Macro mischief – It’s the economy, Stupid.

The wider economy

It’s the economy, stupid. At EP3, we look at a whole bunch of markets in our daily work. Our focus is on agricultural markets, but they do not operate in isolation. Recently, many wider market indicators have been falling faster than an Italian soccer player.

So let’s look at some of those indicators.

Sea Freight

The freight market is important for two reasons. One is obvious – it determines the cost of moving goods around the world, whether that be bulk or boxed.

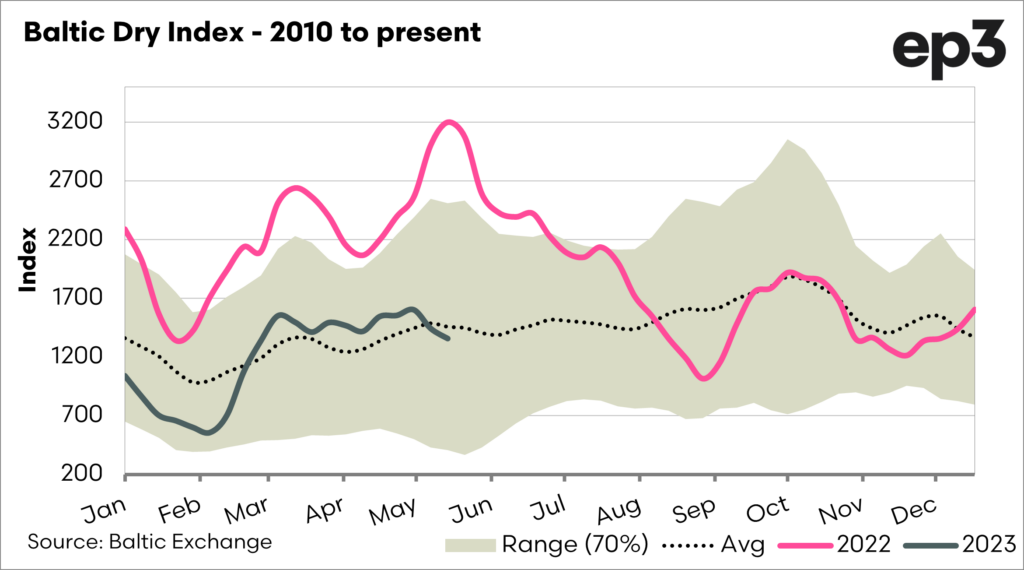

Take the Baltic Dry Index as an example. The vessels that this indicator represents the cost of moving bulk products (grain, minerals etc), which require further processing into consumer goods.

The BDI also holds a further and equally important role. The BDI is considered by many economists to be a leading economic indicator.

As mentioned previously, the BDI represents bulk cargoes, which typically require further processing. A good example is iron ore, which is shipped to other nations to produce steel. A higher BDI signifies increased demand for bulk vessels and as a proxy for the materials which they transport.

A higher BDI, therefore, points to an indication of future economic growth and vice versa. This can be seen in the early 2000s during the commodities boom. During this accelerated economic growth period, a massive demand for bulk carriers drove the BDI to a record 11793.

So reducing sea freight costs can be a lead indicator of reducing economic conditions.

Following typical seasonal patterns, the Baltic Dry Index fell at the start of the year but gained value post-Chinese new year. The levels are just below the long-term average for this time of year.

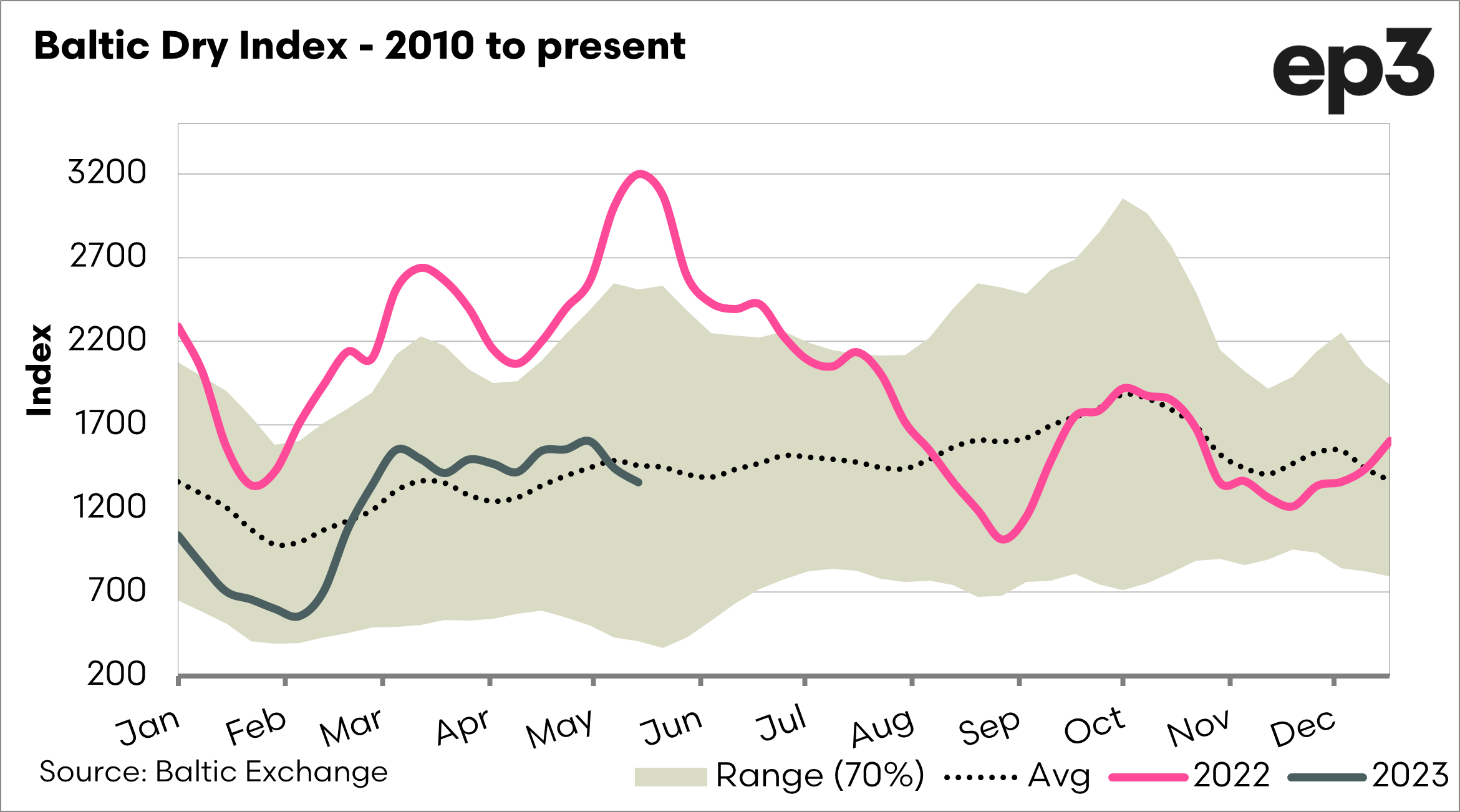

Container rates went gangbusters during covid, especially from China, as supply chains broke down during increased consumer demand for trinkets. The container rates around the world have largely moved back to pre-covid levels.

Minerals

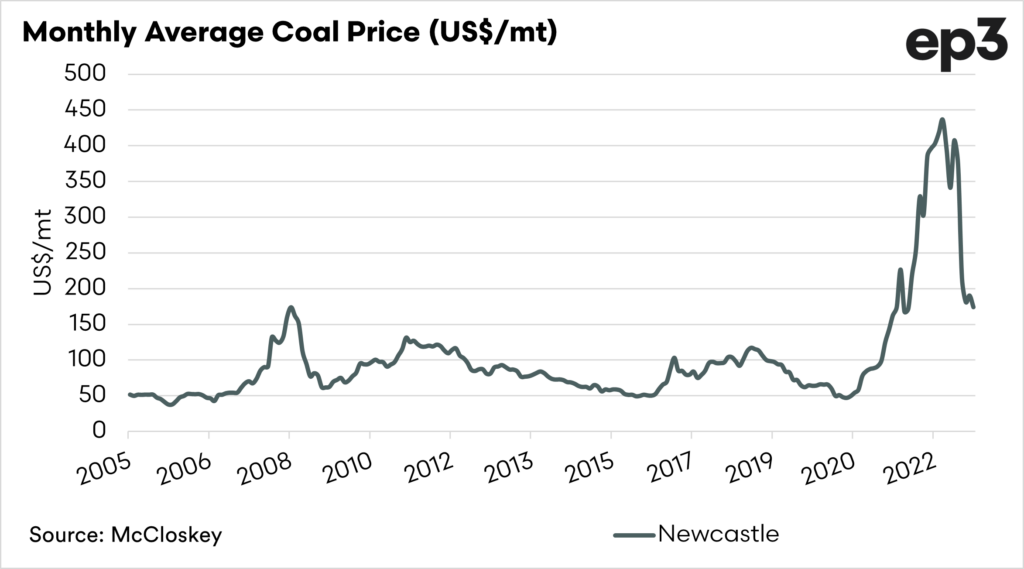

Australia was built on the sheep’s back……..but iron ore and coal have helped somewhat.

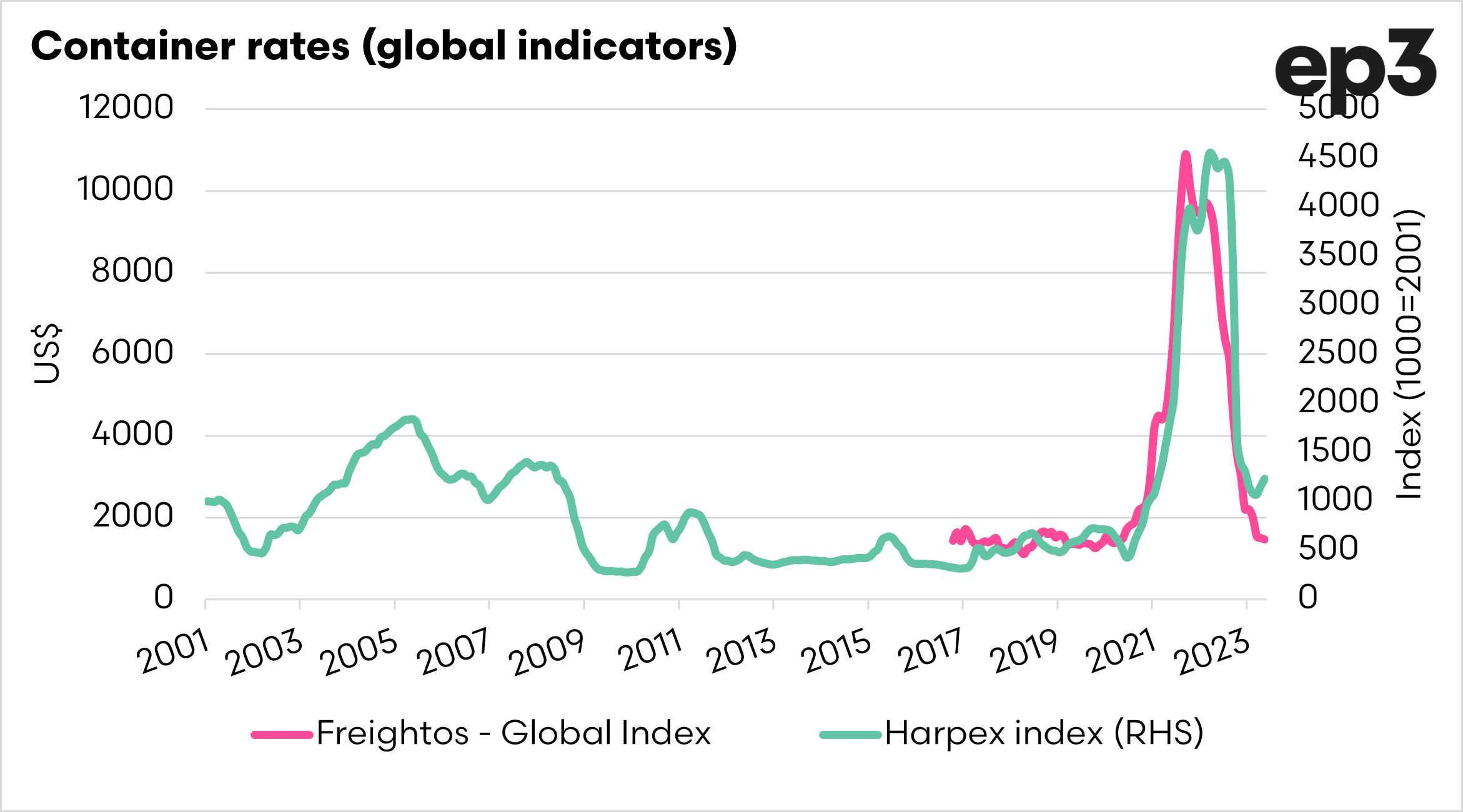

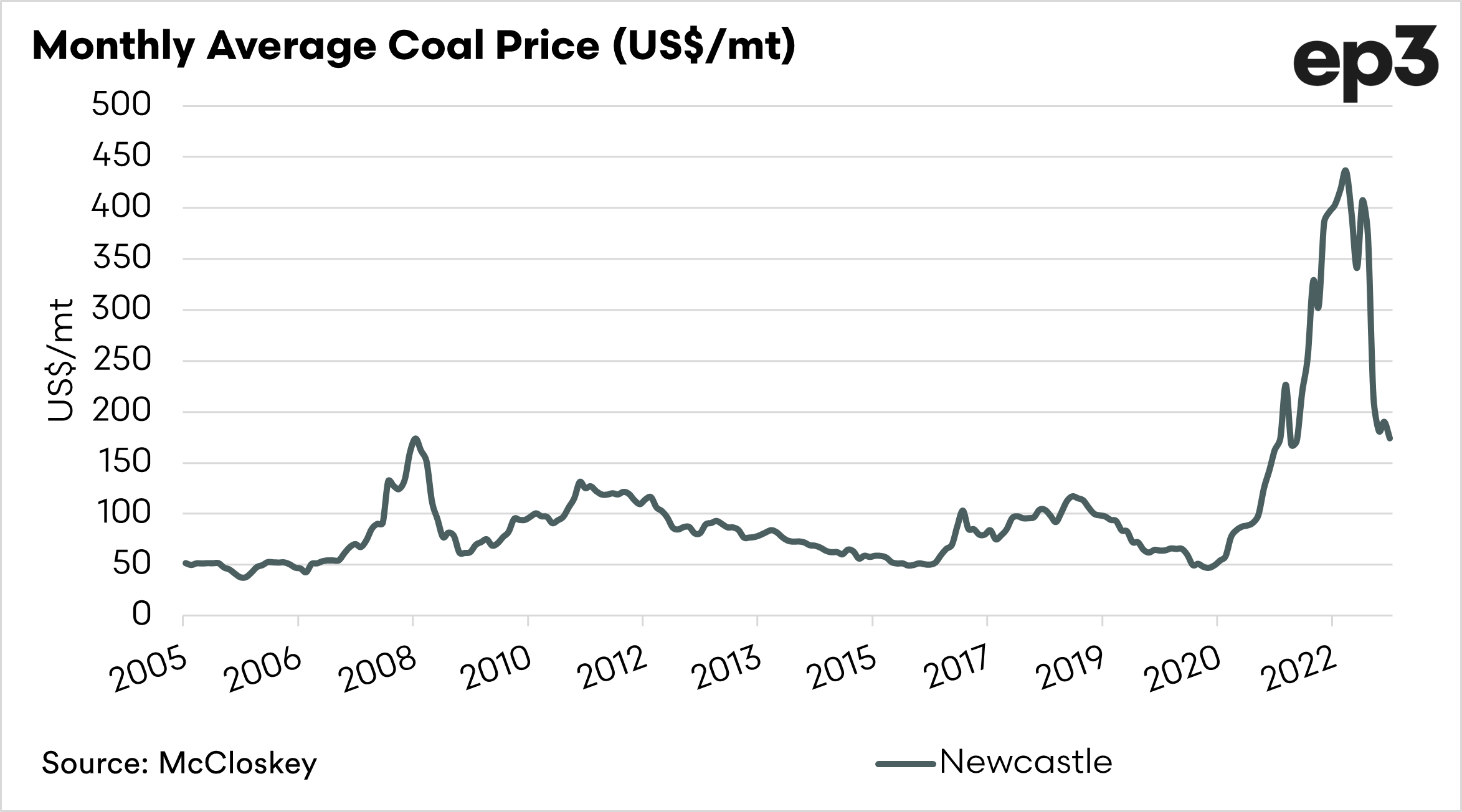

While countries are looking to reduce their coal usage around the world, no one has yet told this side of the world. Demand for coal has been strong, and prices have gone into orbit, hitting close to US$450 last year before crashing back to earth like one of Elon’s rockets.

Presently prices are half what they were last year, but still remain well above the long term average. Last year energy was massively in demand, especially as gas became short due to the invasion of Ukraine. During this time, Europe switched to more coal (see here), causing an increase in coal (and carbon pricing).

Iron ore hit US$215 in 2021. A huge level, and we have started to see pricing levels fall back. At present, iron ore is below US$100. There are fears of a reduction in demand in China in the medium term as growth potentially slows.

Remember those reports of ghost towns and towers being torn down? They were facing a major real estate crisis before being propped up. Construction is seemingly slower than has been experienced during the past two decades.

The Australian treasury might want to look between the couch cushions because receipts from Australian mineral exports will be lower than expected.

Dr Copper

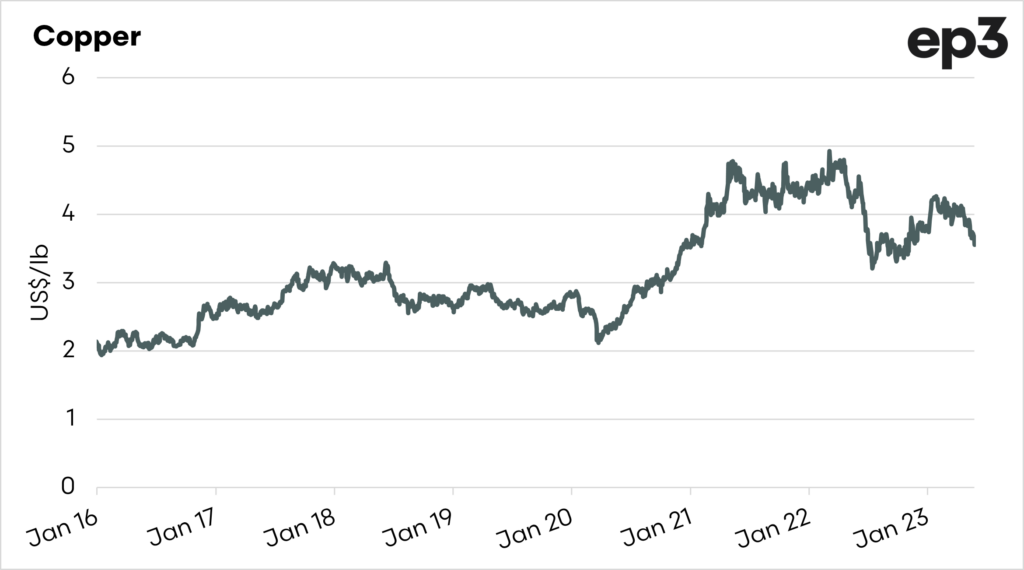

One of the commodities thought of as a lead economic indicator is copper. It has long been established that copper performance provides an insight into the performance of the general economy. This is due to its use in many industrial and electrical processes.

If the copper market is rallying (increasing), it points to an improving economy and, hopefully, more disposable income.

The copper market has fallen to US$3.55/lb or under US$8000/mt. Whilst this is still higher than pre-covid levels, it is a concern for demand for consumer goods – as copper is used in many industrial processes such as for producing electronics and cars.

What does it mean?

One of the commodities thought of as a lead economic indicator is copper. It has long been established that copper performance provides an insight into the performance of the general economy. This is due to its use in many industrial and electrical processes.

If the copper market is rallying (increasing), it points to an improving economy and, hopefully, more disposable income.

The copper market has fallen to US$3.55/lb or under US$8000/mt. Whilst this is still higher than pre-covid levels, it is a concern for demand for consumer goods – as copper is used in many industrial processes such as for producing electronics and cars.