Closed for winter

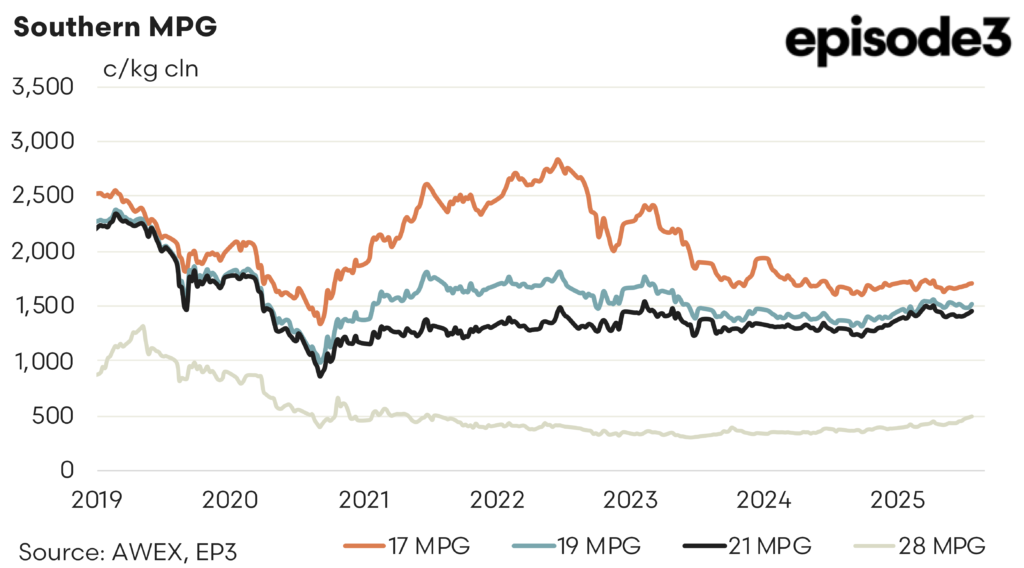

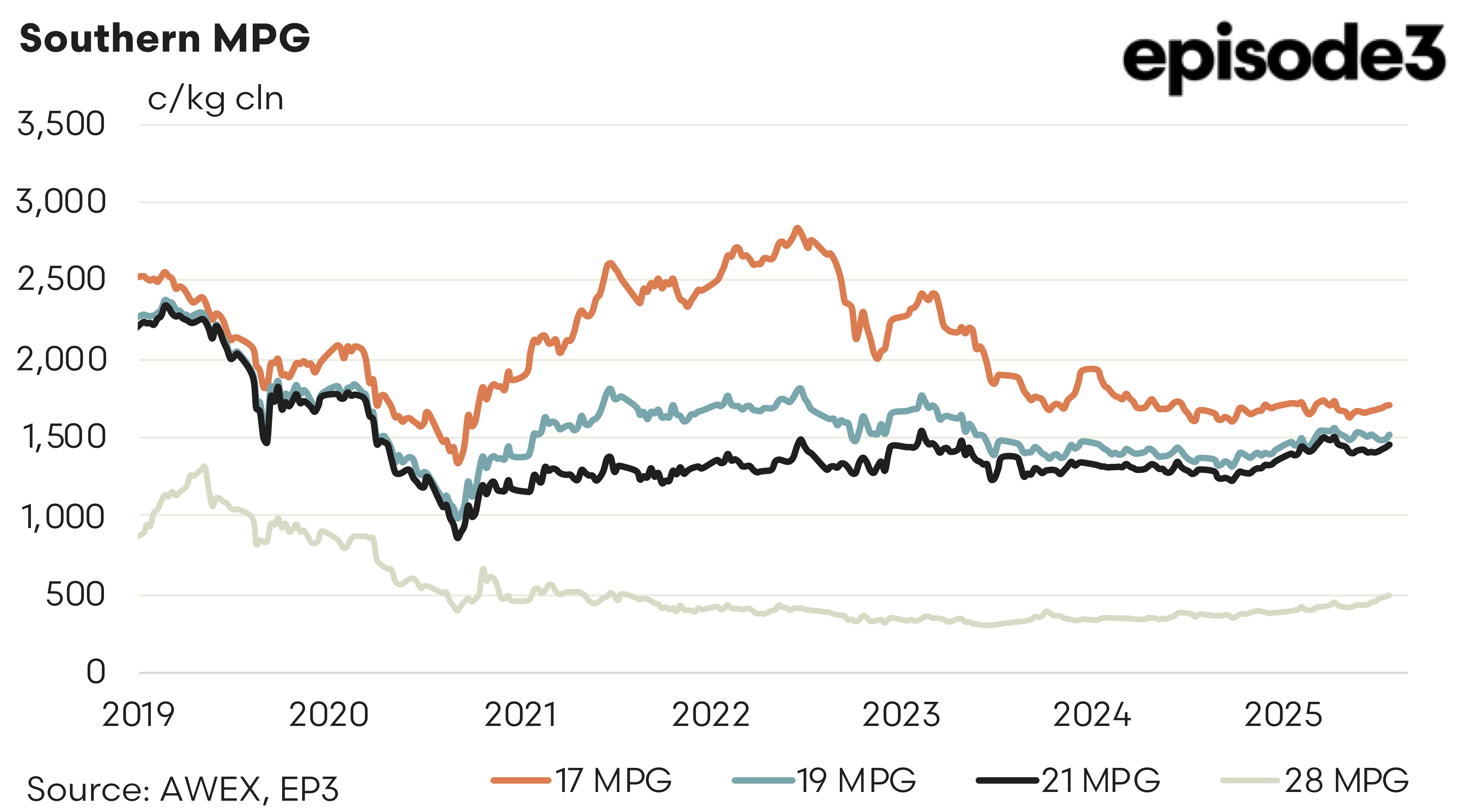

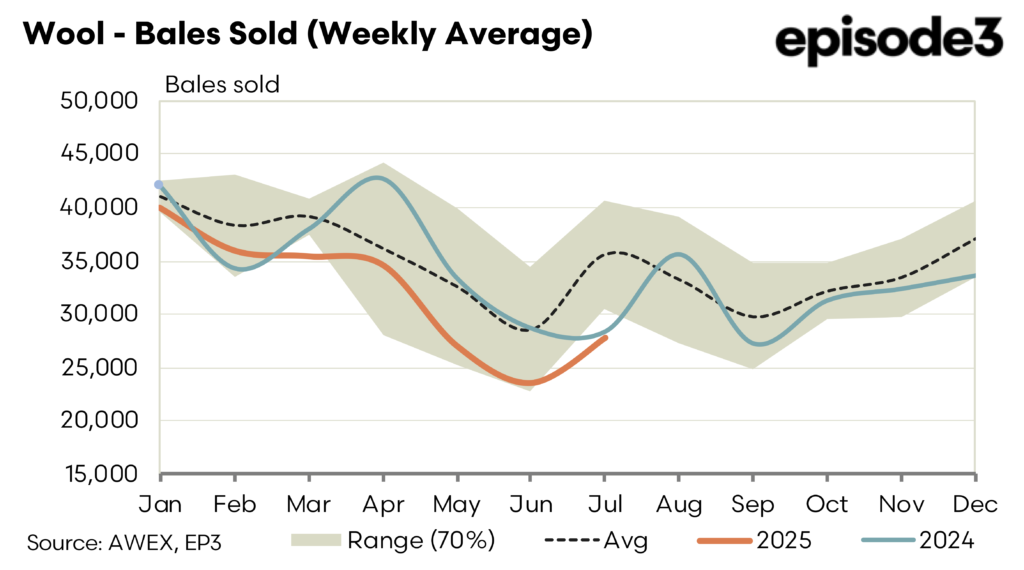

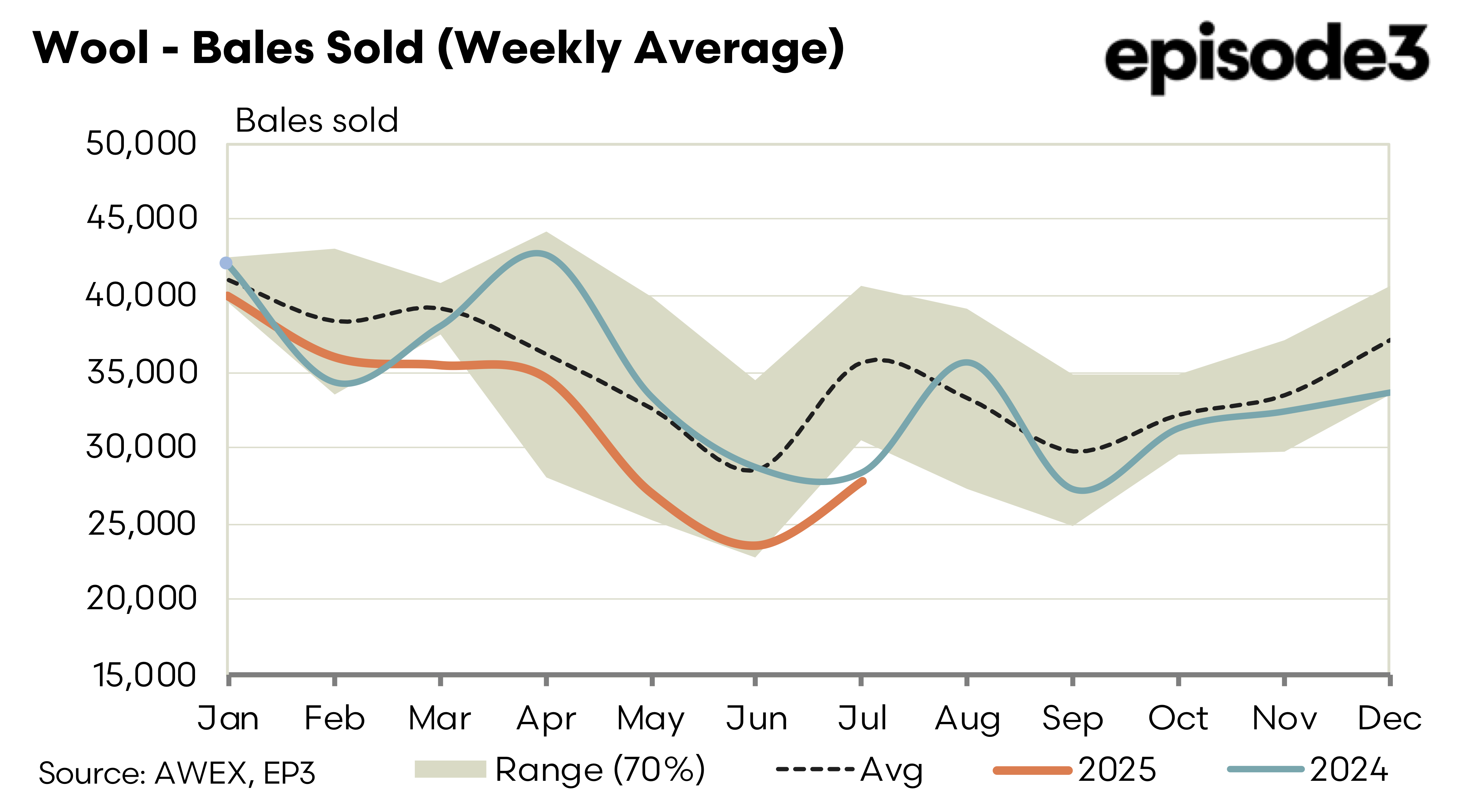

The spot auction market closed for the 3-week mid-year recess continuing its steady upward trend that has been in place since the April pull back. The 2024/25 season in general has been positive. Finer wools 16.5 to 17.5 have struggled coming off a low base. All other merino types have increased between 5 and 10% for the season. Crossbreds, also coming off a low base, have increased 20%.

It has been anything but a straight road with dips and recoveries continually throughout the season particularly pre-Christmas. The second half of the season started with solid rises through January, a pullback in early February and a strong rally to easter. “Liberation Day” in the US came with a tariff announcement, uncertainty, and a significant pull back in all markets. The following three months has seen a steady claw back recovering around two thirds of the April retraction.

On the forwards front volumes throughout the season have not mirrored the volatility or risk in the market. Turnover has staggered at around 50 tons per month (equivalent of 400 bales).

Bidding of the forwards started the week around spot with light offering around 50 cents over cash. The rally in the spot saw that gap narrow to about 25 cents. With the recess upon us action in the forwards will be prompted by outside influences. Given that demand with remain steady over the next three weeks the dominant forces will be the currency and reaction to the Trump tariff deadline of August 1st. All outcomes are on the table although most recent rumblings have been less dramatic that the April 1st chaos.

We are likely to see bids creep up to cash but will require positive sentiment generated by outside stimulus for buyers to offer hedging opportunities at a premium.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.