Beef Processor Supply Conditions Tighten Unevenly

Market Morsel

The shift into spring has done little to bring uniformity to Australia’s cattle market. While signs of a seasonal supply lift have emerged in the eastern states, the recovery remains uneven and lacks the momentum typically seen at this point in the year.

Queensland and parts of northern New South Wales continue to lead the supply recovery, with yardings nudging higher through late August and September. Victoria, Western Australia and South Australia have also shown improvement, albeit from a much lower base. In contrast, Tasmania has slipped backward, and some southern processors are now making difficult decisions about scaling back throughput to protect already thin margins.

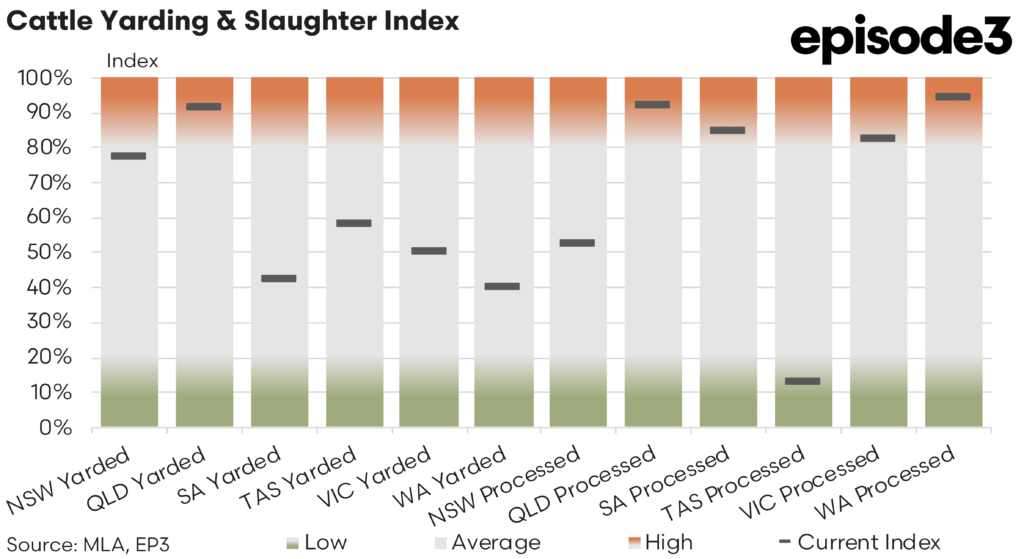

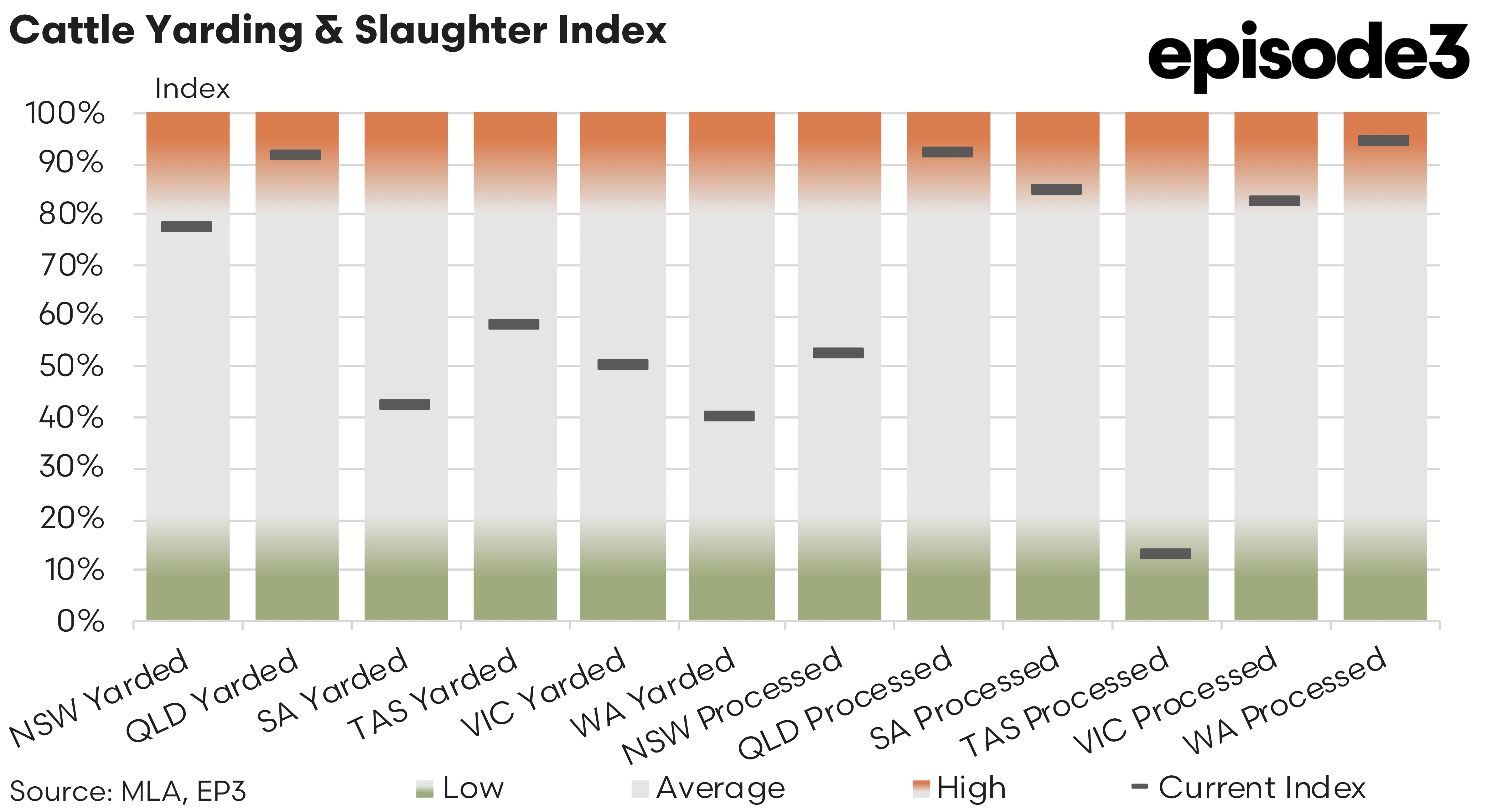

Yarding index data confirms a slight but broad-based lift across most regions. Queensland has improved from 87 percent of seasonal norms in August to 91 percent in September, with New South Wales climbing from 75 percent to 77 per cent. Victoria saw a more pronounced gain, from 41 percent to 50 per cent, likely aided by a mild improvement in cattle condition. Western Australia increased from 29 percent to 40 per cent, while South Australia remained stable. However, Tasmania recorded a drop from 67 percent to 58 per cent, reinforcing concerns that localised weather and lighter cattle are continuing to hinder supply from that region.

Processing activity tells a sharper story. Queensland and Western Australia remain at or near full operational capacity, recording processor index values of 92 and 94 percent, respectively. New South Wales, on the other hand, has seen a dramatic reduction in kill volumes, falling from 82 percent to just 53 per cent. Victoria has eased from 90 percent to 83 per cent, while South Australia saw a marginal decline from 86 to 85 per cent. Tasmania now sits at just 13 percent of seasonal processing activity, down from 19 percent the previous month. This drop reflects an environment where processors are struggling to access suitable animals and manage costs in a sustainable way.

These shifts are occurring at the same time as export demand remains firm and price signals strengthen. The national Heavy Steer Indicator has risen by 10 cents per kilogram live weight over the past four weeks to sit at 434 cents. This rally reflects renewed demand from processors targeting steers with sufficient weight and dressing percentage to meet export contract specifications. However, the number of suitable animals remains tight.

The Processor Cow Indicator has also strengthened, now at 375 cents per kilogram, up 3 cents over the past four weeks. Despite a week-on-week decline in volumes of more than four thousand head, prices are climbing in response to limited availability of heavy cows and strong interest from both domestic and export customers. Notably, processors are becoming more selective, with lighter cows in the south being discounted or redirected, while those in better condition, particularly from northern regions, are attracting strong bids.

Recent procurement behaviour underscores these dynamics. Southern processors are increasingly reliant on cattle from further north, with some plants actively sourcing animals from remote parts of Queensland and even the Northern Territory. These cattle are often trucked hundreds of kilometres to abattoirs in southern New South Wales and Victoria, adding considerable freight costs but deemed necessary to maintain throughput for contract programs. In parallel, northern processors are lifting direct consignment prices, particularly for grain fed stock, with some grids lifting by 30 cents in the past fortnight. Forward contracts for December delivery of 100-day grain fed steers are being quoted over 400 cents per kilogram live weight, reflecting rising competition for heavier cattle.

At the saleyard level, the trend is consistent. Demand for heavier cows has intensified, with some yards reporting hot bidding on well-finished lines. Heavy steers remain less common, but when available in good condition, are commanding strong money. The clear trend is a bifurcation between stock that meets grid specifications and the increasing volume of lighter, unfinished cattle that fall short. The latter are attracting less interest, contributing to the selective kill plans many processors are now adopting.

Across the board, processor strategies are becoming more risk-averse and margin-protective. In the southern states, where local supply of heavy cattle is thin and transport costs are high, processors are reducing shifts, cancelling weekend rosters and shifting procurement zones to chase the right animal. The focus has shifted from chasing volume to managing cost and grid compliance. Meanwhile, northern plants are better positioned to maintain higher throughput, with stronger access to finished cattle and a more favourable freight profile.