Cattle Flow Shifts South as Northern Slaughter Eases

Market Morsel

Australia’s beef processing sector has entered the final quarter of 2025 in a position that reflects both the seasonal tightening of northern supply and a modest but uneven recovery in the southern regions.

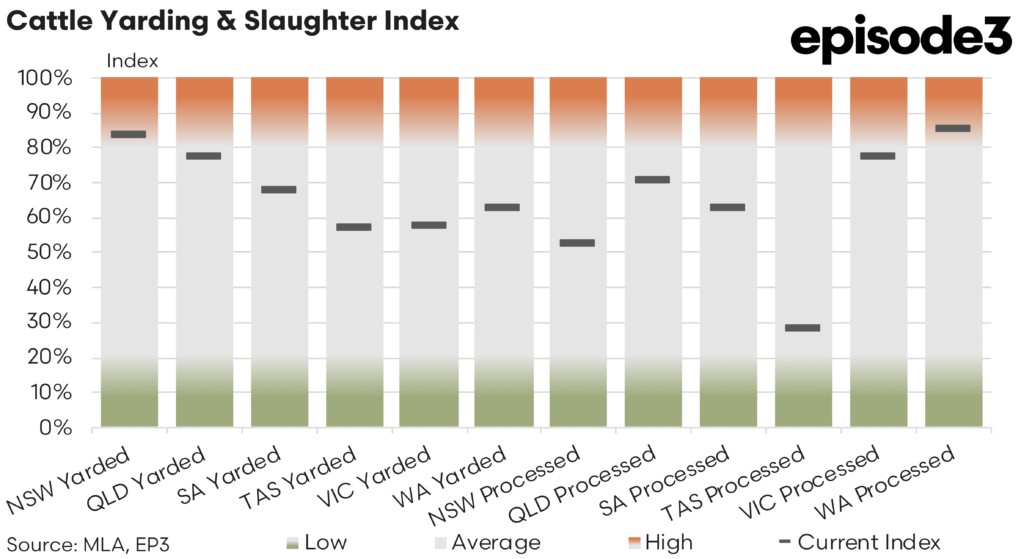

The latest data on yarding and slaughter volumes between September and October confirms that the spring uplift in cattle movement has not been consistent across the country. While some processors remain close to capacity, others are operating well below their typical throughput, and the pattern of supply tightening remains distinctly regional rather than national in nature.

Queensland’s processing index fell sharply from 91 to 71 per cent over the month, signalling that the peak of northern cattle turn-off has already passed. During late winter and early spring, high slaughter rates were sustained as producers moved cattle early in response to hot and dry conditions. By October, however, those forward sales had largely cleared, leaving processors with fewer cattle to draw upon despite underlying demand remaining strong. The impact has been visible in scheduling, with several plants now booked weeks in advance and throughput expected to ease into November. Western Australia, which had also been operating at close to full capacity, recorded a decline in its slaughter index from 94 to 85 per cent, reflecting a similar pattern of earlier heavy kills giving way to moderation as available stock levels normalise.

The story in the south is somewhat different. Victoria lifted its processor activity slightly, from 73 to 77 per cent, supported by better weather conditions and a gradual increase in local supply. South Australia remained steady at around 63 per cent, maintaining a balanced but not excessive level of operations. Tasmania, which had been operating at a very low base of just 13 per cent in September, showed one of the strongest recoveries, rising to 28 per cent by October. That rebound, while from a small base, points to improving cattle condition and the gradual return of market-ready animals after a subdued winter. In New South Wales, the slaughter index was unchanged at 52 per cent, confirming that the state continues to lag behind others in terms of available stock and processing consistency.

The yarding data further supports this picture of uneven supply movement. Queensland’s yardings dropped sharply from 93 to 77 per cent, in line with the easing processor activity. The earlier rush to market appears to have pulled supply forward, leaving fewer cattle now being presented for sale. Western Australia and South Australia moved in the opposite direction, both recording large increases in yardings, up from 45 to 62 per cent in WA and from 51 to 68 per cent in SA. The lift in southern yardings suggests that more cattle are entering the system as producers respond to drying paddock conditions and seasonal marketing windows. Victoria and New South Wales saw more modest gains, with NSW yardings up from 79 to 84 per cent and Victoria from 55 to 58 per cent, while Tasmania remained relatively flat at 57 per cent.

These shifts have translated into a mixed pricing environment for processors. The national heavy steer indicator has held relatively firm, currently sitting around 435 cents per kilogram live weight, virtually unchanged from four weeks ago. Prices have stabilised after earlier gains, reflecting both the continued strong demand for well-finished export cattle and the patchiness of supply across states. In regions such as Victoria and South Australia, where processing activity has improved, the availability of finished cattle has helped maintain competitive pricing without triggering sharp rises. In contrast, Queensland’s earlier high throughput has limited any additional upward price momentum in the north, where some processors have already fulfilled forward contracts and are less active in bidding for immediate deliveries.

The processor cow indicator tells a story of improving demand. The price has gained slightly over the past month, rising from around 373 to 383 cents per kilogram live weight, as increased female turn-off earlier in the spring created short-term supply surpluses. This aligns with the seasonal pattern observed in previous years, where female slaughter rises toward the end of the dry period before contracting again as conditions improve. The indicator remains well above levels recorded a year ago, supported by firm export demand, particularly from the USA.

The north appears to have moved past its slaughter peak and is entering a tightening phase, while the southern and western states are still experiencing incremental increases in yardings and kills. This divergence creates differing operational realities for processors. Northern plants are managing supply tightening and planning for reduced shifts, whereas southern facilities are cautiously increasing throughput as more cattle come forward. Tasmania’s lift from extremely low levels represents the most significant proportional improvement, though it still contributes only a small share to national throughput.

Processor margins remain sensitive to these movements. The relative stability of heavy steer prices and the mild easing in cow values suggest that competition for finished cattle remains active but not overheated.