Biofuel Bonanza Benefits for Australia?

The Albanese Government is launching a A$1.1 billion Cleaner Fuels Program to jump-start a domestic low-carbon liquid fuels (LCLF) industry producing renewable diesel and sustainable aviation fuel. The ten-year package will provide production-linked incentives and competitive grants to attract private investment and build local refining capacity.

Feedstocks such as canola, sorghum, sugar and agricultural waste are earmarked as key inputs, creating potential new markets and income streams for farmers while helping decarbonise hard-to-abate sectors like aviation, freight and heavy industry. The government will consult on scheme design during the current financial year, including mechanisms to guarantee demand and ensure a sustainable market.

This is huge news, with Australia having been behind large parts of the world when it comes to creating a viable biofuel industry.

Australian grain farmers already benefit from biofuels in terms of the price which they receive for our commodities, which I wrote about recently in this article, Green Rules, Golden rewards.

If this scheme is successful, our whole grain industry in Australia could be set for wholesale change.

I thought I would in this article just highlight a few areas of where biofuels could benefit Australian agriculture.

New and Stable Market for Grain and Oilseeds

Biofuel production (ethanol from grains such as wheat, sorghum; biodiesel from oilseeds such as canola) creates a large, price-supportive domestic demand for feedstock. This adds a second pillar of demand alongside food and export markets. When global export prices are weak, a local biofuel industry provides an alternative outlet that can smooth price volatility and reduce growers’ exposure to international market swings.

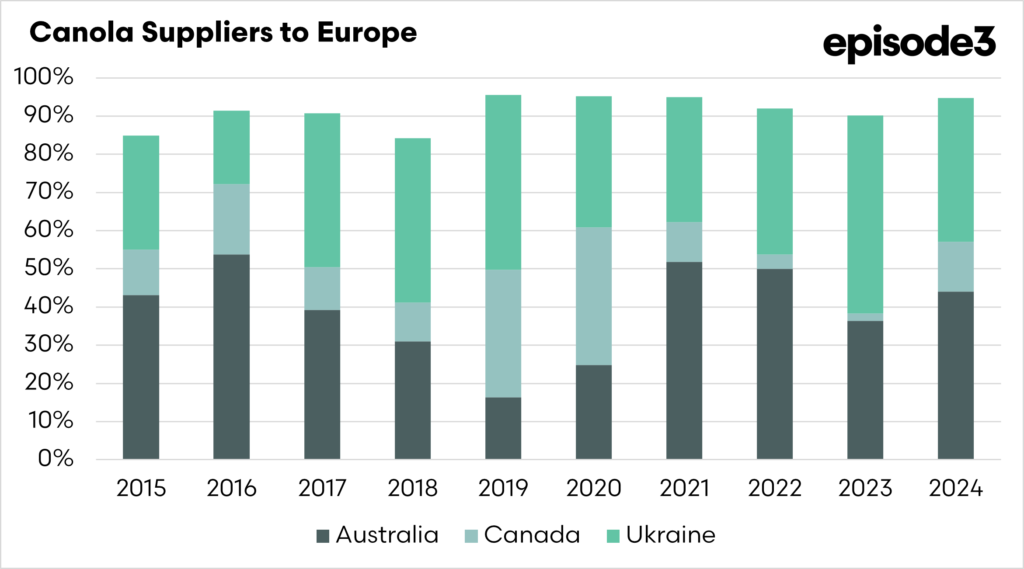

At EP3, we have been concerned about our reliance on Europe for our canola and China for our sorghum exports. A valid and competitive biofuels industry would give a huge new market for Australian grains and allow us to value-add our grain. At the moment, our canola is mainly used for biofuels in Europe.

Price Support and Farm Gate Returns

By introducing an additional buyer into the market, biofuel plants can bid for grain or oilseeds, thereby increasing the regional cash price. Even if growers do not sell directly to the plants, the presence of a nearby buyer tends to tighten basis levels and reduce freight discounts.

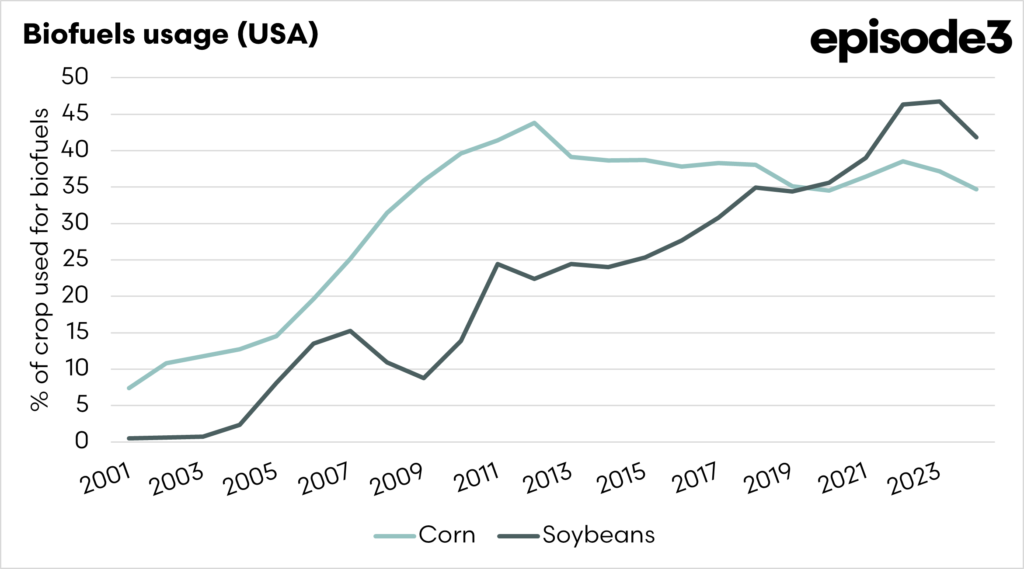

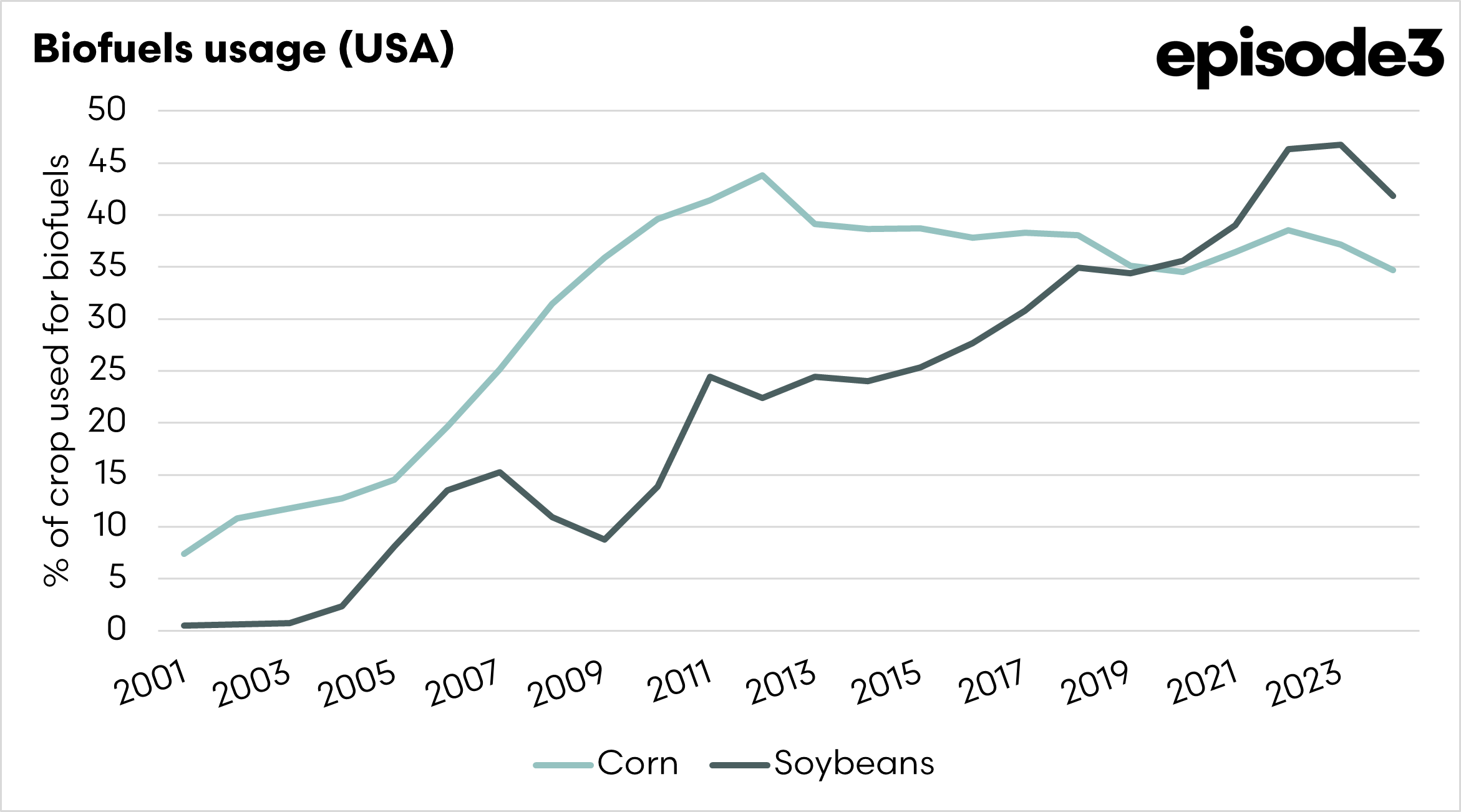

In the United States and Brazil, for example, ethanol demand has consistently added value to corn and sugarcane prices.

Regional Development and Processing Jobs

Biofuel facilities are usually located in grain-growing regions to minimise freight. Their operation creates ongoing local employment (plant staff, truck drivers, maintenance crews) and secondary economic activity (storage, handling, transport).

These facilities are also huge projects, and will bring in income into the regions during the construction phase.

By-products for Livestock Feed

Grain-based ethanol plants produce distillers’ grains and other high-protein co-products that can be used as livestock feed. These by-products can reduce feed costs for cattle, sheep or pigs and help close nutrient loops within the farming system.

The biofuels industry in Australia has to really consider the impact on livestock, as there will be a huge additional surplus of animal feeds.

Diversification and Risk Management

A domestic biofuel industry broadens the end-use base for Australian crops. This diversification enables farmers to manage production and price risk, particularly during periods of export market disruption.