Sheep meat processors squeezed further

Sheep Processor Trading Conditions Model

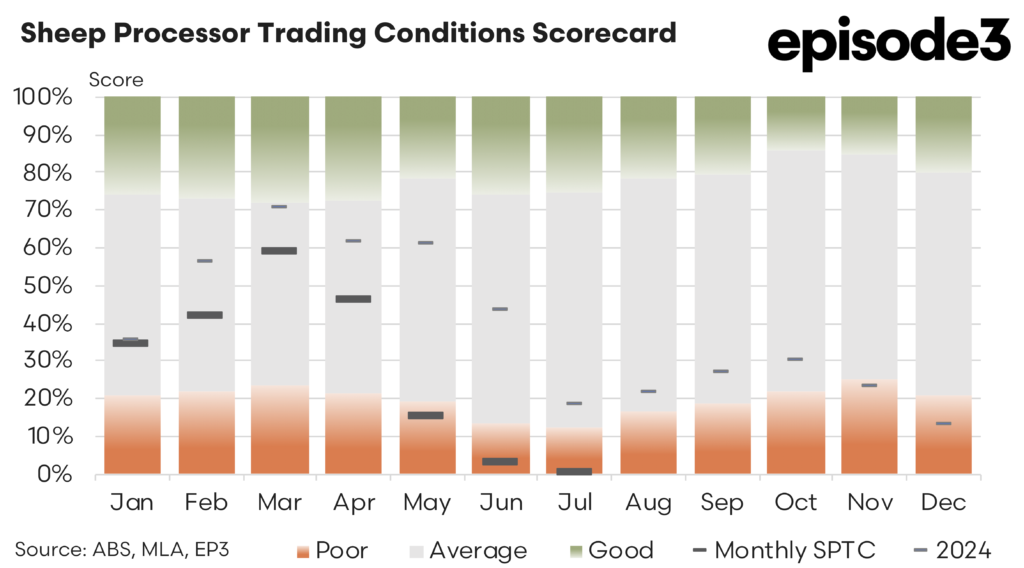

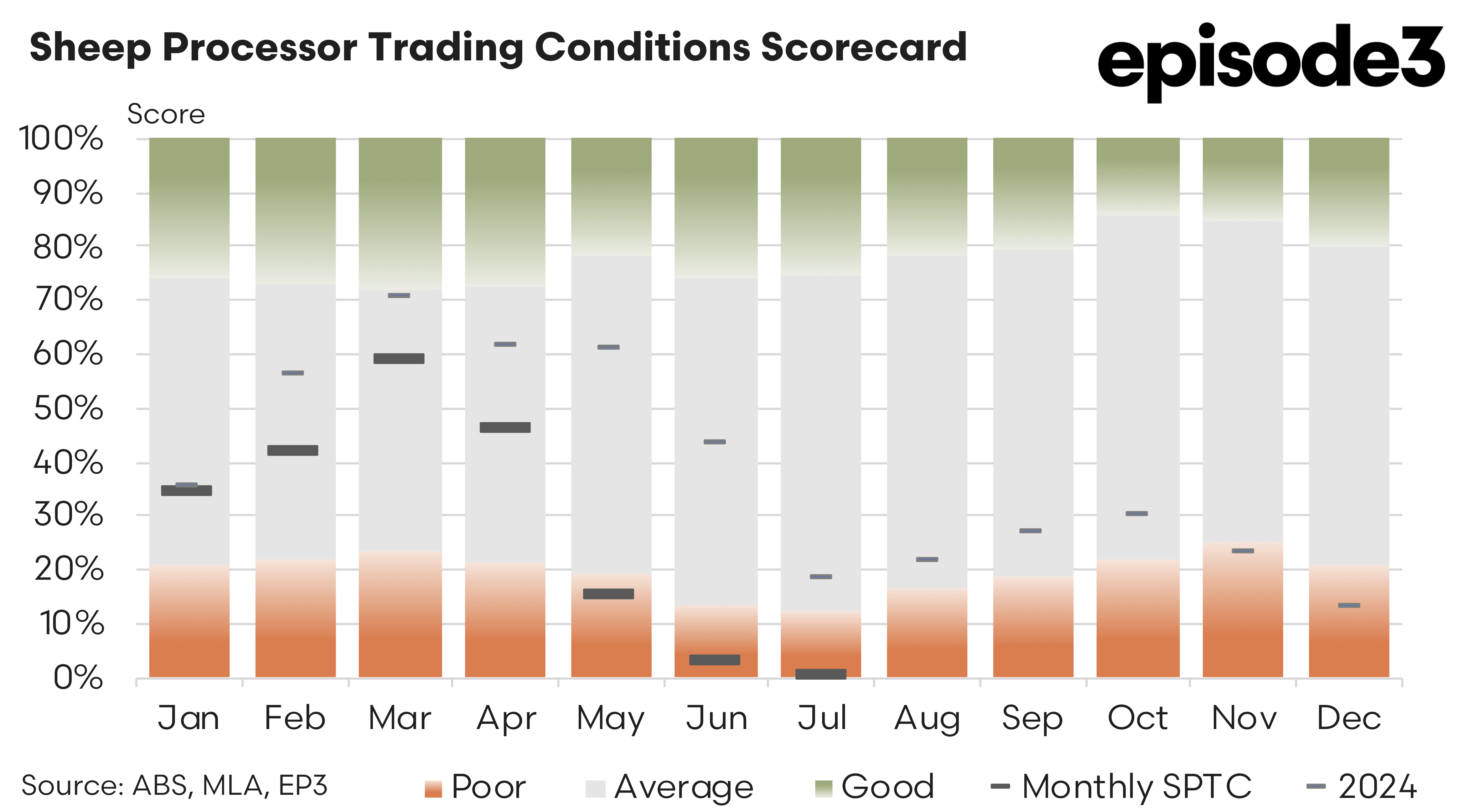

The financial squeeze facing Australian sheep processors intensified in July 2025, with trading conditions plunging to a new low point in the current cycle. The Sheep Processor Trading Conditions (SPTC) index fell from an already dire reading of 2.8% in June to just 0.4% in July, effectively flatlining.

This marks the weakest monthly result on record and drags the year-to-date average for 2025 down to 29%, four percentage points lower than the 33% recorded at the halfway mark in June. While June highlighted the emergence of a severe margin compression, the latest figures confirm that processor profitability has now reached crisis levels.

The continued deterioration in trading conditions stems from the same cost-price imbalance that has dogged the industry throughout the year, only now in a more acute form. July saw livestock procurement costs climb again, further stretching processors already struggling to manage throughput at sustainable margins. The domestic cost of mutton lifted by 7.4% compared to June, while average lamb prices surged a further 10.8%. These are significant increases, particularly following the sharp price hikes already recorded in the previous month, and underscore the fierce competition for available sheep. Seasonal conditions across major producing regions have improved during winter and the BOM outlook into spring is rather positive, lifting producer spirits and saleyard prices as a result. While this is welcome news for producers, the effect on processor bottom lines is overwhelmingly negative.

Offsetting this cost pressure on the revenue side requires meaningful gains in export returns, yet the data from July shows only limited support. Across the major sheepmeat markets, average export prices rose by 1.3% from June to July. This modest lift is nowhere near sufficient to match the sharp escalation in livestock input costs. More importantly, the headline gain masks significant variation between markets. Export prices to China rose by 2.5%, continuing a positive run in that key destination. Malaysia also improved, with a 4.0% gain, building on its recent upward trend and reflecting a steady expansion in demand. The US market recorded a modest 2.0% lift, offering some partial recovery after the steep 11% fall observed in June. However, the United Arab Emirates posted a decline of 2.3%, continuing its weaker performance in recent months.

The overall story here is one of patchy recovery in offshore markets that has not kept pace with the rapid increase in processor outlays. While the gains from China and Malaysia are welcome, the scale of these improvements falls short of what is required to stabilise processor trading conditions. The United States remains a vital market for high-value cuts, and even with the small rebound in July, returns remain well below the levels seen earlier in the year. The softness in the UAE market compounds the issue, limiting the capacity for improved overall export values to rescue processor margins.

The domestic retail environment also offers little support. While updated retail pricing figures are not yet available, the previous quarter showed only a 0.4% lift in lamb prices at the consumer level, suggesting limited capacity for the local market to absorb higher input costs. This reflects a broader pattern of disconnect between farmgate values and what can be recovered through the retail chain, particularly given broader inflationary pressures on Australian households. For processors, the domestic market remains a relatively minor outlet, and without material uplift here, the focus remains squarely on export performance to deliver margin relief.

Adding to the pressure is the continued volatility in co-product markets. Although updated figures for tallow and offal receipts in July are yet to be finalised, June data revealed a 15% drop in tallow values, a key co-product revenue stream for processors. This decline came after earlier volatility and reflected weaker demand from industrial buyers, including the biofuel sector. If this downward trend in tallow has persisted into July, it would represent another blow to processor incomes. While co-products like offal and skins had shown improvement in June, rising by 10%, it remains unclear whether that momentum has continued. Even if it has, gains in minor revenue streams are unlikely to materially offset the sheer scale of the cost blowout from livestock procurement.

The near-zero reading on the SPTC index for July confirms that the structural pressures flagged in earlier months are intensifying. Processor viability is under threat not just from temporary price shifts, but from a sustained misalignment between input costs and achievable revenues. While isolated improvements in some markets offer glimmers of hope, the broader trend is one of relentless cost increases and fragile price support. Maintaining kill volumes at current livestock prices risks deepening losses, yet scaling back production comes with its own challenges, including workforce disruption and throughput inefficiencies.