On the turn

Market Morsel

The latest quarterly data from the ABS confirm that both the national sheep flock and the cattle herd are shifting away from the deep liquidation pressures that characterised the past two years. While neither species has yet reached the rebuild thresholds that historically define the turning point in the cycle, the pattern through Q2 and Q3 suggests that the worst of the contraction is likely behind us.

The updated Sheep Turnoff Ratio (STR) and Female Slaughter Ratio (FSR), when viewed against the long-term charts, point to a herd and flock that are edging back towards stability and are increasingly positioned to enter a rebuild phase in early 2026, provided favourable seasonal conditions continue.

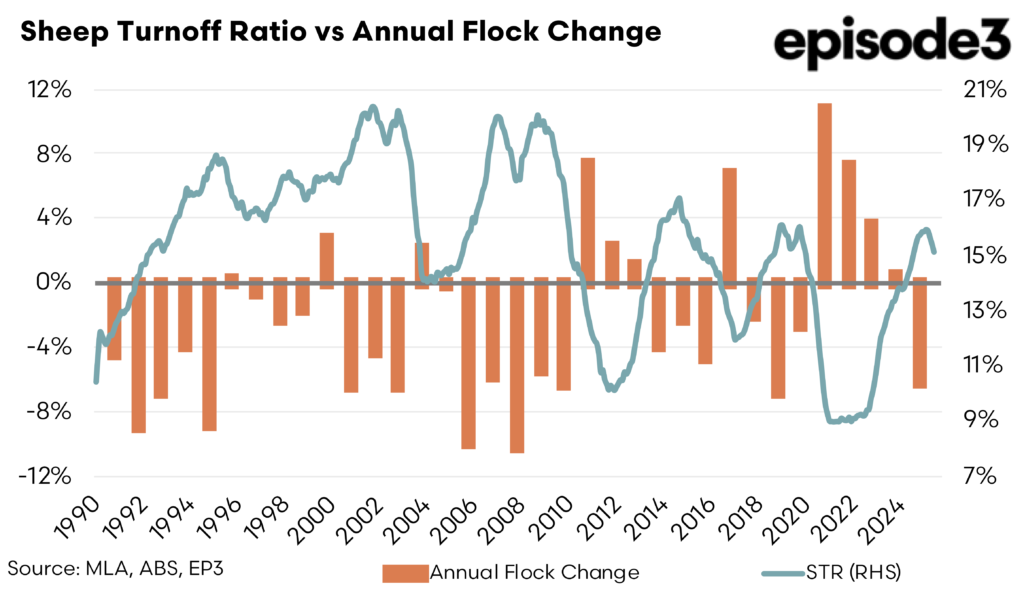

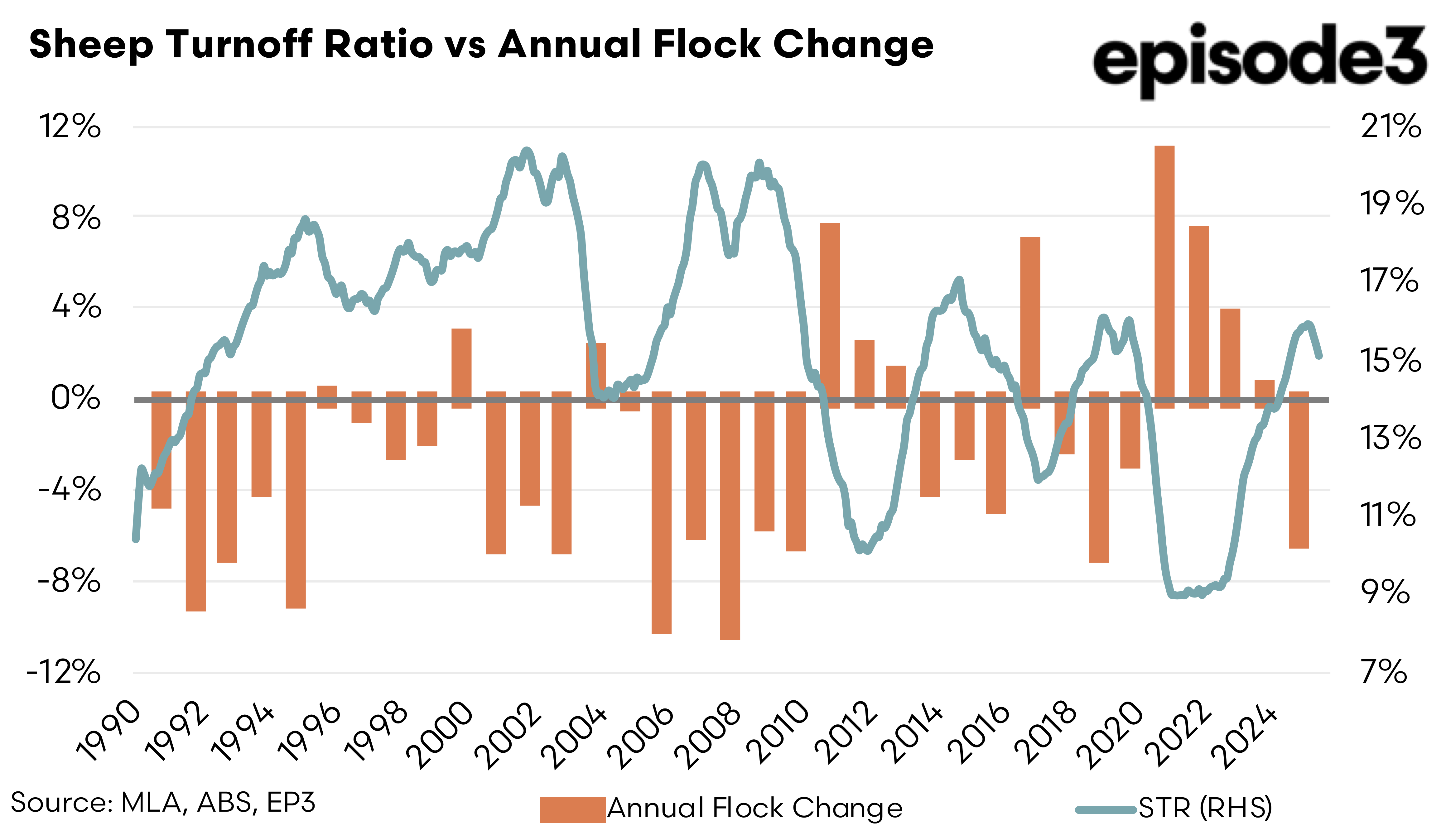

The sheep sector has endured a prolonged period of elevated turnoff, particularly through 2023 and into the first half of 2024, but the momentum is now softening. The STR reached 15.9 percent in Q2, a level firmly in liquidation territory and consistent with earlier expectations of a declining national flock. By Q3 the ratio softened to 15.1 percent. This is still above the 14 percent threshold that historically separates liquidation from expansion, as illustrated in the long-run STR chart, but the directional change is meaningful.

The trend line has begun to bend back towards the rebuild boundary for the first time since the strong destocking phase accelerated in 2022. The pattern on the chart, particularly the way STR typically peaks before a recovery, is now repeating. The timing of this shift coincides with improved rainfall in southern Australia, which has eased seasonal pressure and appears to be lifting producer sentiment. A solid autumn break would almost certainly cement this change and create the restocking confidence needed to push the STR back under 14 percent early in 2026.

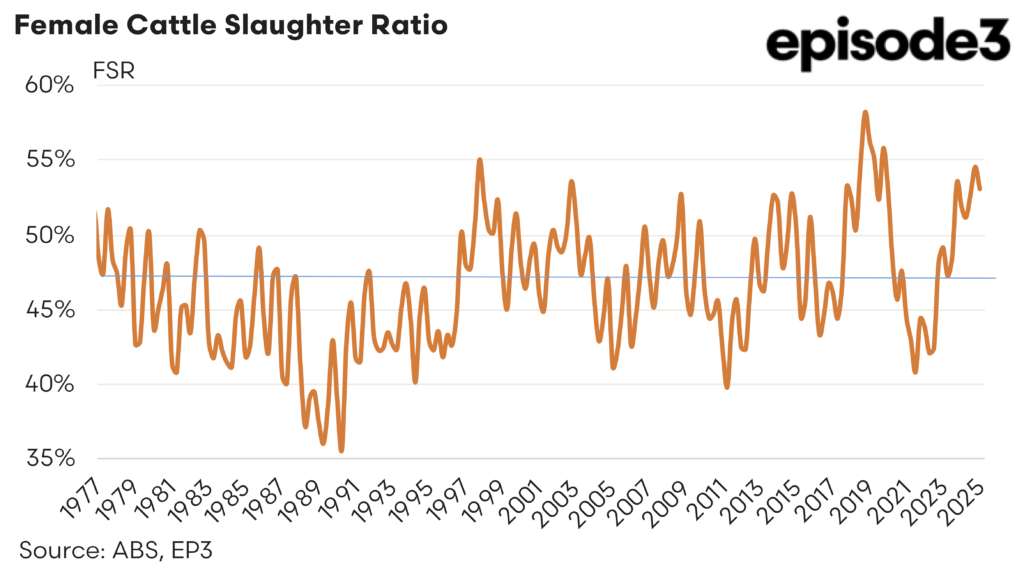

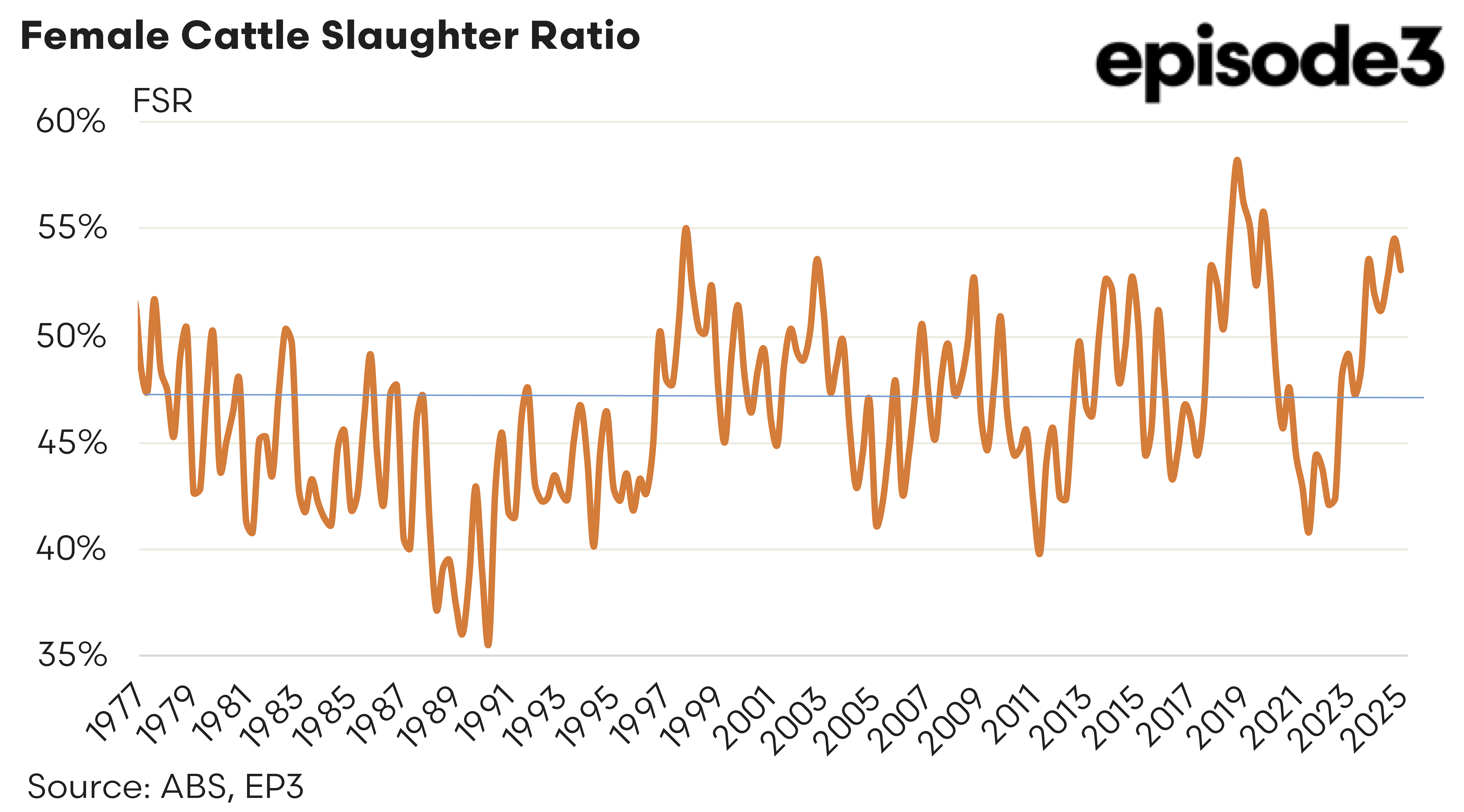

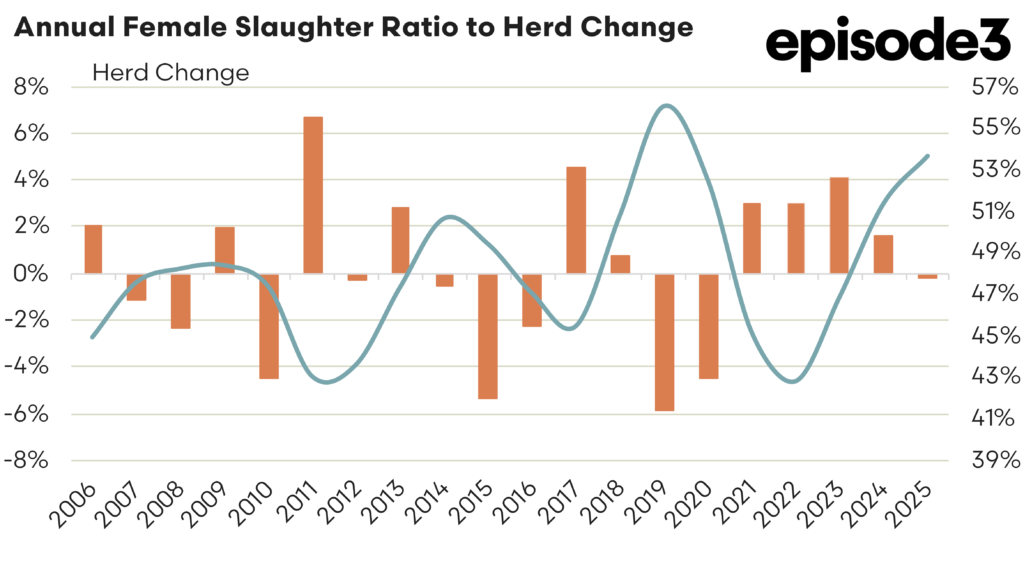

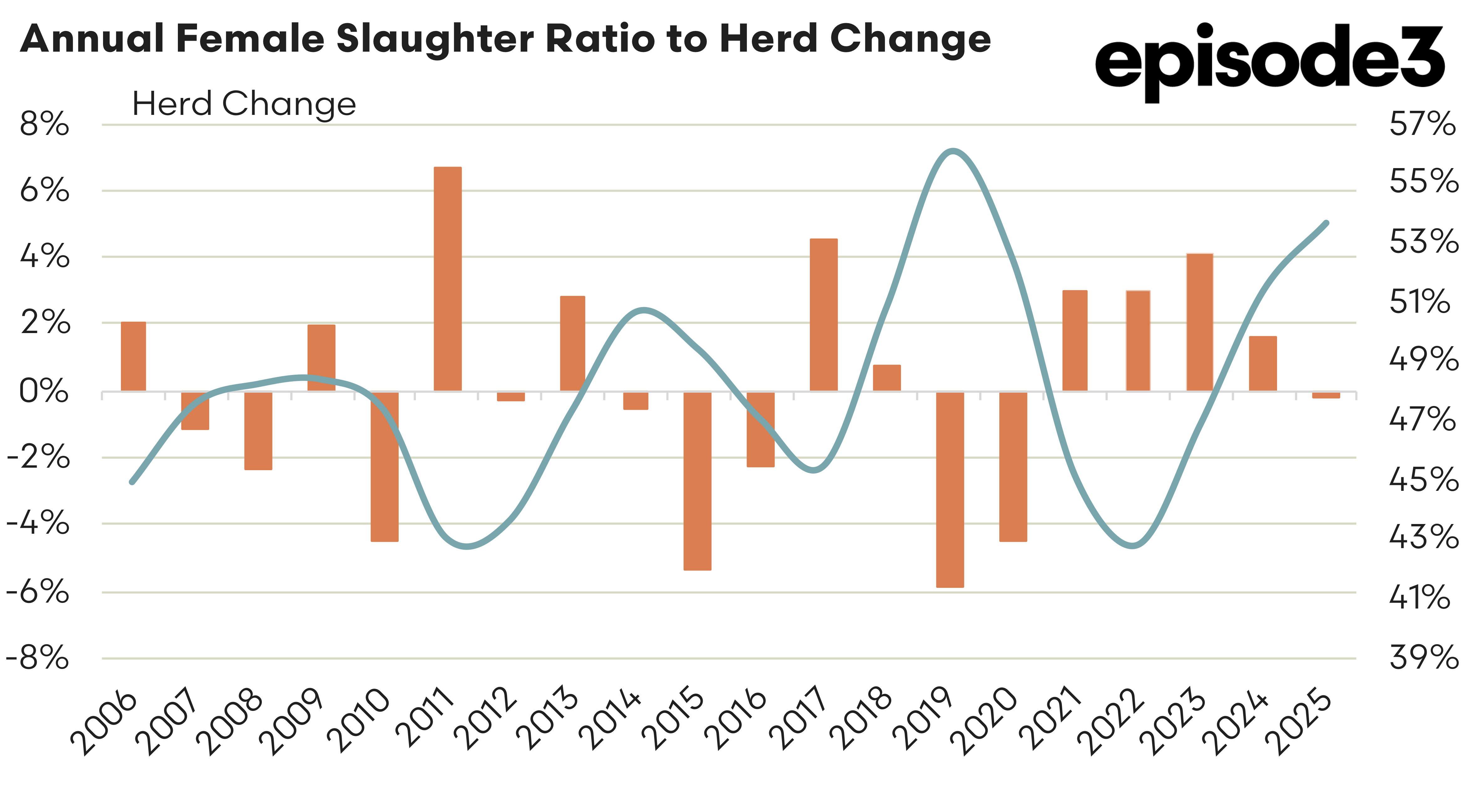

A similar story is emerging in the cattle sector. The Female Slaughter Ratio surged through 2023 and early 2024 as processors worked through abundant supply and producers, facing unfavourable seasons, continued to offload breeding stock. The Q2 FSR of 54.5 percent was emblematic of these liquidation settings. However, the Q3 result of 53 percent marks a clear easing.

The national herd remains above the rebuild threshold of 47 percent, which separates tightening herd conditions from genuine herd expansion, but the recent downward drift has taken the edge off the liquidation pressures visible earlier in the year. The long-term FSR charts show how seldom the ratio stays above 53 or 54 percent for extended periods.

Those peaks almost always give way to a multi-quarter normalisation, and the current pattern looks consistent with previous cycle turns. When this annual FSR series is compared with annual herd change, the correlation is clear. High FSR ensures contraction, but once the ratio rolls over from its peak, herd numbers stabilise and expansion follows. The Q3 reading falls into precisely that historical zone where liquidation loses momentum and the cycle approaches its turning point.

When the STR and FSR are assessed together, the combined message is that Australia’s livestock industries are close to transitioning from contraction to consolidation and, soon after, to rebuilding. Liquidity on the supply side has eased as producers in key regions regain confidence, and improved rainfall through spring has helped alleviate the seasonal drivers that sustained liquidation through 2023 and early 2024. If the seasonal outlook holds and the southern states see a timely autumn break, both the flock and the herd are positioned to enter a rebuild phase as early as the first half of 2026.

This timing aligns with the typical lag observed in past cycles, where the behavioural indicators in slaughter ratios turn before the physical indicators in flock and herd size respond. The charts reinforce this point, showing distinct inflection points in both STR and FSR that usually precede actual livestock population growth by several quarters.

In essence, the updated Q2 and Q3 data provide the first statistically meaningful sign that the liquidation phase in sheep and cattle is either at or past its peak. The STR and FSR remain above their rebuild thresholds, so it would be premature to declare a full transition underway, but the direction of travel is clear. With the ratios moving steadily back towards historical rebuilding zones and the rainfall outlook improving, the national flock and herd both appear poised for recovery. Should seasonal conditions align and producer sentiment lift further, 2026 may well mark the beginning of a new rebuilding cycle across both species, reversing the contraction pressures that have dominated the past two years.