Southern processors take the lead

Market Morsel

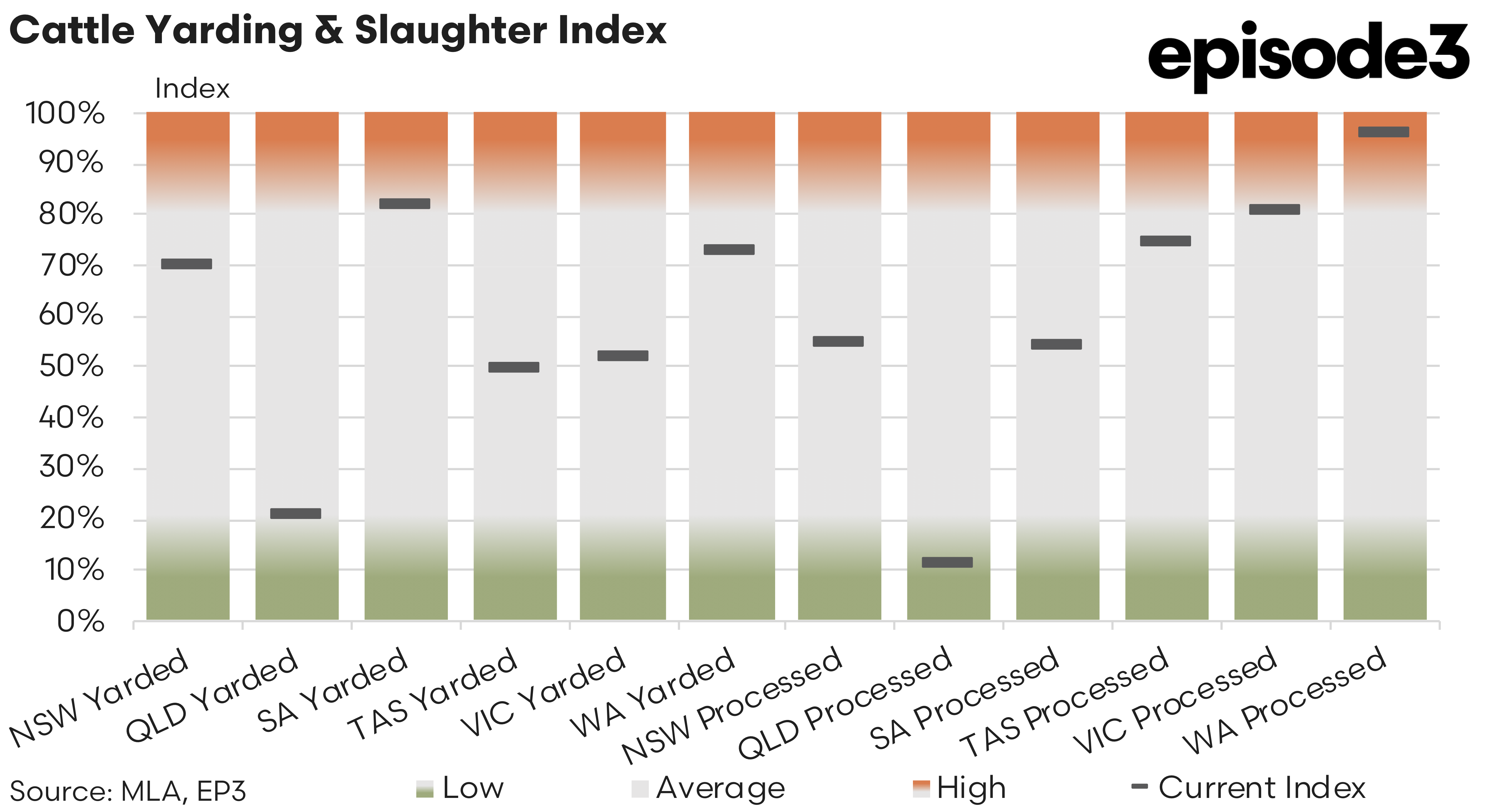

Australia’s cattle market moved through December and into January with the expected seasonal interruption around Christmas and New Year, but the resumption of normal operating conditions in mid-January has clarified how supply and processing dynamics are evolving across regions. The shift in yarding and slaughter indices over this period highlights a market adjusting to uneven cattle availability rather than weakening demand, with clear divergence between northern and southern states.

Nationally, December marked the low point in physical market activity. Reduced saleyard schedules, processor shutdowns and weather disruptions combined to suppress cattle flows, particularly in the north. As activity resumed in January, yarding indices lifted in several states, but not uniformly, reinforcing that supply constraints are increasingly regional rather than national in nature.

New South Wales continued to play a central role in underpinning market activity. The NSW yarding index eased from 74 percent in December to 70 percent in January, a modest seasonal decline that still leaves yardings elevated for the time of year. Processing activity softened more noticeably, with the NSW processing index slipping from 64 percent to 55 percent in January. This suggests processors remained active but became more selective as cattle availability tightened post-Christmas, rather than stepping away from the market altogether.

Queensland showed the clearest evidence of northern supply constraints. Yardings fell sharply from 64 percent in December to 21 percent in January, reflecting the impact of wet weather in some areas. Processing activity followed a similar pattern, with the Queensland processing index declining from 44 percent to 11 percent.

South Australia moved in the opposite direction. Yardings remained comparatively strong, easing only slightly from 90 percent in December to 82 percent in January. Processing activity increased, with the SA processing index lifting from 66 percent to 75 percent. This combination indicates that South Australia is emerging as a key supplier of finished cattle into early summer with a backlog of stock that entered the market once holiday disruptions cleared.

Tasmania also recorded a notable improvement. Yardings eased from 70 percent in December to 50 percent in January, while the processing index lifted sharply from 56 percent to 81 percent. This reflects a seasonal catch-up effect, with cattle held back earlier in the year now moving through slaughter as conditions stabilised and processor schedules returned to normal.

Victoria yarding levels eased from 63 percent in December to 52 percent in January, pointing to a seasonal tightening in availability following stronger spring marketings. Processing activity was broadly steady, with the Victorian processing index edging slightly higher from 80 percent to 81 percent. This suggests processor demand has remained intact, but throughput is increasingly constrained by the availability of suitable finished cattle rather than a lack of capacity.

Western Australia continued to stand out for processing strength. Yardings eased from 78 percent in December to 73 percent in January, yet the processing index remained extremely high, edging up from 95 percent to 96 percent. This indicates processors in the west are continuing to operate near capacity where cattle are available, absorbing supply efficiently despite the seasonal slowdown.

These shifts in supply and processing dynamics are now being reflected more clearly in pricing as activity has resumed since the Christmas–New Year break. Heavy cattle prices have strengthened modestly over the opening weeks of 2026, consistent with tightening availability and the return of processors to more regular slaughter schedules.

The heavy steer indicator is currently sitting at 435 cents per kilogram live weight, still 100 cents higher than this time last year, reinforcing that demand for finished cattle remains firm. The processor cow indicator is now at 365 cents per kilogram live weight, also sitting 100 cents above the levels seen at this time in the season in early 2025.

The December to January transition in yarding and processing indices reveals a sector moving out of its seasonal pause and into a more clearly defined regional pattern. The north remains constrained by earlier marketing decisions and weather disruptions, while the southern regions are carrying a greater share of both supply and processing activity.