China, China, China – are we risking too much?

The Snapshot

- China is a contentious issue, and many people are opposed to having too close of a relationship between our two countries.

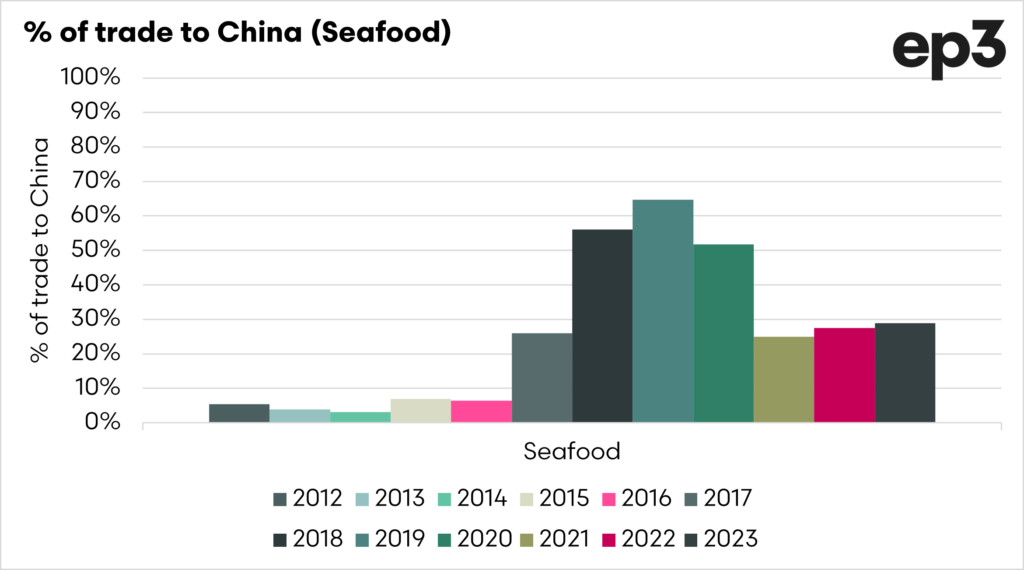

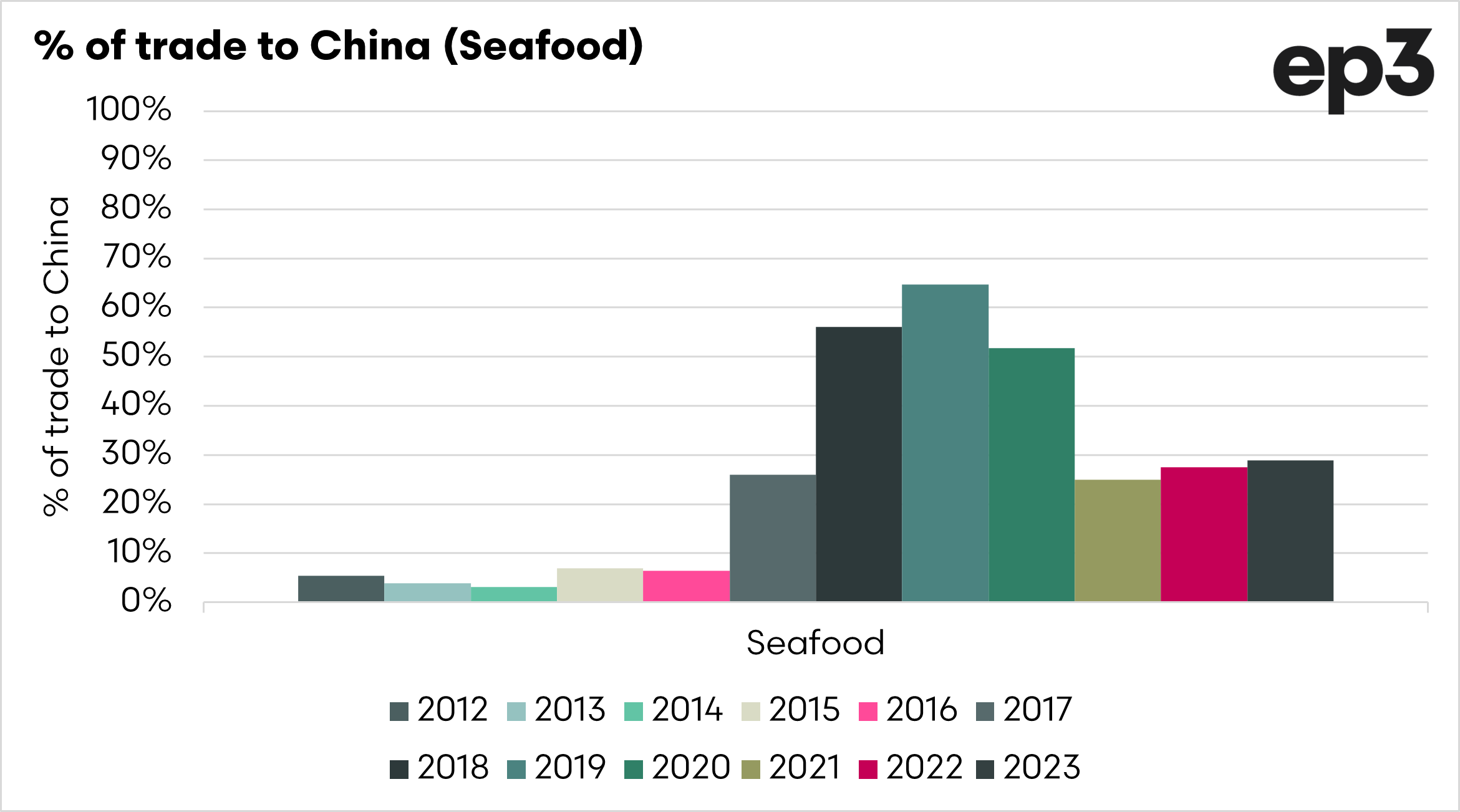

- We effectively lost trade access into China for a few of our commodities (wine, seafood and barley), and there was an attempt to diversify.

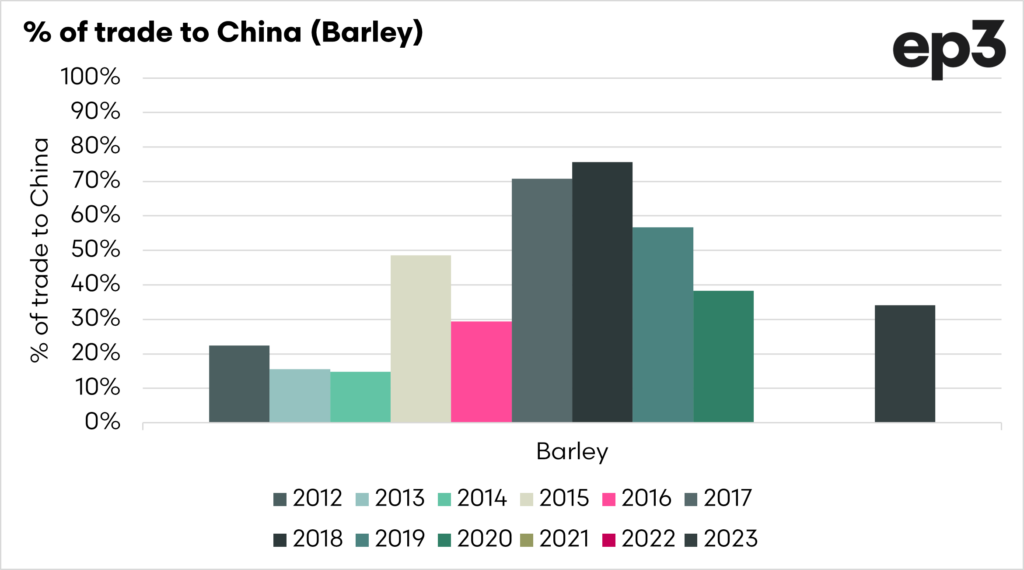

- In the past year, Australia has shipped three quarters of our barley to China.

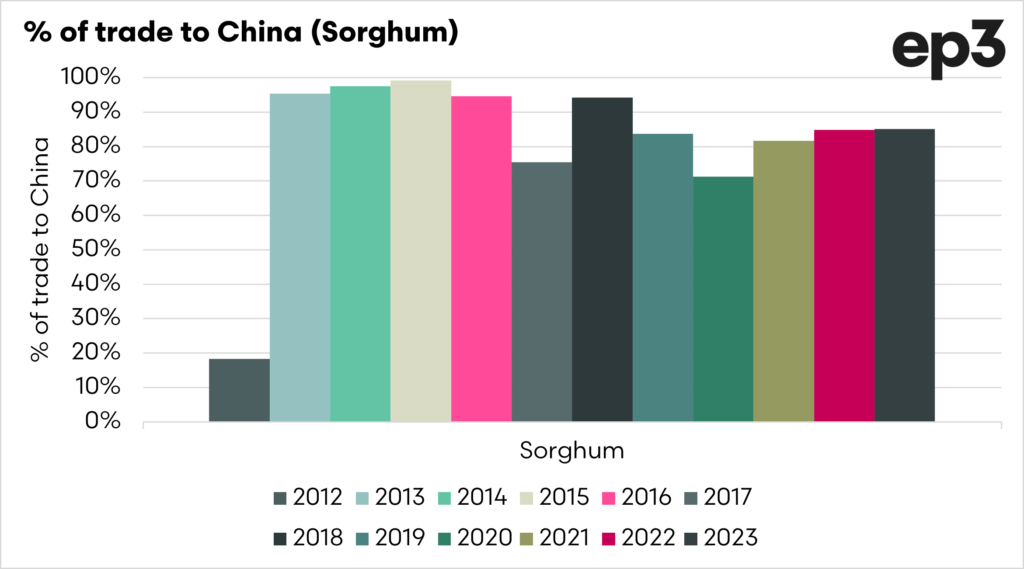

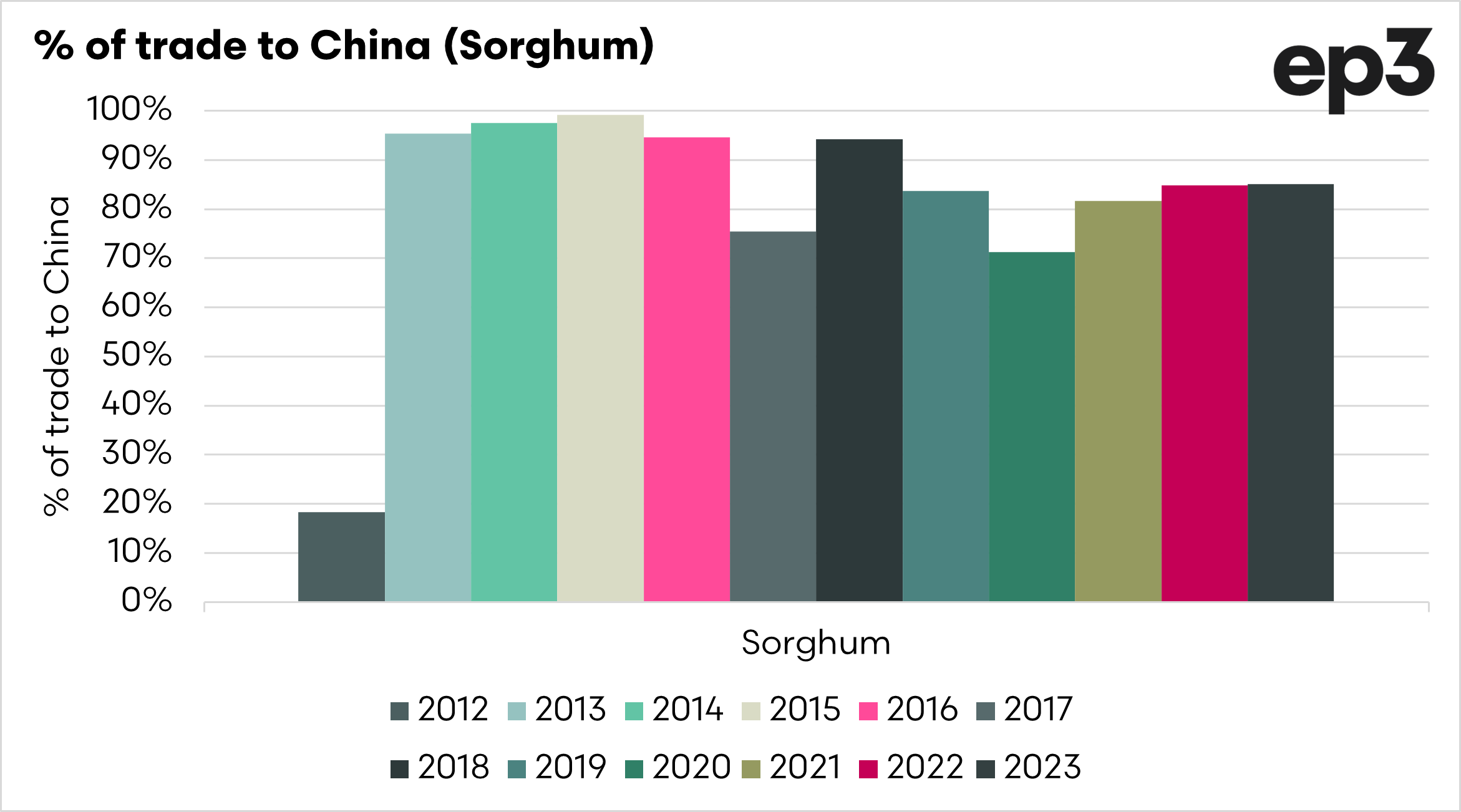

- Sorghum has a huge reliance on China, with at times nearly all of our sorghum exports headed to China.

- All of our agricultural commodities not impacted by government action have seen increases in percentage sent to China compared to ten years ago.

The Detail

Australian agriculture is reliant on exports; increasing domestic consumption of our commodities will only go so far.

I recently recorded an interview with Warwick Long on ABC about the reintroduction of China into our barley market, which you can listen to here. The discussion, and many others we have had recently with people, has been about reliance on one market for our export commodities. It got me thinking, is barley our only reliance on China.

I grabbed the export data available as dollar values for some of our major export commodities from 2012 to 2023.

- Barley

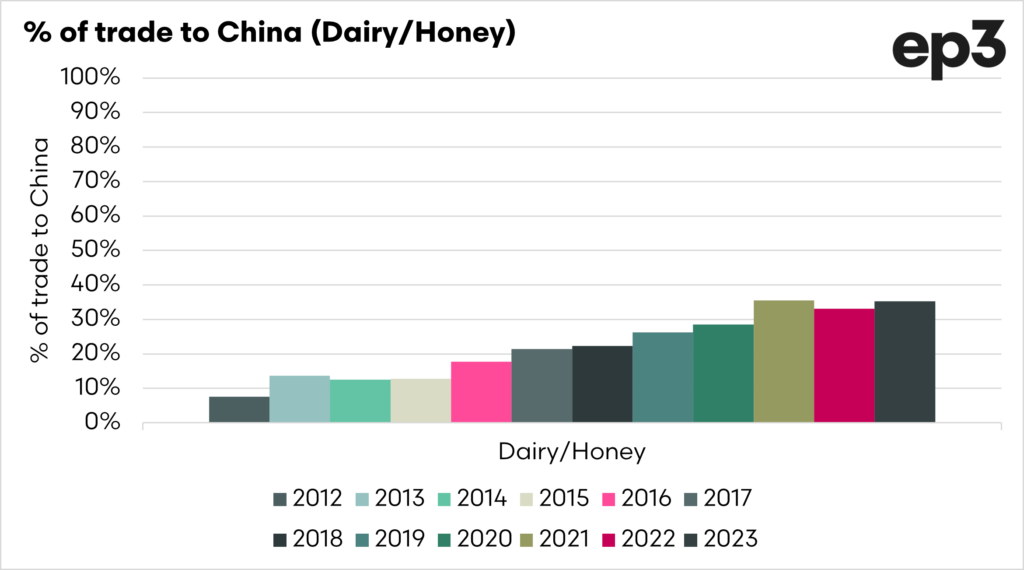

- Dairy/Honey

- Seafood

- Sorghum

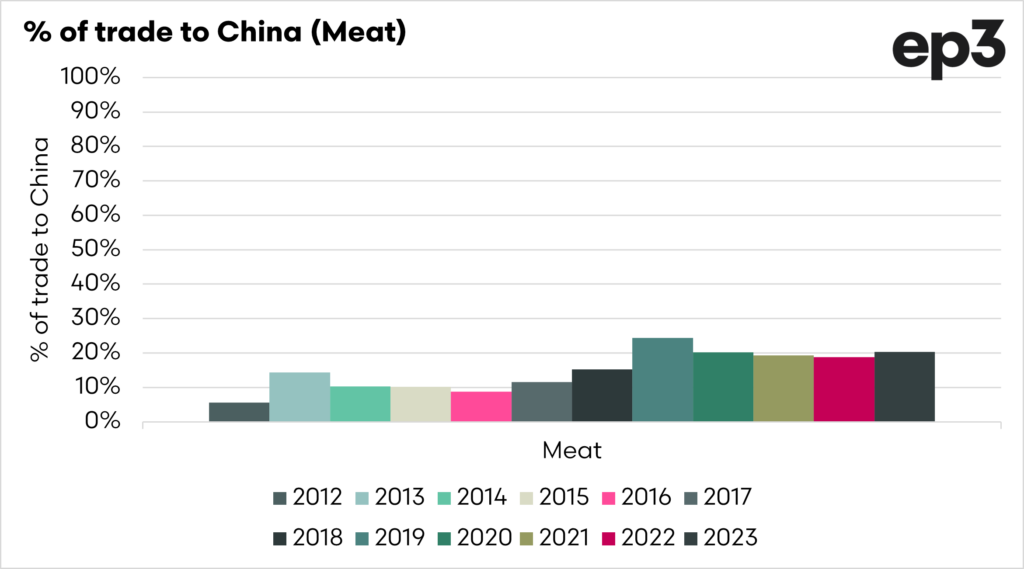

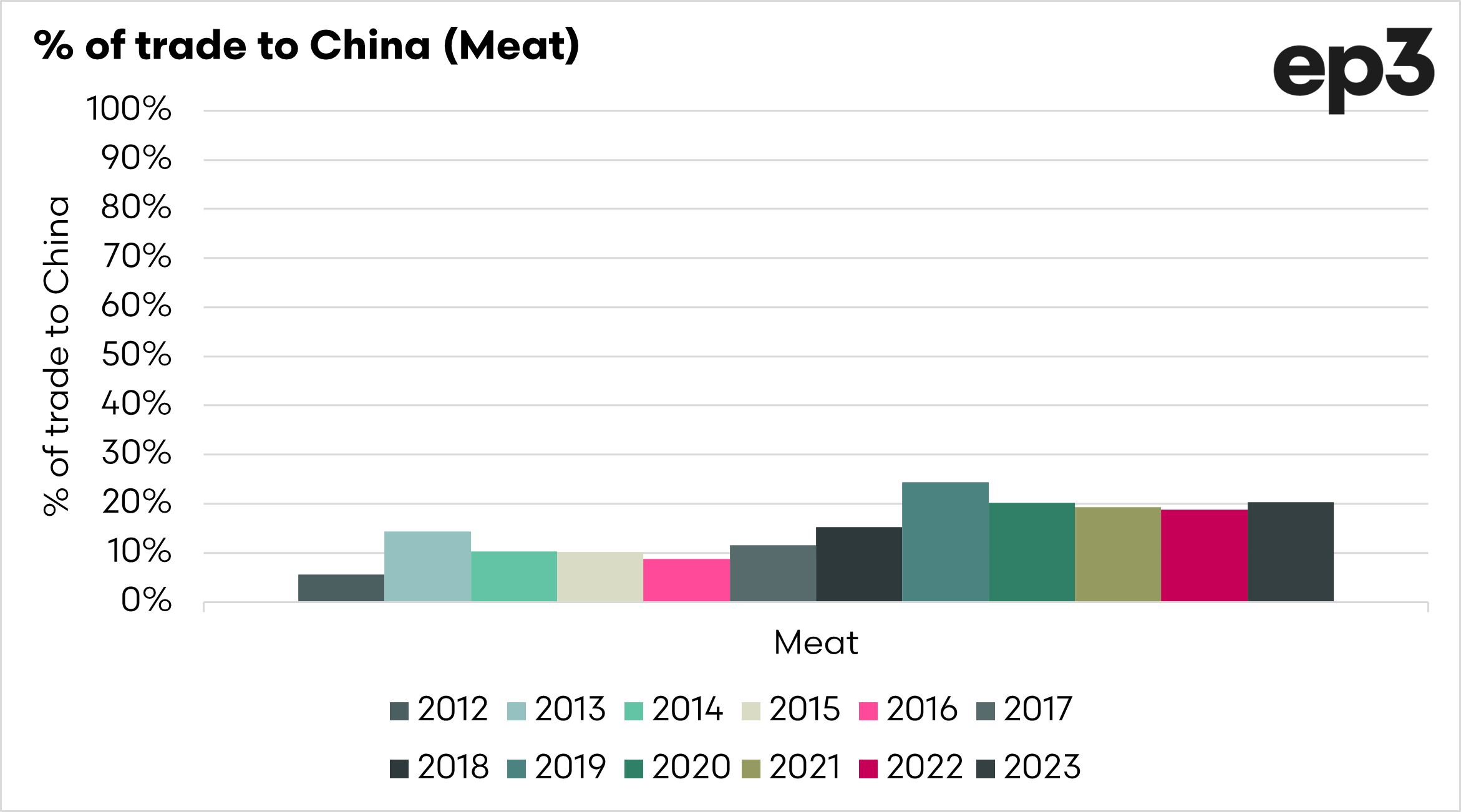

- Meat

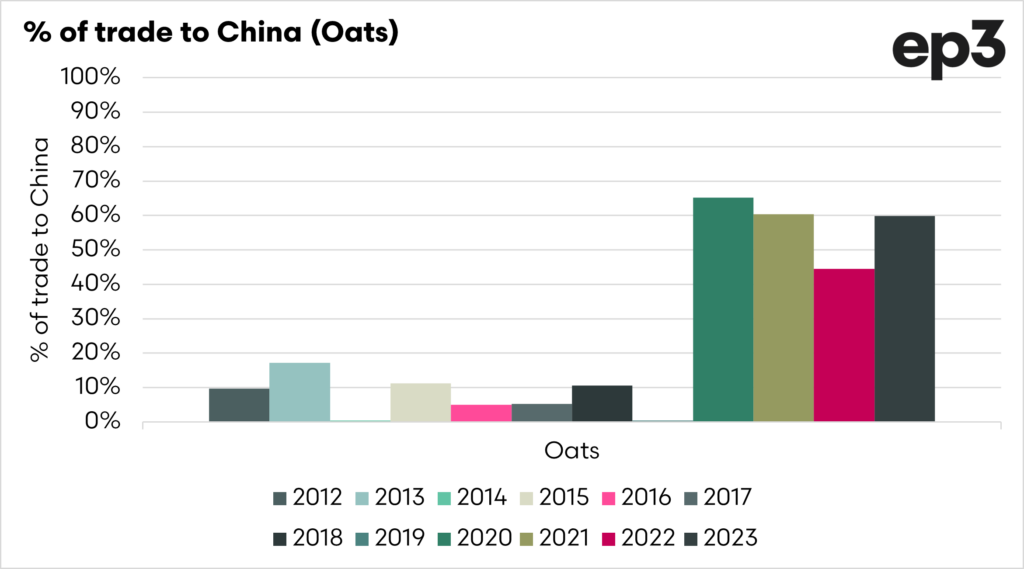

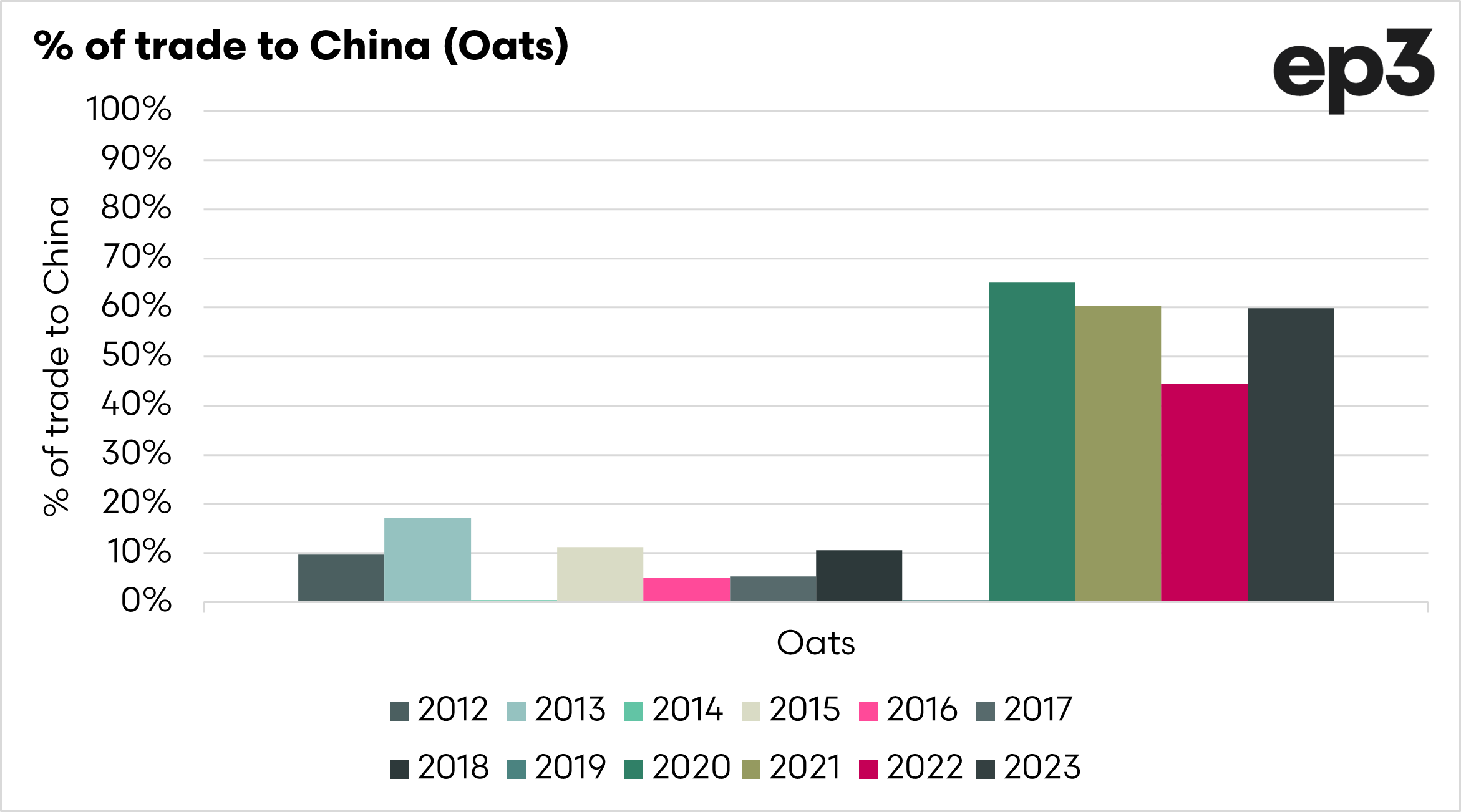

- Oats

- Wheat

- Wine

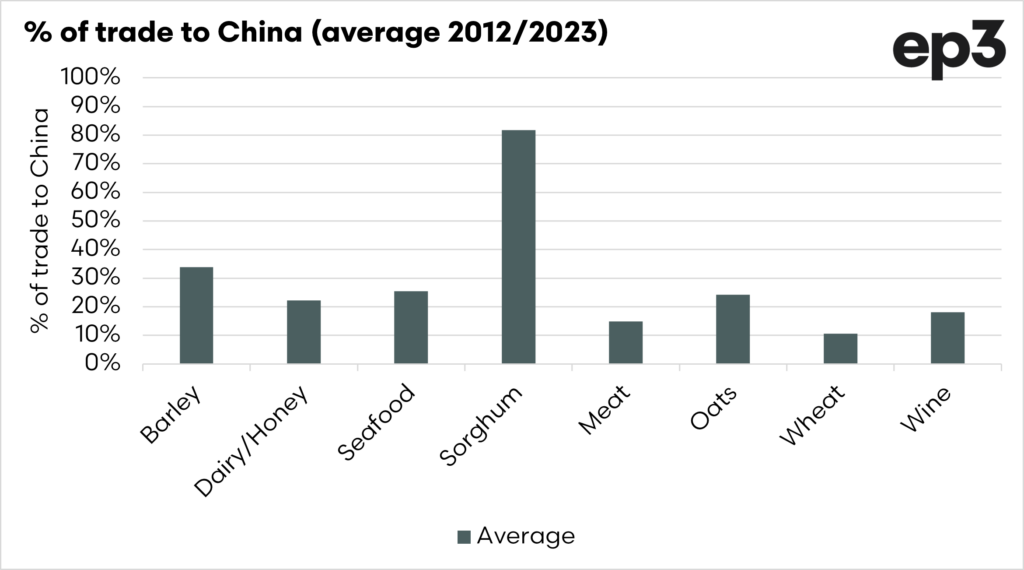

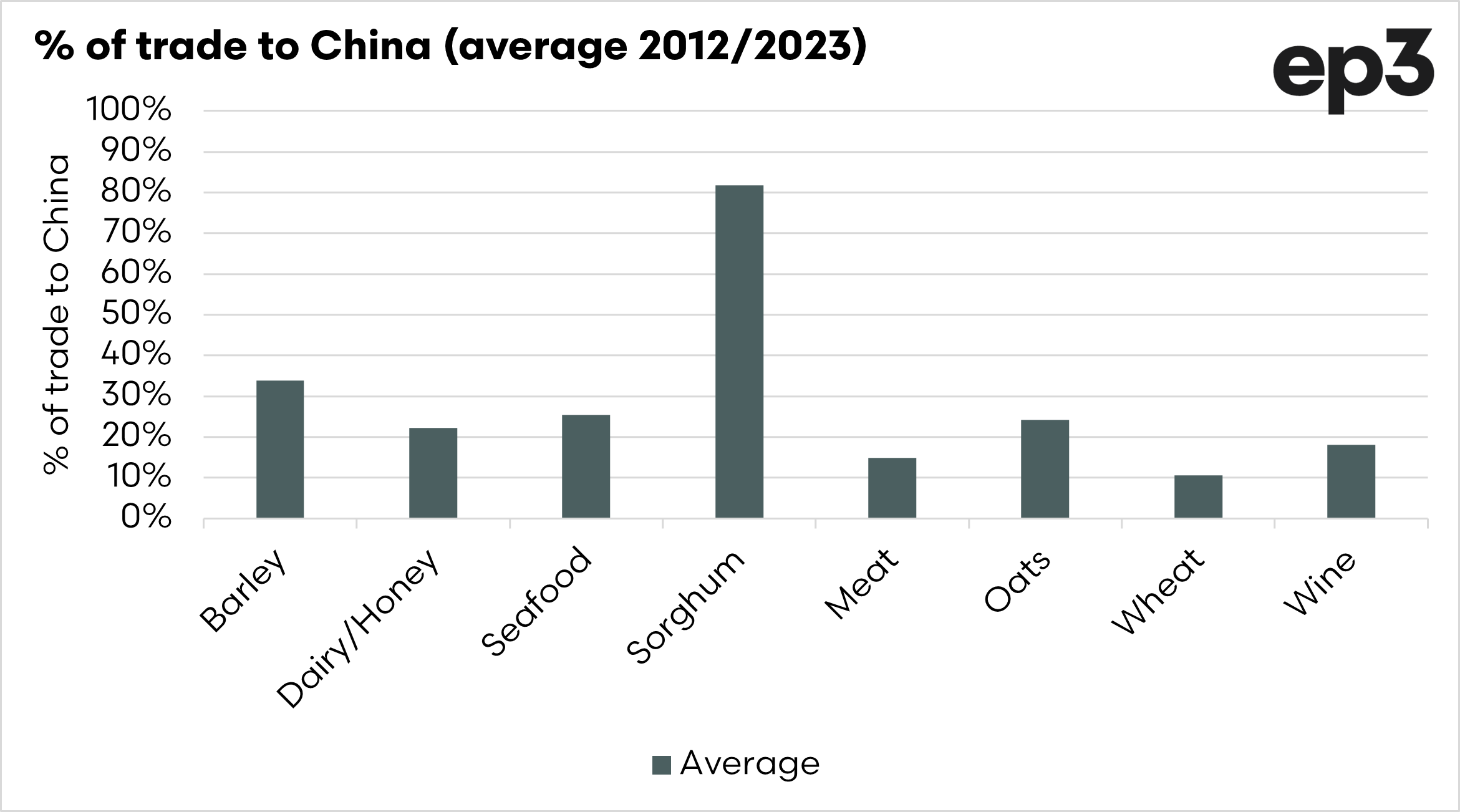

Let’s look at the overall picture, the chart below shows the % of our trade headed to China as an average from 2012 to 2023. China was a market for less than 35% of our trade for these commodities with the exception of sorghum, which was 82% of the total trade.

We are heavily reliant on China as a destination for our sorghum, and it has been like that since 2013. At its zenith, 99% of our exports of sorghum were destined for China. If China has a hiccup and reduces demand, or they decide to play funny with Australia, they could cause a lot of havoc to our farmers.

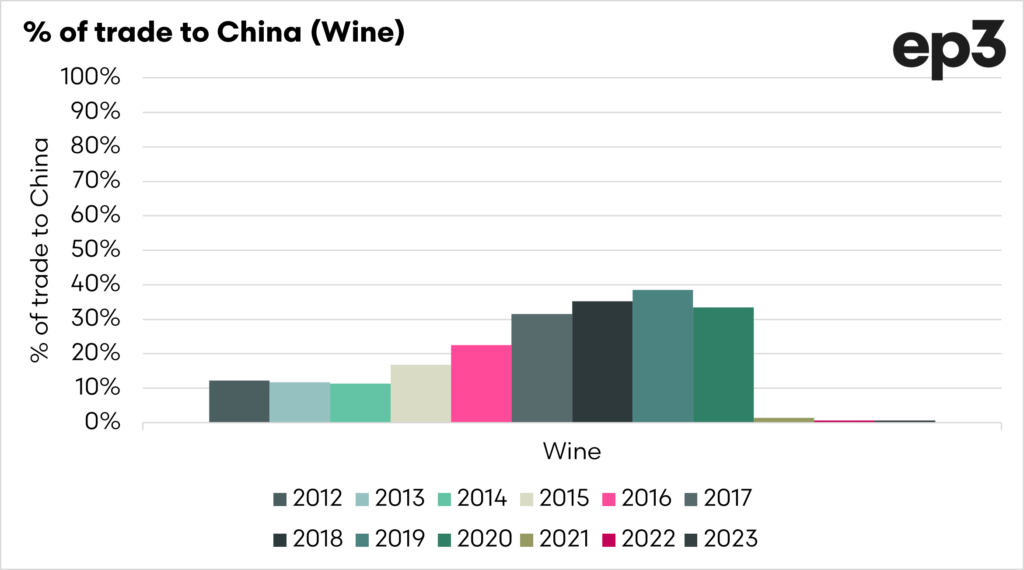

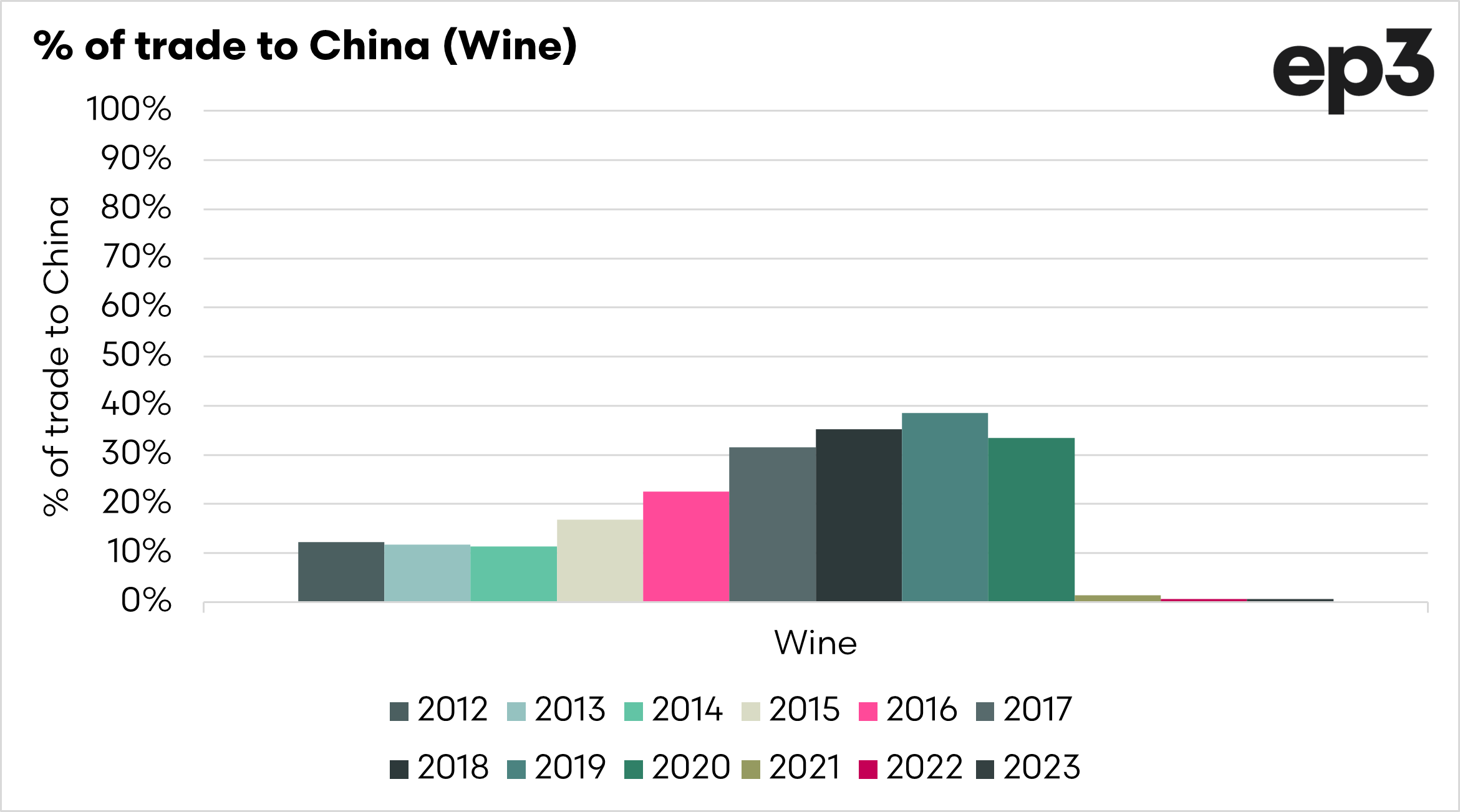

The individual charts all the selected commodities are shown below. There are some commodities where volumes have dropped in recent years due to actions from China, such as barley, wine, and seafood.

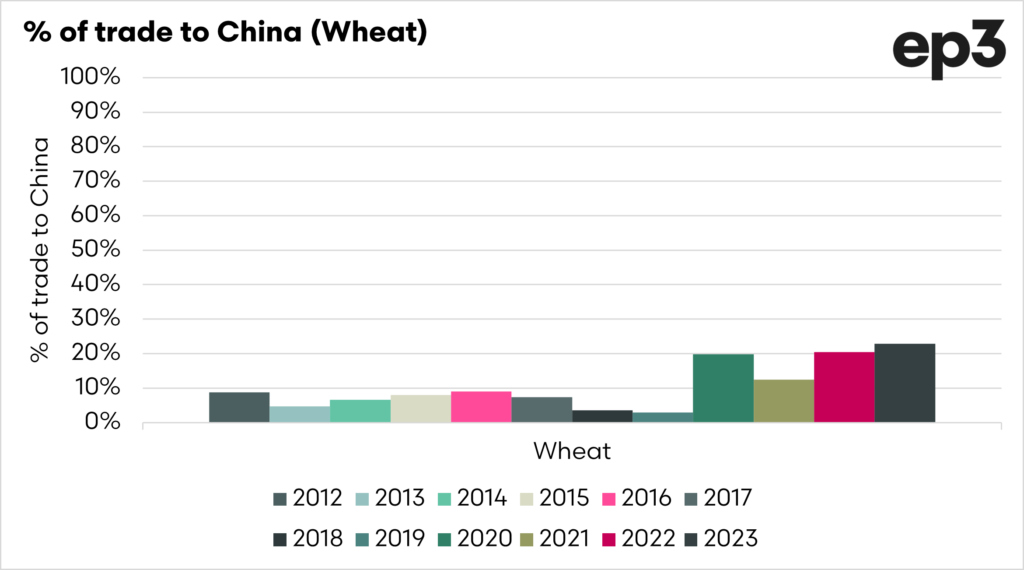

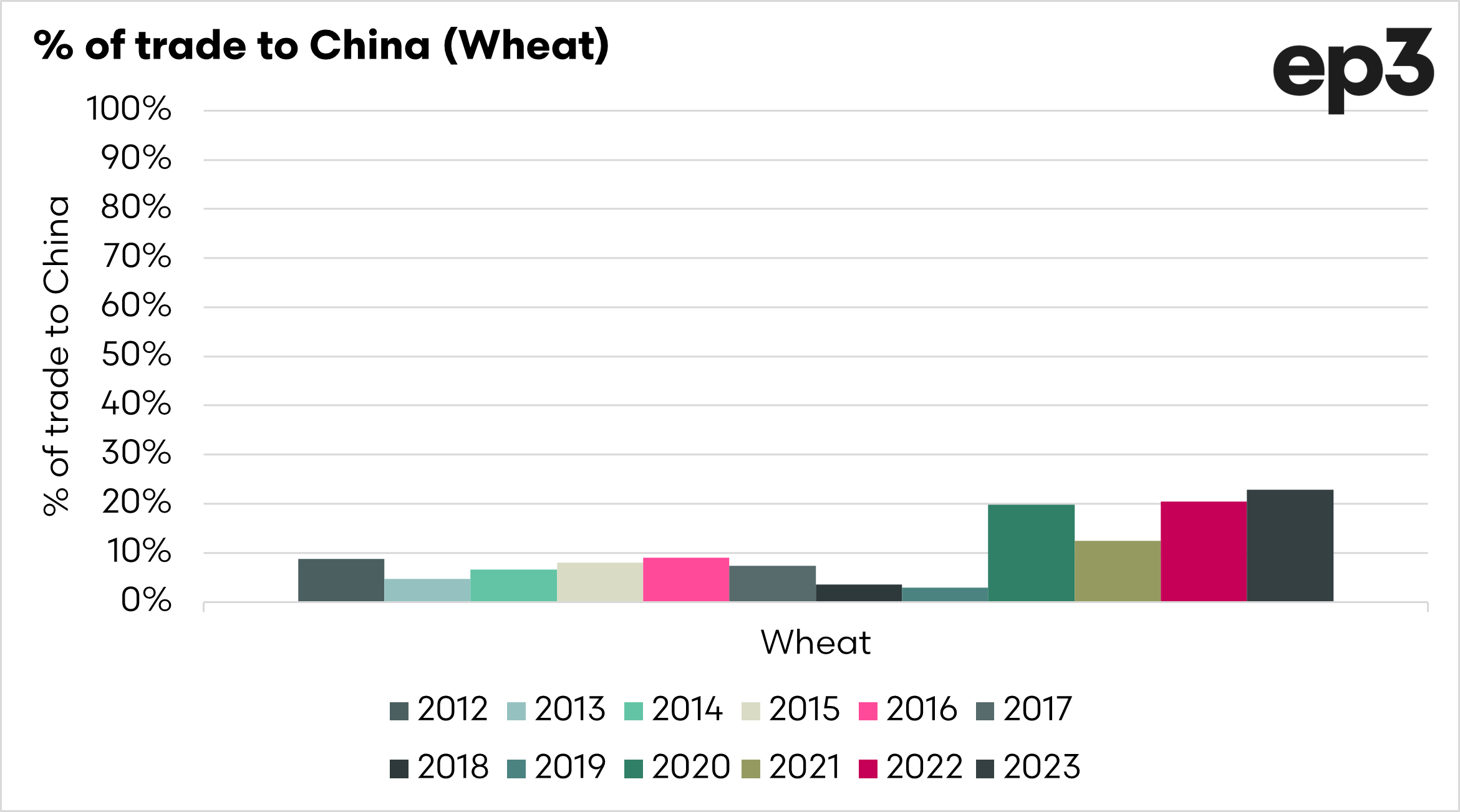

Other commodities have seen strong demand, such as wheat, oats, dairy/honey, and meat, which are all more heavily represented than they were at the start of the timeframe selected.

The volume across all these commodities are all significant, and it is important that we ensure the continuation of a strong relationship with China. They are crucial to ensuring that our commodities get a decent price. If we lose China, then we will be selling into alternate markets, which may not have the same value attached to them.