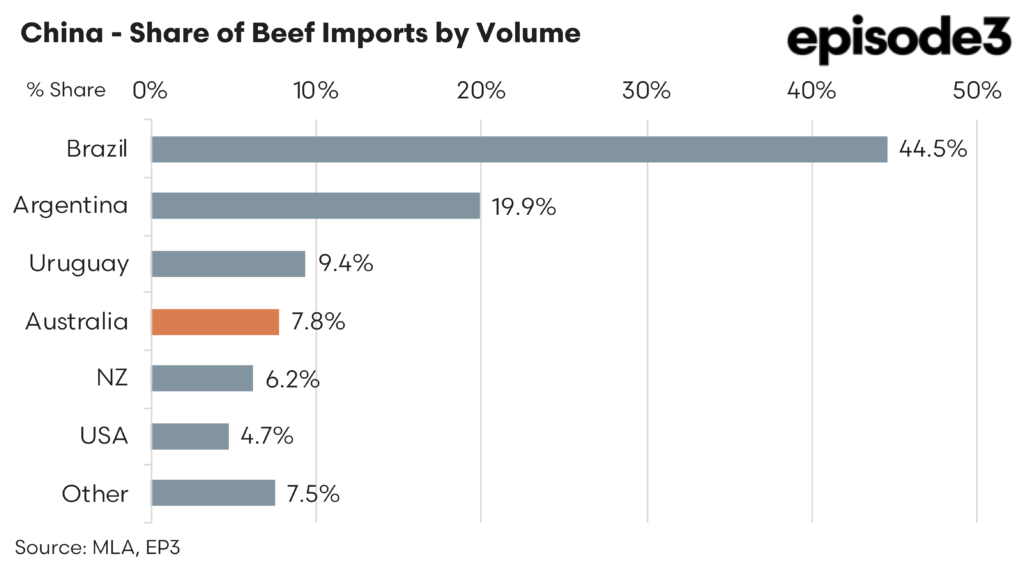

China is the largest destination for global beef exports, but it is also a highly segmented market. While Brazil holds the largest overall share of beef imports into China at around 45 per cent, it tends to supply the volume end of the market, with its product mostly destined for lower-value processing channels or more price-sensitive inland cities.

Australia, by contrast, focuses on premium foodservice and retail segments in wealthier coastal cities like Shanghai, Shenzhen and Beijing. In these high-income areas, Australia’s main competitors are not Brazil but rather the United States, Argentina, Uruguay and New Zealand, who all supply chilled or higher-value frozen beef.

Australia currently holds just under 8 per cent of the Chinese beef market by volume, down from earlier peaks, due to the recent recovery in market share after the temporary suspension of some processing plants. However, Australia’s reputation for food safety, traceability and grain fed or high-quality grass fed beef still gives it a strong foothold in premium channels.

Despite current pricing showing Australian cattle trading at a premium on par with Argentina, this pricing disadvantage is less significant in affluent regions where quality and safety are prioritised. As such, Australia’s real competition in China is not about competing with Brazil on volume, but about holding its position in the premium space from other high-quality suppliers such as the USA, whom we currently enjoy a healthy price discount against.

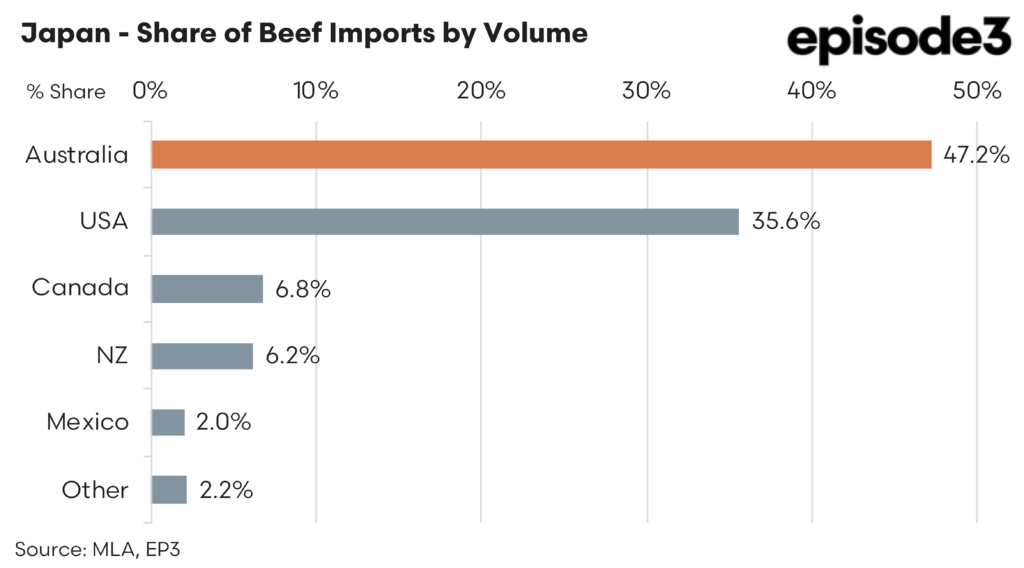

In Japan, Australia remains the largest supplier of beef, accounting for just over 47 per cent of the import market. The United States is close behind at 36 per cent, while Canada, New Zealand and Mexico collectively hold around 15 per cent. Japan is a mature and high-value market, with a strong demand for grain fed beef and established preferences for chilled product.

Australian beef enjoys preferential access under the Japan–Australia Economic Partnership Agreement and benefits from long-standing supply relationships with Japanese importers and foodservice companies. The current discount in Australian cattle prices compared to the US provides Australia with a margin advantage in this competitive market. With US cattle still trading at a significant premium to Australian product, Australia has an opportunity to reinforce its price-to-quality advantage in Japan’s foodservice and retail sectors.

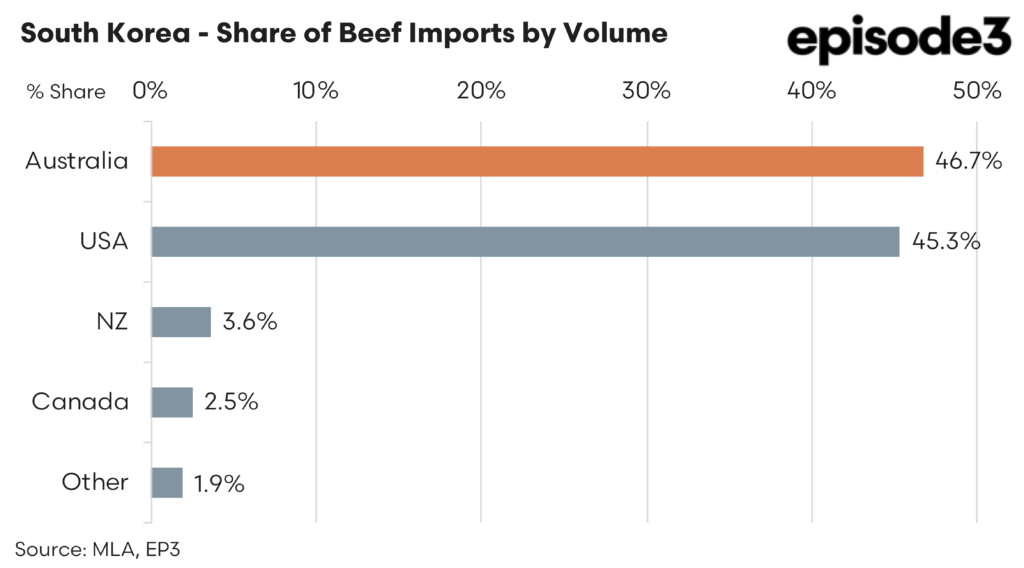

South Korea presents a more evenly split competitive landscape. Australia and the United States each hold around 45 per cent of the Korean beef import market, with New Zealand, Canada and others making up the balance. Korea is highly sensitive to both price and supply continuity, and the Australia–Korea Free Trade Agreement provides a strong basis for trade.

Australia’s current pricing advantage relative to US beef, with a 52 per cent discount in live cattle prices, gives it considerable leverage to grow or consolidate market share, particularly in price-sensitive retail formats and barbecue-style foodservice venues. However, the US remains a formidable competitor in Korea due to its well-established chilled grain fed programs, which appeal to higher-income Korean consumers.

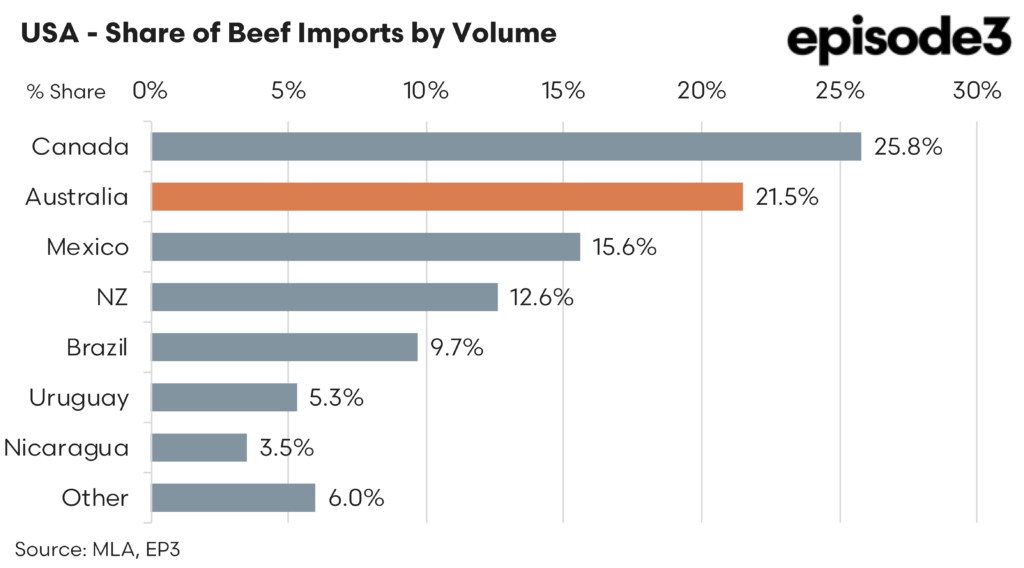

In the US market, Australia is one of many suppliers, with Canada holding the largest share by volume at 26 per cent. Australia’s share is currently just over 21 per cent, with Mexico, New Zealand and South American exporters also present. The US market is unique in that it often requires lean manufacturing beef to blend with domestic fat trim, particularly in hamburger production. Australia has historically been a key supplier to meet this need.

While the US cattle market is currently trading at a substantial premium to Australian levels, the discount in live cattle prices supports the competitiveness of Australian frozen manufacturing beef. With Australian cattle prices well below US levels, Australia is positioned to increase shipments to US importers looking for cost-effective lean beef. That said, trade is still constrained by quota access and regulatory conditions, and Australia’s capacity to expand in the US is not unlimited.

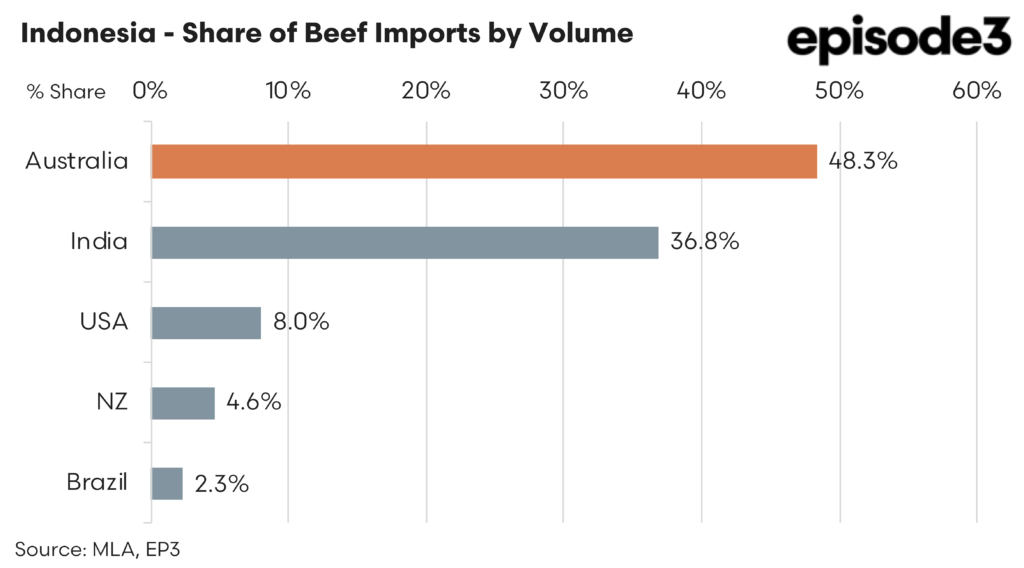

Indonesia is another important market, especially for northern Australian producers. Australia holds nearly half the market share in Indonesia, with India supplying around 37 per cent and the US, Brazil and New Zealand sharing the remainder. Indian buffalo meat is dominant in the low-cost frozen beef segment, particularly for wet markets and foodservice applications.

Australia, in contrast, focuses on both boxed beef and live cattle shipments, supplying more diverse product offerings to wet markets, supermarkets and food manufacturers. While pricing matters in this market, so too does halal certification, animal health assurance and consistent supply. Australia’s current pricing advantage relative to many global peers enhances its competitiveness, particularly as buyers seek reliability and safety alongside affordability.

Taken together, these market dynamics illustrate the strategic positioning of Australian beef. The recent global trends in cattle prices has improved Australia’s competitiveness against key international competitors. With the US and UK cattle markets trading at premiums exceeding 50 per cent over Australian prices, and Brazil holding only modest price advantages, Australia is better placed to defend or grow its market share in key destinations. The challenge ahead lies in balancing volume growth with maintaining brand equity and trust in the high-value segments where Australia has historically excelled.