An expensive brunch

Quarterly Food Inflation Update - June 2025

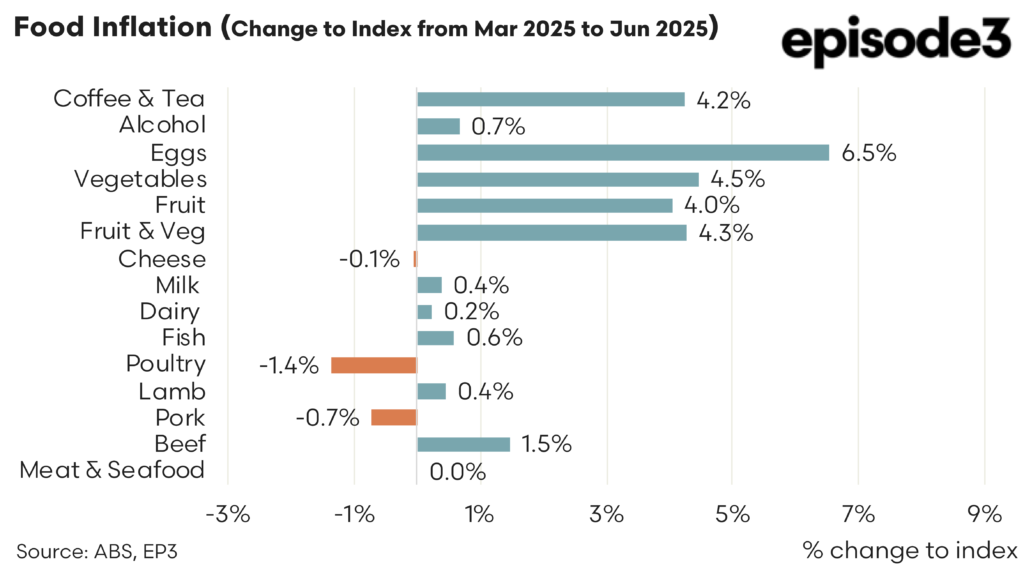

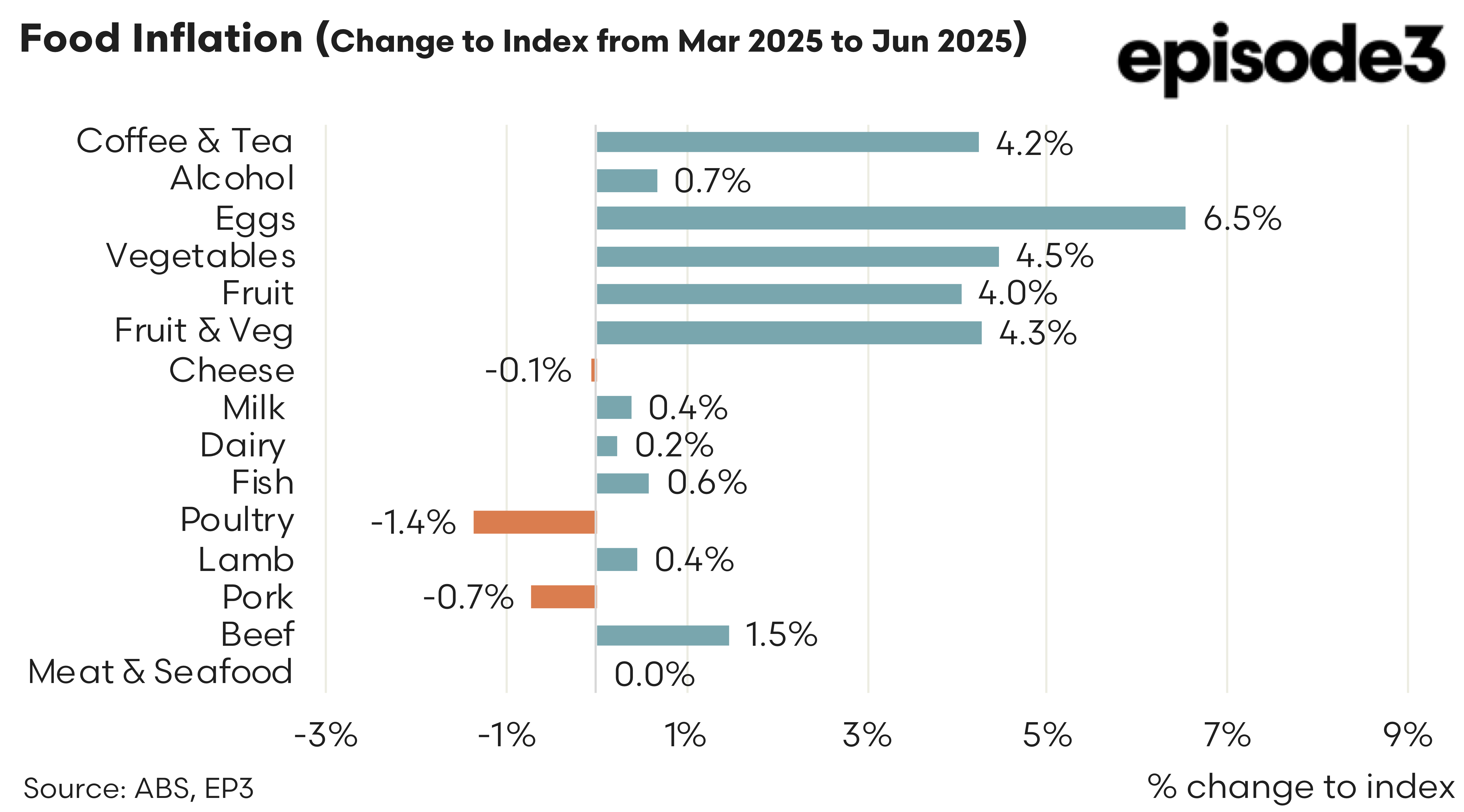

The June 2025 quarter brought a renewed burst of inflation across several food categories, particularly in fresh produce and eggs. From March to June 2025, egg prices jumped 6.5%, maintaining their status as the fastest rising item in the food basket. Vegetables rose by 4.5% and fruit was up 4%, lifting the combined fruit and vegetable category by 4.3% for the quarter. Coffee and tea added another 4.2%, continuing their upward trend. With eggs and coffee getting expensive we may have to cut back on the scrambled eggs and café latte breakfast treat.

Most other categories saw more modest changes. Alcohol prices rose by 0.7%, while dairy categories remained relatively stable. Milk rose by 0.4 %, cheese slipped slightly by 0.1%, and dairy overall was up just 0.2%. Fish prices rose 0.6% over the quarter, reversing some earlier declines.

Poultry recorded the most significant fall, dropping 1.4%, while pork fell 0.7%. Lamb crept up by 0.4%, and beef lifted 1.5%. The broader meat and seafood category remained unchanged overall during the quarter.

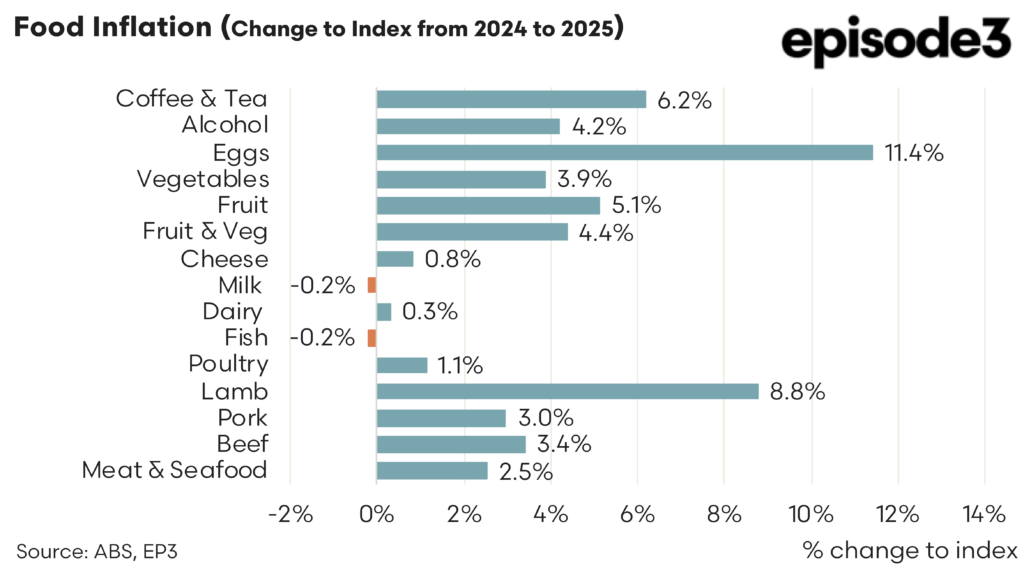

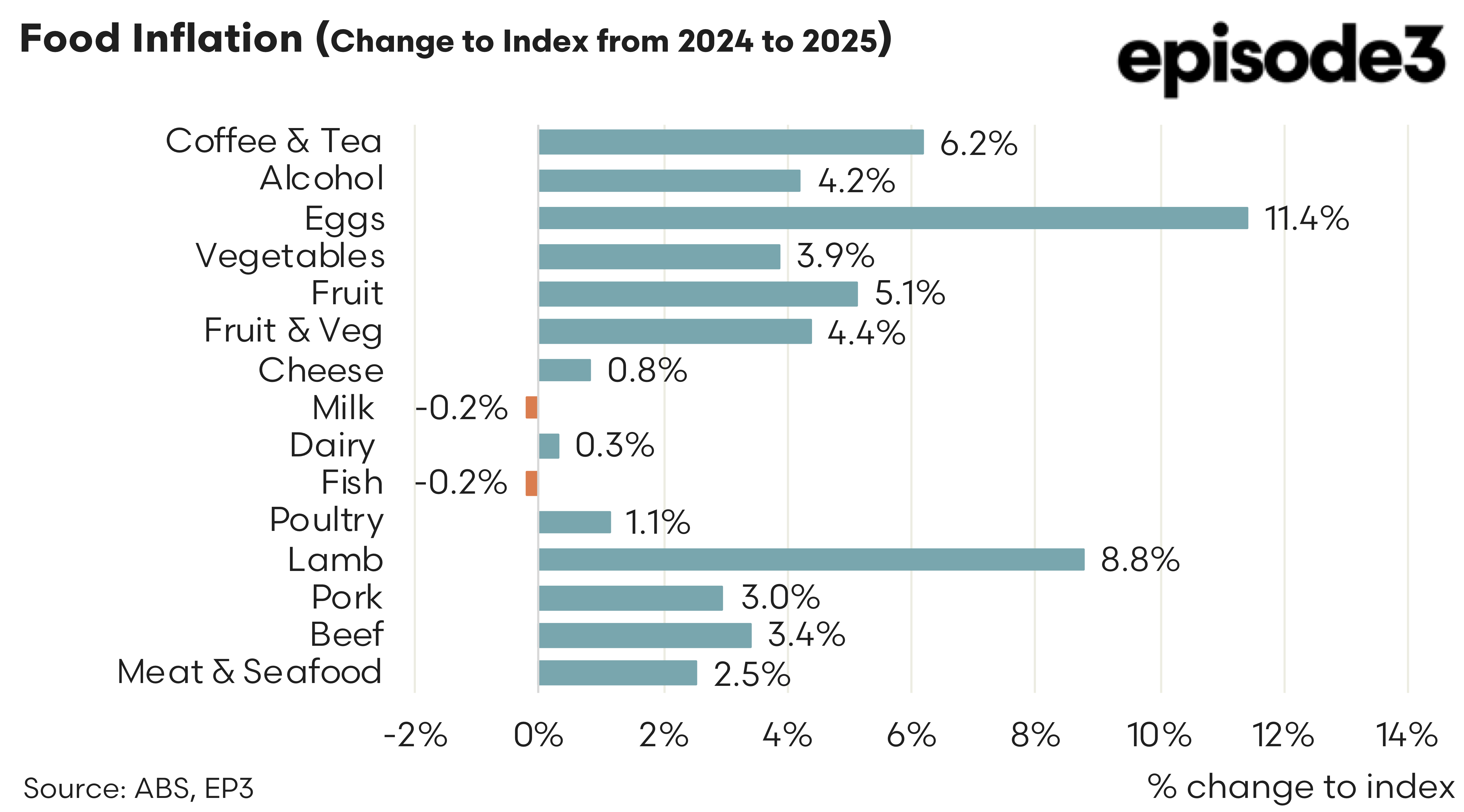

Looking at the year-on-year picture, eggs have now risen 11.4% on average compared to 2024, reflecting sustained pressure in that category. Lamb prices have also surged, now 8.8% higher than last year, marking a strong turnaround from the earlier downward trend. Coffee and tea prices are up 6.2% annually, while fruit has climbed 5.1% and vegetables 3.9%, taking the combined fruit and veg category to a 4.4% annual increase.

Among meat proteins, pork is now 3% higher than a year ago, and beef has risen 3.4%. Poultry, despite its quarterly decline, remains up 1.1% year-on-year. Dairy inflation remains muted, with cheese up 0.8% annually, milk down 0.2%, and the overall dairy group just 0.3% higher. Fish has followed a similar pattern, also down 0.2% over the year.

Overall, while headline food inflation appears relatively contained, the June quarter data reveals stronger seasonal pressures in key categories like eggs, produce and some meats. Annual figures show the longer-term cost burden continuing to shift, with notable divergence between staples and discretionary food items.