Dairy circus 2025

Independent Contributor

The Australia/NZ milk market is quite fascinating this year….after the highly competitive June 2022 and 2023 seasons when Australian processers competed fiercely for milk in a shrinking pool, 2024 was very quiet. Processors had lost money and quietly or accidentally colluded to ‘claw back’ some of their losses.

This season started out with both Australia and NZ processors paying low $8/kgMS, very quickly the GDT auctions bounced, and the NZ milk price hit $10/kgMS and may even finish the season a touch higher with futures about $10.15. Oddly Australian processors did not feel the need to pass on GDT increases, generally with the excuses that 70% is consumed domestically and contracted.

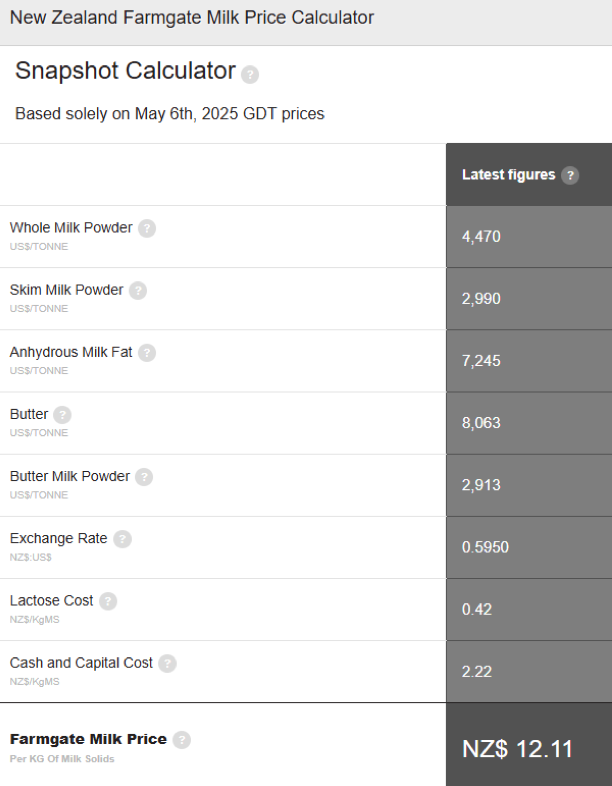

But what will be their excuses come June? This month Fonterra NZ will announce its opening price expected to be at least $10, as you can see below the NZX calculator based off the last GDT indicates a whopping $12.11! This is quite transparent as 90% of NZ product is exported.

The recent U-turn in Fonterra NZ strategy is to focus on its ingredient business and sell off the main brands with the Australian business, which makes the above calculator even more transparent but clearly exposed to Global Supply/Demand metrics, hence their opening price can be adjusted downwards based on the same very simple calculator.

The “Dairy Code” in Australia means Australian processors cannot adjust prices down during the season, so what is going to influence them to pay more than the closing circa $8.50 this season?

The Big 3, Fonterra, Saputo and Bega control roughly 20% of the market each and the curve ball is whether Bega buys Fonterra’s offering or at least a large share…..This is really interesting as effectively Bega is buying their main brands back, in itself quite logical, the odd part of the deal is that Fonterra only has the rights to some of them long term, so brand ownership a bit cloudy to say the least.

Unfortunately this has led to a stumbling block as the original agreement doesn’t allow Fonterra to sell temporary rights to some of these brands, but surely there is a way forward as Barry Irvin (Bega Chairman), David Williams (legendary Ag deal broker) and 11.5% Bega shareholder Tattarang (Twiggy Forrest owned) have all come out favouring the deal and unanimously agree it can only strengthen the Australian Dairy industry to have a domestic owner with 40% of the milk pool.

I’d suggest this is the next best thing to a supplier Co-op, as farmers are welcome to buy shares and possibly enjoy a 10% dividend as NZ Fonterra shareholders are currently.

The other potential buyers are French owned Lactalis, American private equity firm Warburg Pincus, and Japan’s Meiji Holdings, all of which are 100% focused on their shareholder returns and do not have Begas assumed Australian interests at heart.

Unfortunately for Australian farmers, many under enormous pressure from prolonged dry conditions, I expect all this noise means the Australian opening price is unlikely to be much higher than this season’s closing of circa $8.50. However, if you have supported a co-operative model in the past and are Australian loyal, taking a punt, supplying Bega and buying some shares could have you enjoying a possible bounce in share value and a reasonable dividend if a Fonterra/Bega merger is the result.