Engines and Animals: Biofuels Set to Transform Feed Markets

The Snapshot

- Australia’s $1.1 billion biofuels grants will create a major new source of grain demand and regional investment.

- A domestic biofuels sector would compete with livestock feeders for grain, especially in drought years if mandates are introduced.

- Biofuel plants produce high-protein by-products such as DDGS and canola meal that can offset higher grain prices.

- Greater local production of these meals would reduce reliance on imported soybean and palm kernel meals, improving feed security and lowering transport emissions.

- Locating plants near feedlot, dairy and pig hubs would maximise co-product value and support integrated grain-livestock supply chains.

The Detail

The news of A$1.1 billion in grants to develop a biofuels industry in Australia is significant and a huge boost for Australian agriculture. We have spoken extensively about the need to find new sources of demand for Australian grains, and biofuels have consistently been identified as a significant opportunity that has largely been overlooked in Australia.

Like our mining, we export the base commodity and allow other countries to add value to it. We do this through sending our canola to Europe and our sorghum to China.

The announcement has been well received by most in the Australian grain sector. There is another sector which will be significantly impacted – the livestock sector.

The livestock sector will experience significant changes if the biofuels sector becomes a primary industry in Australia, due to the byproducts.

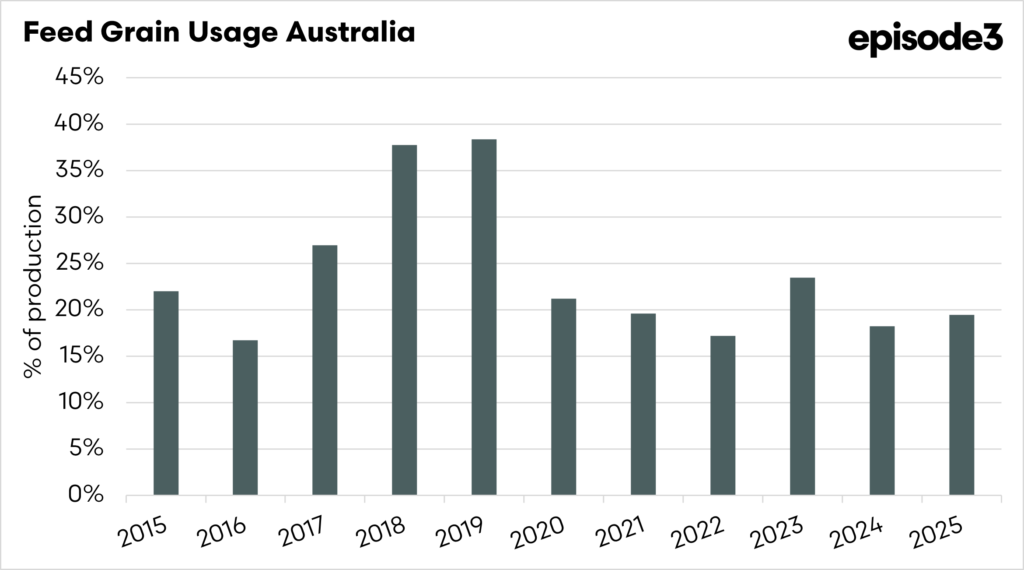

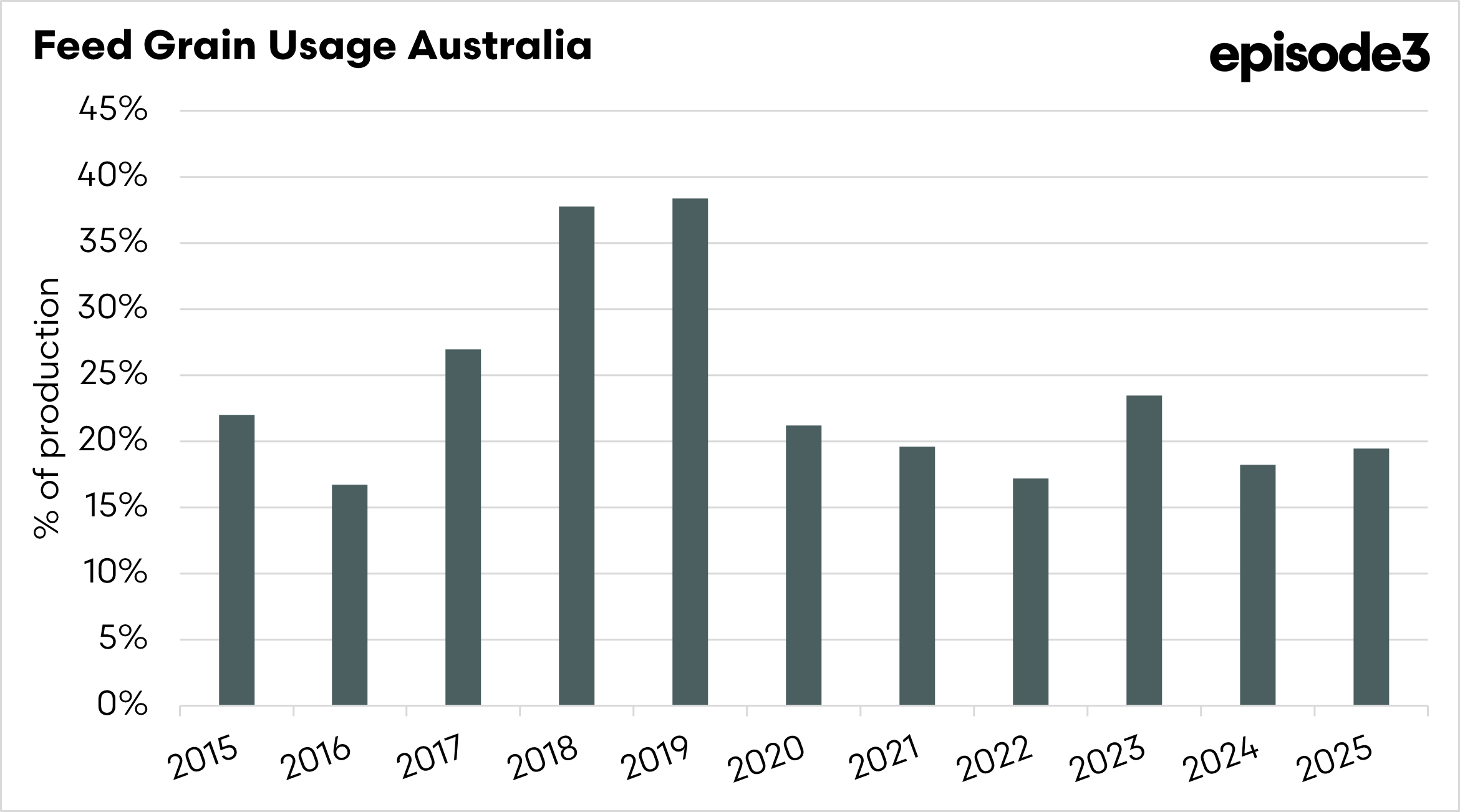

The Australian livestock industry purchases a significant volume of grain grown in Australia. Typically, around 20% of all grain produced in Australia will be used for domestic feed grain, whether that be dairy, pigs, poultry or cattle. This volume increases significantly as a percentage during drought, due to the higher demand for feed resulting from the lack of pastures.

The advent of a new domestic biofuels industry will result in feed users competing with the biofuels sector. Currently, there is no discussion of a mandate for the inclusion of biofuels. However, if such a mandate were to be implemented, it could become a requirement that the biofuels sector must meet, regardless of the price. During a drought, this could be particularly detrimental for feed users.

On the flipside, there will be significant benefits for livestock feeders in the form of by-products. Grain-based ethanol and renewable diesel plants generate high-protein co-products such as distillers’ grains or canola meal. These feeds are proven staples in markets like the United States, where the ethanol industry supplies feedlots and dairies with large volumes of cost-effective protein and energy. If Australia develops a sizeable biofuels sector, these by-products could partly offset higher grain prices by creating a new, consistent supply of high-quality feed.

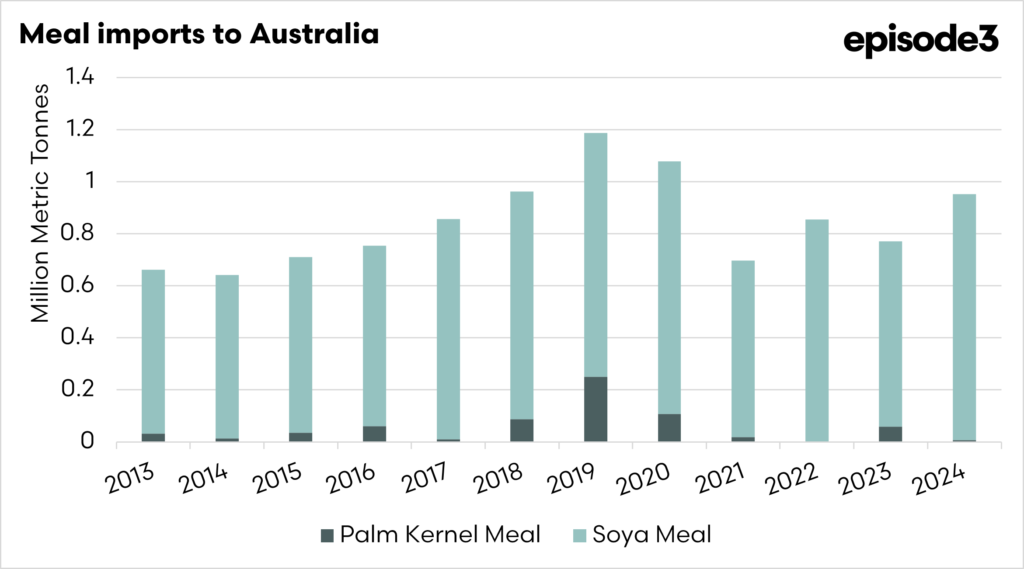

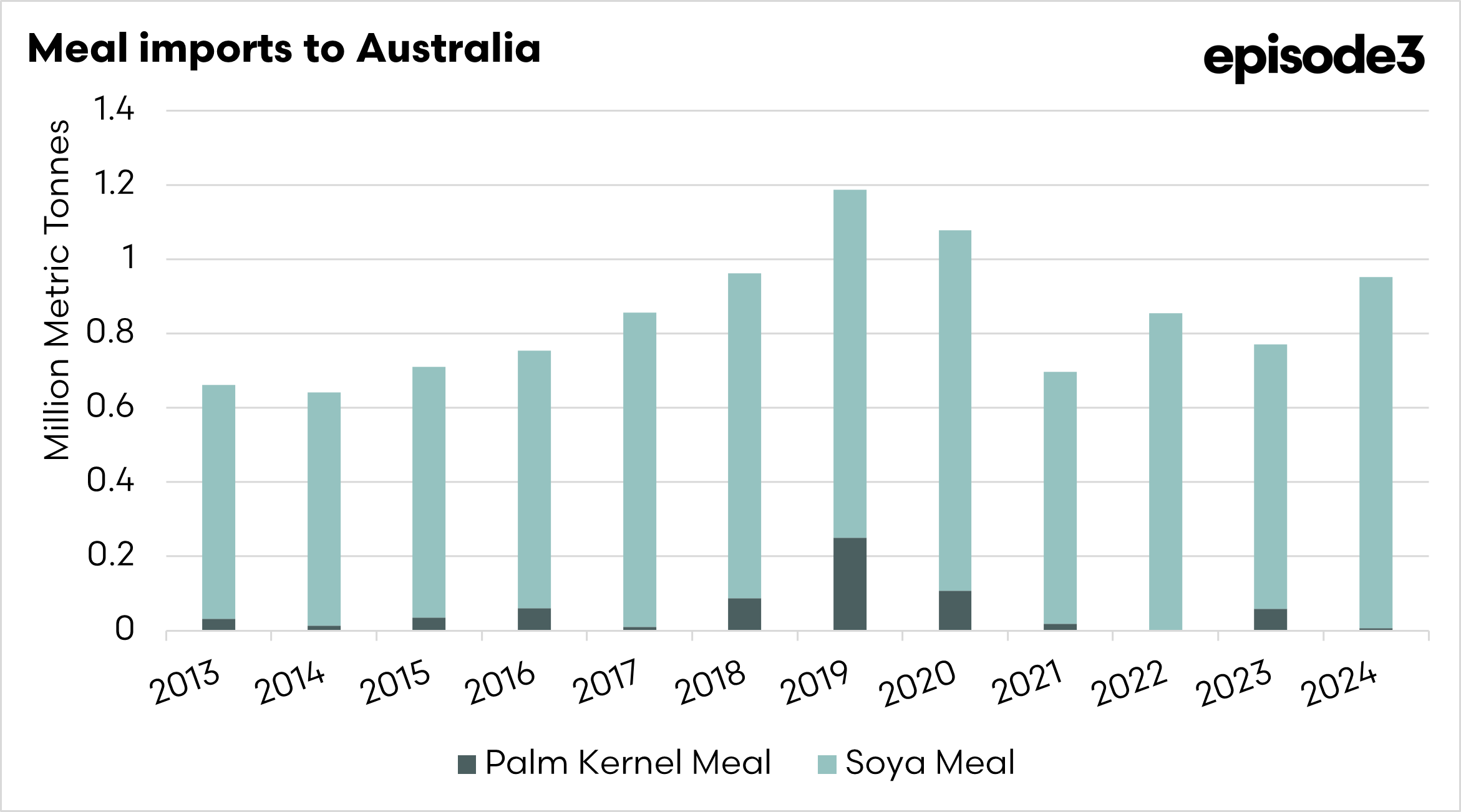

Australia already imports meal into Australia for the domestic feed market, mostly soya meal and a little bit of palm kernel meal. A domestic biofuels industry would take away some of this requirement to import.

If Australia’s biofuels industry expands on the back of sorghum and canola, the resulting surge in distillers’ dried grains (DDGS) and canola meal would provide local livestock feeders with high-protein alternatives to imported meals.

Greater domestic crushing of canola for renewable diesel would generate large volumes of canola meal, while sorghum ethanol plants would produce DDGS, both of which are well suited to beef, dairy and, to a lesser extent, pig and poultry diets. This additional supply would reduce Australia’s reliance on soybean meal, which remains essential for monogastric species but is currently almost entirely imported, and significantly curtail the need for palm kernel meal, primarily used as a lower-quality filler for cattle. The net effect would be a more secure and competitive domestic feed market, less exposed to global price swings and freight costs.

When the government and industry are considering their plans for the future of biofuels in Australia, the livestock sector needs to have a seat at the table.

As plans for this new industry take shape, the livestock sector must have a clear voice in policy and investment decisions. Locating biofuel plants near established feedlot, dairy, or pig production hubs would maximise the value of co-products, lower freight costs, and encourage the growth of integrated grain–livestock supply chains. Alternatively, plans for a livestock sector to grow in parallel with the biofuels sector would create significant synergies.

When done well, a domestic biofuels industry can create a rare win–win for Australian agriculture, driving new demand for grain while delivering protein-rich byproducts and regional infrastructure that underpin a competitive and resilient livestock sector.

Australia’s A$1.1 billion biofuels push is more than an energy policy. It is a structural shift for the nation’s grain and livestock industries. If designed with care, the same plants that compete for grain can also deliver protein-rich meals and regional investment that strengthen feed security, reduce import dependence, and lower emissions by reducing the need to ship feed meals from the other side of the planet. Ensuring the livestock sector is embedded in planning from the outset will be critical to capturing these benefits. Done well, the rise of biofuels can fuel both engines and animals, creating a more resilient, lower-carbon and profitable future for Australian agriculture.