The Fert Bullets

New Updates

Episode 3 has been reporting on Australian fertiliser markets for a long time, and in this update, we are changing the format slightly, to become our weekly updates. Our format will cover the main points impacting the fertilizer market, along with updates on local pricing and imports.

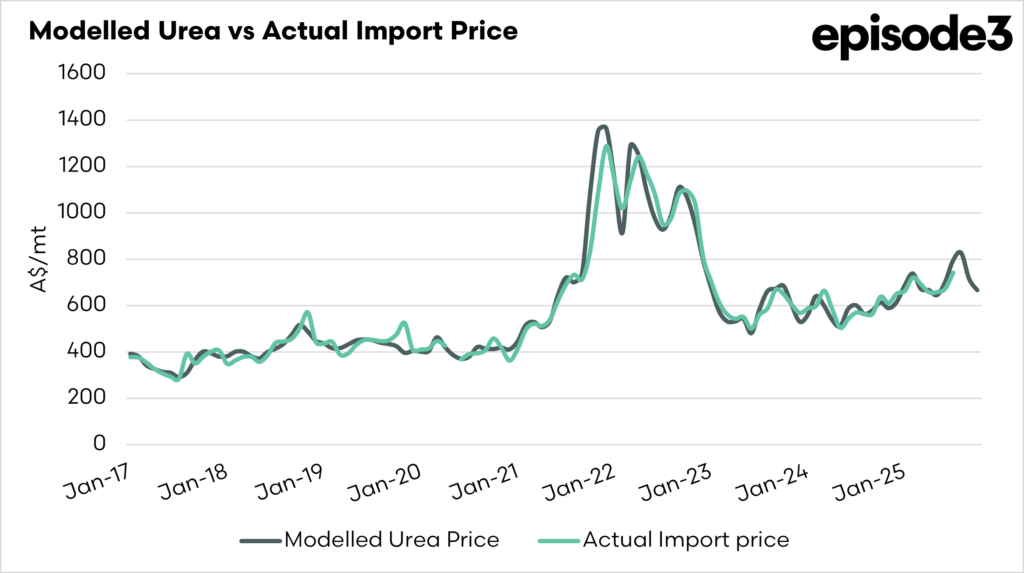

Our fair value model for pricing, which has recently been revised and improved after the you all filled in our fertilizer census, which you can continue to fill in here

Market Drivers

Tender

It is expected that India will be back in the market to purchase Urea. India has huge tenders on a regular basis and they can drive the market. The expectation of this tender coming has help lift values.

China

Uncertainty continues from China. It is expected that there will be no more quote in 2025, but domestic demand and price controls are keeping Chinese urea in the local market.

European

European buyers are moving fast to purchase urea ahead of the introduction of the EU’s Carbon Border Adjustment Mechanism which commences in the new year.

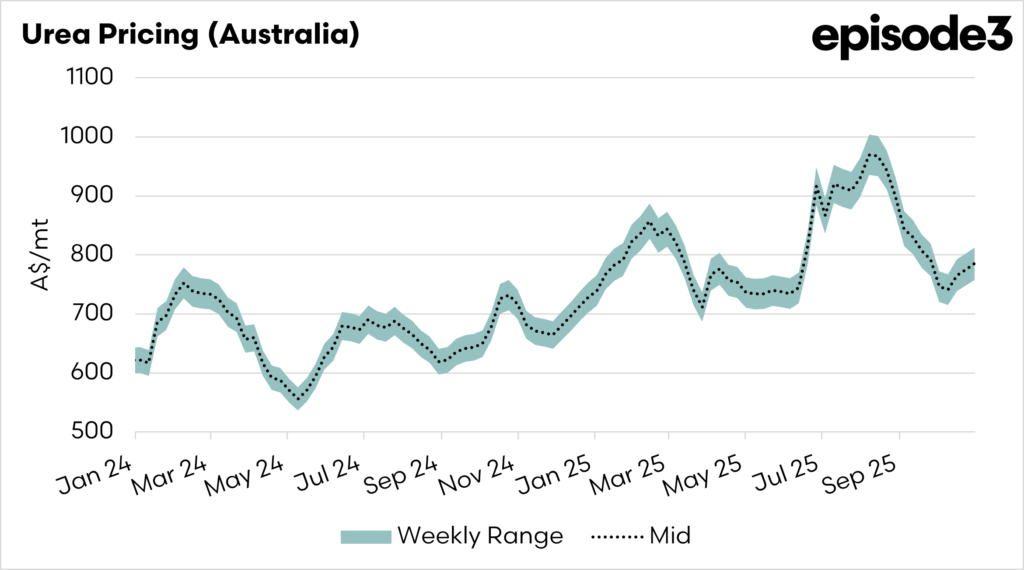

Australian Pricing

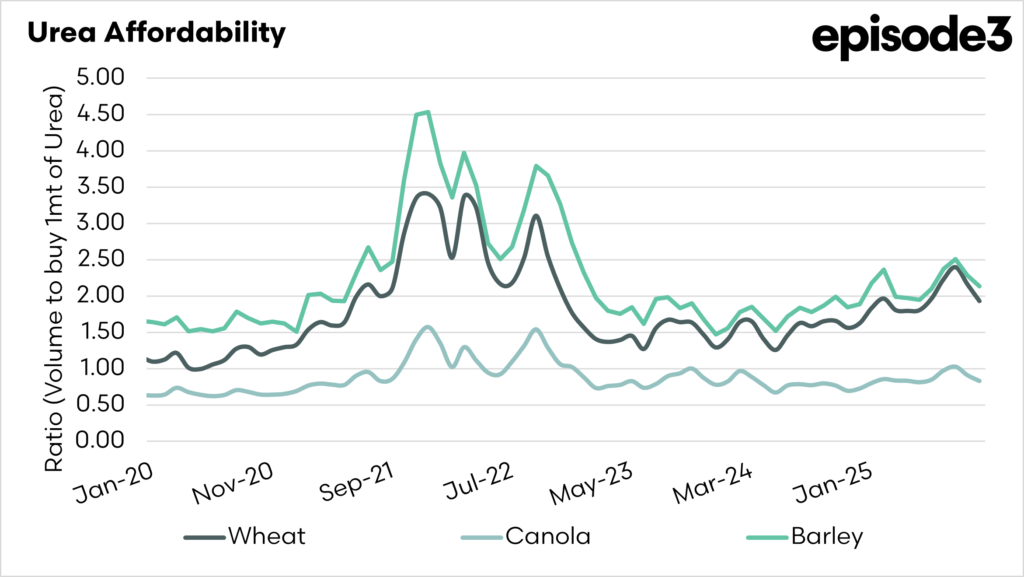

Demand in Australia is over for the season. Pricing in Australia has kicked up a little in line with the rest of the world, but significantly lower than it was in the middle of the year. Affordability for urea has improved in the past month as grain prices recovered.

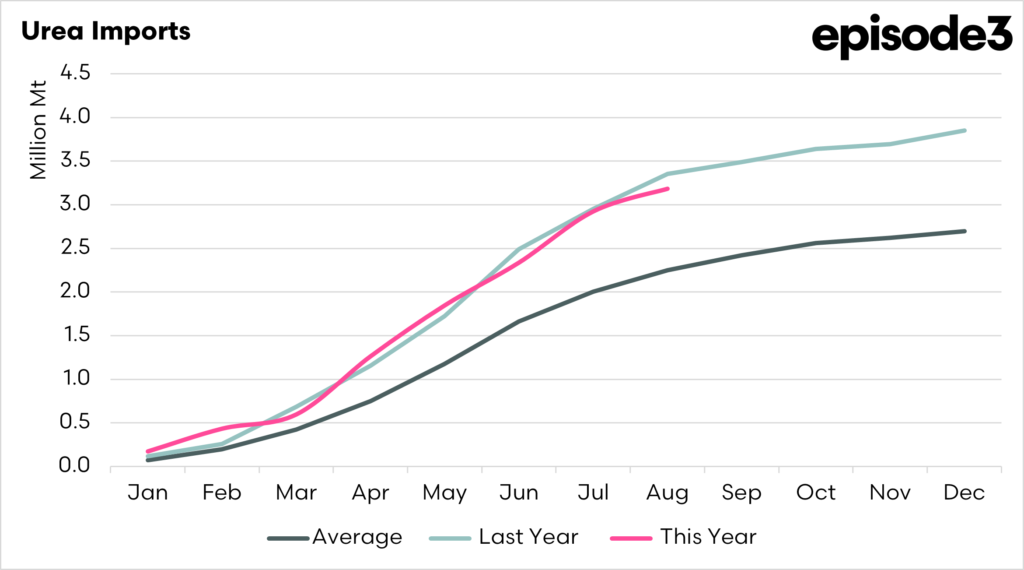

Australian Imports

By the end of August, Australia had imported 3.1mmt of urea, which is the second-highest level on record.