Market Morsel: Trump-Xi have a deal

Market Morsel

After months of uncertainty about trade between the United States and China, the two superpowers have come to the negotiating table, and reached an agreement.

There were a lot of discussions about rare earth minerals and access for US companies, but the one we really care about at EP3 is agricultural commodities, and it is mainly soybeans.

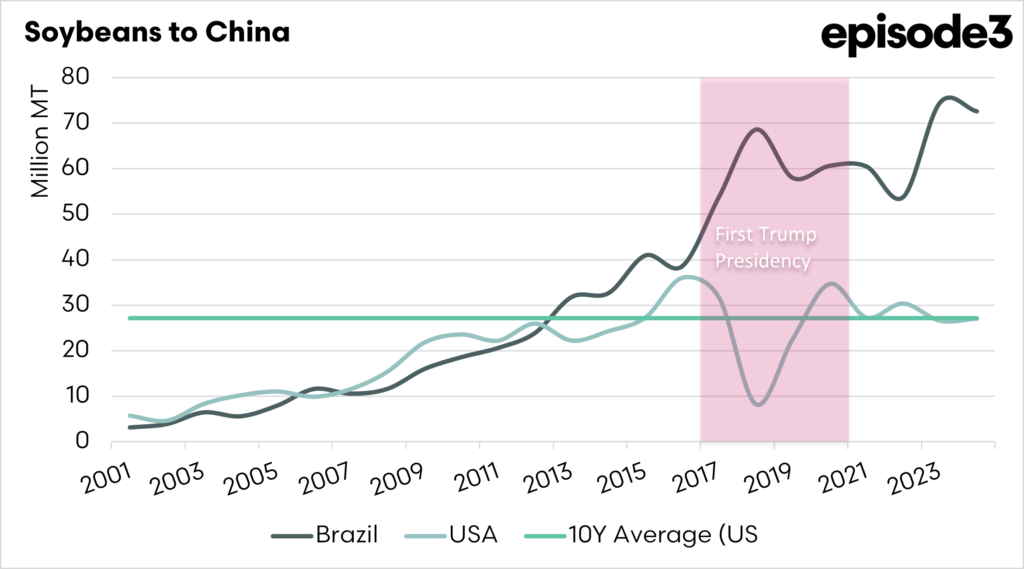

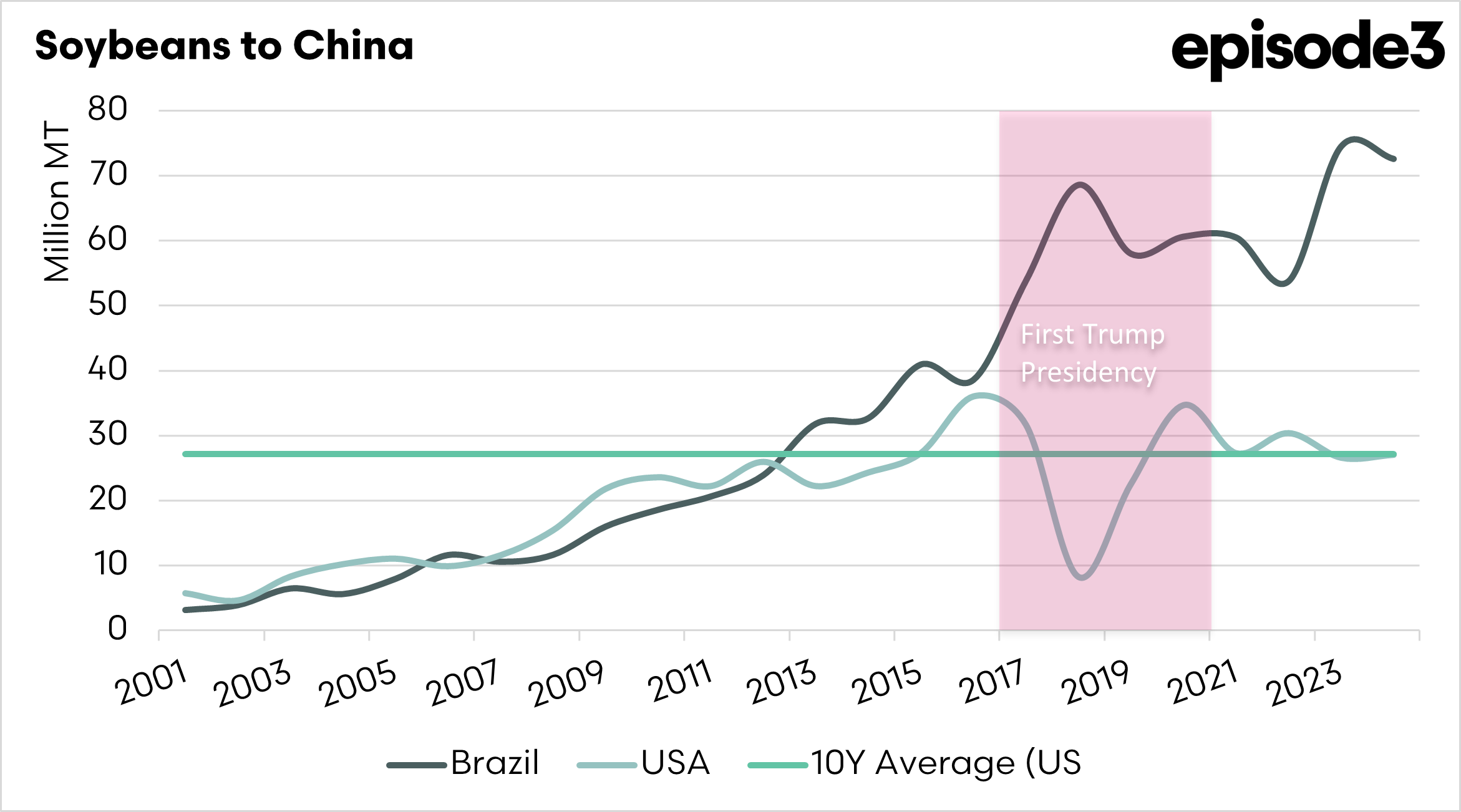

China have been quickly reducing their reliance on US soybeans, and focusing more heavily on supplies from Brazil. They were hit hard by the previous Trump administration, and wanted a more secure, diversified supply chain.

China stopped buying US soybeans, which was a massive concern for farmers, who had overwhelmingly voted for republicans, and the lack of the Chinese market was having a substantive impact on their bottom line.

Trump and Xi met in South Korea yesterday, and initially, the details were scant. The only detail was that it was a great deal, and China would buy soybeans. The market reacted to the lack of detail, and oilseed markets fell.

Then some more details emerged. China would now buy 25mmt of soybeans per year for the next three years.

This sounds like great news, but as you can see from the first chart below, this is actually lower than the average that the US has sold to China for the past ten years.

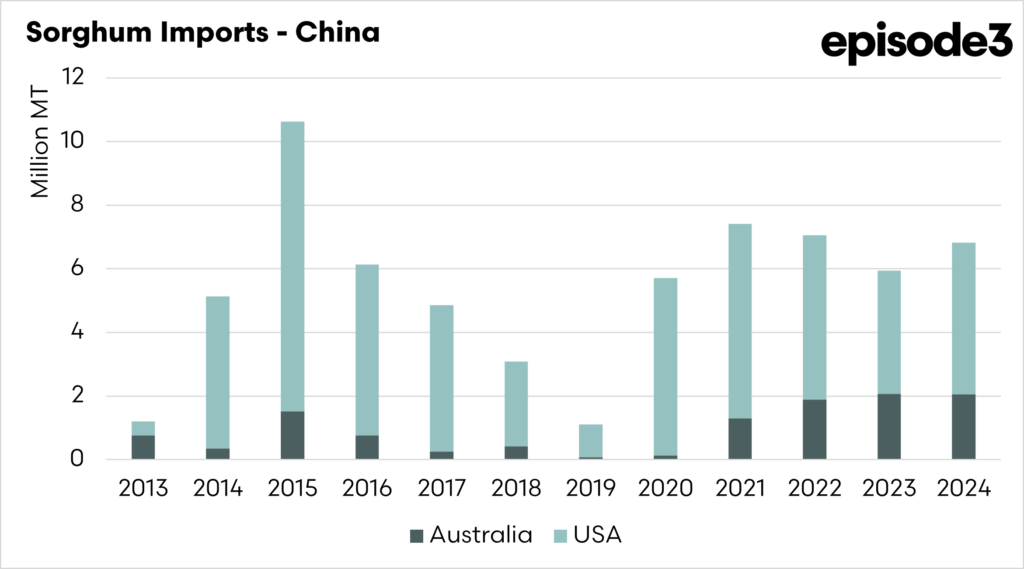

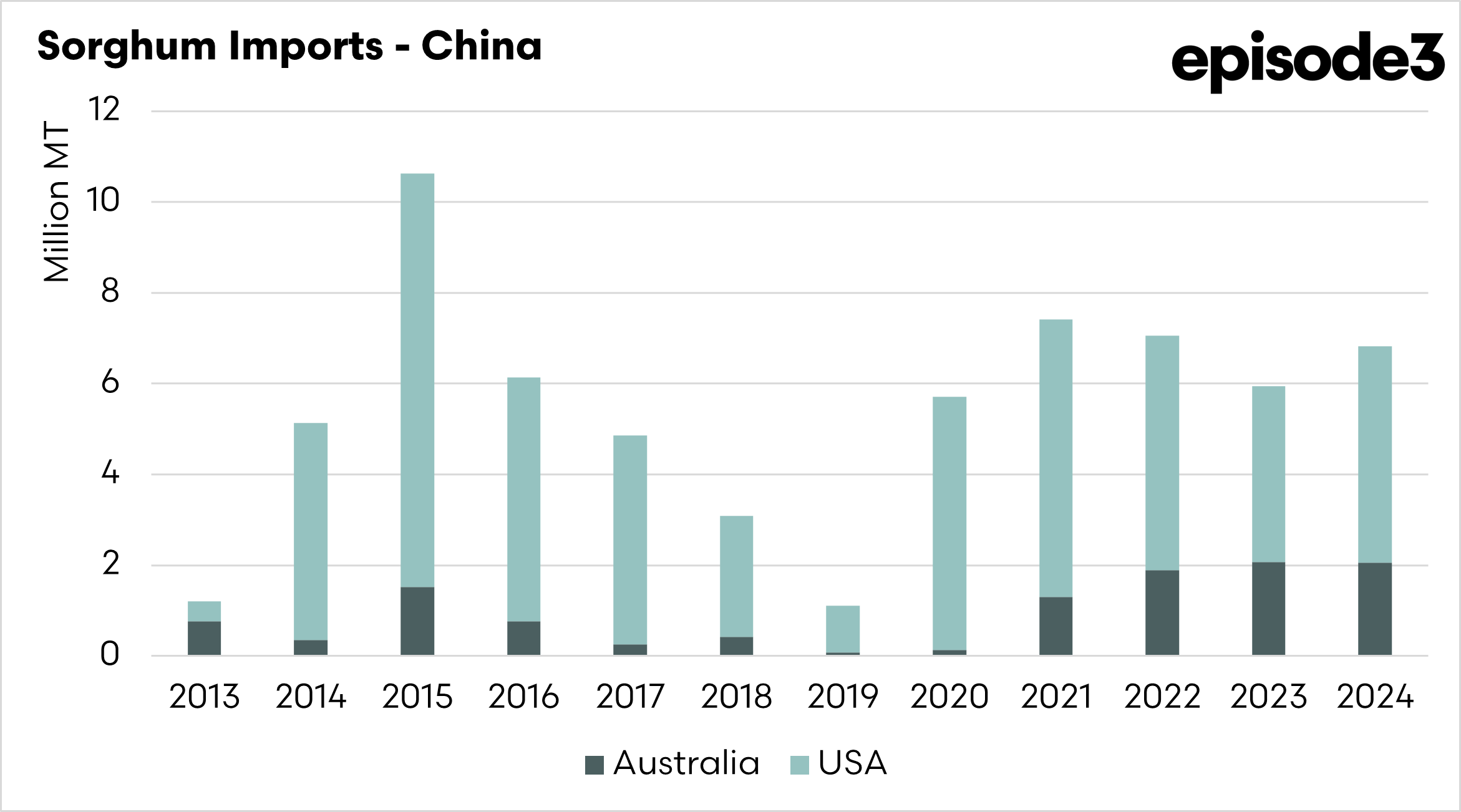

They have also promised to buy sorghum from the US, but no details on volumes. China purchases most of the sorghum which Australia exports, and it is a concern if China focuses closely on the US to keep Trump happy, at the expense of Australia.

This deal doesn’t seem to have a huge impact on Australian ag, which is good news. At EP3, we were worried about a phase one type deal from the previous Trump Administration, which compelled China to buy significant quantities of all ag commodities, and in our view, led to some of our own trade woes with China in relation to beef, barley and wine.

There will be meetings with Mark Carney and Xi this afternoon which could have an impact on Canola pricing.