The sheep meat trade

Market Morsel

Sheep meat exports are critical to demand, with over 50% of lamb and 90% of mutton production exported. Major lamb markets during the 2024/25 season included the USA, China, the Middle East and South-East Asia. Most exports are frozen boxed meat, with some chilled shipments to premium markets.

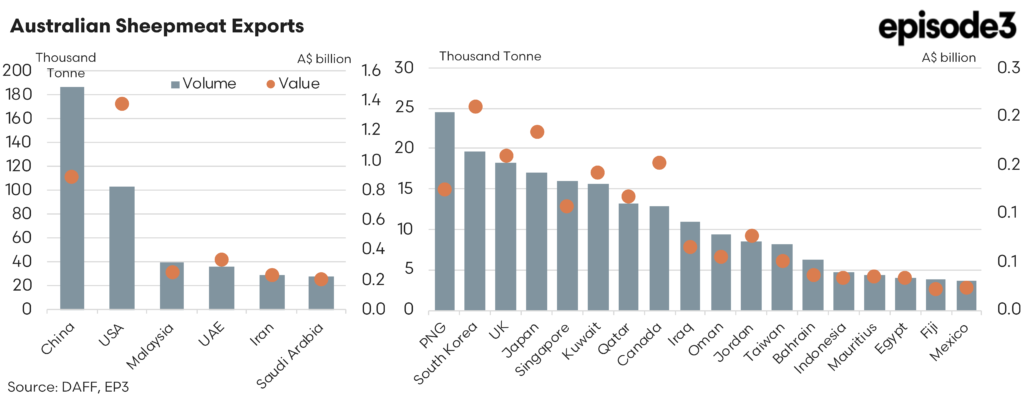

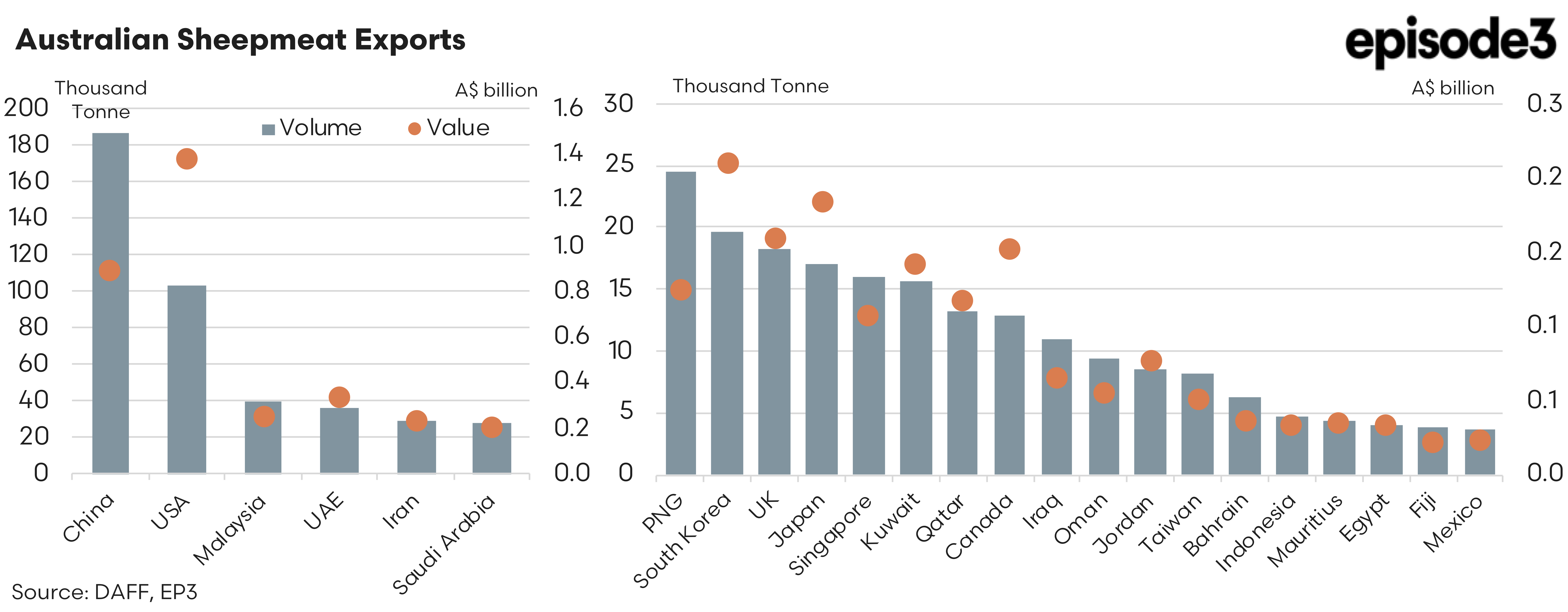

Australian sheep meat exports are highly diversified, with Asia and the Middle East accounting for the majority of demand. In Greater China, more than 186,000 tonnes were shipped in 2024 worth nearly A$0.9 billion, dominated by frozen lamb and mutton for hot pot and barbecue foodservice. Chilled access is expected to expand following approvals for additional plants, lifting premium demand in urban retail and high-end restaurants.

In the Middle East and North Africa, Australia exported more than 150,000 tonnes of sheepmeat in 2024 worth around A$1.24 billion, with the UAE, Iran and Saudi Arabia the largest destinations. Demand is split between frozen mutton carcasses and higher-value chilled lamb cuts. The region remains critical, accounting for a large share of mutton exports. Live export from Western Australia continues to service Middle Eastern demand, though volumes are declining due to regulatory and policy changes.

North America remains a premium market. The US imported over 102,000 tonnes of Australian lamb in 2024, valued at more than A$1.37 billion, dominated by chilled product for retail and foodservice. Canada, while smaller at under 13,000 tonnes, shows steady growth in premium lamb demand.

Japan imported over 17,000 tonnes in 2024, worth A$184 million. Lamb dominates, particularly chilled racks, loins and legs for retail and foodservice. Japanese consumers value tenderness, leanness and provenance, areas where Australian lamb has a strong reputation. In South Korea, imports of nearly 20,000 tonnes were valued above A$210 million, with lamb racks and other premium cuts highly sought after in restaurants, though lamb still accounts for only about 1% of protein intake.

South-East Asia is an increasingly important growth region. Indonesia took more than 4,600 tonnes in 2024, largely frozen mutton for satay and manufacturing. Malaysia and Singapore together imported over 55,000 tonnes, both favouring frozen mutton but with rising demand for chilled lamb in urban retail. In Singapore, premium chilled lamb is establishing a niche in hotels, restaurants and gourmet retail.

The UK and EU together imported around 23,000 tonnes in 2024, with preference for chilled lamb legs and racks. Australia’s position has been strengthened by the UK-Australia free trade agreement, though New Zealand remains the dominant competitor. EU demand is stable but constrained by quota limits.

Overall, Australian sheep meat exports are underpinned by a broad spread of markets that balance premium lamb demand in developed economies with volume-driven mutton demand in developing regions. Australia’s brand strength, product integrity and expanding market access continue to support growth across differentiated product segments. Export performance underscores the importance of overseas demand and processing capacity in sustaining industry resilience during periods of price volatility.