Feedlot records broken

June 2025 cattle on feed update

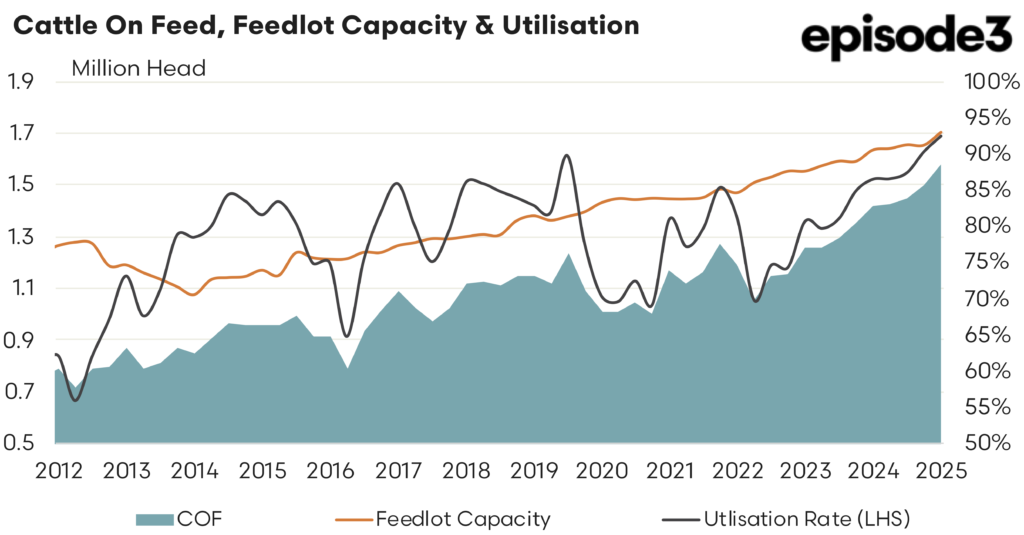

Nationally, cattle on feed climbed from 1.50 million in March to over 1.58 million head in June, a 5.5 percent increase that saw feedlot utilisation hit a record 93 percent. This rise occurred alongside a 3 percent lift in feedlot capacity, which now exceeds 1.7 million head across the country.

Grainfed cattle marketings followed suit, reaching a record 894,178 head for the quarter. This marked a 4 percent increase from March and an 22 percent rise compared to the same period last year. Queensland alone accounted for nearly all the quarterly growth in turnoff, with more than 537,000 head exited, up 11 percent, cementing its position as the engine room of national lot feeding.

New South Wales also expanded its cattle on feed by nearly 30,000 head and lifted its utilisation to 95 percent, the highest in the country, despite a small decline in cattle marketed. Western Australia recorded the strongest cattle-on-feed growth of any state, up 13 percent to just under 71,000 head, while Victoria and South Australia held steady on feeding volumes but saw turnoff ease from earlier peaks.

This lift in feedlot activity came despite seasonal tightening in feeder availability and continued cost pressure. Throughput on both the NLRS feeder steer and heifer indicators declined during the quarter, while feeder prices lifted on the back of strengthening cattle markets. The feeder steer indicator rose 22 cents to 384 cents per kilogram live weight, and the heifer indicator climbed 21 cents to 336 cents per kilogram.

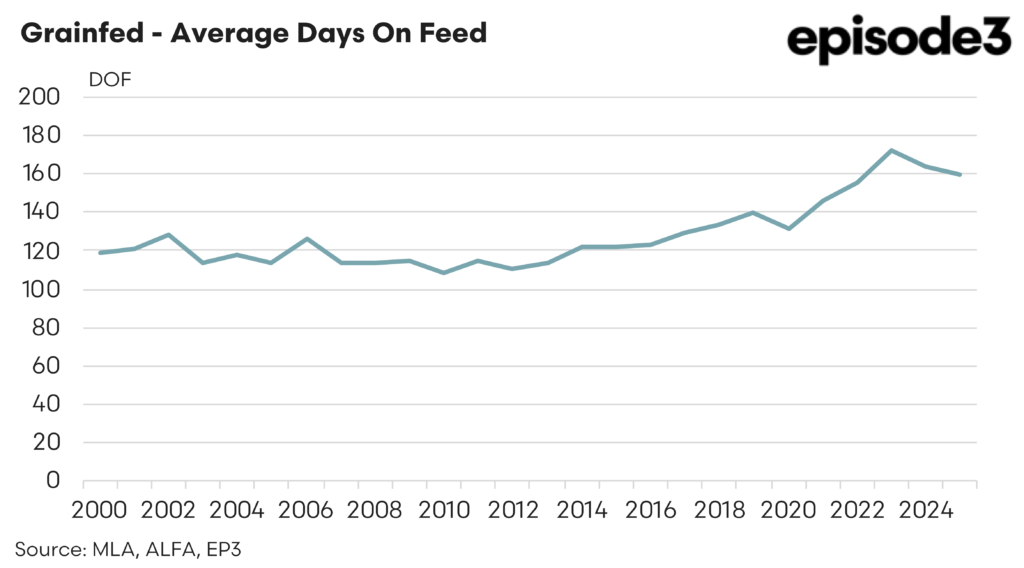

At the same time, Darling Downs wheat prices rose 4 percent to 350 dollars per tonne, although this remained below year-ago levels. Even with rising input costs, operators were able to maintain or improve efficiency. Average days on feed continued to trend downward, falling from 166 days in 2024 to 160 days in the first half of 2025. This figure has dropped steadily from 172 days in 2023, and reflects both greater turnover of feedlot infrastructure and a possible strategic adjustment of feed durations with a noted reduction in longer fed Wagyu items during 2025.

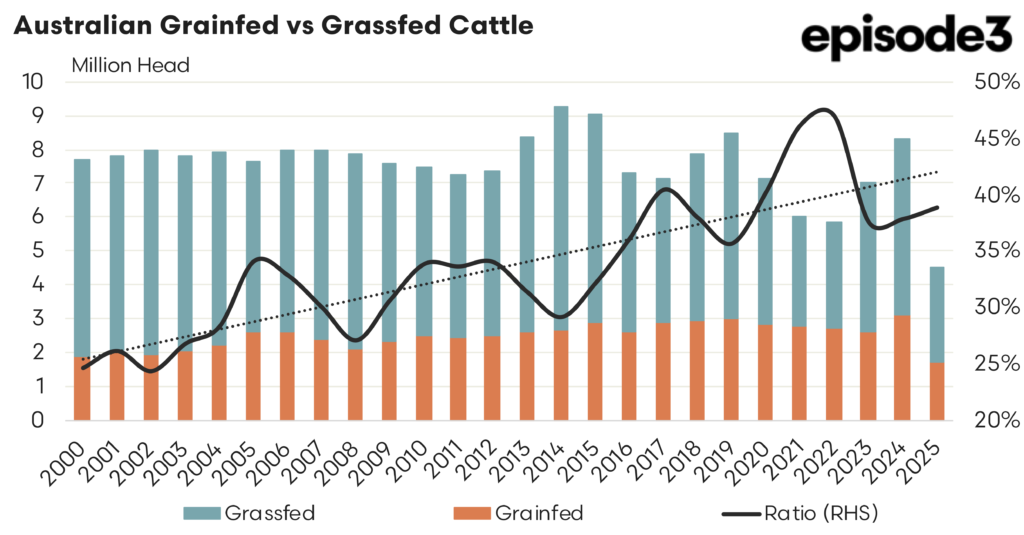

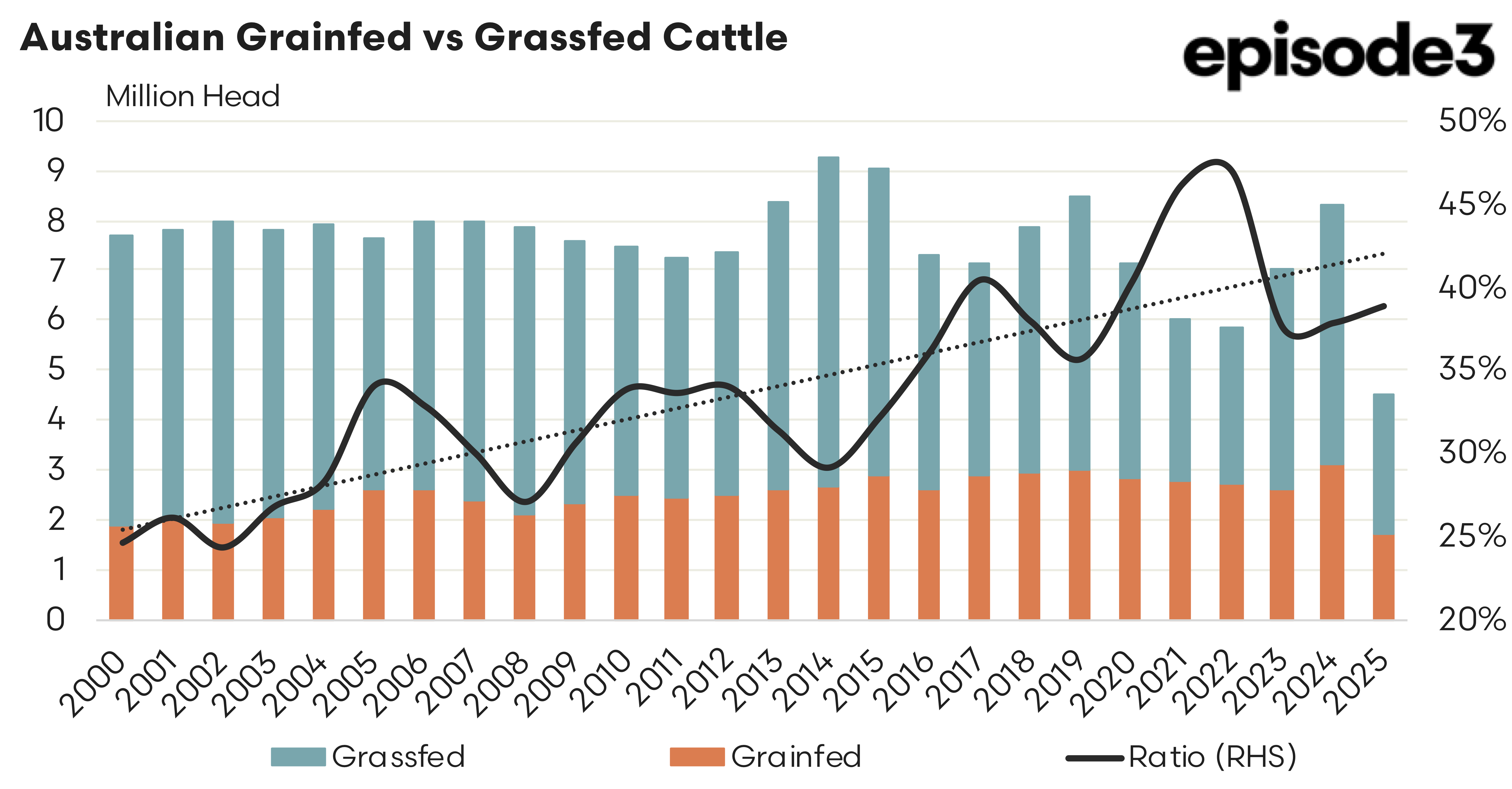

At the national level, the structural shift toward grainfed production continues. In 2025, grainfed cattle are projected to make up 39 percent of adult cattle slaughter, up from 38 percent in 2024. Grainfed slaughter volumes sit at 1.75 million head, meanwhile grassfed slaughter is at 2.76 million head, as at the midyear mark for 2025.

The March to June quarter confirms that the feedlot sector is not only large and growing, but also increasingly central to the shape of Australia’s red meat supply chain. The expansion in infrastructure, the rise in grainfed market share, the gains in turnover efficiency, and the lifting of export volumes all signal a feedlot sector that is operating with confidence.