Biosecurity Levy: Farmers or importers?

The Snapshot

- The Australian government plans to introduce a biosecurity levy, where producers will pay a % of their sales to fund biosecurity controls.

- The levy aims to recoup A$50m

- Farmers groups are up in arms about this new levy.

- There was talk of a container levy in the previous government.

- A container levy on imports of A$15 would cover the A$50m that the government have earmarked from producers.

- A potential option is a levy of A$10 on imports and A$5 on exports. This would recoup most of the revenue required.

- The biggest biosecurity risk is the importer. A container levy is a potential route to covering biosecurity costs.

The Detail

The different areas of agriculture are not always in sync with one another, nor should they be. Each commodity has its own needs and wants. One topic has united all the different agricultural industries – the new biosecurity levy (or tax).

The aim is to collect approximately A$ 50 million through a new biosecurity levy on agricultural produce (see here for details). For example, a grain producer will pay 0.102%, and a cattle producer will pay 50¢ per head.

This biosecurity levy has gotten the attention of agricultural lobbyists, and they have been united in their opposition to the policy.

Biosecurity is obviously essential, especially with the recent outbreaks of LSD, ASF and FMD in our northern neighbours.

One of the concerns is that the language used implies that farmers are the sole beneficiaries of increased biosecurity and that they should pay for increased spending.

According to the department, the costs will be shared in the following percentages:

- 44% taxpayer funding

- 48% importers

- 6% producers

- 2% Australia Post

The most often proposed alternative is a container tax on imports. So, let’s take a look at that.

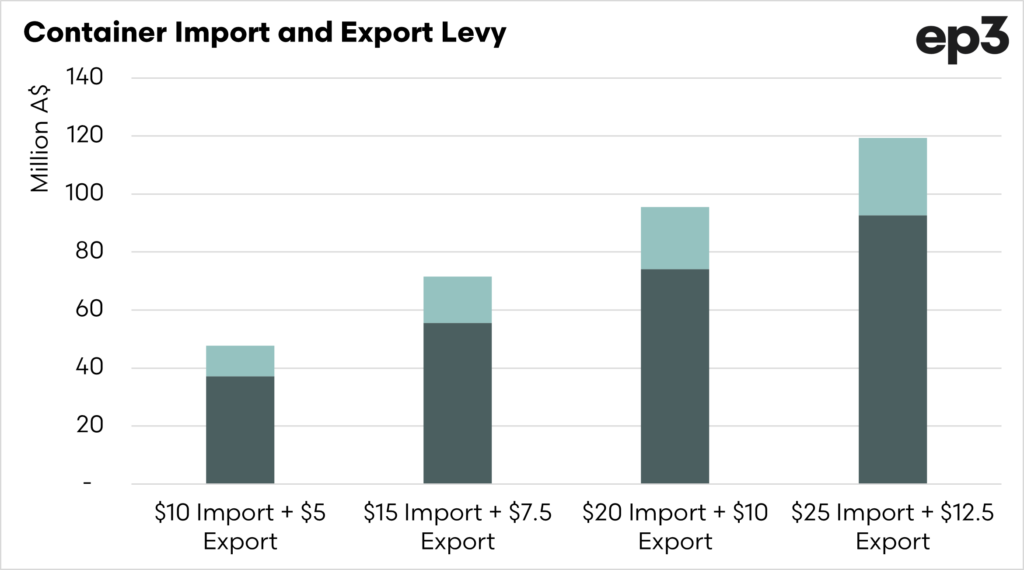

The chart above displays the container terminal throughput for the five major container terminals (Adelaide, Brisbane, Fremantle, Melbourne and Sydney).

I am measuring the TEU, which is the twenty-foot equivalent. This is a standard term used to define a twenty-foot container or the equivalent.

We can see in the chart that Australia tends to import far more containers of goods than we export. On average, we export around 60% of the volume that we import. This is obvious because we are no longer a significant manufacturing country.

During the period from 2015 to 2021, Australia imported an average of 3.7m TEU per year. So, let’s look at a container levy at its most basic.

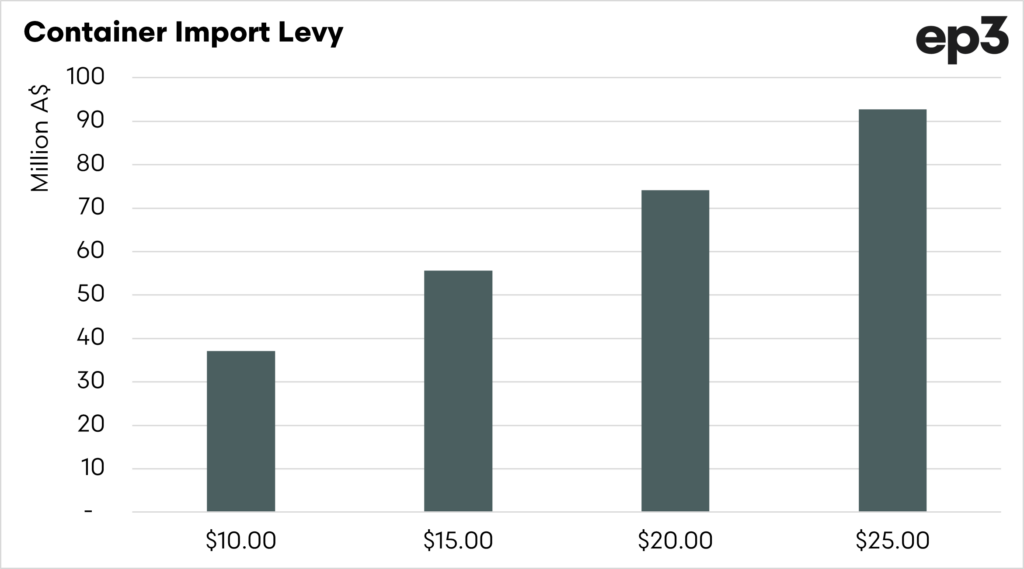

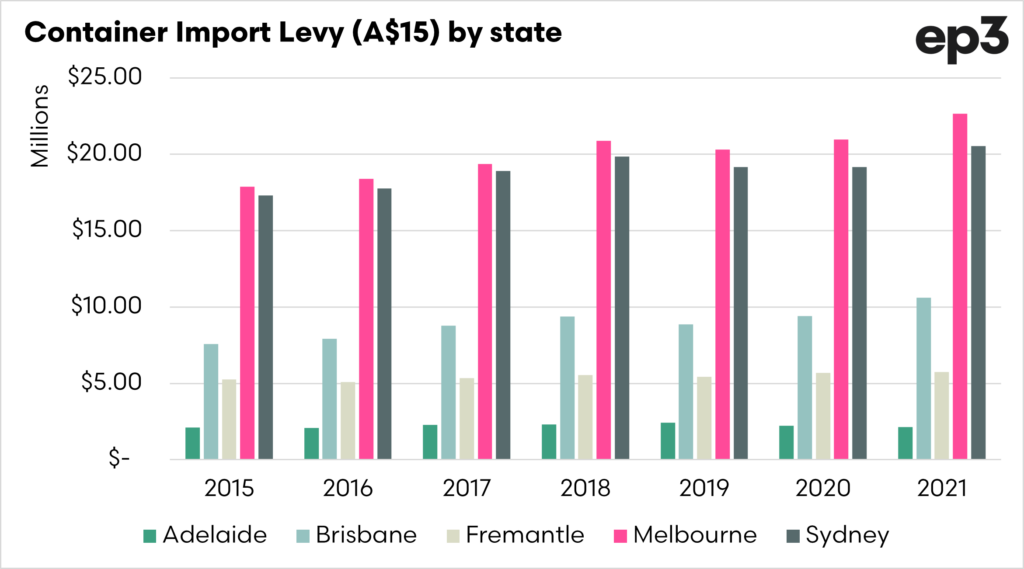

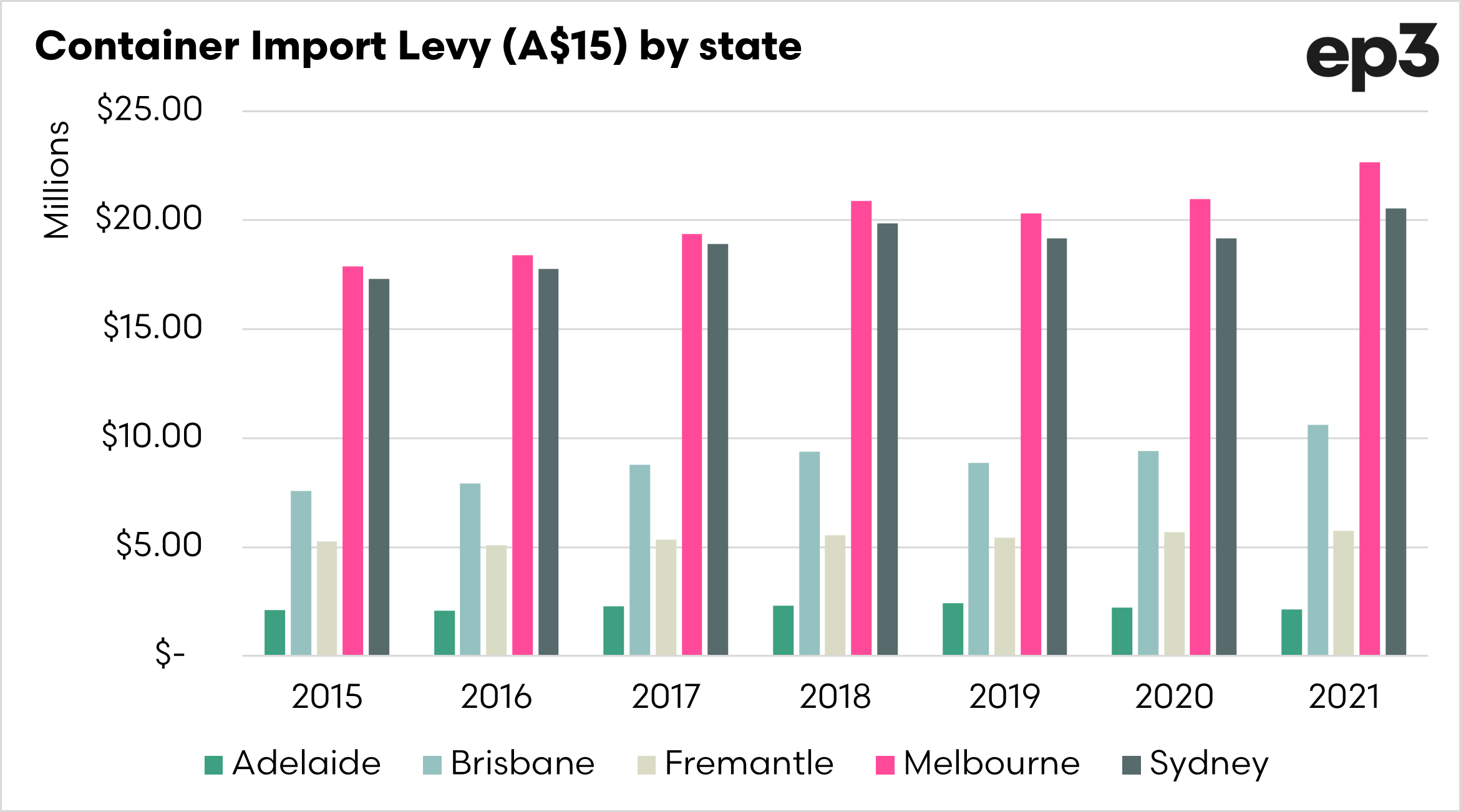

The chart above displays the average revenue raised by a container levy at different rates from A$10 per TEU to A$25 per TEU.

At an import levy of A$15 per TEU, Australia would raise the same revenue expected through the new biosecurity levy but from importers rather than producers.

Some arguments point to importers as the main biosecurity risk, more so than tourists.

Can it be made fairer and more equitable?

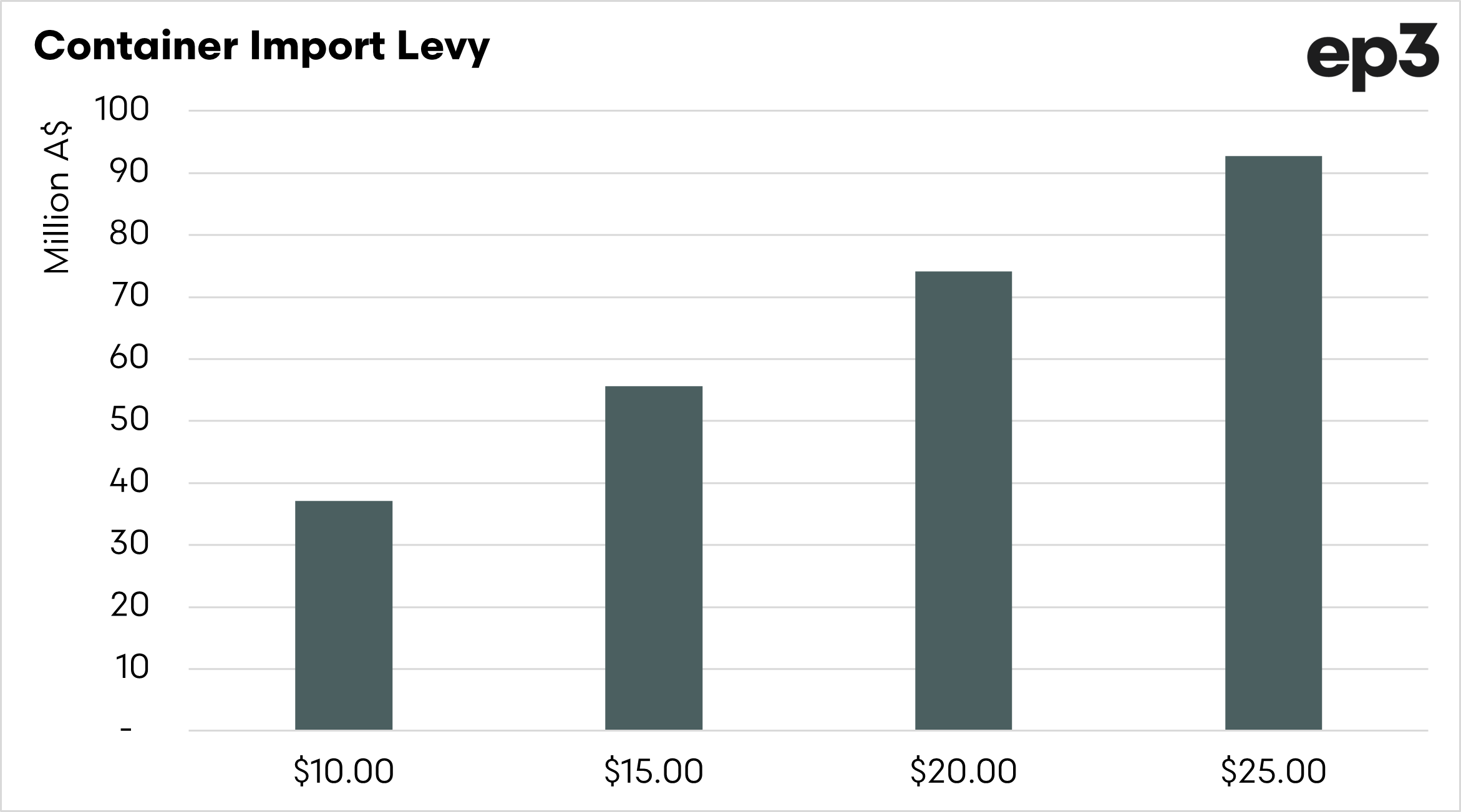

The more significant biosecurity risk is importers, but maybe the costs could be shared between importers and exporters, with a reduced cost to exporters.

If we add an A$10 levy and an A$5 export levy, we would get close to the A$50m raised through the biosecurity levy.

Although I am just brainstorming, I think a levy on both imports and exports, at different levels based on risk, would be one that would be potentially fairer.

Is it too expensive?

In recent years, the cost of importing containers has been increasing and well above the cost of inflation.

If we look around the country, the terminal access charge for importing a container are roughly A$170-180.

So, if we added a container import levy of A$15, it would equate to 8.5% of the cost of port costs. If we look globally at the value held within each TEU, on average, the value of the contents is approximately A$83,000. The cost of passing on A$15 to the consumers of these products would not be insurmountable.

The container import levy would be a direct charge for those creating the most significant risk and would be a consistent fee, as our imports are not hugely variable.

In the biosecurity levy based on farmer performance, there is the risk of not recouping the A$50m expected, for instance, during periods of drought when levies would be reduced.