Beef export update July 2025

July 2025 - Beef export update

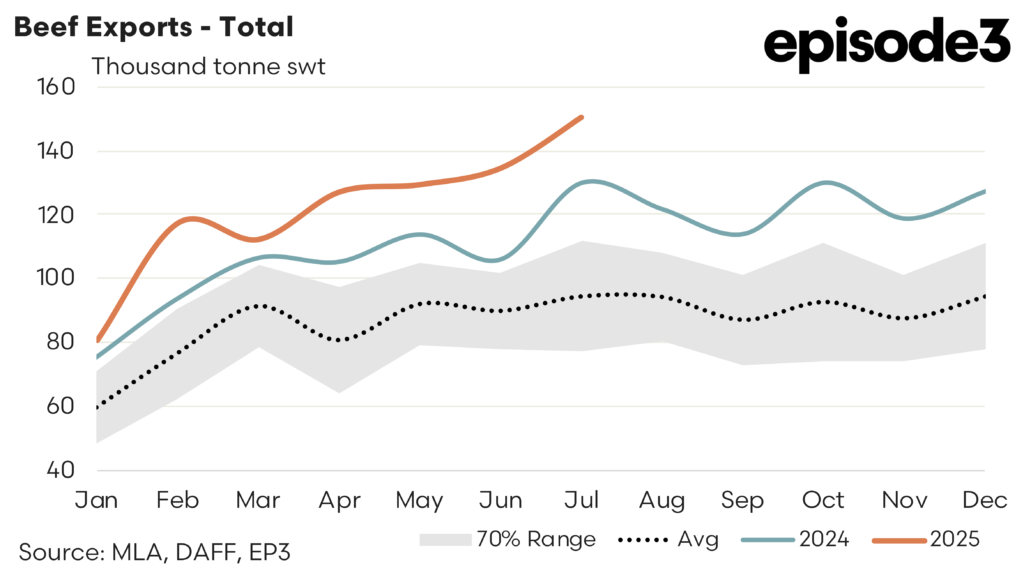

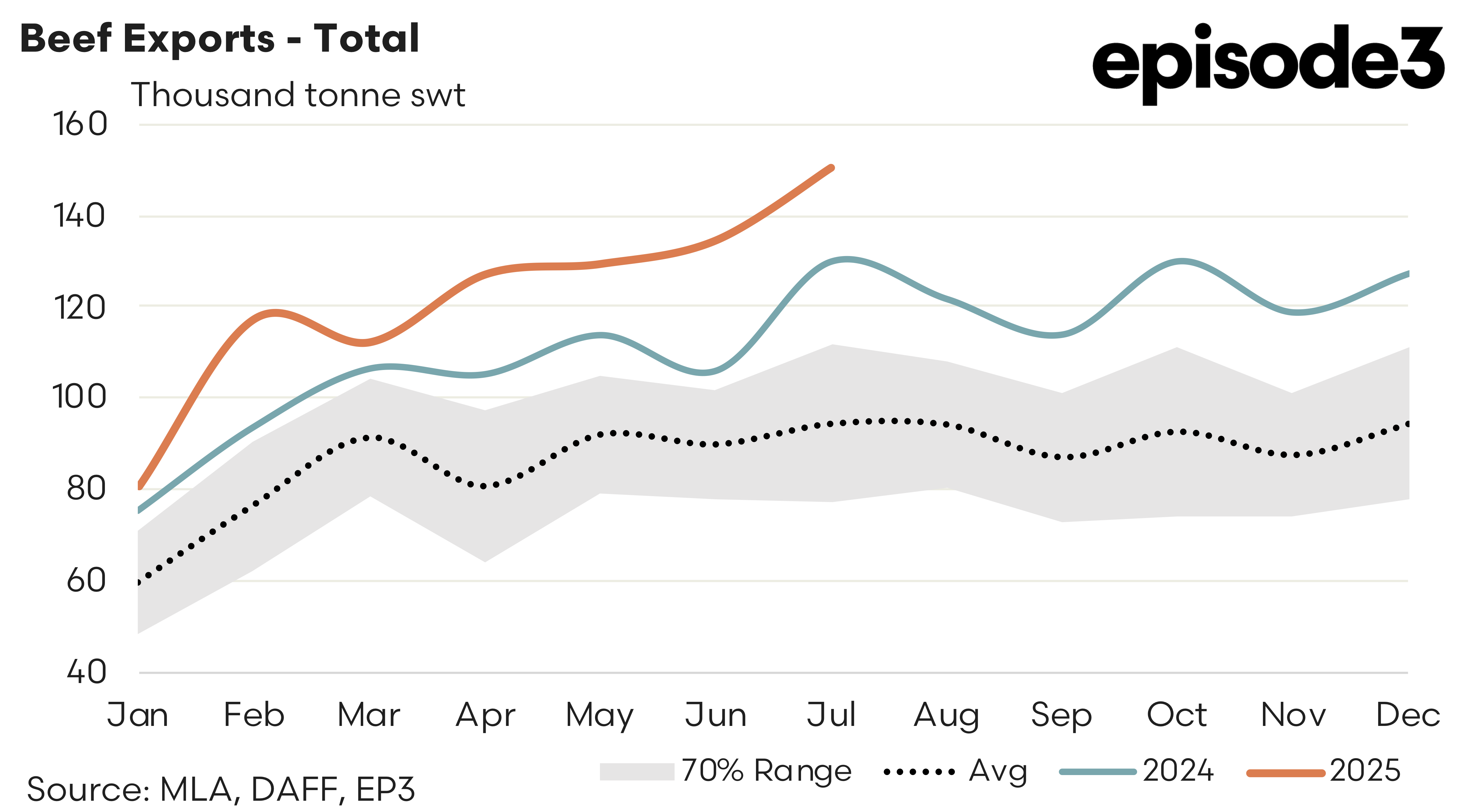

Australian beef export volumes reached a new historic peak in July 2025, with a total of 150,435 tonnes shipped offshore. This was up 12% from the previous record set in June at 134,593 tonnes. The result is also well above the five-year average for July by nearly 60%, underlining the exceptional strength in export demand.

For the year-to-date, exports now sit at 852,653 tonnes, which is nearly 16% (about 121,000 tonnes) higher than the same period in 2024. Continued elevated shipments to the United States, along with strong demand from China, Japan and South Korea, have driven this record performance. These four markets remain the core destinations for Australian beef, accounting for the bulk of trade flows so far in 2025.

A summary of the top trade locations, in order of top market share for 2025, is as follows:

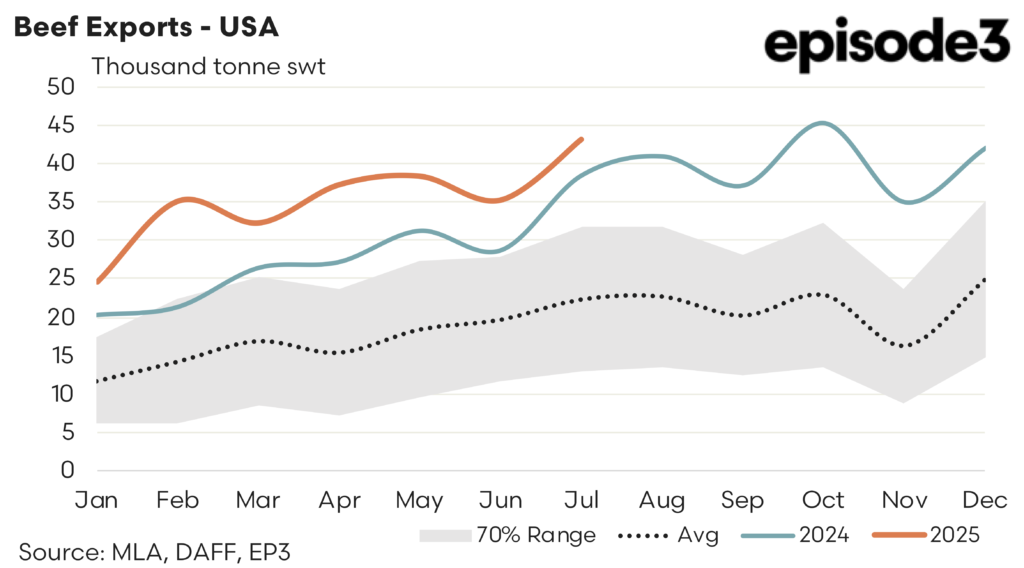

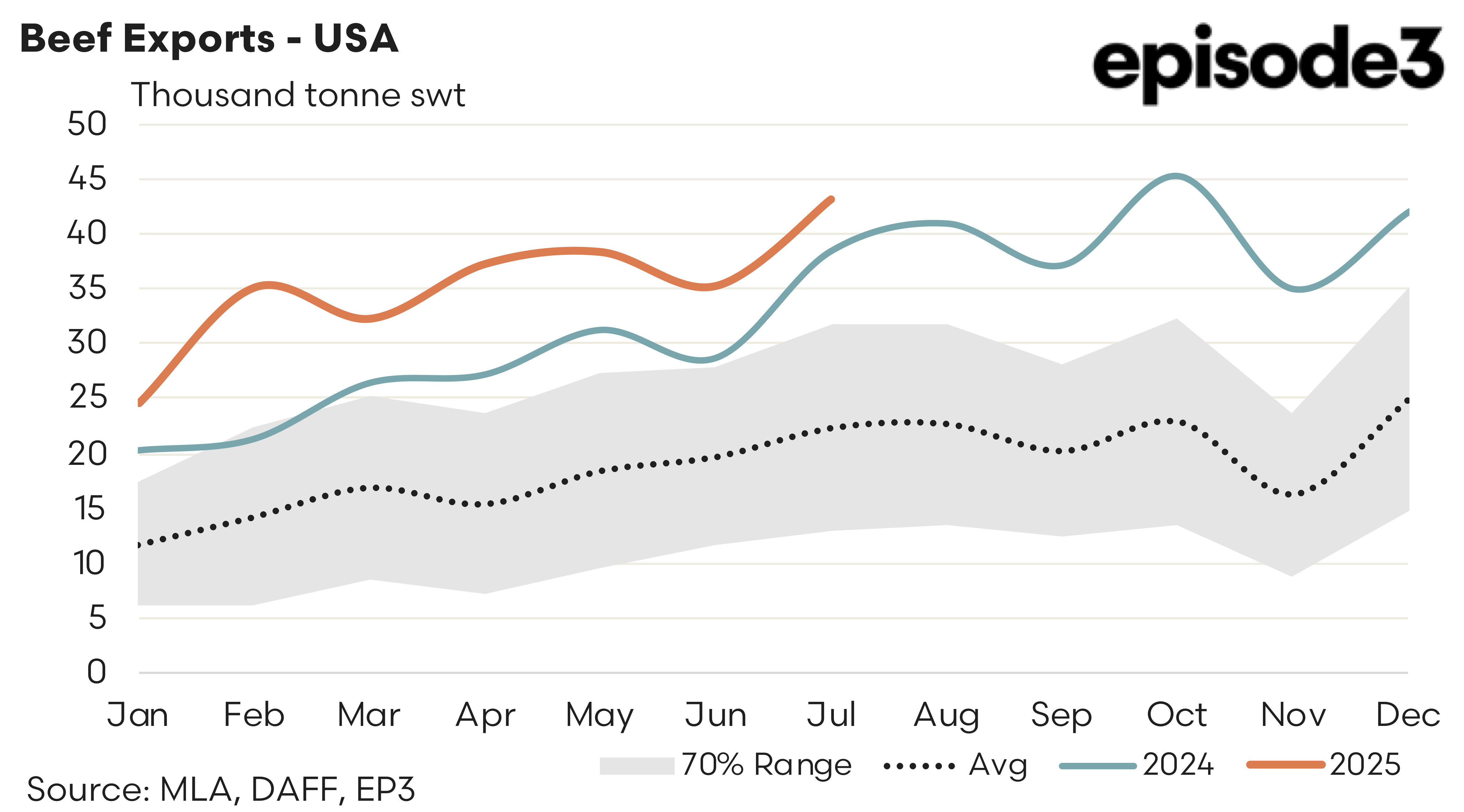

USA – Remains the largest export market for Australian beef in 2025. July volumes increased by 22% to 43,038 tonnes, and year-to-date exports are around 246,000 tonnes, up approximately 27% on the same period in 2024. Strong demand is being fuelled by US domestic cattle herd numbers at 70-year lows and reduced competition from Brazil due to tariff restrictions. Compared to the five-year average for July the beef trade flows to the USA are 93% stronger this year.

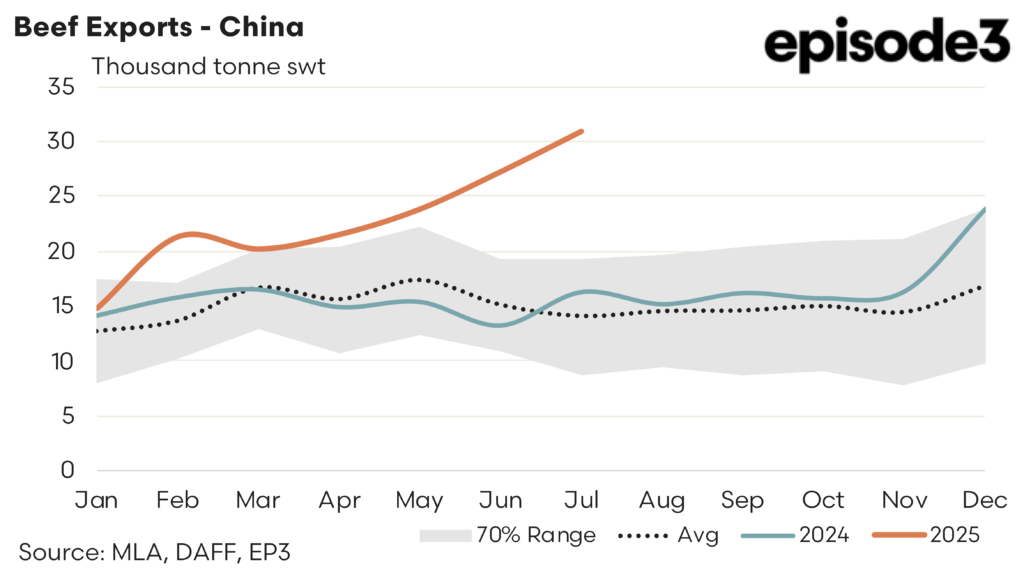

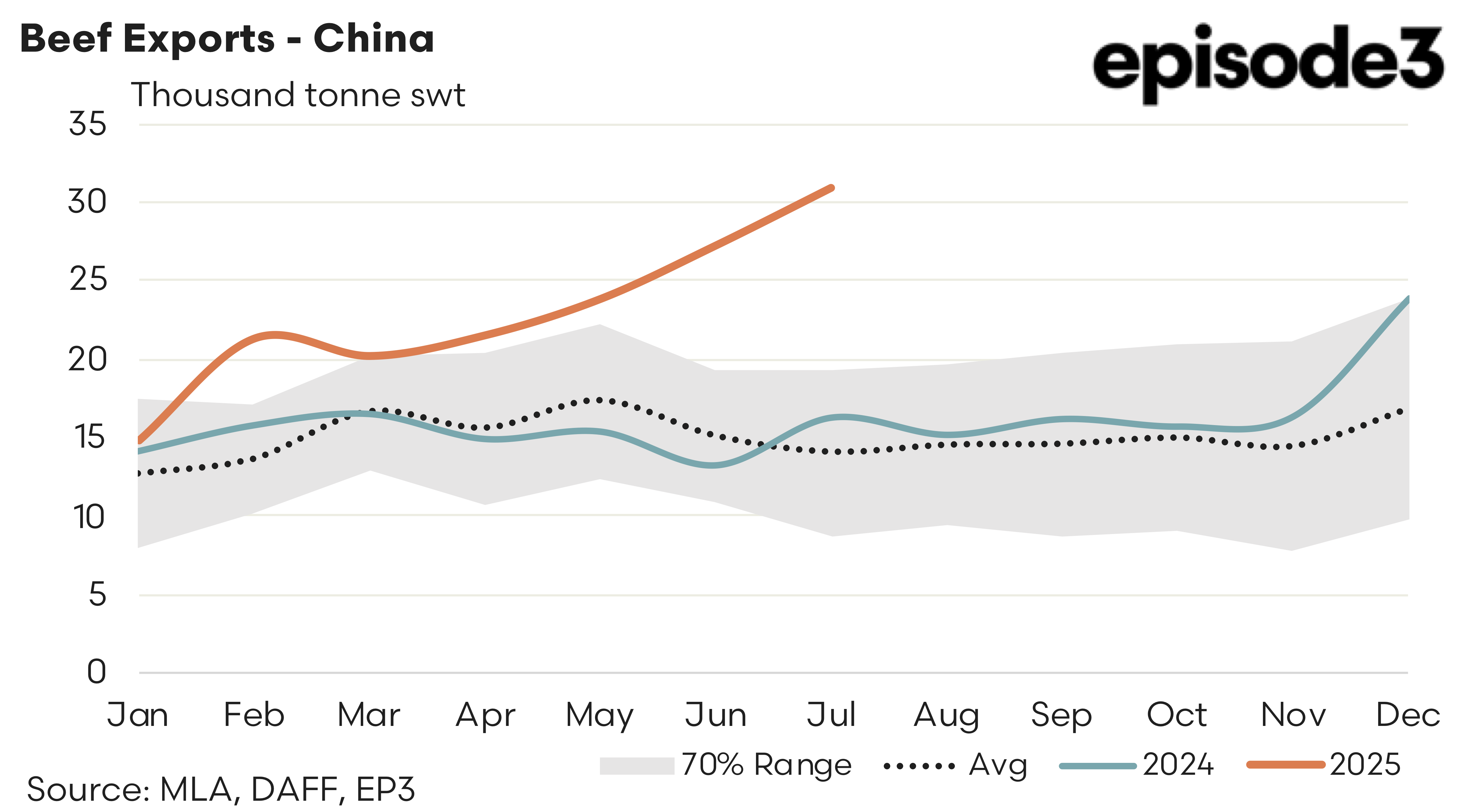

China – There has been a steady increased in Aussie beef to China with July increasing a further 13% on the back of the 14% lift seen in June and the 11% gain seen in May. July saw 30,925 tonnes shipped which represents trade levels that are 120% above the normal July average flows based upon the last five years of the trade, with year-to-date volumes at around 160,000 tonnes, up about 51% from 2024. Demand remains solid across both grain-fed and grass-fed categories.

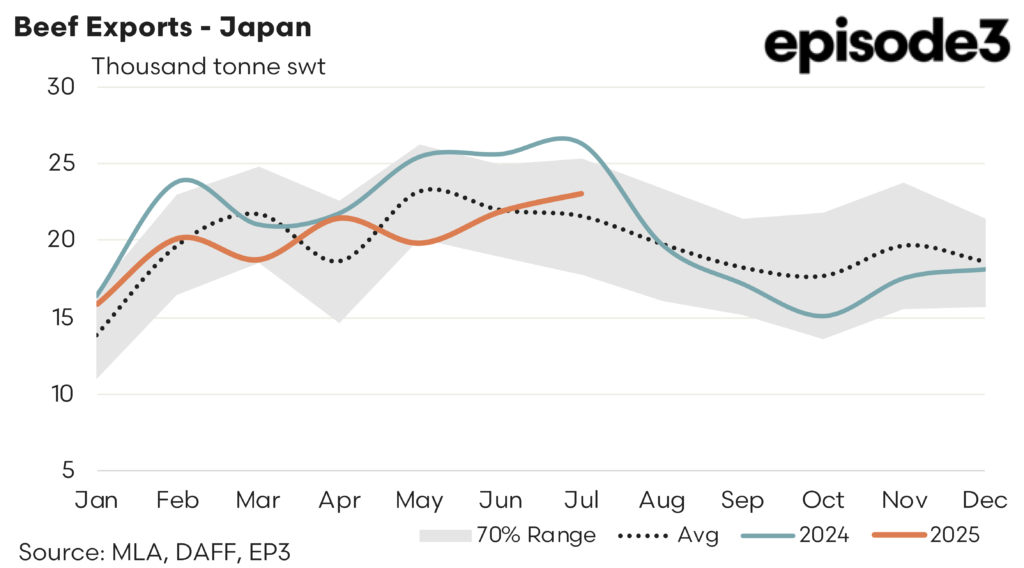

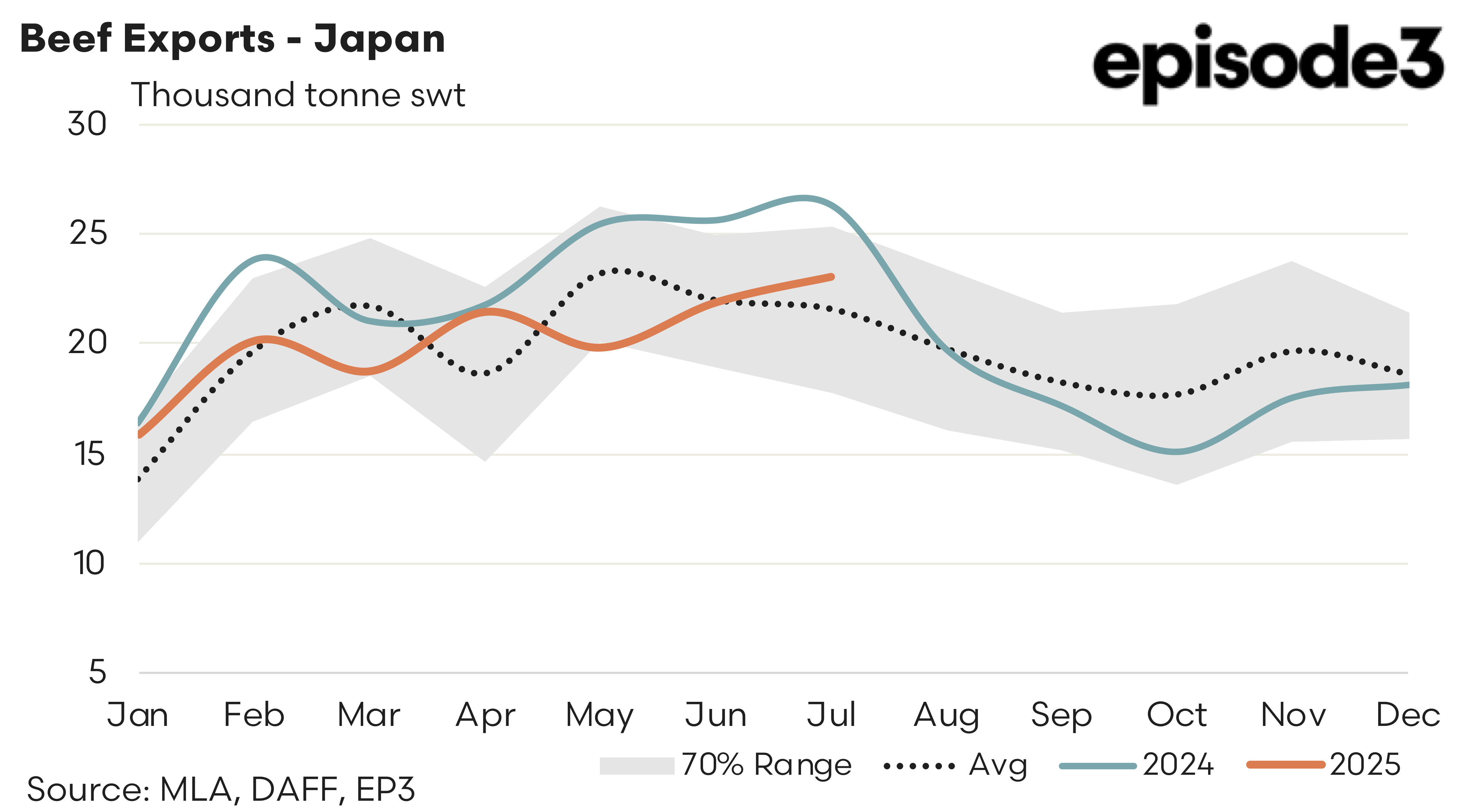

Japan – A reasonably consistent high-value market for Australian beef, with year-to-date shipments sitting near 140,000 tonnes. Monthly volumes this year have typically tracked in the low-20,000-tonne range, supported by steady retail and foodservice demand. July flows came in 5% stronger than June at 23,056 tonnes, representing trade levels 7% higher than the five-year average trend for July.

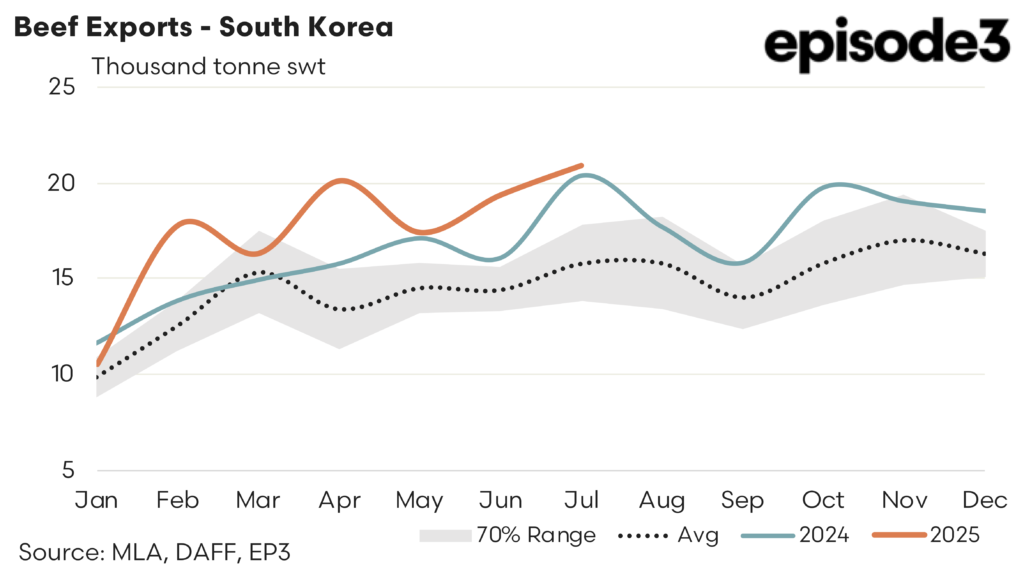

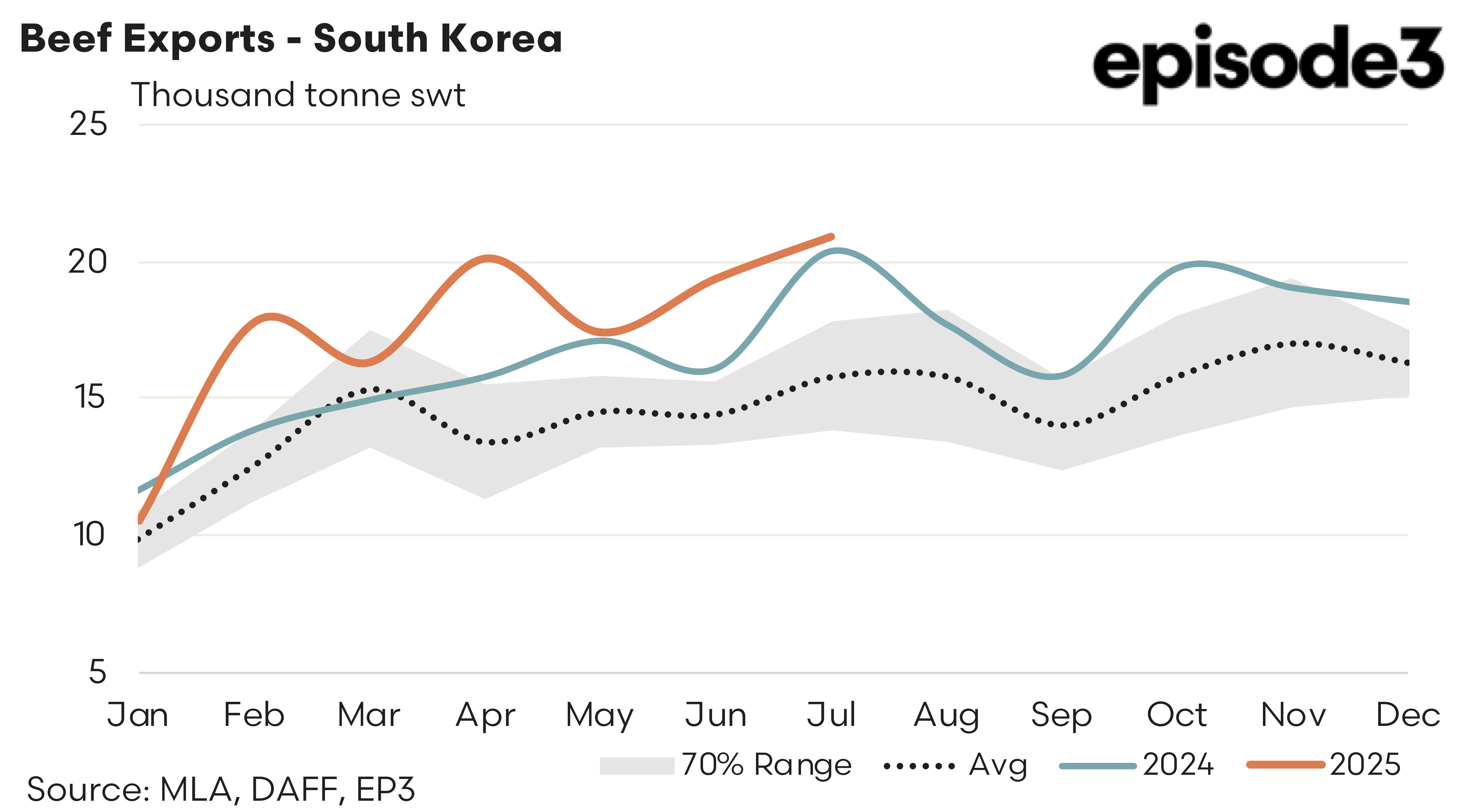

South Korea – Continued robust demand was seen in South Korea with during July with trade flows at 20,869 tonnes, an 8% gain on June’s results. Year-to-date volumes are close to 123,000 tonnes, which is about 12% higher than the same period in 2024.

.