Hard times

Sheep Processor Trading Conditions Model

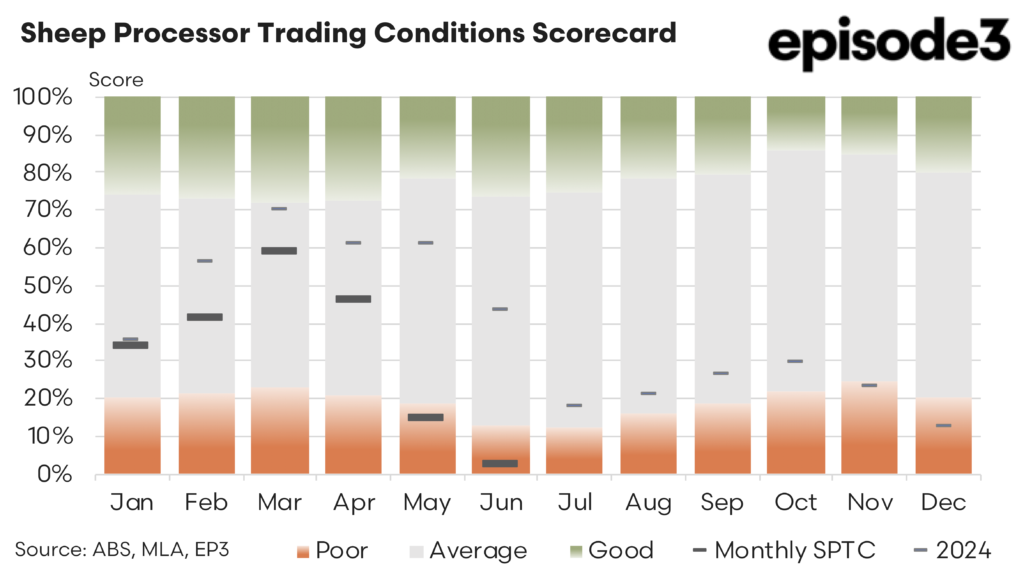

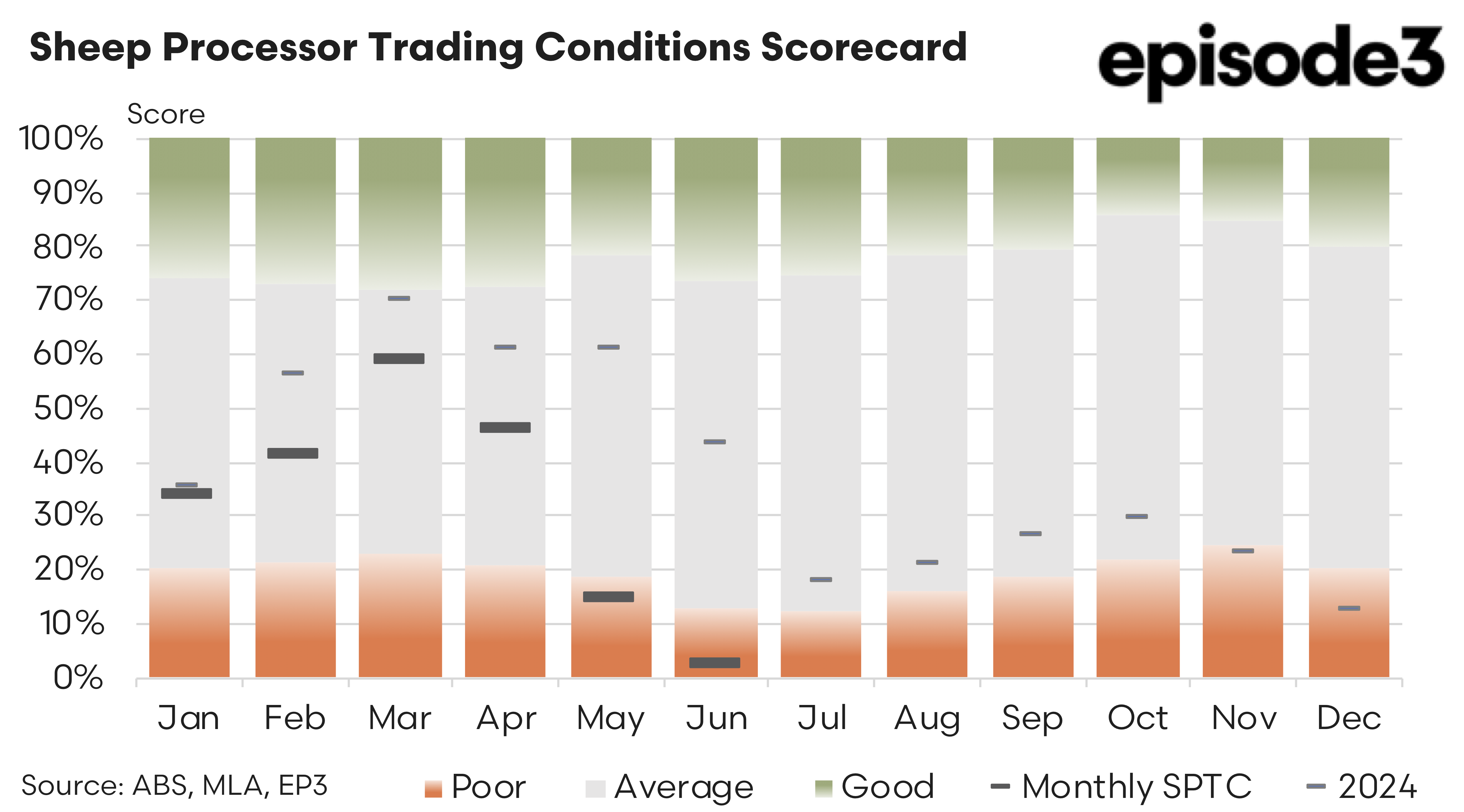

The slide in sheep processor trading conditions has continued into June with the monthly index score tumbling to just 2%. This is the weakest reading since March 2020 and takes the 2025 annual average score down from 39% to 33% during June. The latest figure reinforces the pressure processors are facing as high livestock procurement costs collide with softer export returns and mixed results from co-product sales.

The primary driver behind the slump in June has been the steep increase in livestock input prices. Lamb values surged by 16% over the month while mutton prices climbed by 14%. This escalation in procurement costs has occurred at a time when downstream markets have failed to deliver commensurate gains, leaving processors squeezed on both sides of the ledger.

Export market performance provided little relief in June. Across the key sheepmeat trade destinations, average export prices fell by 3% compared to May. The overall decline masked a wide variation between markets. The United States recorded an 11% drop in export values which was particularly damaging given the significance of that market for high value cuts. The United Arab Emirates also posted a softer performance with values easing by 1%. In contrast, Malaysia provided some encouragement with a 3% increase in returns, while China continued its recent momentum with an 8% gain. However, the combined effect of these mixed results was still negative for the overall export price trend.

Domestically, retail lamb prices were almost static into the June quarter, rising by just 0.4%. While the stability in consumer pricing may help support retail demand, it does little to offset the sharp lift in processor procurement costs. In practice, the domestic market remains a relatively small outlet compared to all of the other offshore export destinations, and without significant price improvement here, processors remain dependent on stronger returns from overseas buyers to balance their books.

Non-meat revenue streams, which often play a key role in processor profitability, also delivered a mixed performance. Tallow values dropped by 15% in June, eroding an important co-product revenue source. The decline in tallow prices followed earlier volatility in the year and reflects weaker demand signals from industrial users, including biofuel producers. On a more positive note, co-product receipts, which include items such as offals and skins, improved by 10% compared to May. While this provided some cushioning to the overall downturn, the uplift was not nearly enough to counter the hit from tallow and the pressure from meat markets.

The combined impact of these factors has pushed processor margins into extremely tight territory. The June result represents a continuation of the cost-price squeeze that has defined much of 2025, but with the severity now more pronounced than at any other point in the current cycle. The sharp rise in livestock prices reflects strong competition for available stock, particularly as seasonal conditions are looking more promising. While this benefits sellers in the short term, it exacerbates the difficulty for processors trying to maintain throughput at profitable levels.

Looking across the first half of 2025, the annual average index now sits well below the five-year trend. Earlier months offered some relief, particularly in March and April when co-product and tallow values provided a boost, but those gains have been undone by the heavy falls in May and June. The result is an industry landscape where processors must balance operational viability against the risk of cutting kills and reducing shifts to limit losses.

The resilience of the Chinese market in June is one of the few bright spots. The 8% lift in export values to China shows that demand there remains robust, particularly for a range of product specifications. Malaysia’s modest improvement also offers some encouragement, especially as that market has shown steady growth in recent years. However, the reliance on a handful of key destinations leaves the sector vulnerable to fluctuations in just one or two major markets, as evidenced by the sharp fall in US returns in June.

Looking ahead, processors face a difficult winter. Livestock prices have remained elevated during July and August and if export values have not risen enough to meet what the processors have outlaid to secure stock then further margin compression is inevitable. The prospect of ongoing softness in tallow markets adds to the challenge. Some relief could come from continued growth in co-product values, but without a broader lift across all revenue streams, the sector will remain under significant financial strain.

The June data paints a picture of an industry in the grip of a severe profitability downturn. The collapse in the SPTC index to 2% is not just a reflection of short-term market volatility but a symptom of deeper structural supply pressures facing the sheep processing sector.