Carbon dating?

The Snapshot

- The carbon price in Europe has gone through the roof.

- The average between 2010 and the present was A$18. The EU market is now trading at A$98.

- There is still a large basis spread between the Australian and European carbon price.

- The carbon market is complex compared to the other markets in which we operate.

- Farmers have the ability to sequester carbon on their properties.

- There are a number of questions that farmers and the industry have to consider when it comes to the carbon market.

The Detail

At EP3, we love markets. I have spent some time recently looking at carbon markets, as they seem to be in vogue at the moment. I will be honest with you; this article may raise more questions for the industry than answers.

Carbon markets and accessing them are complex, but they do have the potential to be a revenue source for farmers, if they are done correctly.

Carbon credits permit businesses to emit carbon dioxide. Industries which sequester carbon dioxide are able to sell these credits – such as agriculture.

The purpose of the market is to reduce the amount of carbon emitted. The higher the price of carbon becomes, the more drive to move to greener technologies.

How is the market performing?

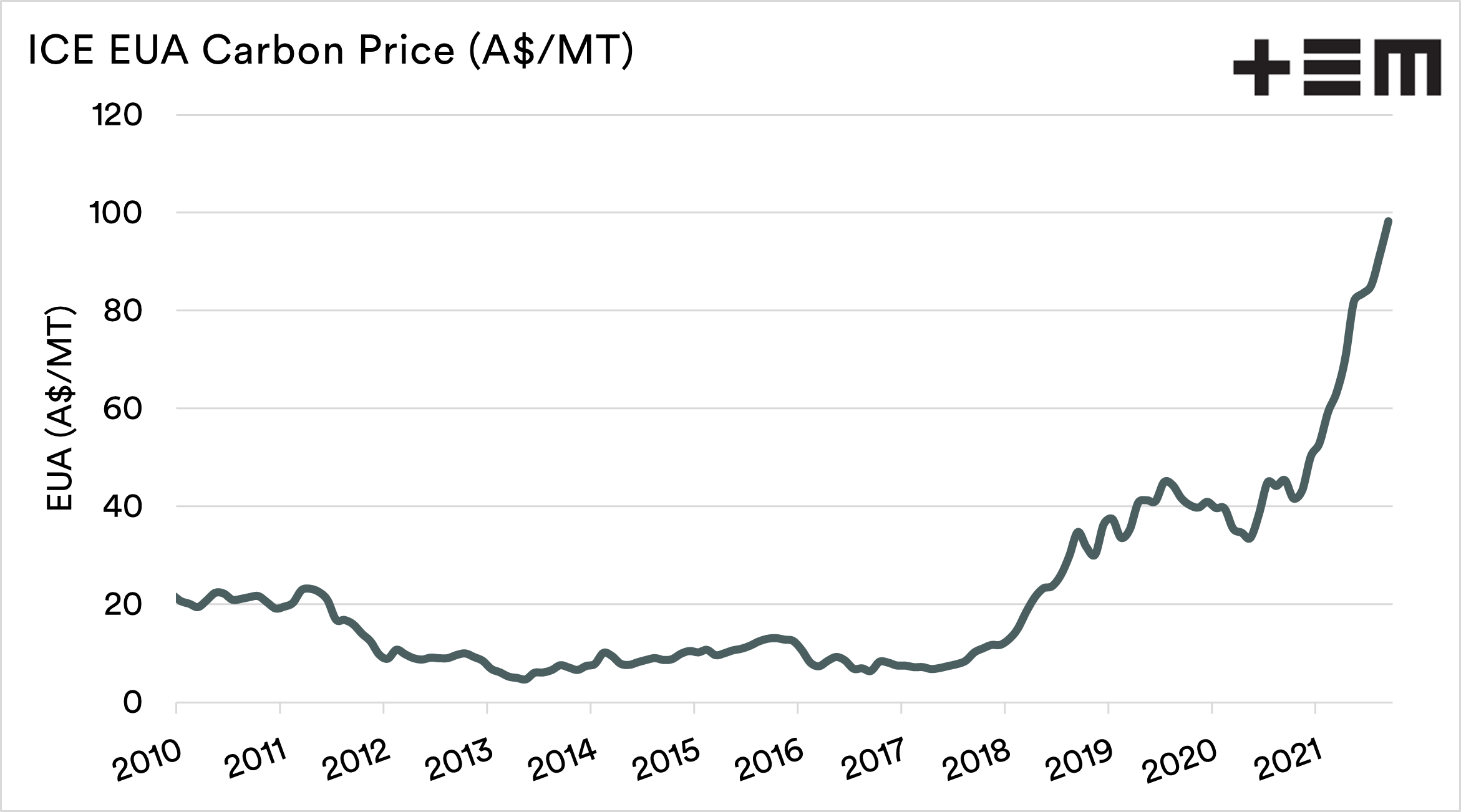

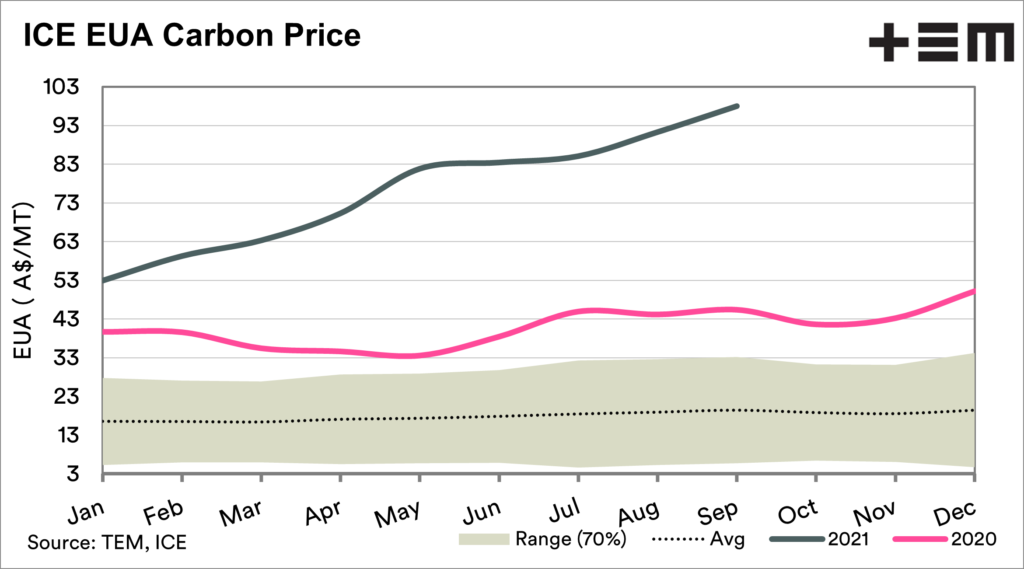

The fchart below shows the EU carbon spot price. Europe is probably the most advanced when it comes to carbon markets.

The EU carbon price (in A$ terms) has spent most of the past decade trading at an average of A$18, and as low as A$4.60.

The carbon price has risen dramatically during the last year and is currently averaging A$98 for September. The carbon price when trading at A$18 doesn’t seem that attractive of a proposition to warrant the extra work required for farmers to claim credits and sell them, but maybe when it gets closer to A$100, it is worth examining?

Why is the market rallying so hard?

Here are a few potential reasons:

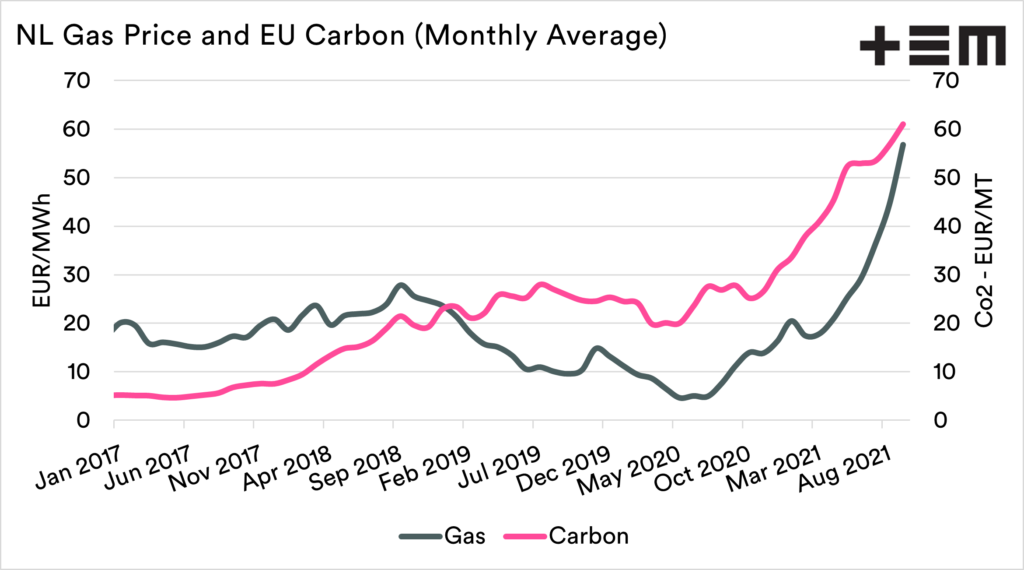

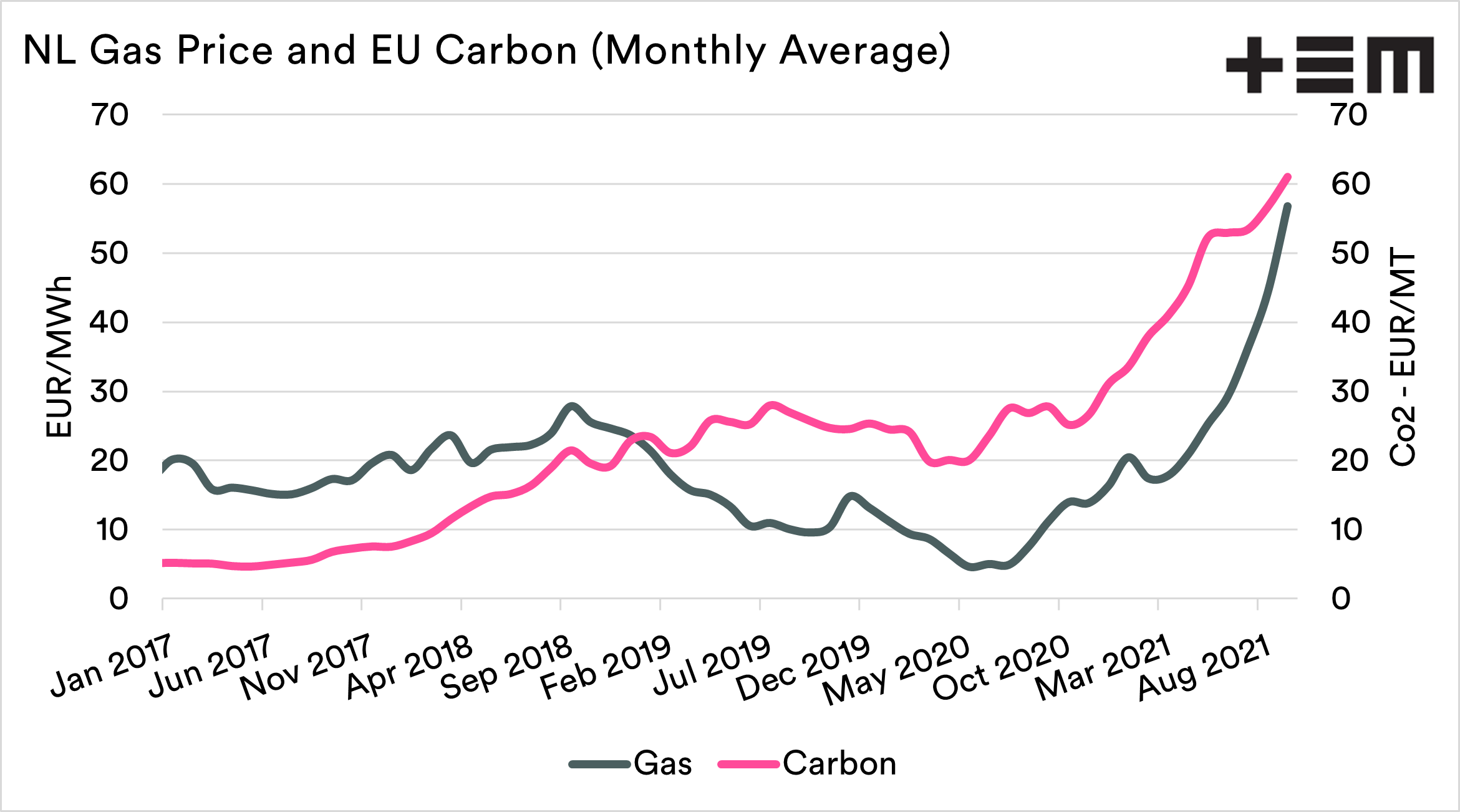

The EU regulation on emissions is set to continue being tightened, therefore increasing the demand by emitters. For most of the recent time, most of the requirements for credits were the power industry. Now additional industries are requiring them, but with a finite number of credits, this causes demand to increase more than supply.

Natural gas prices have increased in recent times. This has caused all manner of concerns, including some European fertilizer plants closing due to the high input cost. One other impact of increasing gas prices is that this results in the increased use of coal for power production.

Suppose more power production in Europe switches to coal. In that case, there is a corresponding increase in demand for carbon credits to offset their emissions.

What about Australia?

The carbon market in Australia is still very much in its infancy and has been some time to get off the ground.

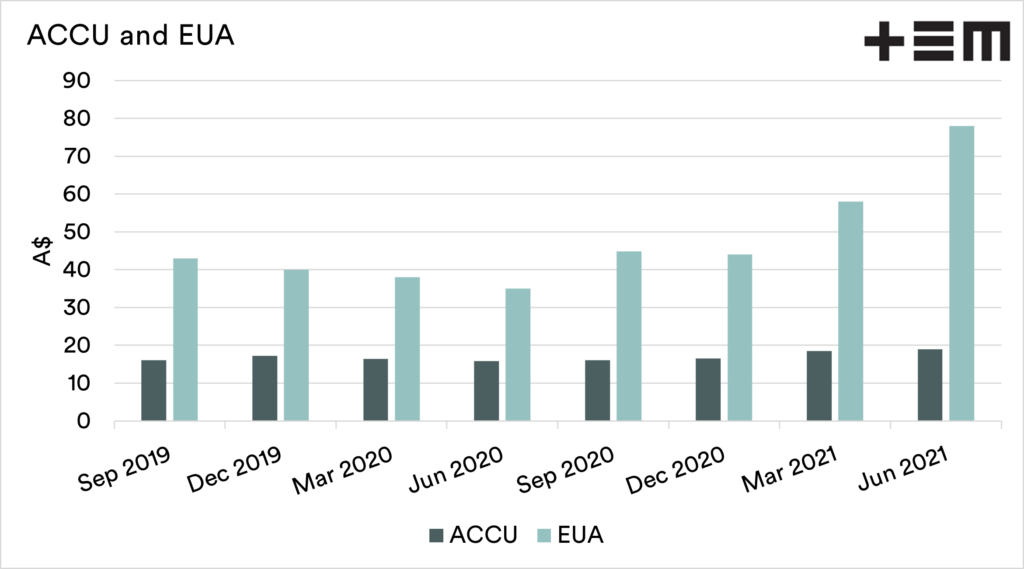

The chart below shows the average quarterly price for Australian carbon credits versus EU carbon credits up until the June quarter. We can see that there is a large discount between the two.

I can understand the spread between grain/oilseed prices between two nations, as this is a supply and demand issue i.e. Canadian canola is at a premium due to their drought and lack of local supply.

However, carbon dioxide is carbon dioxide. We live on a sphere, and a carbon credit in Australia that offsets 1mt of Co2 should be worth the same as an offset in Europe. Over time there should, in theory, be an equalization of pricing around the world, or at least that should be the aim.

Whilst I do not in any way profess to understand the ins and outs of emissions trading schemes and carbon sequestration, I have many questions. There are many questions and concerns which I have and will read up on, but some of the most important ones are below. These are what individuals and the industry should have a think about:

Additionality

At the moment, most schemes pay the farm for additional work. A farmer is provided credits for additional carbon sequestration.

This means that farmers who have done very little work will receive more significant rewards for any carbon mitigation action, as they start from a lower base with more to add. Those who have done this work over the recent decades are starting at a higher base and have less potential to add value, as they have less to add.

Washouts

If you are signing up for a long term carbon sequestration project, then you have to think about what you are signing up for. Let’s use an example of planting trees over a 50-year time frame.

It’s important to take very close consideration of all the terms and conditions. What happens if your trees burn down? Does this mean you need to pay a washout to make good for the carbon dioxide you haven’t sequestered?

The Price

Suppose farmers are considering carbon as an opportunity, which we think they should. In that case, they have to think of it as a market just like they do grains or livestock. They can’t think of it as just a little freebie, with little extra work.

You don’t want to sign up for a long term contract at a price that becomes very unattractive. As an example, carbon credits in Europe have doubled in the past year. If I was signing up, I would be looking for pricing that is somehow indexed to the market.

What carbon price is required to make creating carbon credits work?

Higher input pricing.

There is the potential that emissions trading schemes and government carbon mandates for emitters will result in higher input prices such as fertilizer. This is a concern at a time when we are facing increasing fertilizer costs (see last weeks report)

The question is whether farmers can recoup the extra cost of inputs by creating carbon credits.

Complexity

This is something for the industry representative groups. The carbon market is very complex. The fact that the market in Australia is in its infancy is a good thing, as farmers, when they sign up to these schemes, will be doing so in a higher-priced environment.

The reality is that the whole carbon market needs to be explained better.

If you liked reading this article and you haven’t already done so, make sure to sign up to the free Episode3 email update here. You will get notified when there are new analysis pieces available and you won’t be bothered for any other reason, we promise. If you like our offering please remember to share it with your network too – the more the merrier.