Minimal harvest pressure on pricing

Harvest is in full swing around the country, and whilst there are some poor areas, the consensus is that the crop will be significant.

Let’s take a look at what is happening with prices.

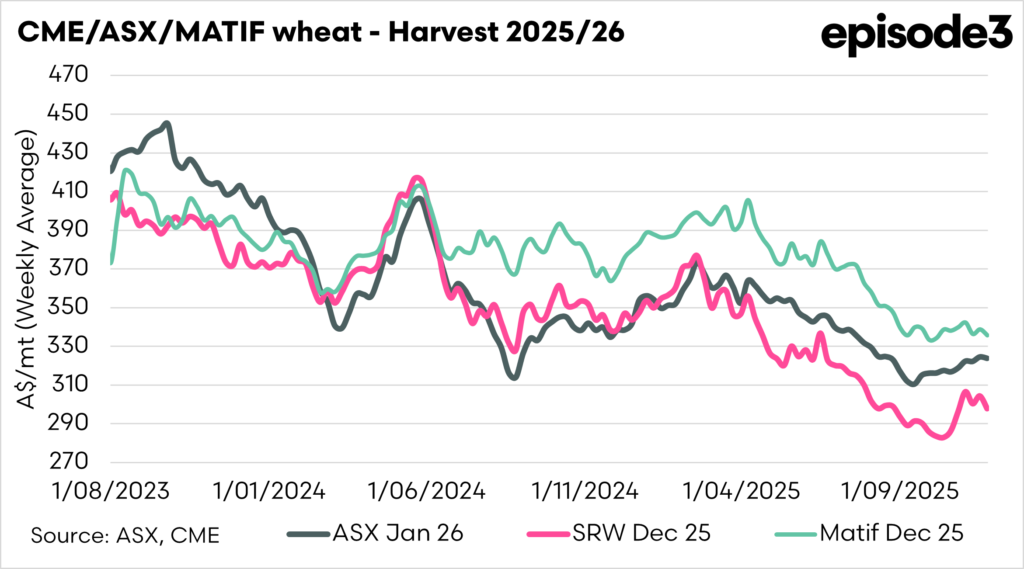

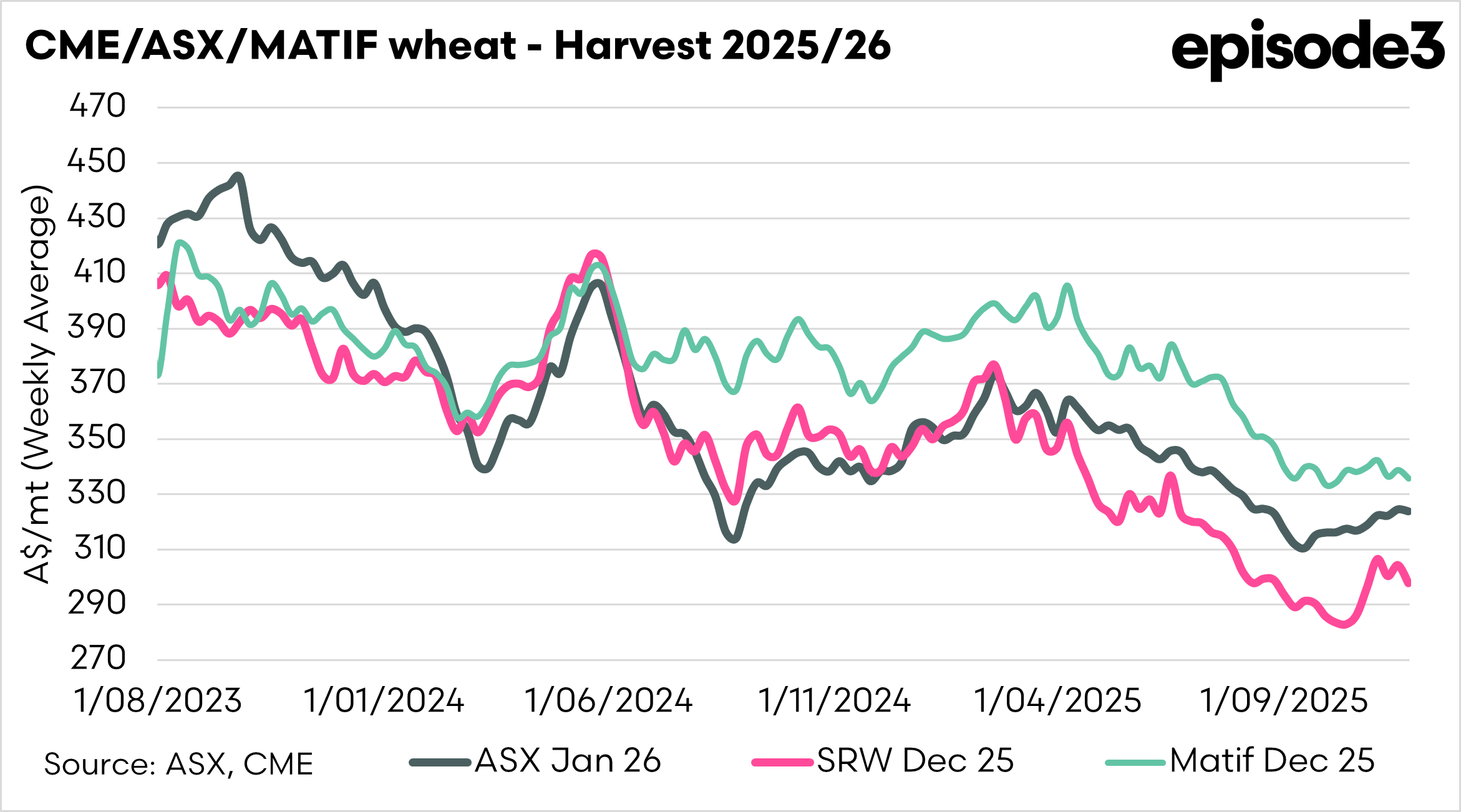

Let’s start with the futures chart below. This chart includes the ASX wheat contract, which gives a reasonable view of the east coast wheat crop, along with Matif and CBOT wheat pricing.

The majority of our pricing movement, especially in a year of above-average production, will be determined by events overseas; hence, it’s important to look at overseas markets.

The futures market across all three markets has been in a downward trajectory since April, but in recent weeks we have seen a price uplift.

Interestingly, Australian values have risen quite strongly, despite the fact that we have a major crop being harvested.

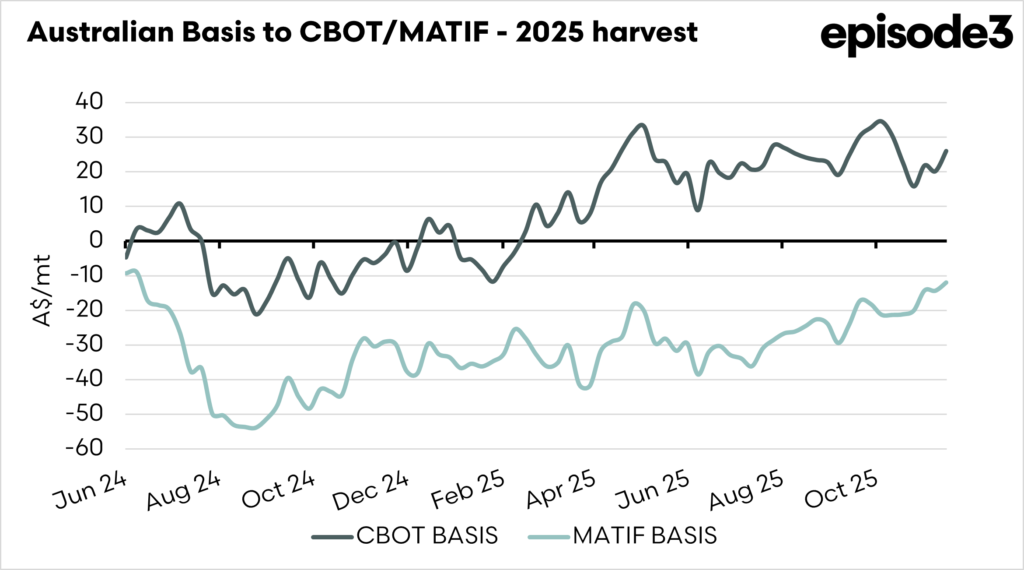

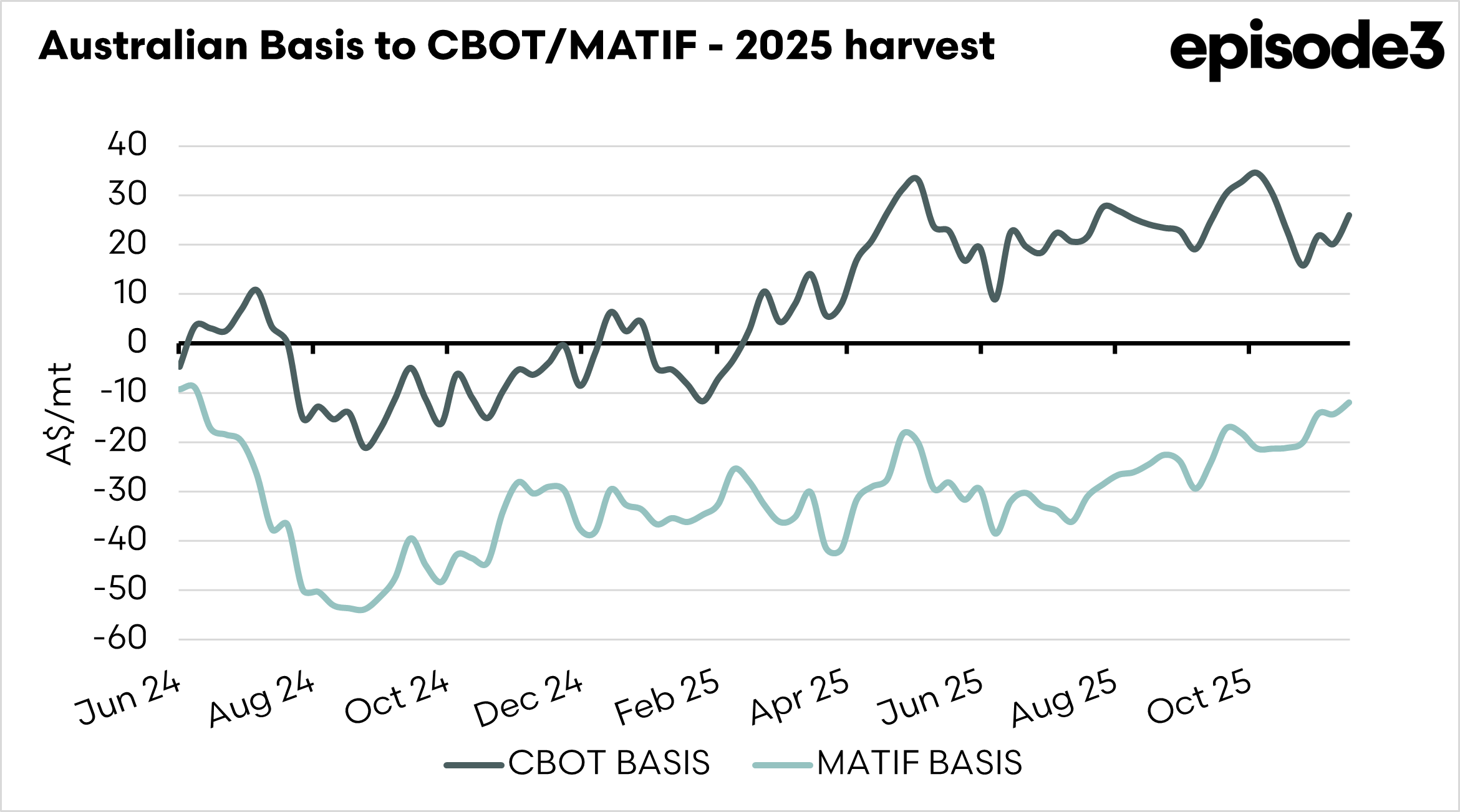

This is evident in our basis levels. Basis is simply the difference between the Australian physical wheat price and the equivalent CBOT wheat futures price. It shows how local market conditions in Australia compare with global benchmark values. A strong basis means local prices are higher than CBOT because demand is firm or supply is tight. A weak basis means local prices are lower than CBOT because supply is plentiful or export demand is softer. It is the link between global futures prices and what Australian growers and traders actually receive.

The uplift in local values has been more substantial than the overseas move, which has increased our basis. Therefore, we are getting a stronger ‘premium’ (for CBOT) than we had before.

The conventional view of markets is that basis would decline in a year with a huge crop, due to supply coming onto the market. This year, however, many farmers are unsold and holding off on selling grain, which to an extent can force the market higher.

The question remains on what happens when the bills come through, and sales need to be made, and whether the basis will come under pressure as more volume hits the market.

Time will tell!