Sheepmeat export update July 2025

July 2025 - Sheep Meat Export Update

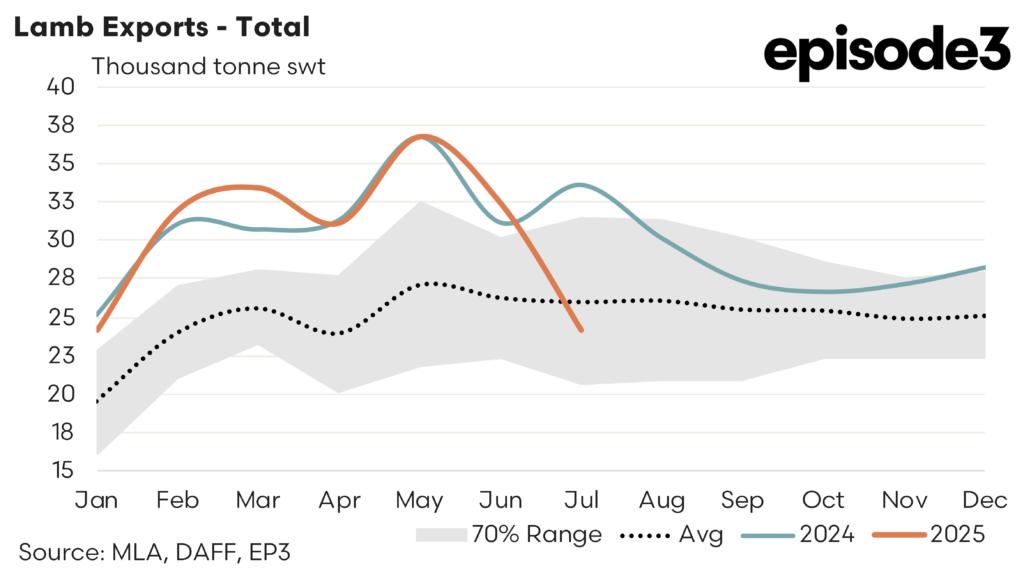

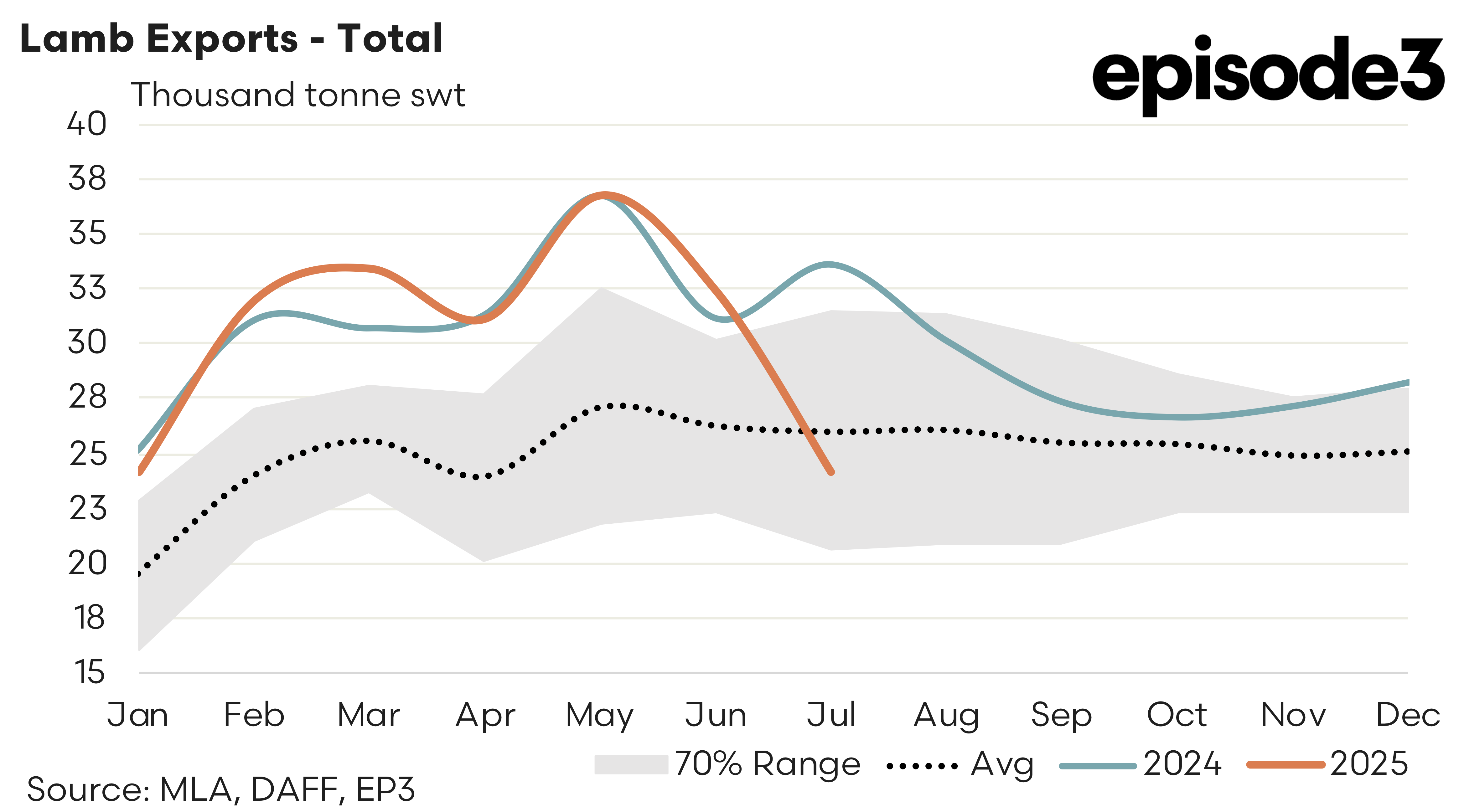

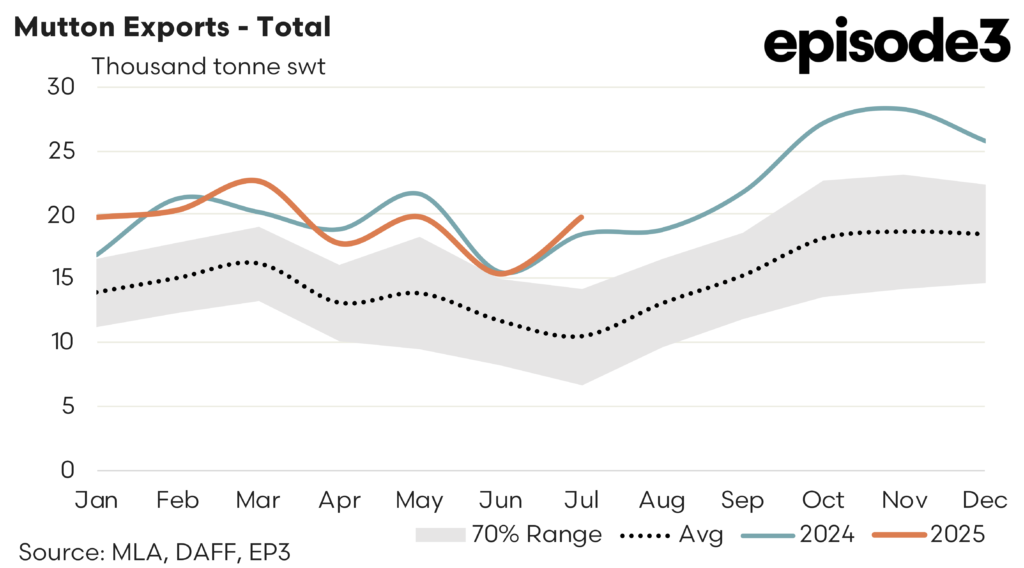

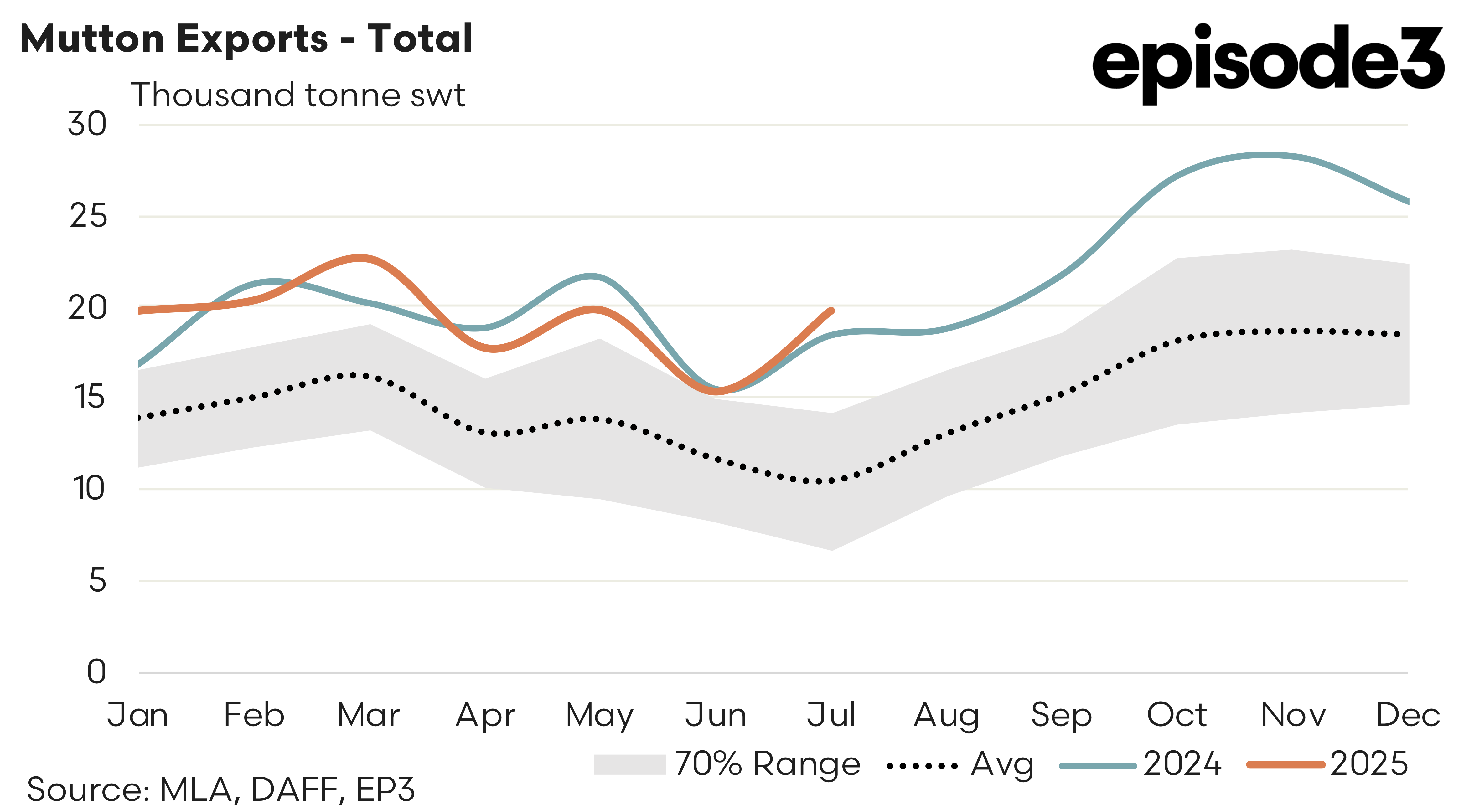

Record high prices at the saleyard during winter have continued to take their toll a little on offshore demand for Aussie lamb export flows over July with significantly reduced trade to several key destinations. Although mutton markets have remained a little firmer as offshore buyers seek out cheaper sheep meat options.

Total Australian lamb export flows eased by 25% to see 24,177 tonnes shipped offshore over the month. The sharp turn downwards in lamb export flows over July has pushed the monthly export volumes below the five-year average levels for the first time in two years with the current trade flows sitting 7% below the July average.

Total mutton exports from Australia remained resilient as some export destinations perhaps opted to switch from relatively more expensive lamb to relatively cheaper mutton. There was a 29% increase in mutton exports during July, taking the total flows to 19,776 tonnes. This represents levels that are slightly better than July 2024 and around 89% higher than the five-year average flows usually seen in July.

In terms of the top trade destinations for Australian lamb exports, the following was noted.

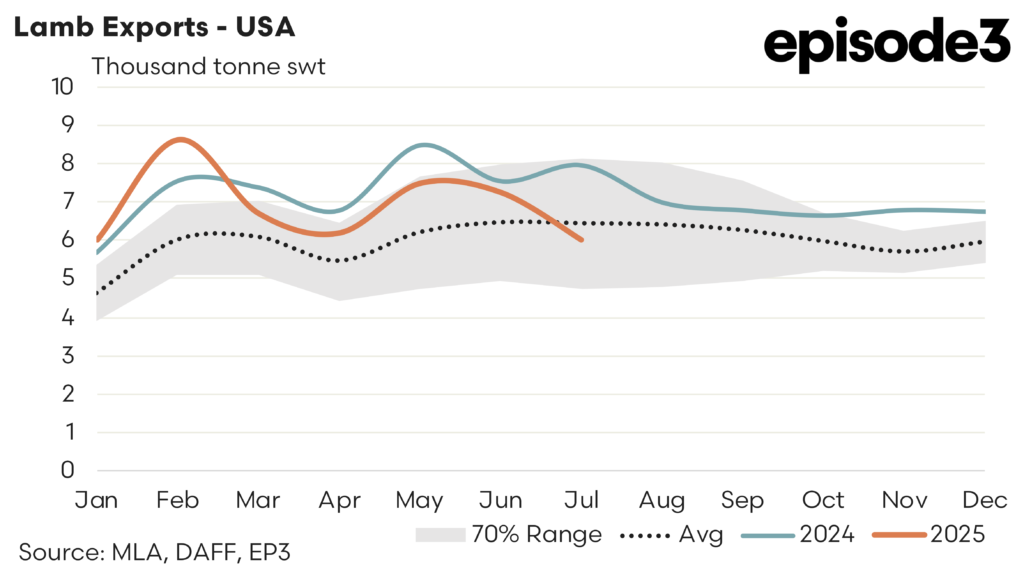

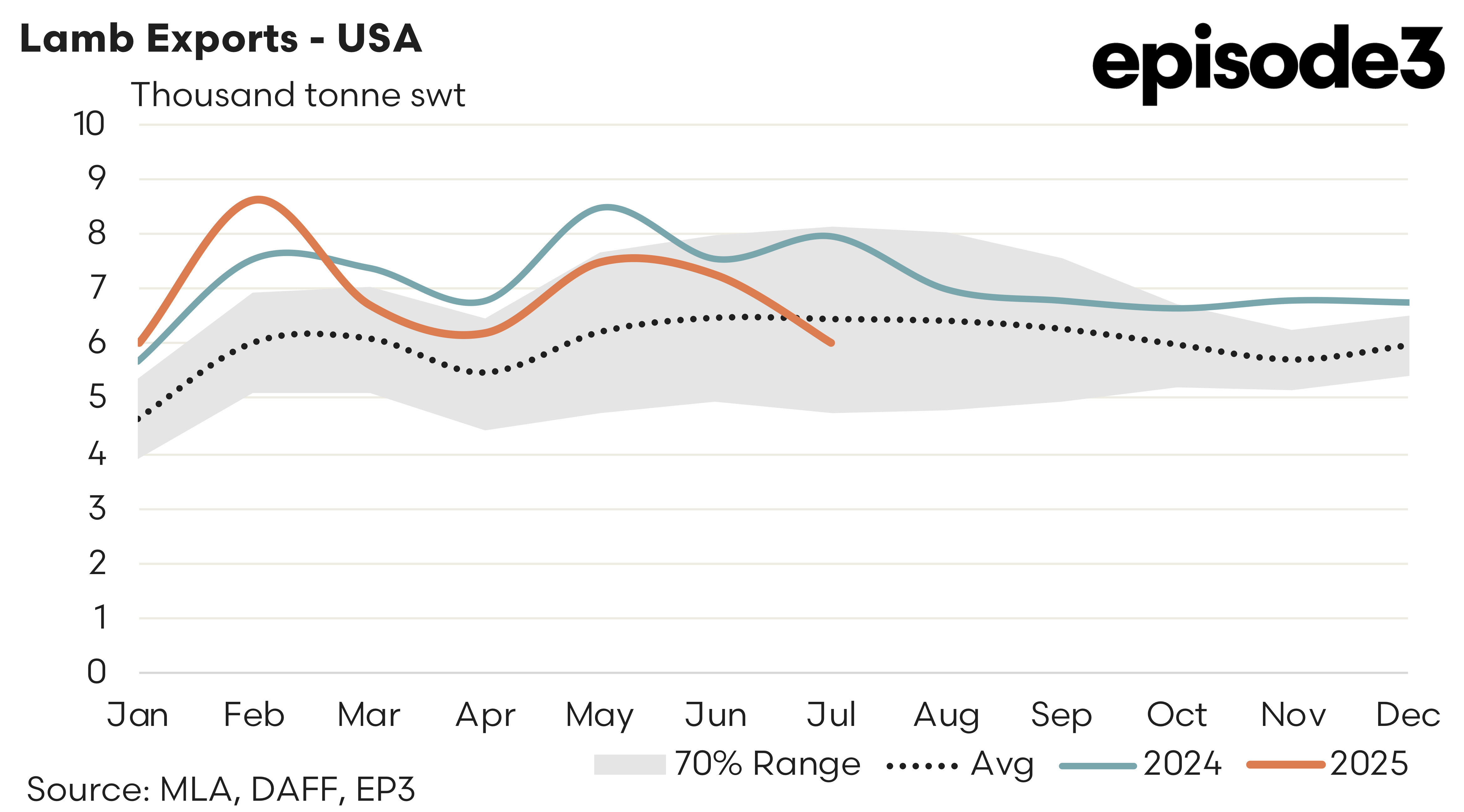

USA- The Aussie lamb trade to the USA dipped 17% in July to see 6,020 tonnes recorded shipped over the month. This pushed the monthly flows below the five-year seasonal average trend for the first time since October 2023. Current trade volumes to the USA are sitting 6% under the five-year average for July.

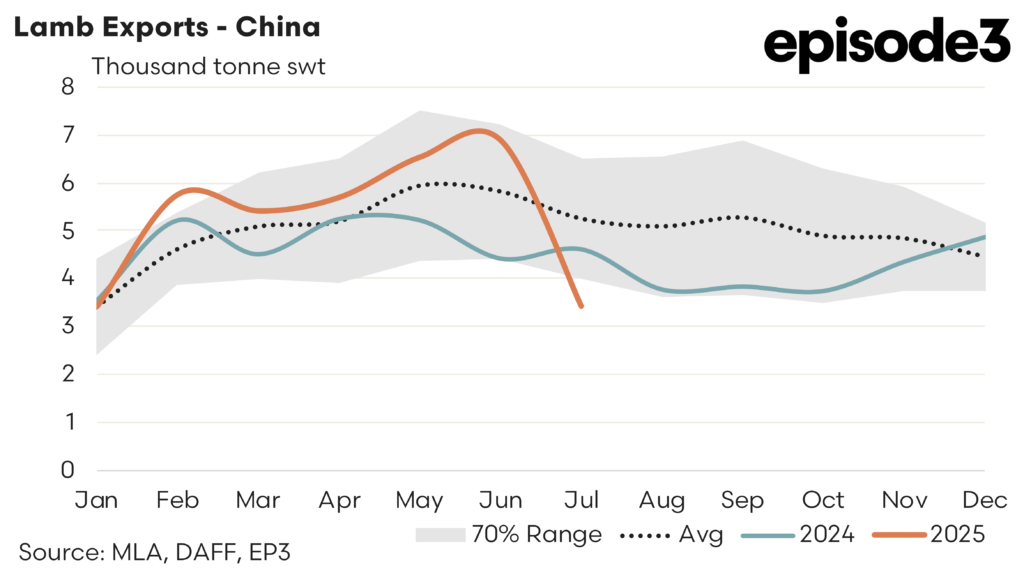

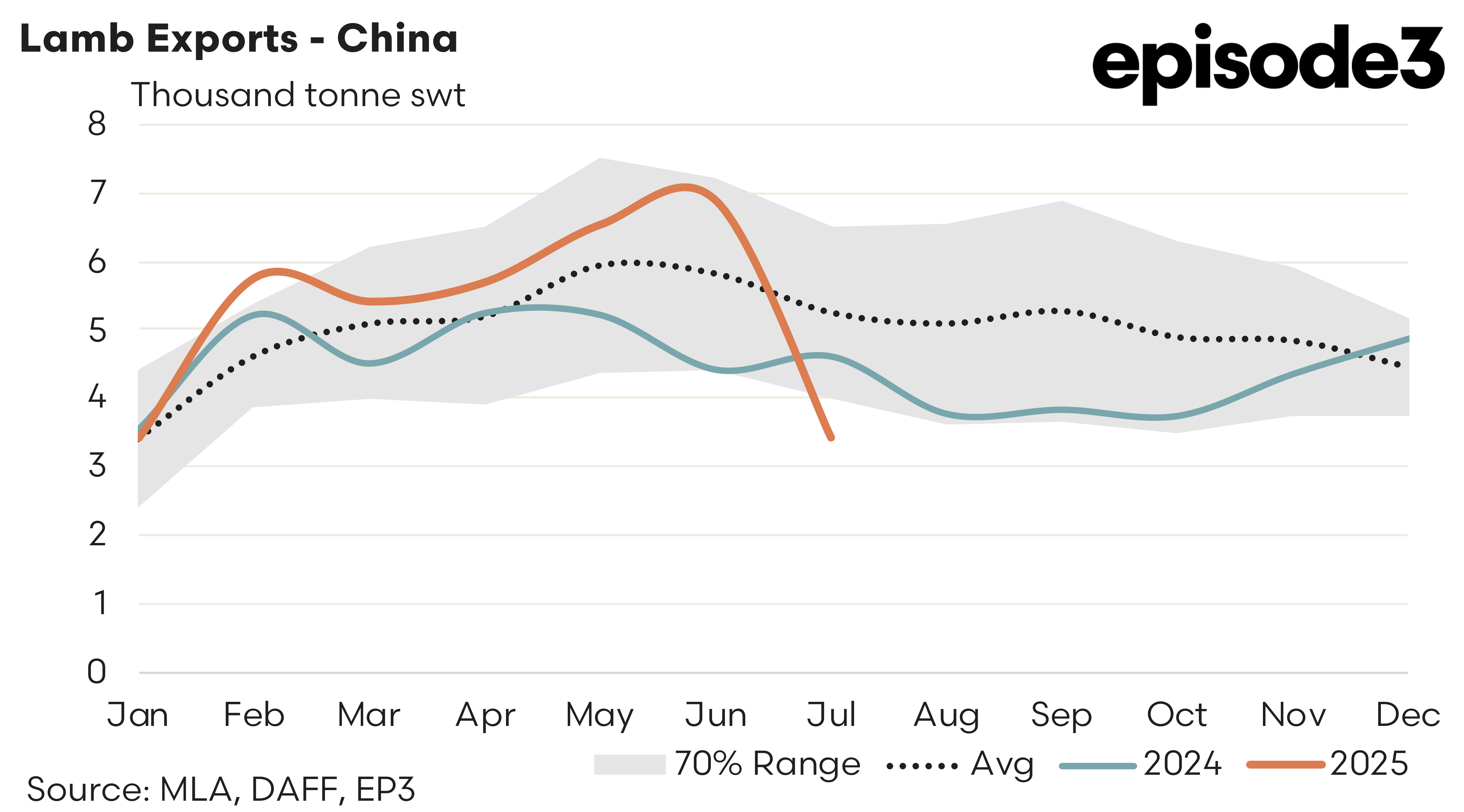

China – The was a sharp 50% decline in lamb exports to China during July with trade volumes dropping to 3,414 tonnes. The monthly trend for 2025 had been sitting near the upper end of the normal range and crashed to levels below the lower end of the normal range during the month. Presently monthly lamb export volumes to China are sitting 35% below the five-year average for July a significant turn around from sitting 18% above the five-year average levels in June.

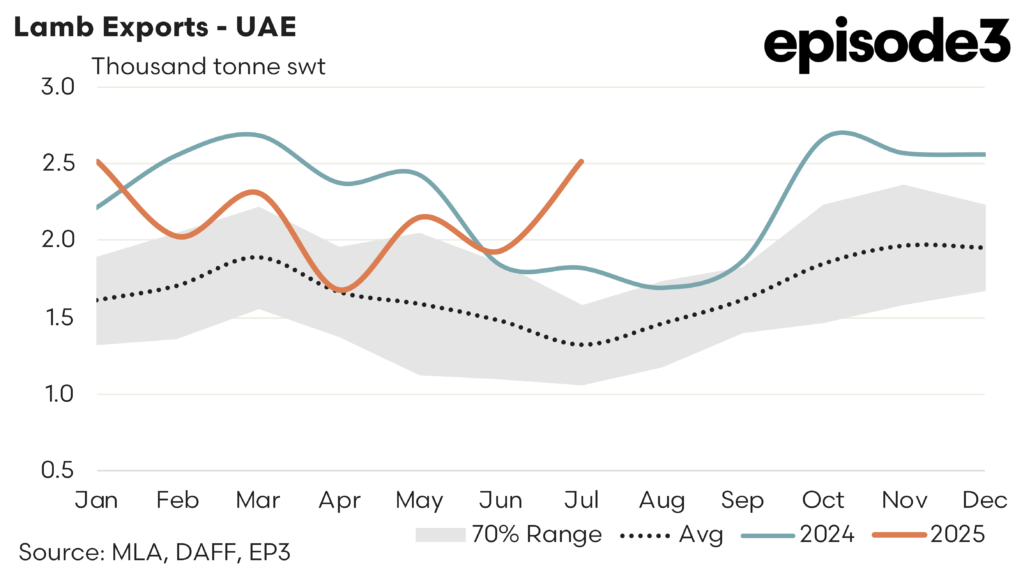

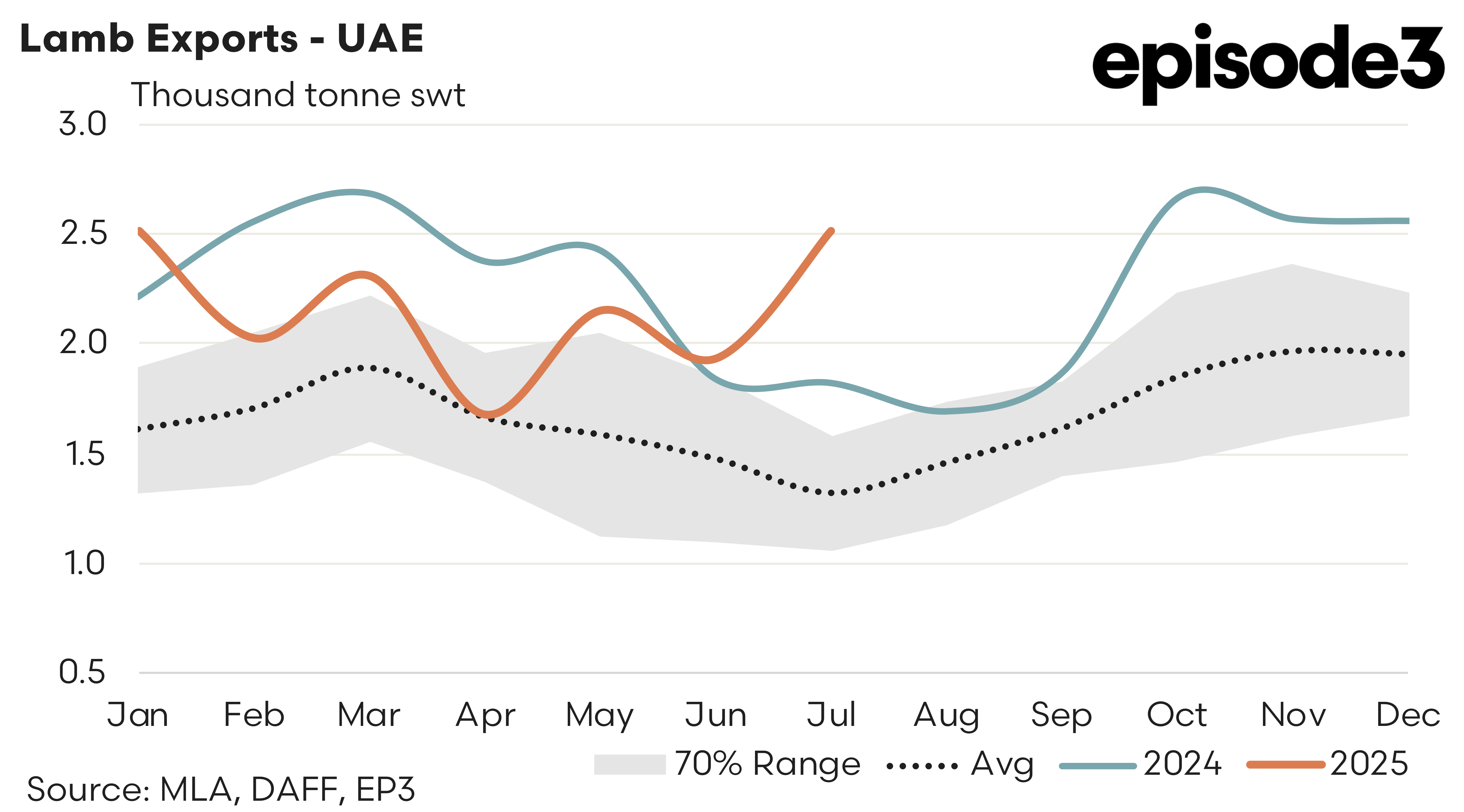

UAE – The United Arab Emirate were the bright spark of the top trade destinations for Aussie lamb in July with a 30% gain in volumes noted over the month. There was 2,516 tonnes shipped during July, taking the current trade flows to levels that are 91% above the five-year average flows for the July period.

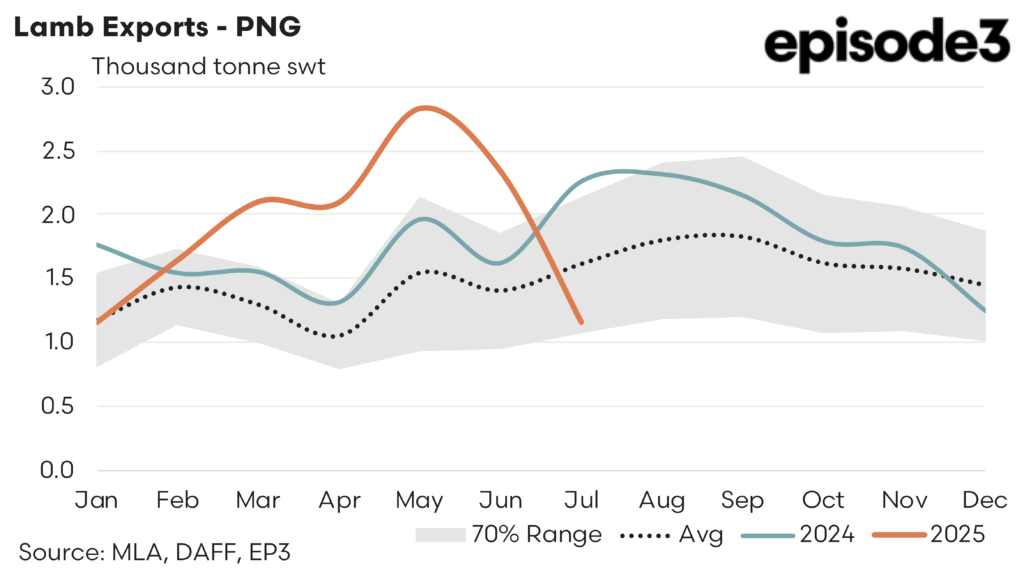

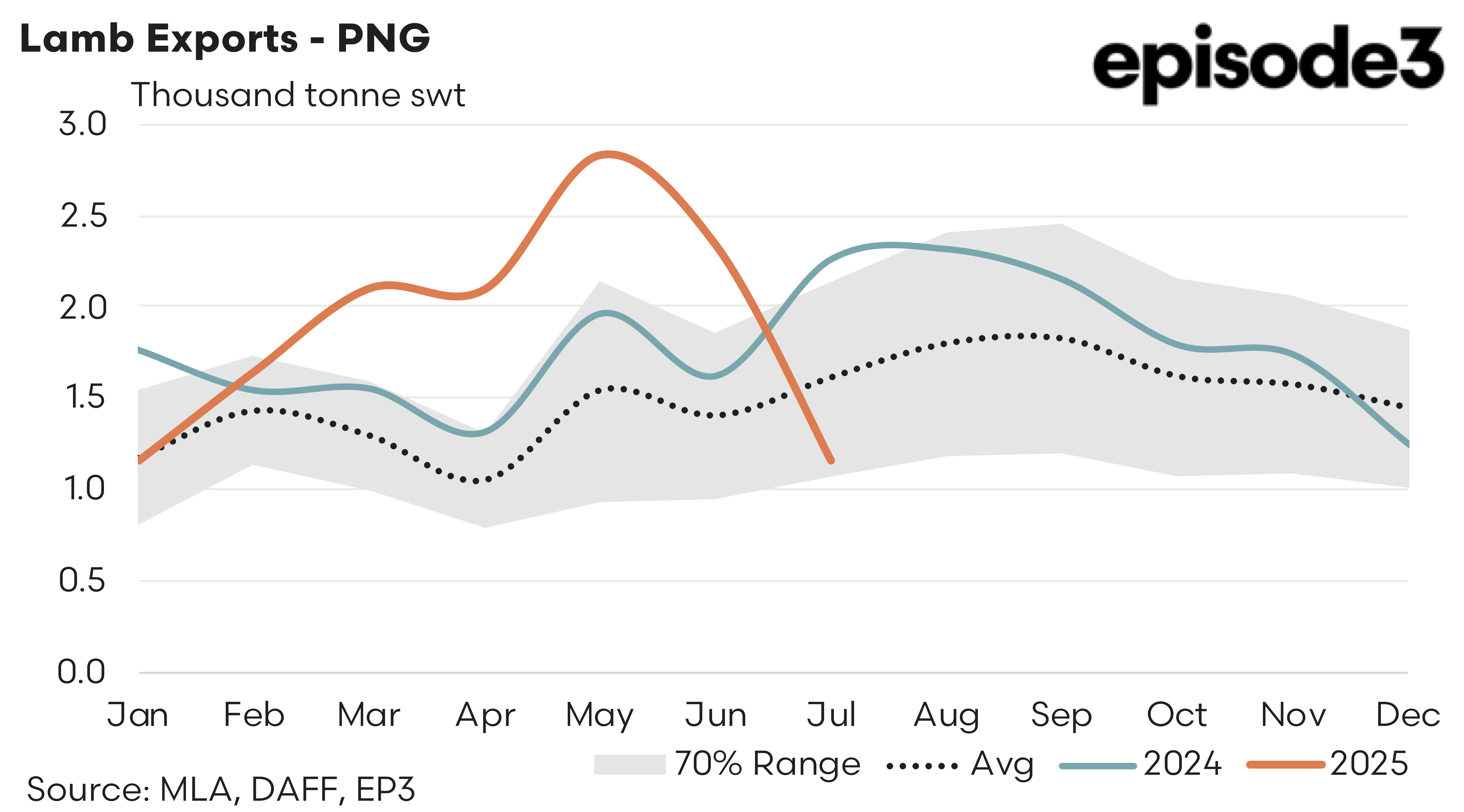

PNG – Like China, Papua New Guinea saw a 50% drop in lamb exports from Australia over July. This is somewhat unsurprising given the strong domestic lamb prices and the fact that PNG general takes the more cost effective cuts. It serves to highlight that some offshore markets are rather difficult to pass on higher input prices and there is a cap to what some offshore consumers are prepared to pay for lamb, particularly those destinations that consider sheep meat as a commodity item, broadly speaking. There was 1167 tonnes shipped to PNG during July, pushing the monthly flows to levels that are 28% under the five-year seasonal average levels for this time in the year.

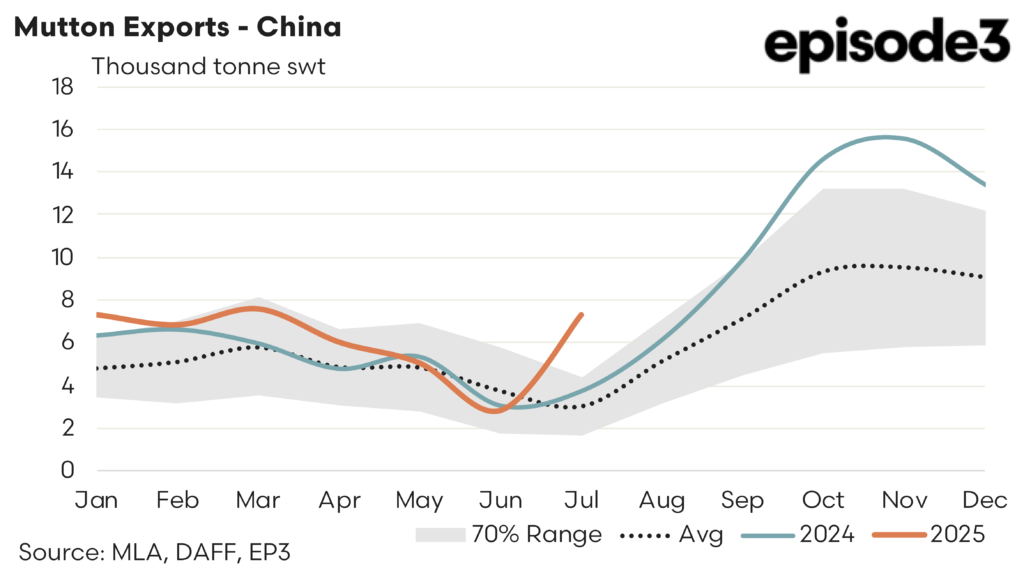

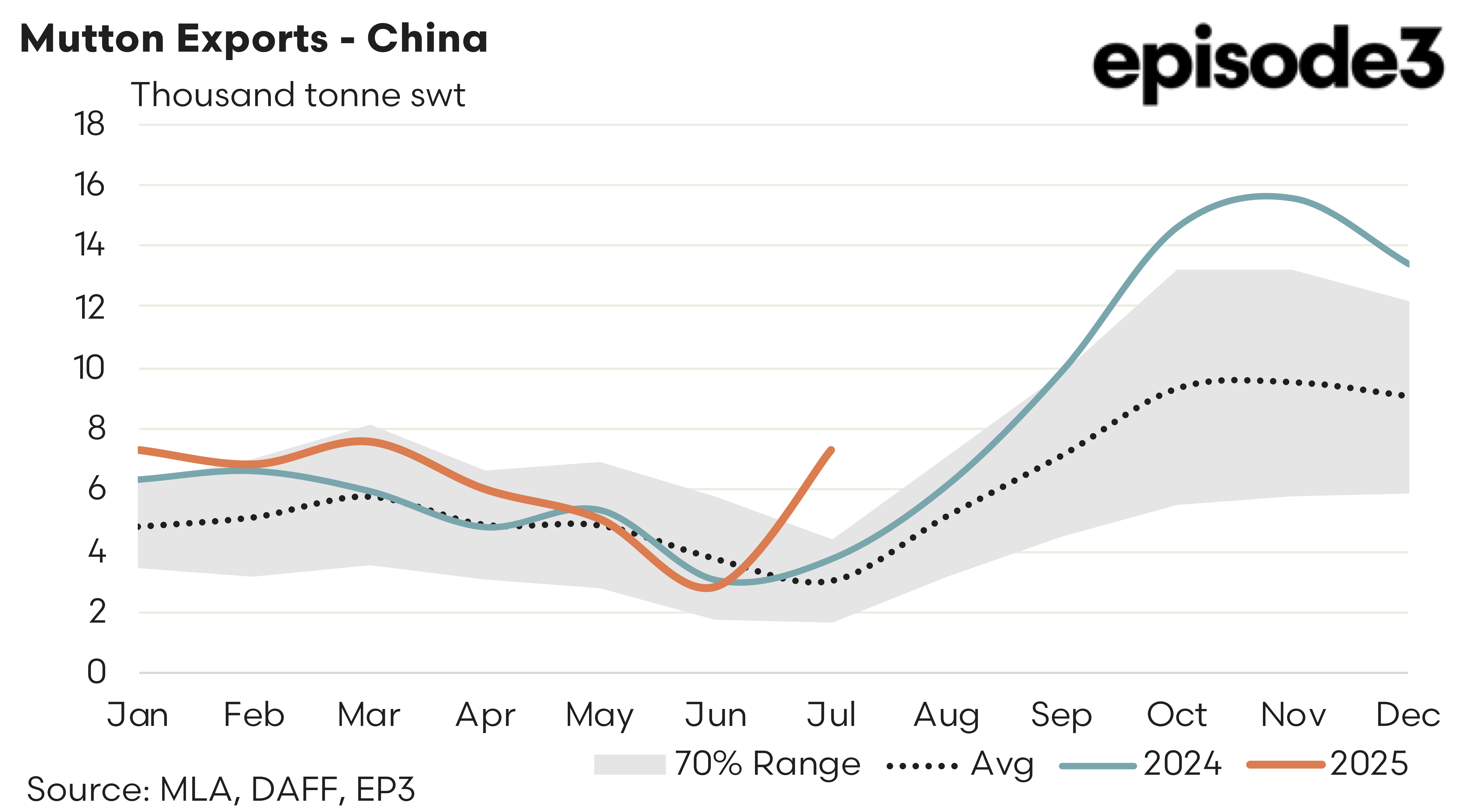

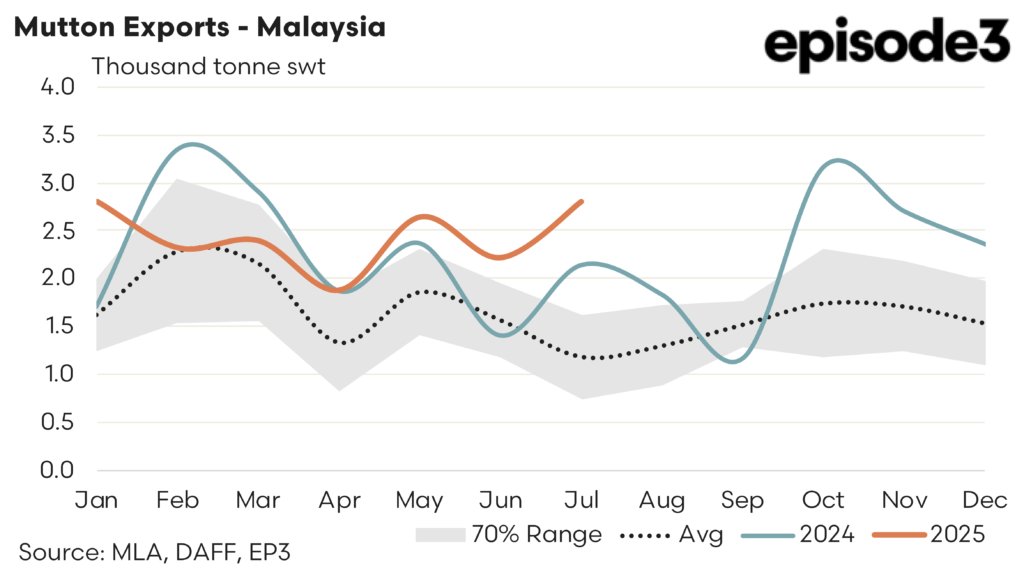

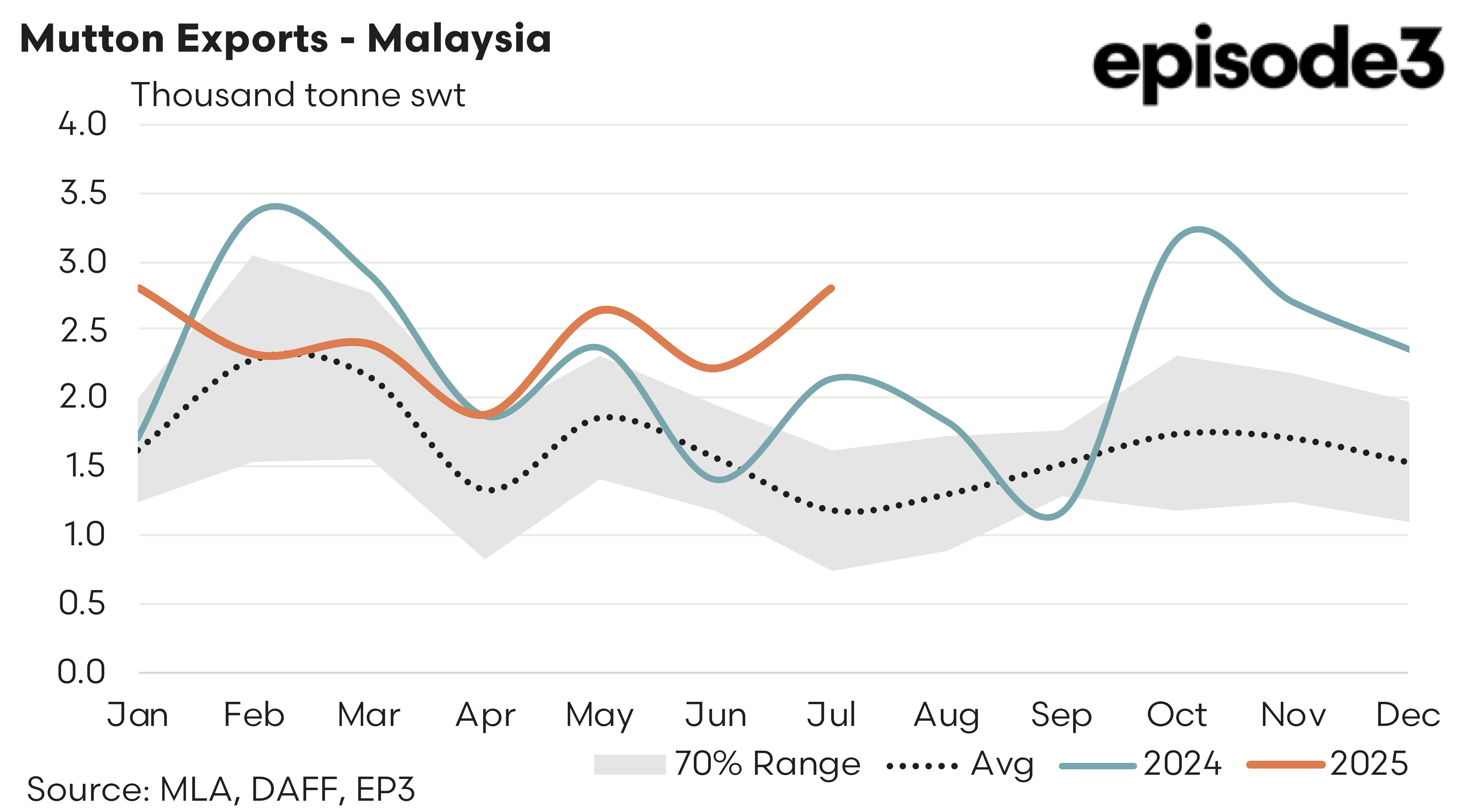

In terms of the top trade destinations for Australian mutton exports, the following was noted.

China – After reaching the low ebb for the season in June demand for mutton from China began to lift in July with a 154% jump in export flows, albeit off of a low June base. July saw 7,326 tonnes shipped to China, which represents flows that are 139% above the normal July levels, based upon the average flows seen over the last five years. Contrasting the change in mutton flows to China versus lamb flows from June to July we saw a 4,446 tonne increase in mutton exports versus a 3,454 tonne decline in lamb exports suggesting a fair amount of “value switching” occurring over the month.

Malaysia – Mutton demand in Malaysia has remained firm with a 26% increase over July noted. There was 2,792 tonnes shipped to Malaysia over the month taking current trade volumes of Aussie mutton to levels that are 135% above the five-year average flows for July.

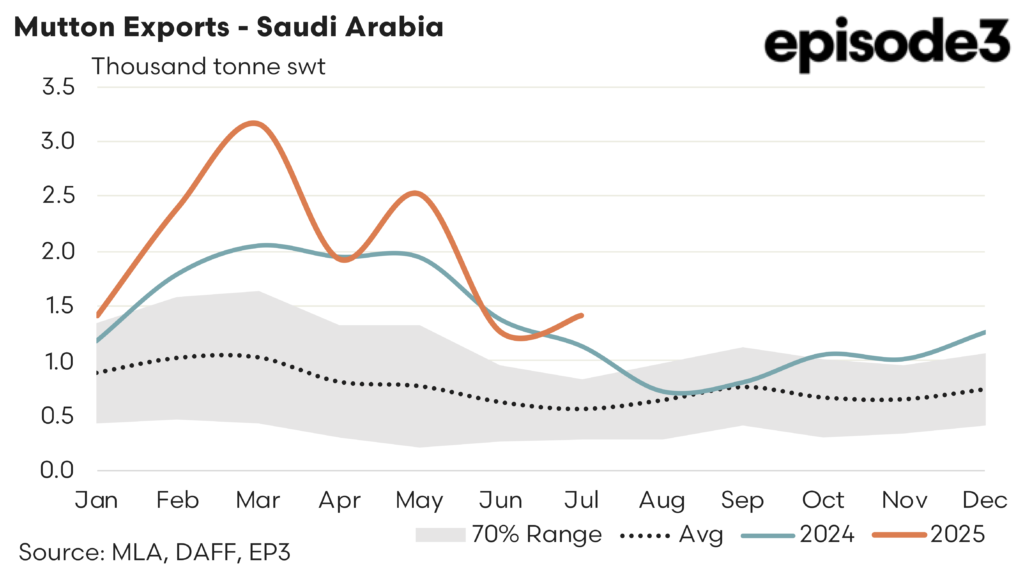

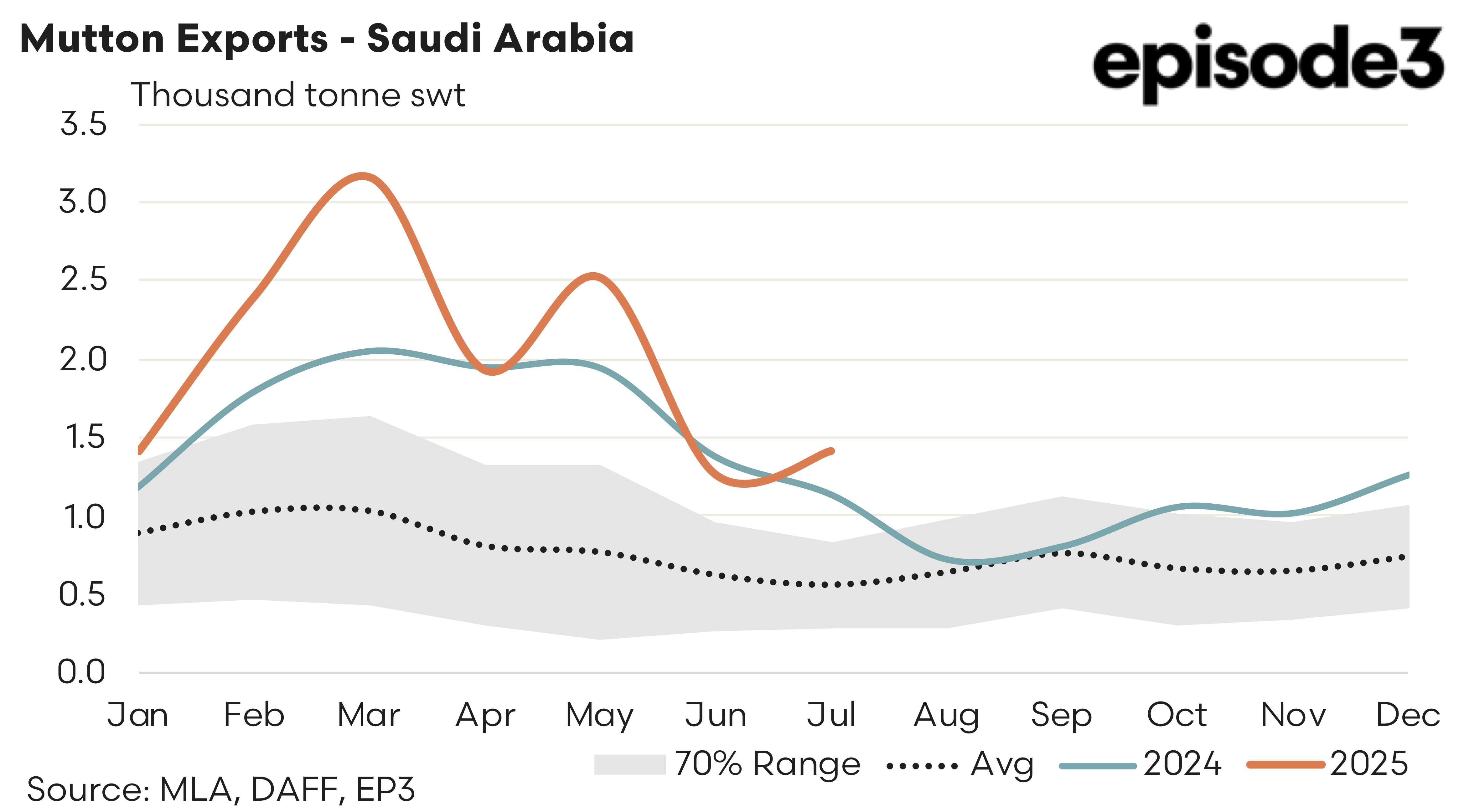

Saudi Arabia – Mutton flows to Saudi Arabia have been in a broad downtrend since March, albeit from very strong levels. July saw a mild bucking of the trend with Aussie mutton exports lifting by 12% to 1,416 tonnes shipped. Compared to historic flows the trade to Saudi Arabia remains in great shape though with current mutton trade volumes sitting 153% higher than the normal July levels, based upon the average volumes seen over the last five years of the trade.

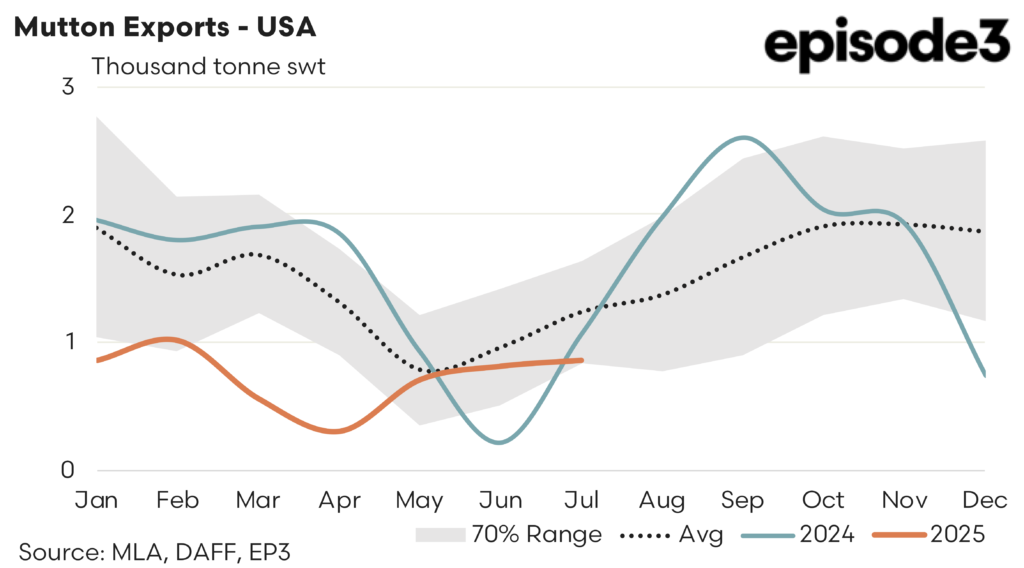

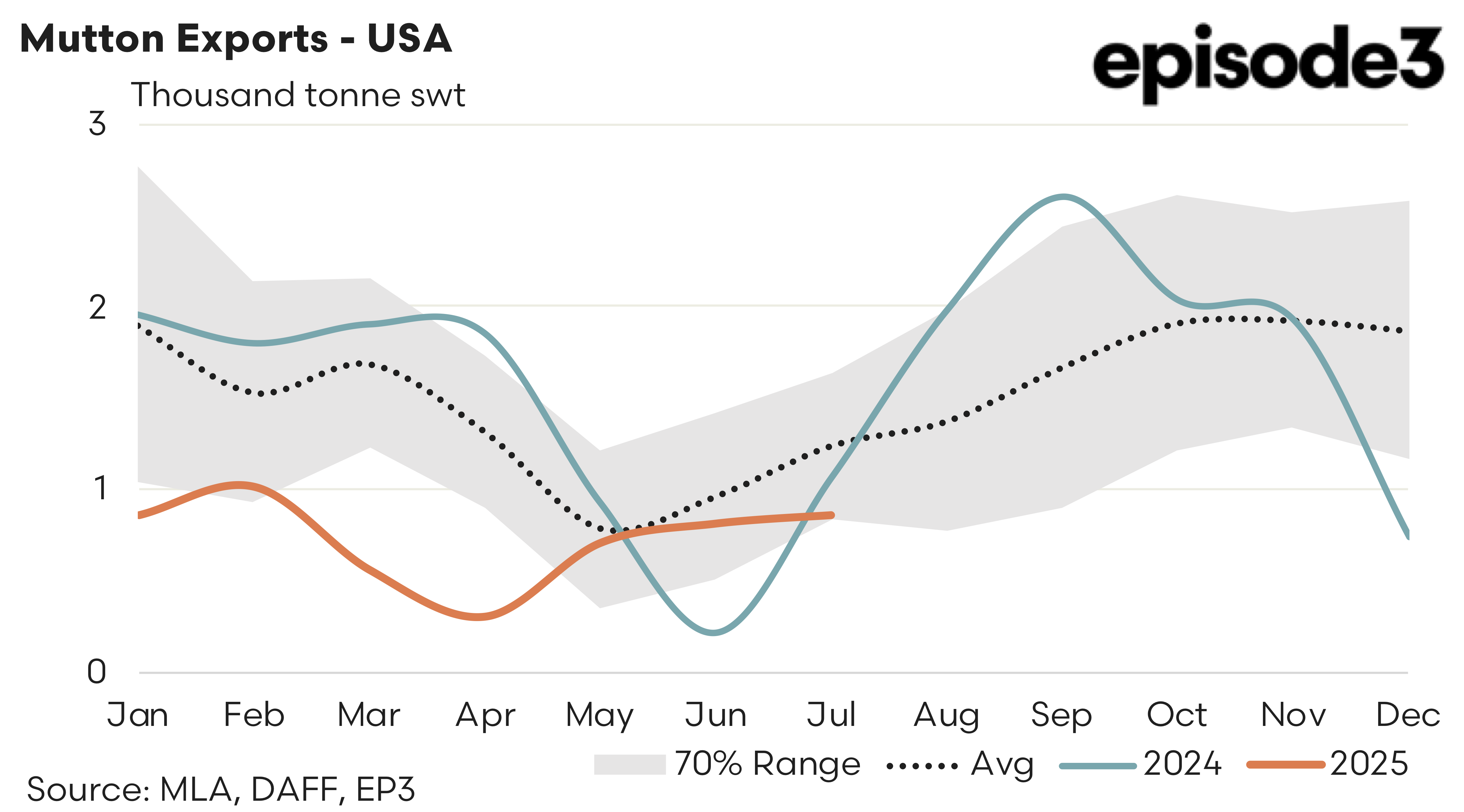

USA – Aussie mutton flows to the USA remain somewhat subdued during July with levels still under the seasonal average flows by 30%. July managed to see a mild 6% lift in the mutton trade from the levels seen in June to reach 864 tonnes in July. However demand this season remains soft and continues to kick along at the lower end of “normal expectations”, as per the shaded 70% range highlighted on the chart in grey.