Global Ag Investment

Independent Contributor

On the third bottle of shiraz over lunch I convinced a client to partially sponsor me to seek investors for him at the Global Ag Investment Conference in New York 22-24 April. The annual event attracts circa seven hundred delegates and investors from all over the world, with three days of fantastic speakers and networking.

After a week in Chicago with Russian friends I headed to the Big Apple and immersed myself into three days of presentations and networking. As we all know much can change in a year and the hot topic to start was of course Trumps tariffs…Various inconclusive scenarios were suggested by different speakers, but the general consensus was its just big Don stirring the pot and things will settle down, although overwhelming opinion that he is an idiot.

All American’s I spoke to saw no logic in the tariffs and many close relationships especially Canada had been damaged. Brazil, other BRICS countries and us, seem likely to supply China with tariff free produce, trade which American farmers are unlikely to get back. One presenter mentioned that while the USA has 4% of the world population they have 26% of the worlds GDP.

The mix of the attendees seemed to be about a third Investors, with a combination of Pension, Institutional, family business and private equity. A third Fund managers seeking investors as well as opportunities, and the other third Real Estate firms, bankers, tech firms and some farm services.

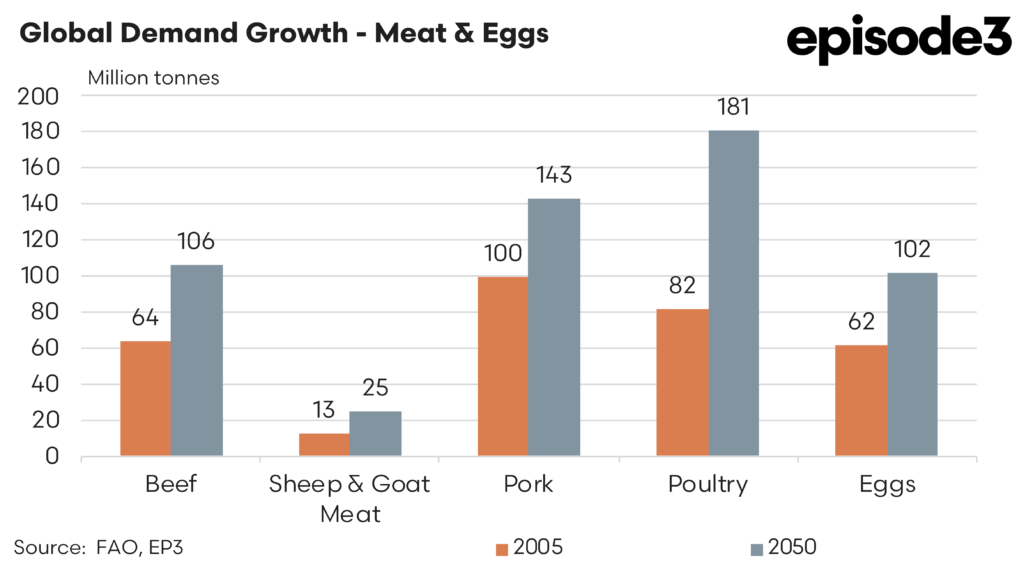

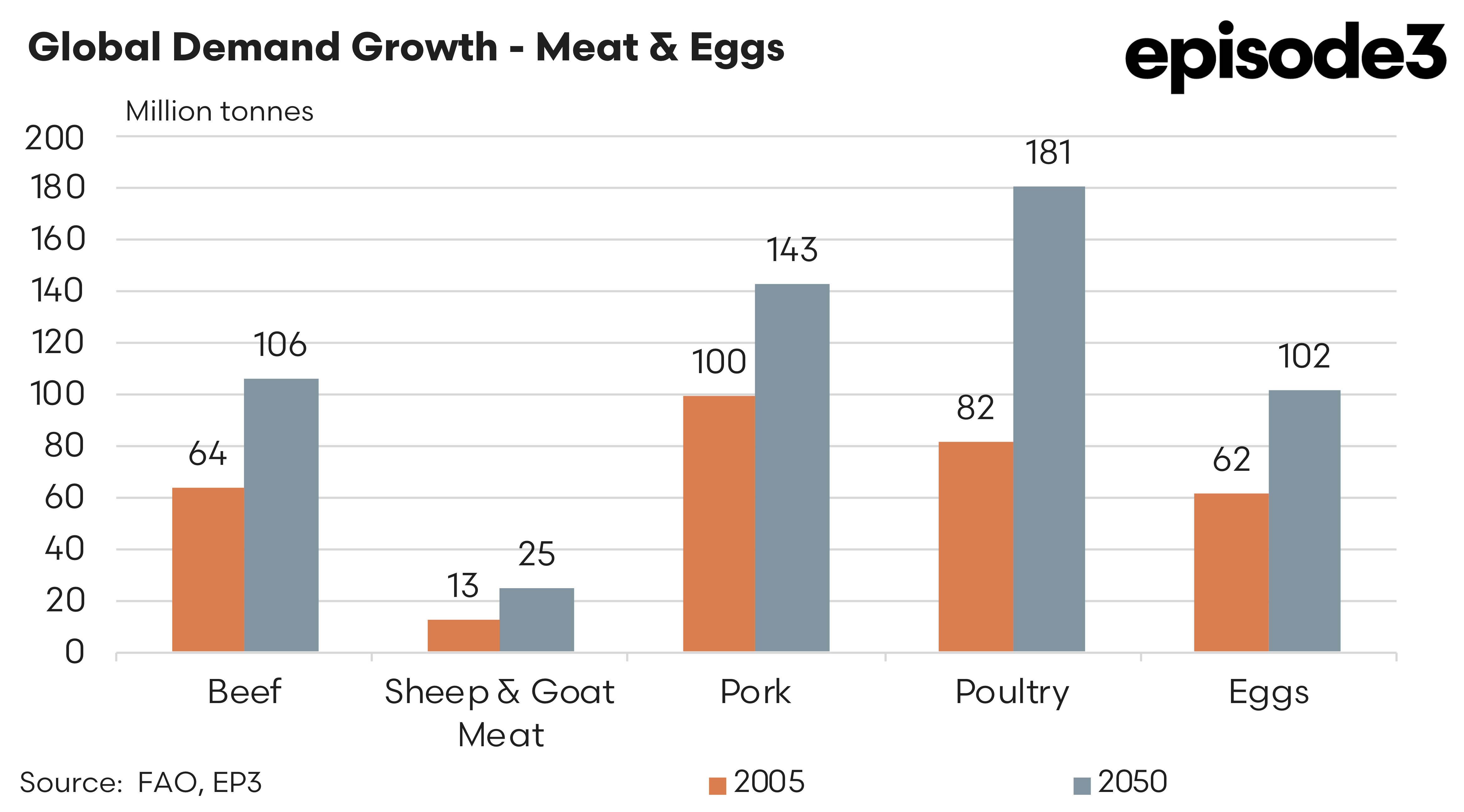

Australia based fund managers presented on their industries. All of them very upbeat based on the below demand numbers. Horticulture and Dairy demand telling the same story.

Go-farm – Spoke on the improving Almond prices and olive oil demand with a new project to potentially plant another 7,000 acres. They highlighted an almost 2 for 1 deal for Americans with the current exchange rate.

Warakirri – Displayed another graph with global dairy demand doubling between 2023 and 2032, and have a strong desire to grow their dairy portfolio in Australia and NZ. Benefits included a 20% lower cost of production and 50% less emissions than most other milk producing countries. They spoke about the Indonesian government’s intention to give their 83 million students milk every day.

ROC Partners – Excited by tech, these guys have a large part of their business in glass houses. Robots are literally taking over and the labour savings are significant. They actually partner with the Robotics companies to lead the industry in new developments. Of particular interest was robotic pollination which significantly improved yields.

Laguna Bay and Stepstone Group – Had a panel discussion on natural capital and queried whether we had reached ‘peak greenwashing’ and suggested this may have turned to ‘greenhushing.’ With carbon markets around the world flat, natural capital while trendy will need to show reliable returns to attract investment.

There seemed to be a step change in regenerative farming and natural capital attitudes, investors and the public slowly waking up to the fact that most farmers were already regenerative or sustainable, reversing desertification and human damage a separate argument.

The emphasis was on a business’s ‘green story’ as opposed to money or systems invested in emissions offsetting. ESG seemed to be a ‘worn out’ term, and put in the box ticking file, although social license came through as increasingly important in our nanny states. Oddly but not unexpectedly this has a different level in the States with an open appreciation of cheap Latin labour.

Some fun fact about America….and a Trump story

- Petrol and Diesel at AU$1.50/litre

- A pitcher of Lager $AU and a pie $AU12, don’t forget the 10% tip!

- The government pays 65% of farmers crop insurance premiums.

My friend in Chicago immigrated from Russia 10 years ago after 2 years in the Ukrainian army followed by 5 years in the Russian special forces fighting in Chechnya (I know, some crazy stories). He has been a contract truck driver for 10 years hauling big stuff (diggers, tanks for army etc) sometimes from Texas to Alaska across multiple states, all with different laws and taxation/fees, ie. in one state he pays $15 to drive through, the next is $800 and a pilot vehicle.

During Trumps second term last time he saved half a million dollars in 2 years as a contract truck driver (doesn’t own the truck)..…Trump was literally making America great…..now he still trusts Trump to pull them through.

One negative from the conference was livestock farming was barely mentioned until it came up in a succession planning session with local beef ranchers. Many of the funds I spoke too had an aversion to beef, sheep, poultry, pork, and often dairy farming due to the perceived animal welfare reputation risk they could be exposed too.

Remote management of permanent and rows crops is seen as having lower operator or management risk especially when combined with reliable irrigation water.

American farm values have lifted recently and this quote from George Morrow of University of Illinois in 1878 came up.

“There are two sources of return to agricultural land: the first the annual income on the products grown thereon and the second the increase in the value of the land itself. The latter will be the greater through time.”

The best news was that the Conference is coming to Brisbane next year! If you want to get a good feel of what is happening around the globe lock it in. They had a 4-rancher panel talking about succession planning, so expect they be keen for an Australian producer’s panel….