Slow start for lamb yarding

Market Morsel

The transition from December 2025 into January 2026 marked a clear turning point in sheep and lamb supply dynamics across Australia, with yarding index movements confirming that the spring flush has passed and that markets are now adjusting to a materially tighter flow of stock. The shift has been broad based across states and categories, and when read alongside four week price trends, it provides a coherent picture of a market moving from surplus conditions toward a more balanced, and in some cases tightening, supply environment.

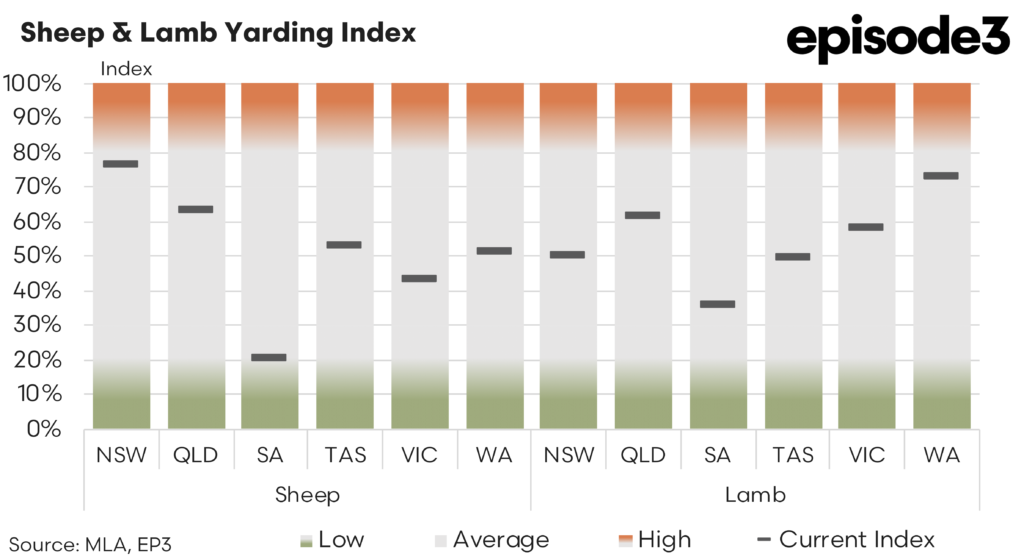

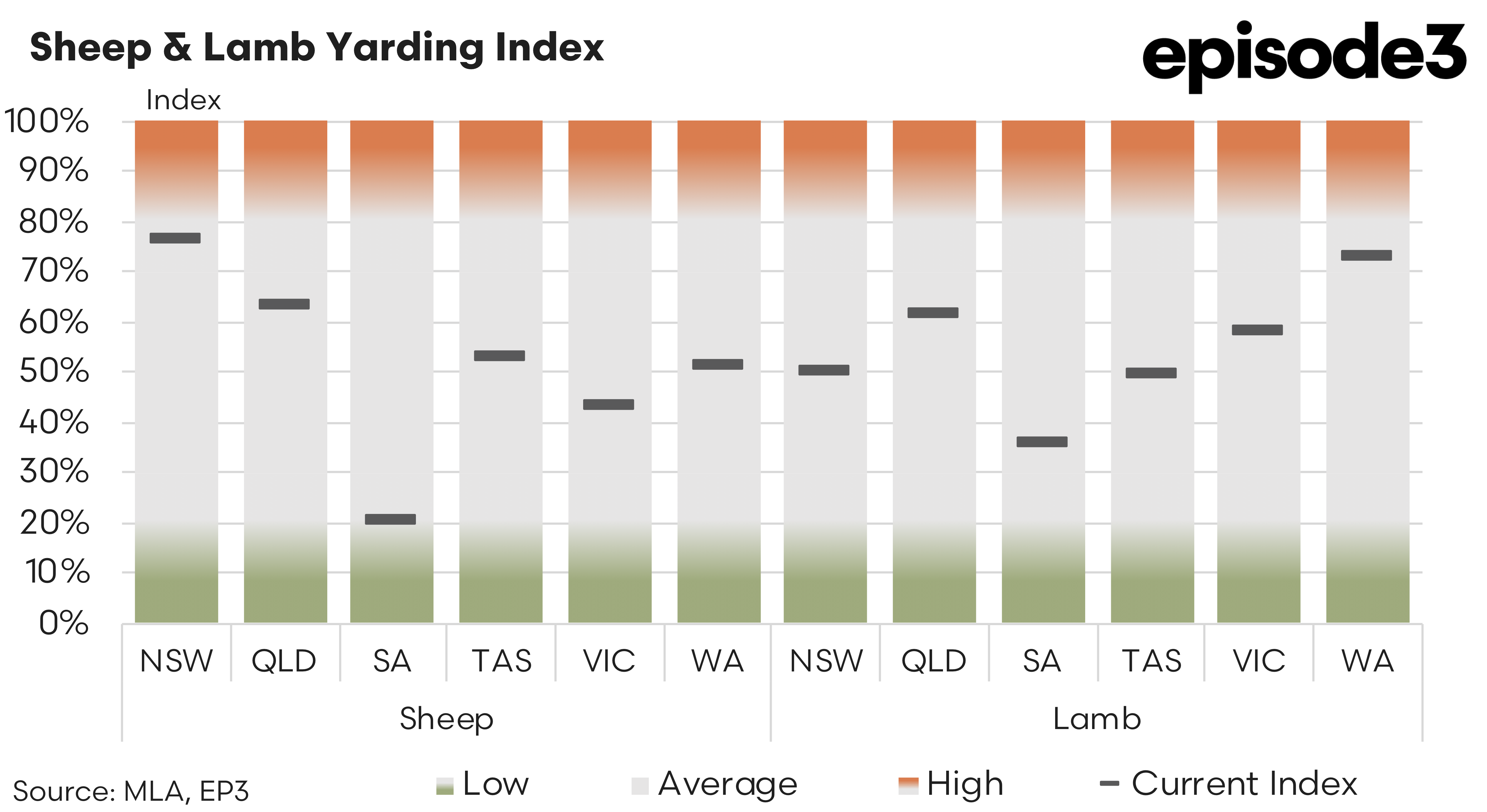

Sheep yarding indices declined sharply across all states between December and January, underscoring how decisively seasonal offloading has concluded. New South Wales eased from 85 percent to 76 percent, indicating that while supply remains present, it is no longer being replenished at late spring levels. Queensland recorded a much larger fall from 92 percent to 64 percent, highlighting how quickly earlier elevated throughput has been drawn down. South Australia experienced the most pronounced contraction, dropping from 63 percent to just 20 percent, confirming that the state has moved well beyond its peak supply window. Similar patterns were evident elsewhere, with Tasmania falling from 76 percent to 53 percent, Victoria from 71 percent to 43 percent, and Western Australia from 89 percent to 51 percent. Collectively, these movements point to a clear tightening in sheep availability nationally, particularly across the southern states that had carried much of the late 2025 supply burden.

Lamb yarding indices show a parallel, though slightly more nuanced, adjustment. New South Wales eased from 58 percent to 50 percent, suggesting a gradual reduction rather than an abrupt contraction. Queensland declined from 72 percent to 61 percent, consistent with its typical pattern of early season strength followed by a steady fade. The most significant shifts again occurred in South Australia and Victoria, where lamb indices fell from 82 percent to 36 percent and from 95 percent to 58 percent respectively. These moves confirm that December represented the high water mark for lamb throughput in both states and that January has seen a rapid adjustment of flows. Tasmania also recorded a decline from 75 percent to 50 percent, while Western Australia eased more modestly from 82 percent to 73 percent, leaving it comparatively better supplied than the eastern states but still below late spring levels.

Price behaviour over the past four weeks aligns closely with these supply signals and highlights the lagged response that often characterises livestock markets. Trade lamb prices rose by around 48 cents over the four week period and are currently trading at about 1112 cents per kilogram carcase weight. This strength reflects the rapid withdrawal of supply following the December peak, particularly in Victoria and South Australia, where trade lamb availability tightened quickly once flush conditions ended. Light lamb prices have also strengthened, lifting by roughly 61 cents over four weeks to sit near 1096 cents. This reinforces the view that lighter categories have become scarcer as seasonal runs tapered off.

Heavy lamb prices were not as robust, rising by about 4 cents over four weeks to around 1069 cents. Despite this, values remain elevated on a historic basis sitting 278 cents higher than this time last year, signalling that processors are still actively competing for numbers even as the residual effects of December supply continue to work through the system.

Restocker lamb prices gained over the four week period, up approximately 33 cents to about 1115 cents. While physical availability has tightened, restockers still appear cautious, likely reflecting seasonal uncertainty and a reluctance to chase prices higher until there is more certainty provided around what type of autumn break rainfall is received this year.

Merino lamb prices also lifted, gaining 23 cents over four weeks to around 1000 cents. This milder price increase is consistent with longer running demand challenges within the Merino lamb category rather than being a direct reflection of current supply pressure. Yardings have declined, but not enough to offset structural demand softness in the near term.

Mutton prices increased by about 8 cents over four weeks to sit near 760 cents. The January yarding indices show a clear tightening in sheep numbers across all major states. With sheep supply contracting and export demand remaining firm, particularly into Asian and Middle Eastern markets, the mutton market outlook appears firmer than the four week price trend alone would imply.