Grain Exports – Who bought our grain in 2025

Wheat

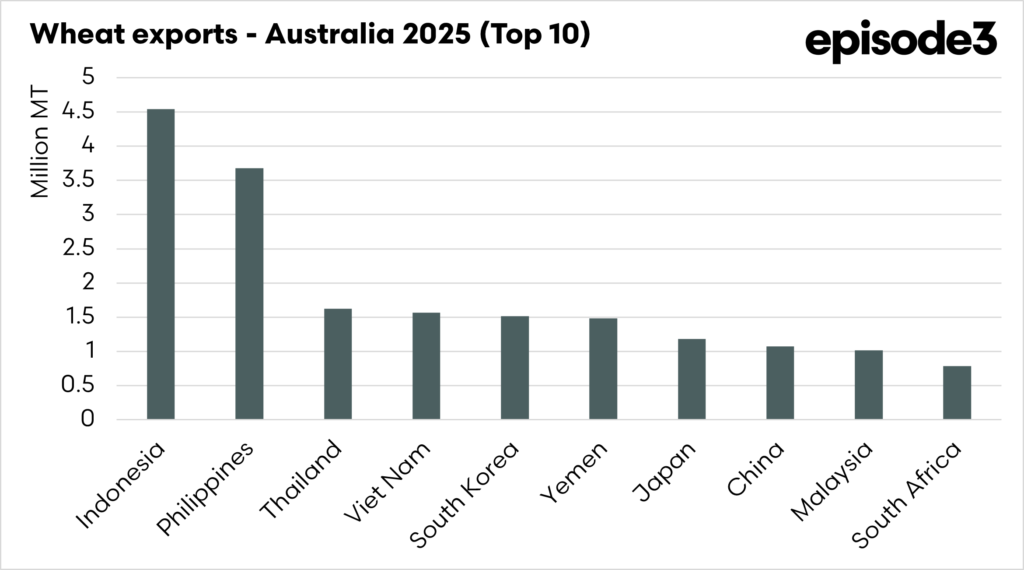

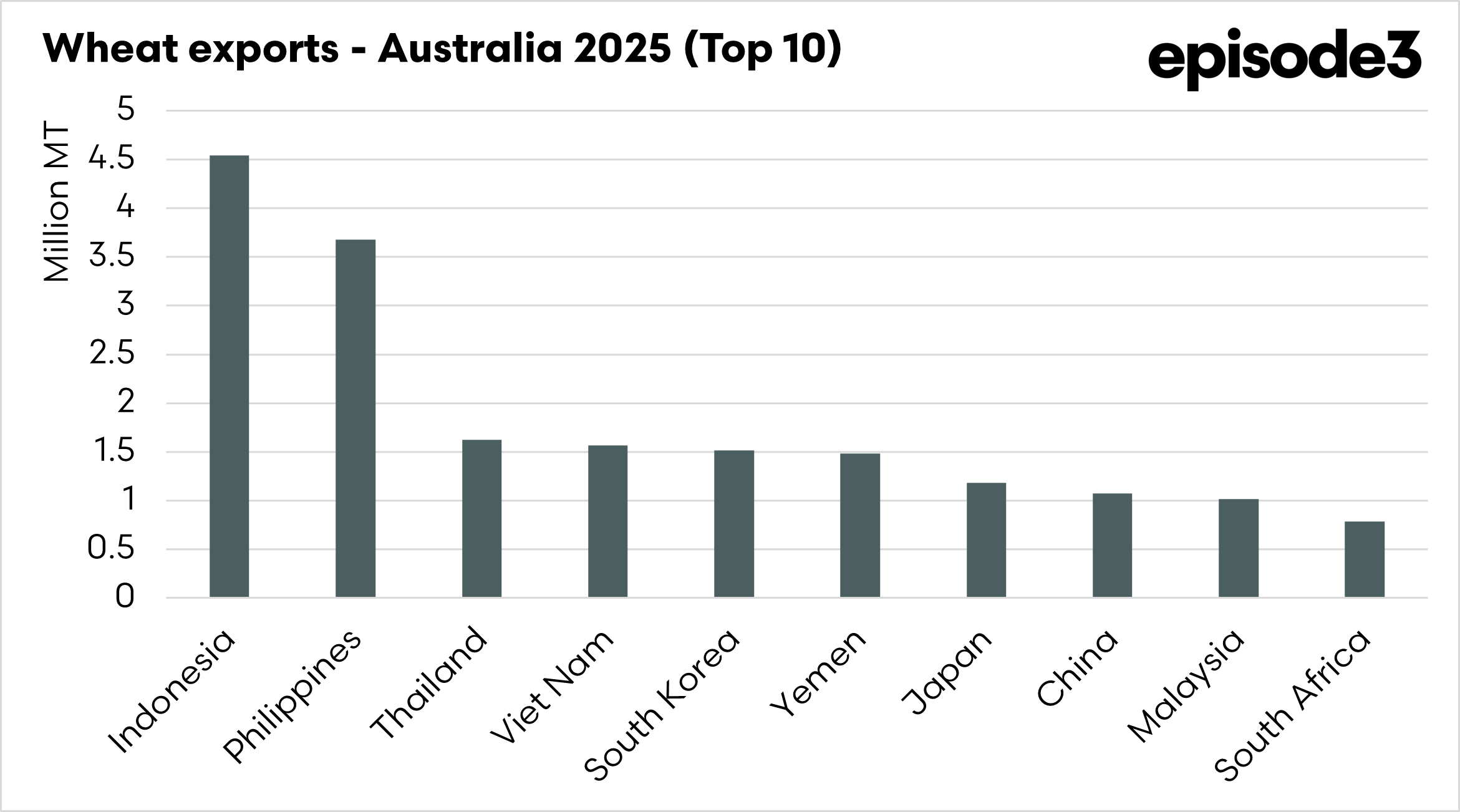

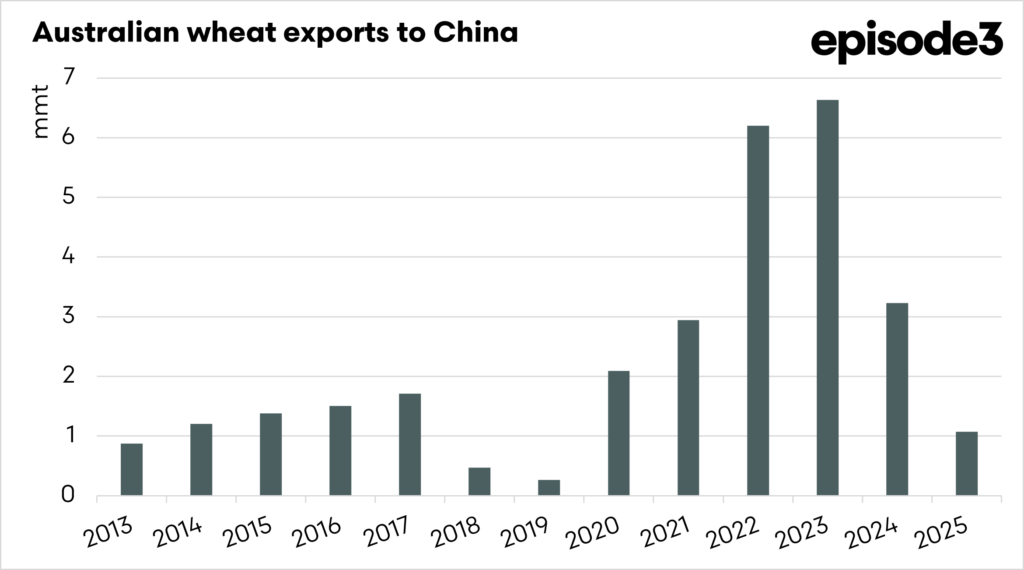

Australia’s wheat exports were strong in 2025, but point to some changes in trade flows. Total shipments of just over 24 million tonnes point to a strong overall export year, reinforcing Australia’s position as a major global supplier. Demand remains heavily concentrated in Asia, with Indonesia the dominant destination, followed by the Philippines, Vietnam, Thailand, Malaysia, Japan and South Korea. These markets continue to form the backbone of Australian wheat exports, reflecting proximity, freight competitiveness and consistent end-use demand.

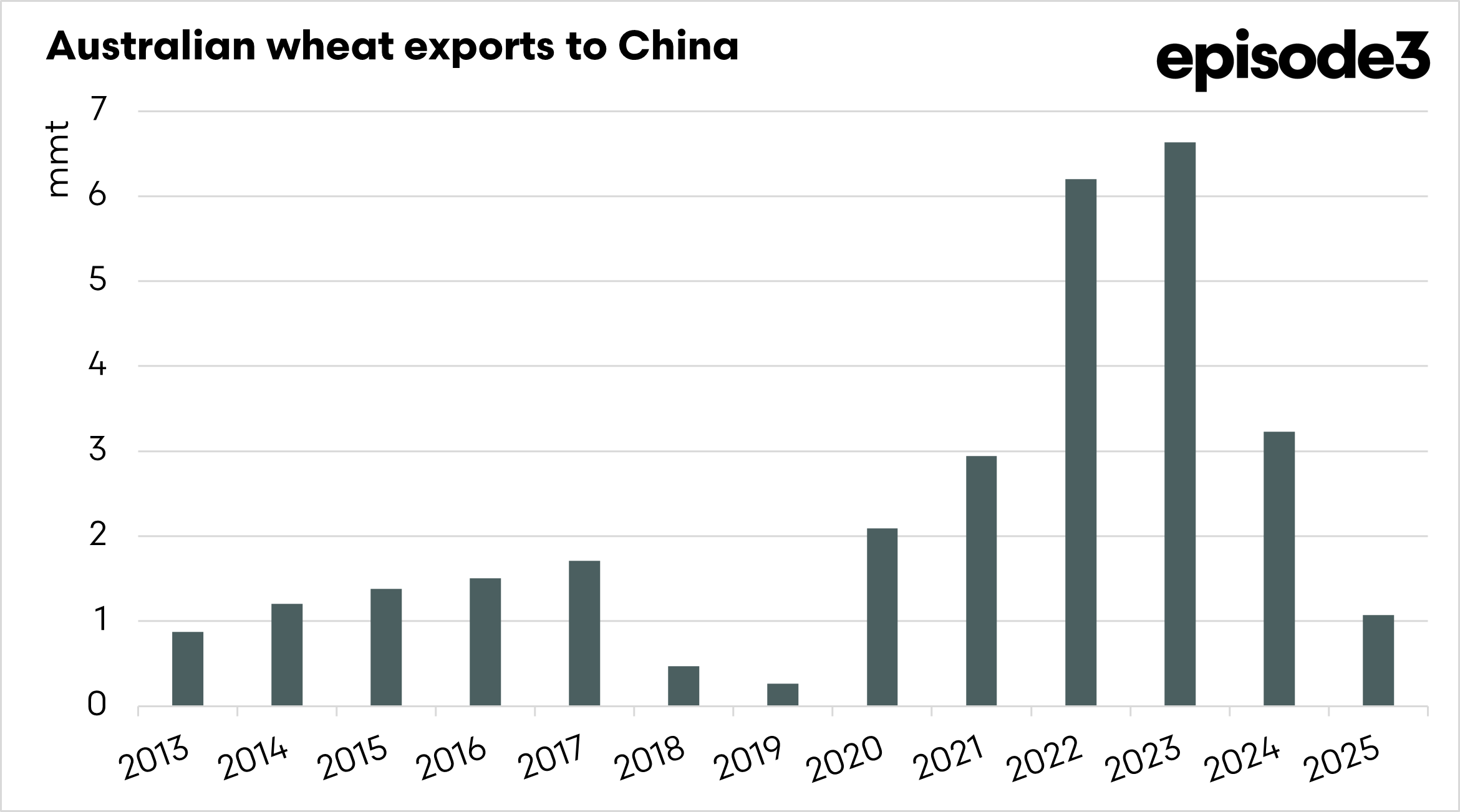

China, however, stands out as a notable exception in 2025. Exports to China fell to just over one million tonnes, a sharp decline from recent peaks above six million tonnes in 2022 and 2023 and well below the 2024 level of more than three million tonnes. This marks one of the lowest volumes shipped to China in the past decade, outside the drought years of 2018 and 2019, when our basis rose to substantial premiums relative to the rest of the world. The data suggests that China played a far less influential role in Australia’s wheat export program in 2025, either due to improved domestic supply, alternative sourcing, or changes in import policy.

Beyond China, strong demand from Southeast Asia, North Asia, the Middle East and Africa helped absorb Australian supply, highlighting the importance of market diversification. This breadth of demand reduced reliance on China and supported overall export resilience despite the sharp fall in Chinese volumes.

Canola

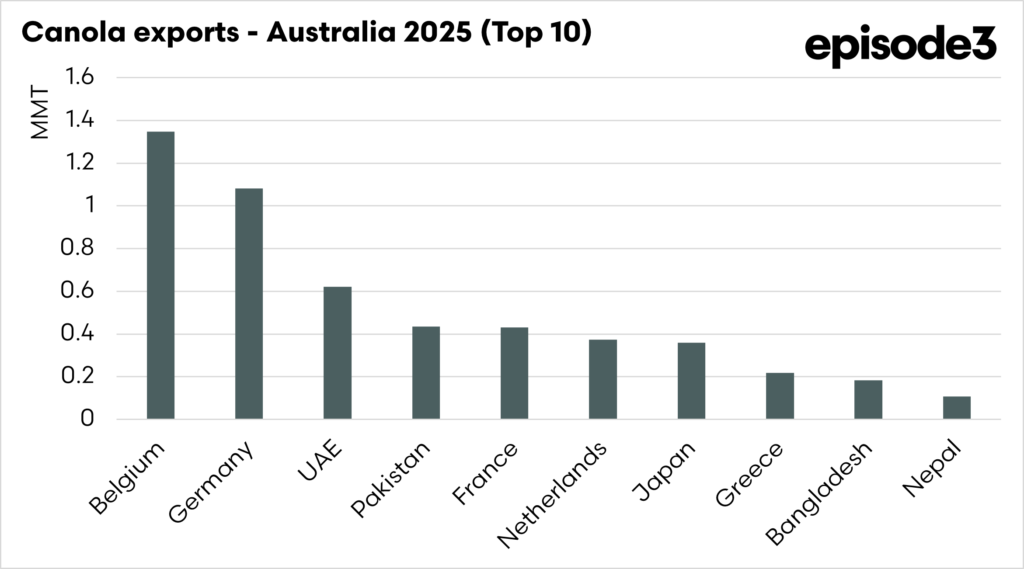

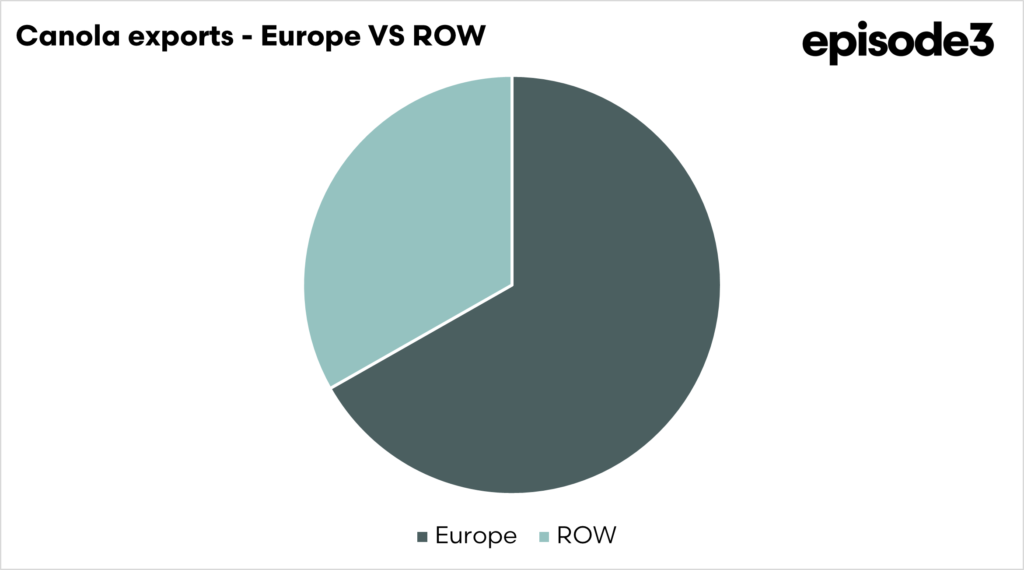

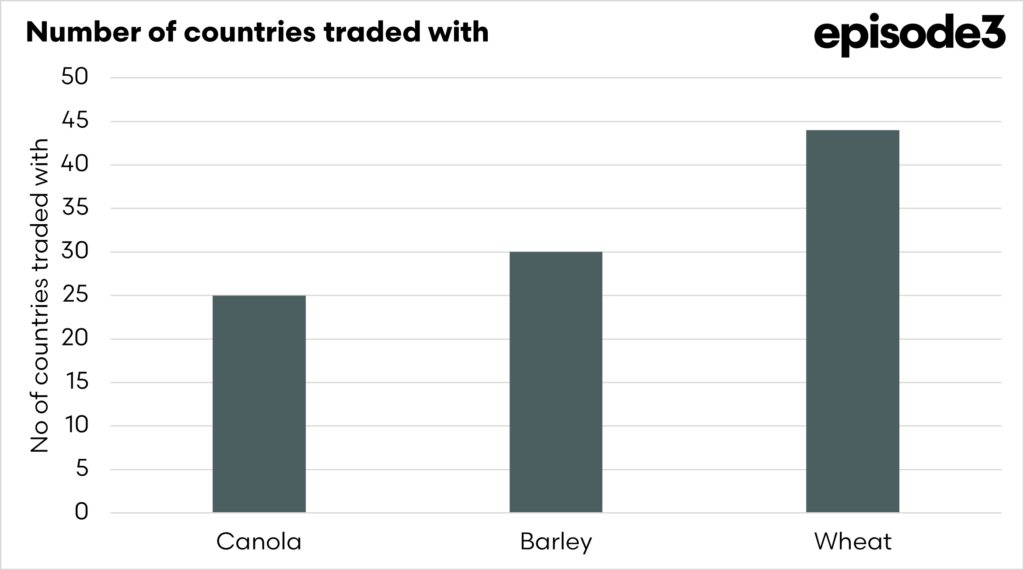

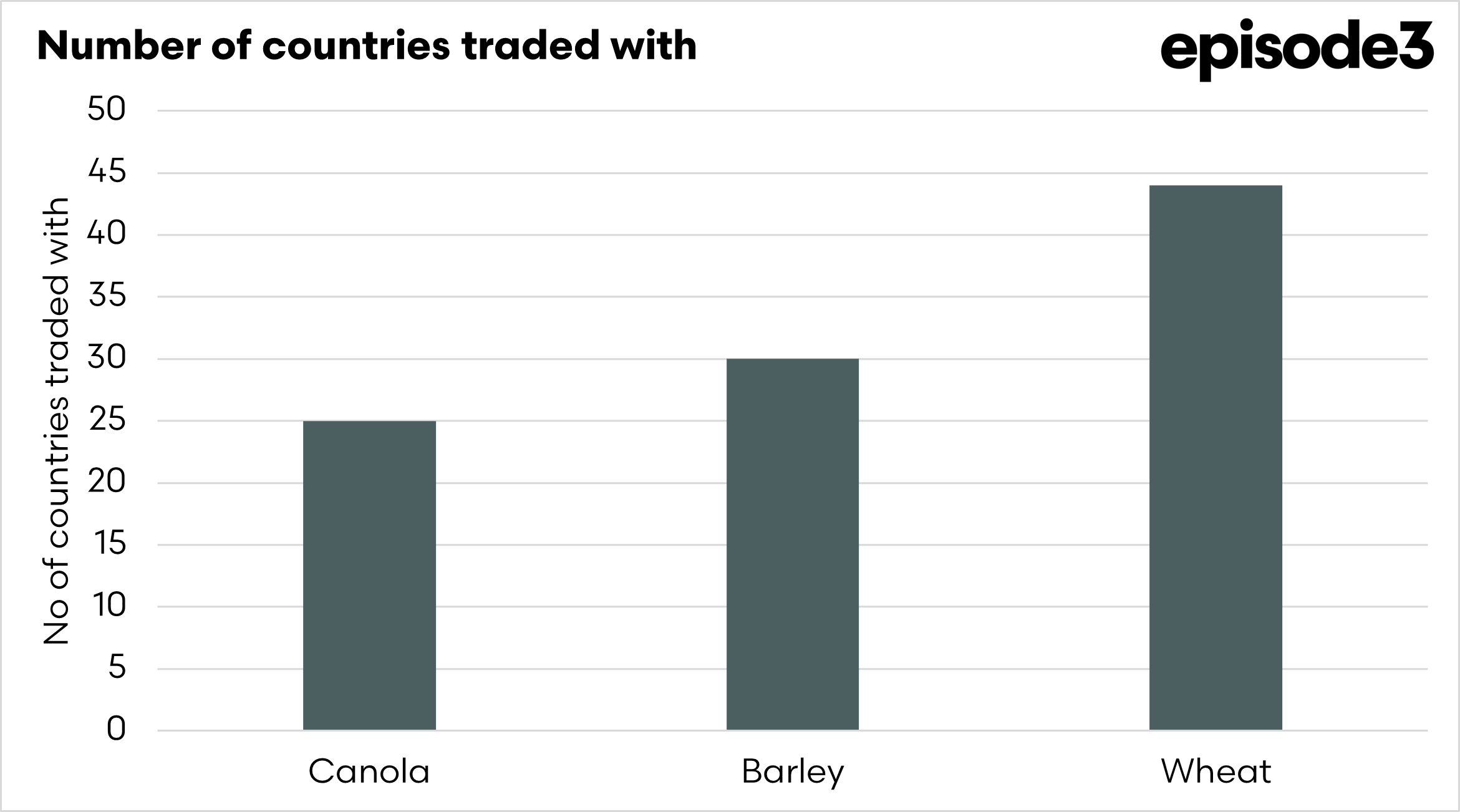

This canola export table shows a markedly different trade structure from wheat, with Australia’s 2025 program dominated by European markets and energy-linked demand rather than food markets in Asia.

The most striking feature is the overwhelming concentration in the European Union. Belgium and Germany alone absorbed more than 2.4 million tonnes, with additional substantial volumes in France, the Netherlands, Greece, Spain, and Portugal. Taken together, Europe accounts for the majority of Australian canola exports in 2025. This volume is largely used for biofuel purposes. Australian canola’s low carbon intensity and non-GM status make it well-suited to EU sustainability requirements.

At EP3, we are concerned about this long-term reliance on Europe, especially if green policies on chemical use could disrupt our trade flows.

Outside Europe, the United Arab Emirates is the largest non-EU destination, underscoring its role as both an end user and a regional trading hub. Pakistan and Bangladesh also appear to be significant buyers, reflecting food-oil demand in price-sensitive markets. Japan remains Australia’s principal premium food-use destination in North Asia, but volumes are modest relative to those in Europe.

Another key signal is what is absent. China are only just back on the scene for Australian canola, and we expect to see China appear in the data this coming season.

Barley

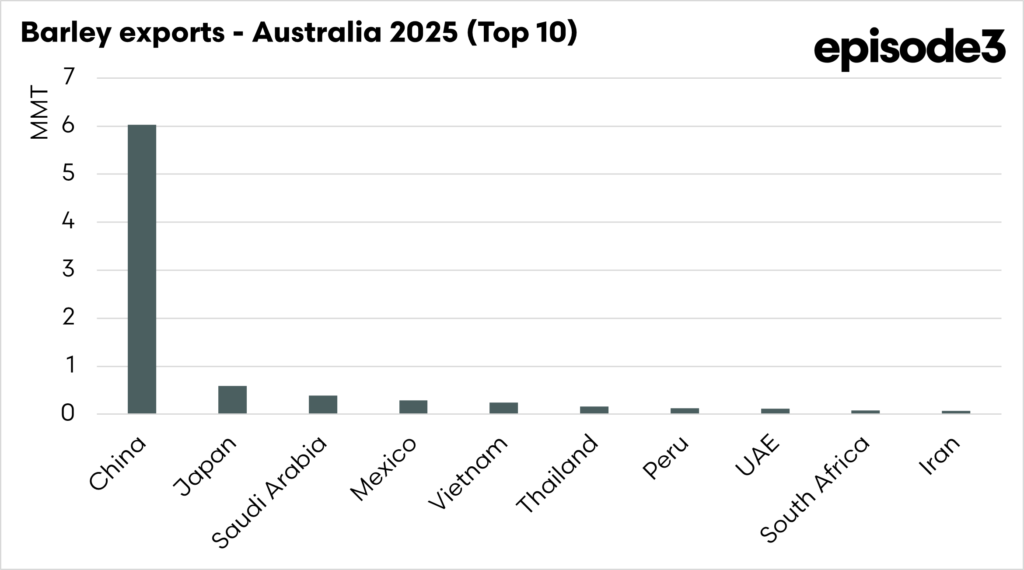

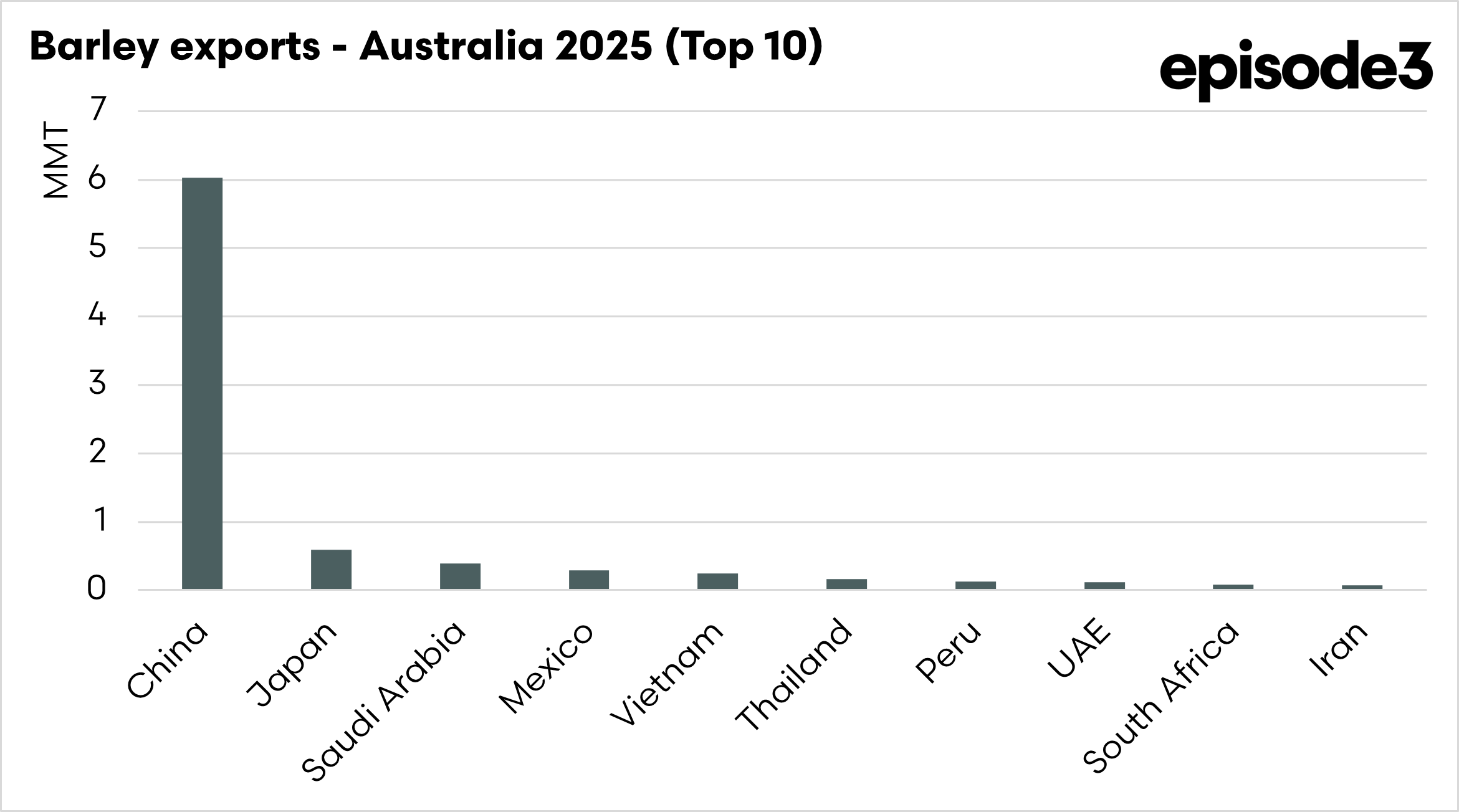

This barley export table shows a highly concentrated and structurally different trade profile compared with both wheat and canola, with China overwhelmingly dominating Australia’s 2025 barley program.

The most striking feature is the scale of shipments to China, which at just over 6.0 million tonnes dwarfs all other destinations. This confirms that China was, by a very large margin, the largest importer of Australian barley in 2025. The next-largest destination, Japan, received under 600,000 tonnes, indicating that China accounted for more than 10 times the volume of the second-ranked buyer. This level of concentration is far greater than seen in wheat exports and highlights a renewed reliance on Chinese demand.

China has been our largest customer for barley since we regained access following the removal of anti-dumping tariffs. This places significant concentration risk in a single country, which could be problematic in the current tense geopolitical environment.

Overall, the data indicate strong export volumes but high market risk, with Australia’s barley sector in 2025 far more exposed to changes in Chinese import demand, policy, or substitution than its wheat or canola sectors.