The beef trade

Market Morsel

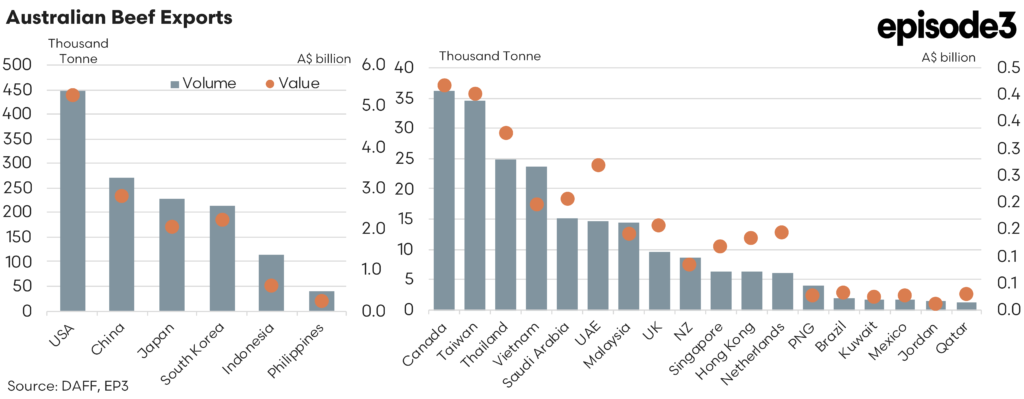

Australia’s beef export profile continues to reflect the breadth and diversity of global demand, with key markets spanning both established and emerging economies. Exports represent over 70% of Australian beef production, with key markets including the USA, China, Japan and South Korea.

Live cattle exports, primarily from northern and western ports, remain important with Indonesia, Vietnam and China the key market destinations. China, Japan, Korea and the USA dominate boxed beef export volumes, collectively accounting for more than 75% of Australian beef exports in FY2024/25.

The United States remains the leading destination by volume, importing over 448,000 tonnes annually, valued at more than A$5.2 billion. Demand from the USA is underpinned by a mix of lean grass-fed beef used in manufacturing and high-quality grain fed cuts destined for the premium foodservice channel. Volumes tend to fluctuate with the cyclical nature of the US domestic cattle herd and quota access, but the US remains a critical high-value market for Australian beef.

China is the second-largest destination, accounting for nearly 270,000 tonnes in volume and contributing roughly A$2.8 billion in export value. Chinese demand is primarily driven by foodservice segments, particularly through hotpot restaurants, barbecue outlets and modern Western dining formats. Imports have grown steadily over recent years, although access risks and competitive pressure from the USA and South American suppliers are ongoing challenges.

Japan and South Korea continue to play important roles. Japan imports around 230,000 tonnes annually (valued at A$2 billion), favouring chilled grain fed beef products supported by strong consumer trust in Australian food safety and brand quality. South Korea sources both chilled and frozen beef at around 213,000 tonnes (A$ 2.2 billion in value), with Australia maintaining a strong presence despite increasing competition from the United States. Together, these two north Asian markets form a critical part of Australia’s high-value grain fed beef trade.

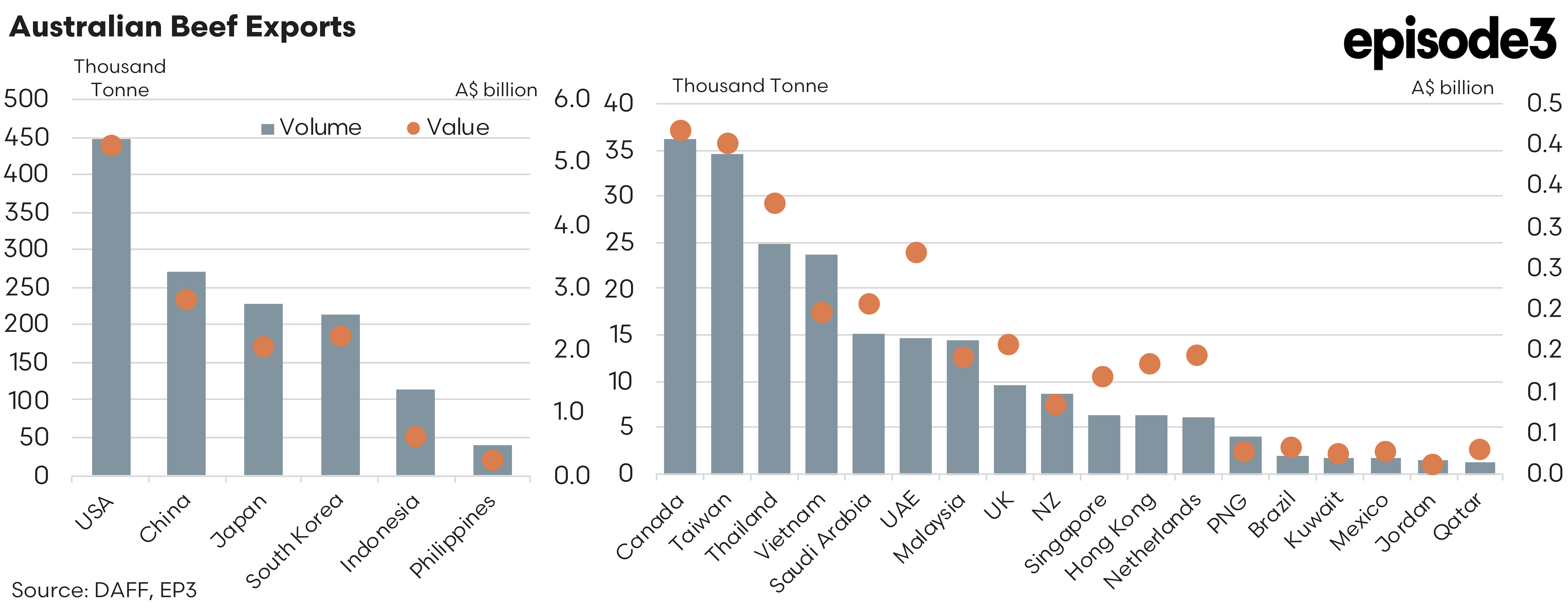

In South-East Asia, Indonesia remains Australia’s most significant customer number one in live export and fifth in the boxed trade, purchasing over 112,000 tonnes of boxed beef last financial year. Australian beef enjoys widespread use in wet markets, warungs, and quick-service food outlets. The Philippines, Vietnam, Malaysia and Thailand also represent growing destinations as their foodservice sectors mature and household incomes improve. These smaller markets are valued for their growth potential and ability to absorb secondary cuts and manufacturing product.

In the Middle East and North Africa (MENA), Australian beef exports remain steady but highly targeted. In 2024/25, the region imported approximately 37,000 tonnes of Australian beef, valued at over A$584 million. Key markets include Saudi Arabia, the United Arab Emirates, Kuwait and Qatar, with demand focused on frozen product for commercial kitchens and institutions. While smaller in scale than the sheepmeat trade, the MENA region offers a reliable outlet for Australian beef, particularly during religious and seasonal peak periods. Halal certification and competitive freight access continue to be important enablers of this trade.

The United Kingdom and European Union represent modest but stable markets. In 2024/25, around 18,000 tonnes of Australian beef were shipped to the region, valued at over A$372 million. The UK-Australia Free Trade Agreement has improved quota access and tariff conditions, supporting renewed interest in high-quality grass-fed beef. While the EU remains a difficult market to expand in due to limited quota and strict certification rules, Australia’s clean production reputation positions it well for niche retail and premium dining applications.

Beyond the established markets, smaller but emerging destinations such as Thailand, Taiwan, Canada and Singapore round out Australia’s global footprint. Newer markets including Jordan, Mexico and Brazil, while currently small in volume, demonstrate the sector’s ability to diversify and adapt to shifting international demand conditions.

Overall, Australia’s beef export sector is underpinned by its ability to meet a wide array of market specifications, from lean manufacturing meat to high-end grain fed steaks. This geographic and product diversification enhances resilience and supports growth across price cycles. The industry’s international reputation for quality, traceability and food safety continues to provide a competitive edge as global consumers seek consistent, sustainable and premium red meat offerings.