Its spring, where are the lambs?

Market Morsel

As spring begins to unfold across Australia, the sheep and lamb market remains tightly supplied, though signs of modest recovery in yardings have emerged in some states. Yet despite some upward shifts in throughput, particularly in Western Australia, price indicators continue to reflect the pressure of restricted finished stock availability and resilient processor and restocker demand. The latest saleyard yarding index scores and Meat & Livestock Australia (MLA) price indicators provide a clear picture of a sector still navigating constrained supply, high competition for lambs, and robust export-driven fundamentals.

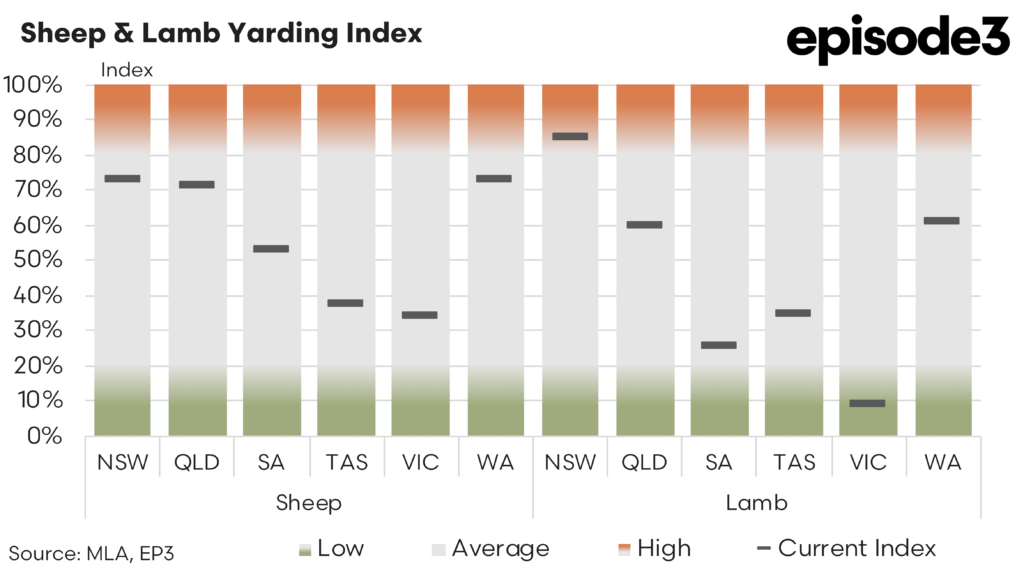

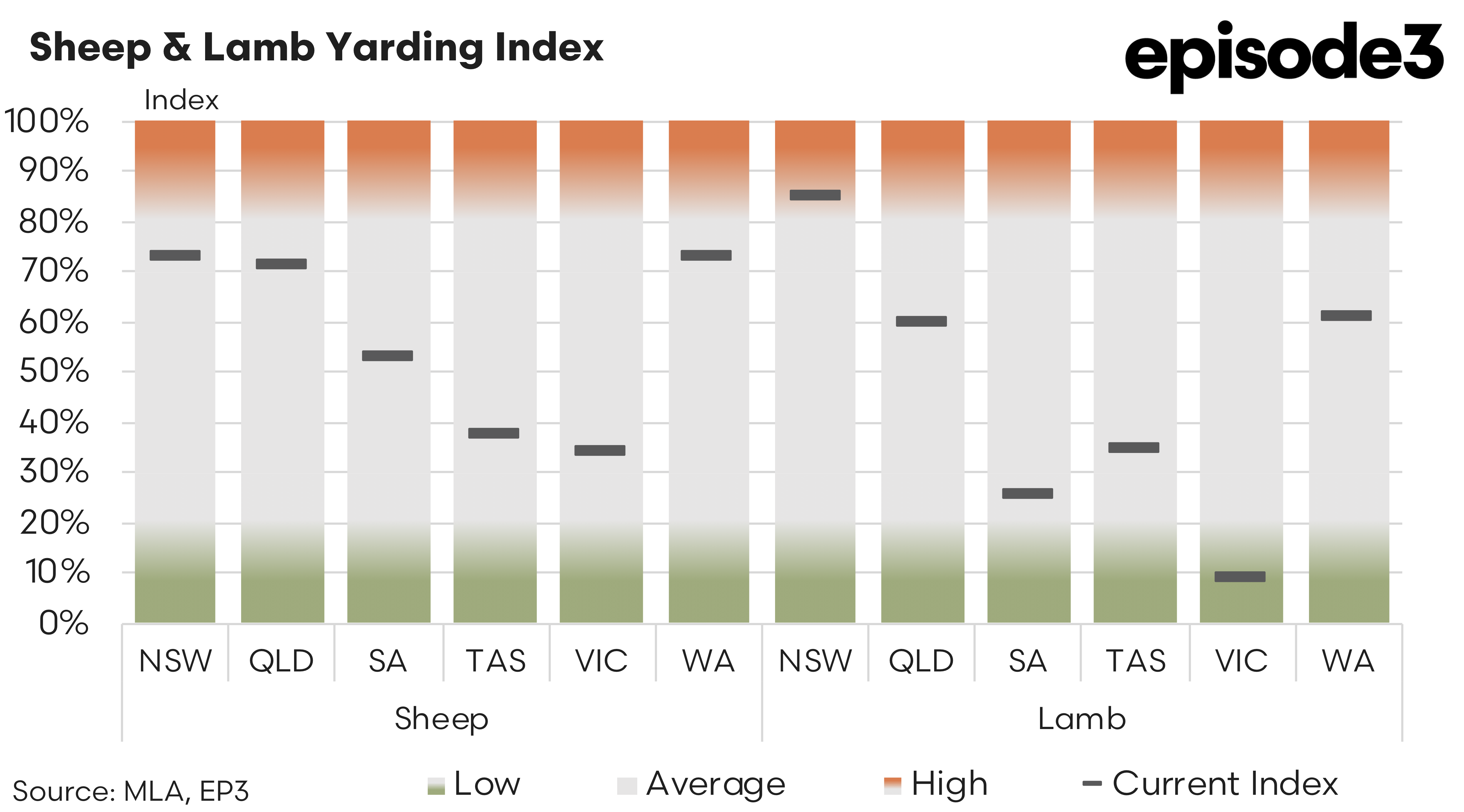

In the sheep market, index scores from August to September show mixed movements across the country. New South Wales slipped slightly from 75 percent in August to 73 percent in September, remaining well above average for this time of year and still reflective of strong saleyard activity. Queensland also maintained a relatively high level, dipping from 72 percent to 71 percent. South Australia rebounded sharply, lifting from 29 percent to 53 percent, a notable jump suggesting tentative beginnings of stronger sheep turnoff. Tasmania and Victoria both eased, with Tasmanian yardings falling from 58 percent to 37 percent and Victoria slipping from 40 percent to 34 percent. Western Australia, in contrast, improved from 61 percent to 73 percent, indicating renewed turnoff activity due to the ongoing structural uncertainty in the WA sheep sector from the live export phase-out.

Lamb yardings painted a slightly different picture. NSW increased from 82 percent in August to 85 percent in September, suggesting improved spring saleyard offerings. Queensland posted a solid recovery from 51 percent to 60 percent, while South Australia saw a sharp drop from 35 percent to 26 percent. Both Tasmania and Victoria experienced marginal reductions, with Tasmanian yardings down from 46 percent to 34 percent and Victoria declining slightly from 11 percent to 9 percent, indicating extremely tight supply persists in the south. WA, meanwhile, experienced a significant contraction in lamb yardings, down from 91 percent in August to 61 percent in September. This shift may reflect the seasonal transition from old season to new season lambs, with supplies of the latter not yet in full swing.

These supply constraints continue to support healthy national price indicators. The Trade Lamb Indicator is currently at 1,170 cents per kilogram carcase weight, down 13 cents over the past four weeks. Despite the small decline, prices remain firm by historical standards. Heavy Lambs are averaging 1,125 cents, having eased by 33 cents across the month. Tight supply of finished lambs continues to underpin this category.

The Light Lamb Indicator sits at 1,071 cents, up 33 cents over the past four weeks, reflecting continued processor and restocker competition for lighter stock as the seasonal outlook improves. Merino Lambs are priced at 1,044 cents, down 5 cents for the month. While largely stable, limited availability has kept prices supported. Restocker Lambs are trading at 1,154 cents, rising 74 cents over the past four weeks. This category remains the strongest performer in terms of price movement this past month, somewhat unsurprising given the robust 3-month rainfall outlook from the BOM. The Mutton Indicator is at 809 cents, up 95 cents over four weeks. Mutton continues to provide a critical buffer in processor workflows as lamb supply remains constrained.

Although some categories are showing signs of modest price softening after a winter peak, the overall trend remains one of tight supply and elevated pricing. Processor procurement remains competitive, particularly for lambs suited to export specifications, and restocker activity is adding further pressure to limited yardings. The latest data shows a general trend of easing numbers through the saleyards on a national basis, particularly in Victoria, where lamb supply appears especially constrained. Meanwhile, New South Wales remain relatively strong in terms of volumes, but pricing suggests that even in these states, supply is still failing to meet demand.

As spring progresses, supply will likely lift in some regions, particularly as new season lambs become available. However, the low base from which many categories are starting, coupled with strong demand fundamentals, suggests that any easing in pricing is likely to be modest. Processors continue to express concern about their ability to secure adequate throughput into October and beyond, particularly as seasonal constraints and flock rebuilding programs continue to shape producer decisions.