ISCC: Is the overseas-owned certification an overreach?

The Snapshot

- The ISCC is a privately owned certification body; it is not the EU government.

- ISCC is used by the Australian grain and oilseed industry to ensure adherence to the renewable energy directive for biofuels.

- There are many schemes which can be used.

- The ISCC covers a lot more areas than the minimum requirements to trade biofuels into Europe; many farmers consider this to be an over-reach.

- Australia has focused on Europe as a market, but as China re-emerges as a potential major buyer of canola from Australia, we are in a better negotiating position.

- Europe may find that they have to pay a higher premium to ensure that farmers sign the ISCC form.

The Detail

Paperwork is the mortal enemy of productivity, and farmers are drowning in it. Over the past few months, I have been lucky enough to travel around the country, delivering presentations and MCing events. Whilst we are primarily there to provide the audience with information, we also get a lot from the audience, especially what is frustrating them, and one thing has come up time and time again – ISCC audits.

The International Sustainability and Carbon Certification (ISCC) is a Germany-based scheme originally designed to prove compliance with the European Union’s Renewable Energy Directive (RED). While it operates under the label of a non-profit, ISCC is run by ISCC System GmbH, a private limited company registered in Cologne and managed by the consultancy Meo Carbon Solutions. Oversight is provided by the ISCC Association, a multi-stakeholder group of industry players, NGOs, and auditors, but ultimate control remains firmly in Germany. Certification itself is delivered through commercial auditors, with farmers and exporters footing the bill.

The ISCC was designed as one of many certification bodies to ensure companies adhered to the Renewable Energy Directive. It has always had a much larger scope than meeting the RED requirements, and this is frustrating farmers.

The Renewable Energy Directive calls for a couple of key items:

Land Use Rules (No-Go Areas)

Canola can’t be grown on land cleared after 1 January 2008 if it was forest, wetland, peatland, high-biodiversity grassland, or other high-carbon areas. Protected zones like national parks and wetlands are also off limits.

Greenhouse Gas Emissions Savings

Biofuels must cut emissions compared to diesel: 50% for older plants, 65% for new ones, and up to 80% under the latest rules. These savings are worked out through life cycle assessments, using either EU default numbers or farm-level data.

Mass Balance / Chain of Custody

Certified grain has to be tracked all the way through the supply chain. The mass balance system stops mixing or double-counting, with records checked at every step from paddock to port.

Audit and Certification

Independent auditors sign off on compliance under EU-approved schemes like ISCC, RedCert or RSB. They check land use, emissions savings, and paperwork to prove the canola meets Europe’s sustainability rules.

If you meet these requirements, you essentially meet the agreements of the renewable energy directive, making it possible for your canola to be used as biofuel in the European Union. This might be surprising for many people who have gone through an audit, as the requirements are simple.

The RED does not include anything on bribery declarations, waste management plans or pollinator action plans. The additional questions that the ISCC audits pose are not necessarily onerous; in fact, most farms in Australia already meet the audit process requirements, but it takes time to gather all the necessary information to prove that you are, in many cases, abiding by the law.

The Australian sector has undergone significant changes to the ISCC scheme over time, during which we have exerted some influence on its development. However, ultimately, it is not an Australian scheme, and we are subject to the ISCC’s decisions.

A new negotiating position?

We are, however, potentially at a critical juncture, with a possible better bargaining position, as farmers become increasingly frustrated with the scheme and consider either continuing with ISCC or creating an Australian-operated certification which meets the RED requirements.

If we keep the ISCC, we want to make sure it is not overly onerous, and there are options for that.

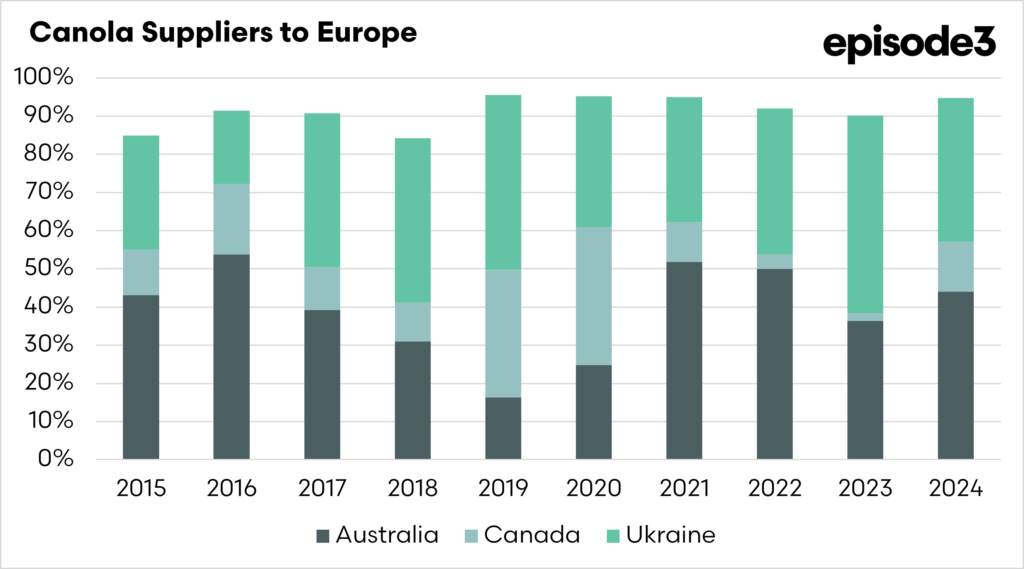

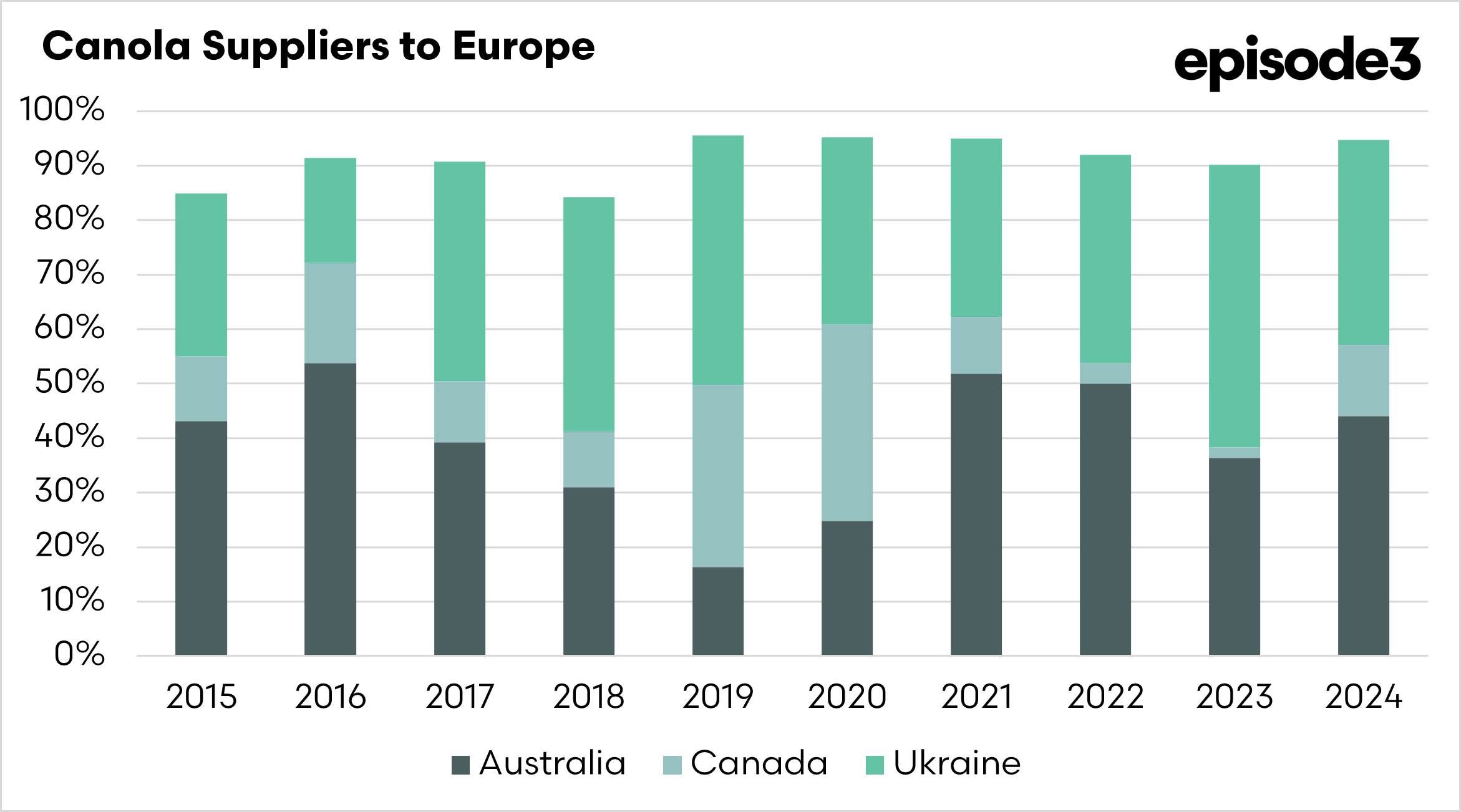

Why do I think we are in a better position? The European Union is reliant on imports to meet its demand, and the majority of our canola, which leaves our shores, will end up in Europe. When the drought years are excluded, Australia supplies just under half of its canola import requirements; they do need us. As of recent times, so does China.

In the past fortnight, China has slapped a whopping big tariff of 75.8% on Canadian canola, which is large enough to make imports from Canada unviable. Canada was the largest supplier to China, and since 2020, Australia has been locked out due to fears of black leg.

Necessity is the mother of invention, and now they are showing a more relaxed view on Australian canola, including expectations of commercial trials, and this week, the speculation that at least one cargo of GM canola has been purchased for the new crop.

China, before the black leg issues, was a buyer for up to a quarter of our canola; they will now be back in our market, and we could feasibly see our trade with China higher than in the past due to the absence of Canada.

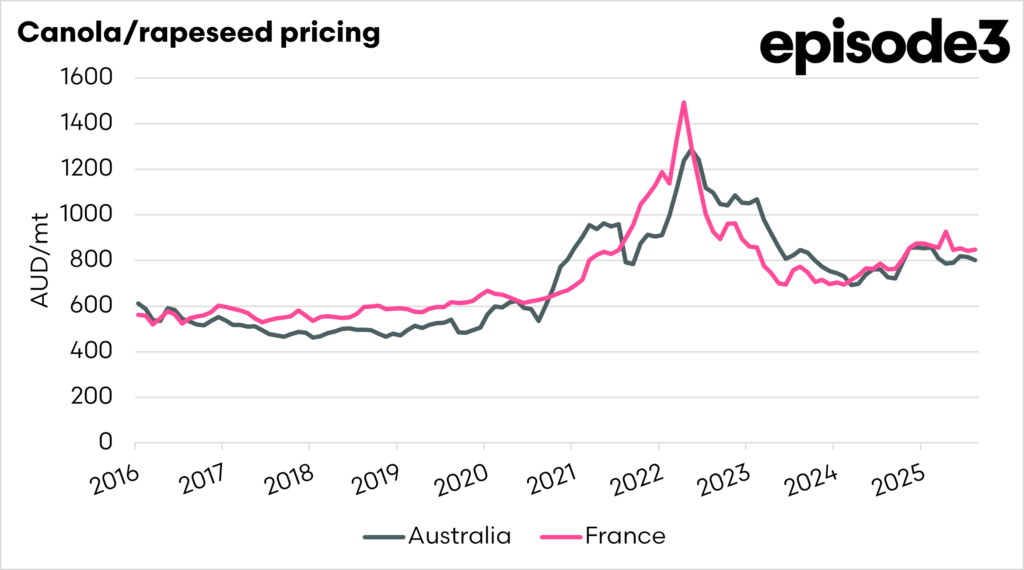

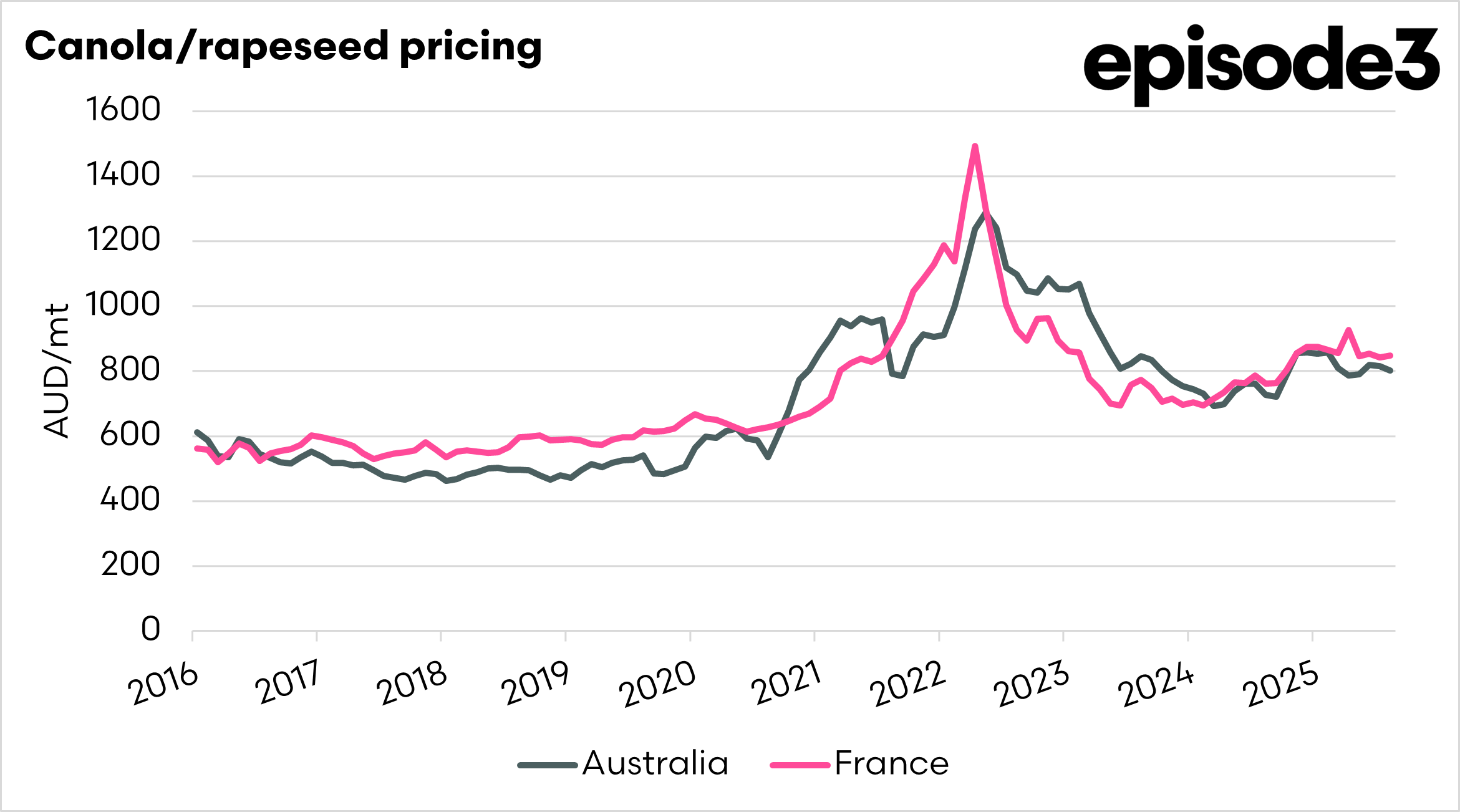

This puts Europe in a tricky situation. If China is paying up for our canola, then Europe will have to show a much higher premium, but if farmers don’t see the premium as being beneficial, then those ISCC forms will not be getting signed.

So, our industry could use this as an opportunity to develop a solution that suits our farmers, who ultimately have to do the audit work.