Market Morsel: Australia stuck between two giants.

Market Morsel

At the start of this week, it was announced that the US would apply tariffs to Mexican and Canadian imports unless they fixed their borders. A day later, the tariffs were delayed for a month as both nations agreed to increase border security. However, China has decided to retaliate with tariffs on US products, but will they escalate or will a deal be sought.

There are expectations that China will respond to the potential tariffs with the reintroduction of the phase one deal, which was introduced in the prior Trump administration.

The Phase One Trade Deal between the United States and China, signed in January 2020, was a significant step in de-escalating the trade war that had escalated between the two economic giants. One of the most critical aspects of this agreement was China’s commitment to purchase an additional $200 billion worth of American goods and services over two years, compared to 2017 levels.

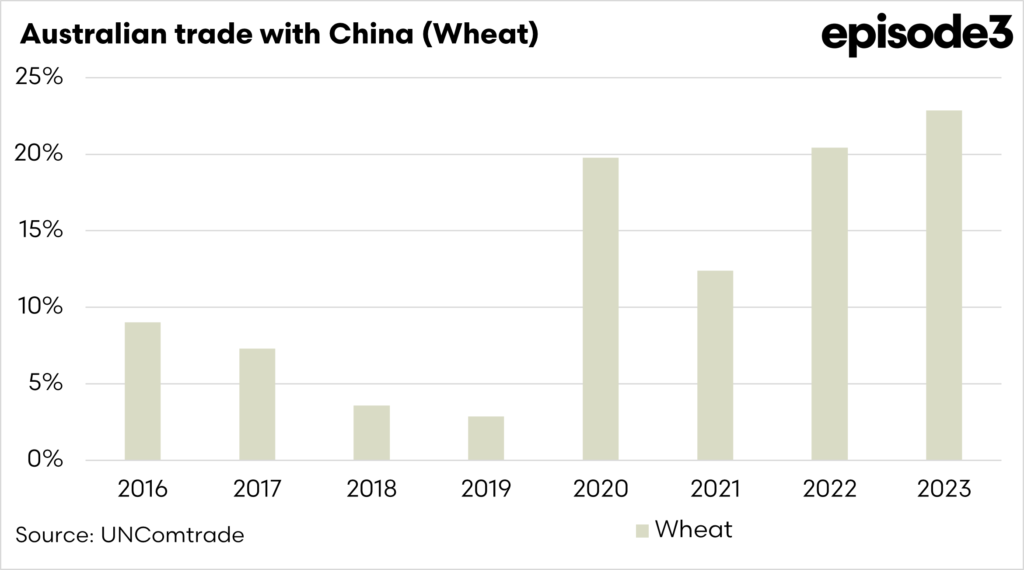

Of this, $32 billion was earmarked for agricultural commodities, including soybeans, corn, wheat, pork, and beef. This commitment was designed to benefit American farmers, who had been significantly affected by retaliatory Chinese tariffs during the height of the trade war. In return, the US agreed to reduce some tariffs and suspend new ones, while China promised structural reforms in areas such as intellectual property, technology transfer, and currency practices.

At the time of the introduction of the phase one deal, we were concerned that this trade deal would discourage Australian purchases. We examined the products which we believed, based on the numbers, were at risk of being replaced by US product The most worrisome commodities were:

- Wood products

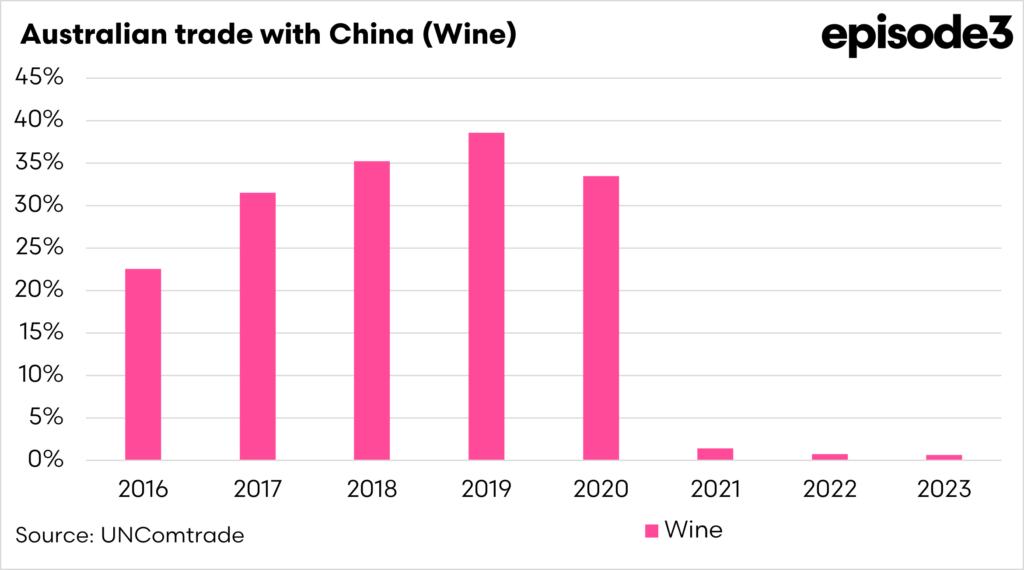

- Wine

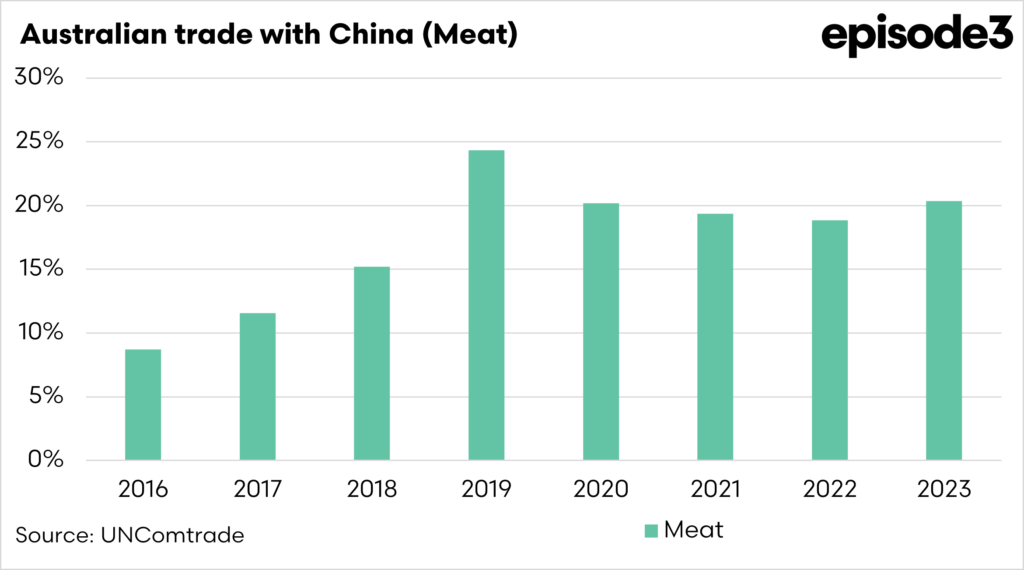

- Beef

- Milk

- Almonds

- Crustaceans

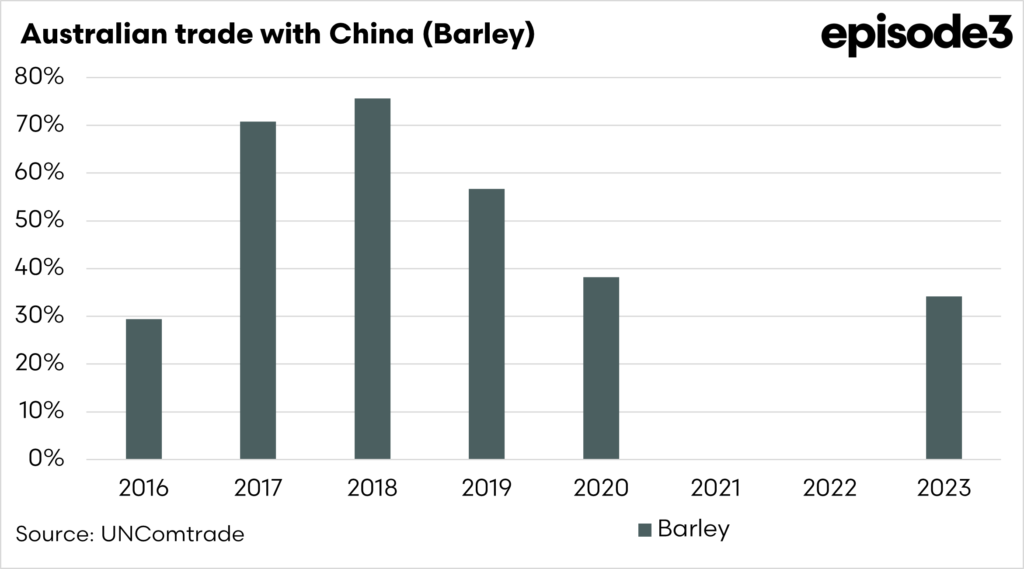

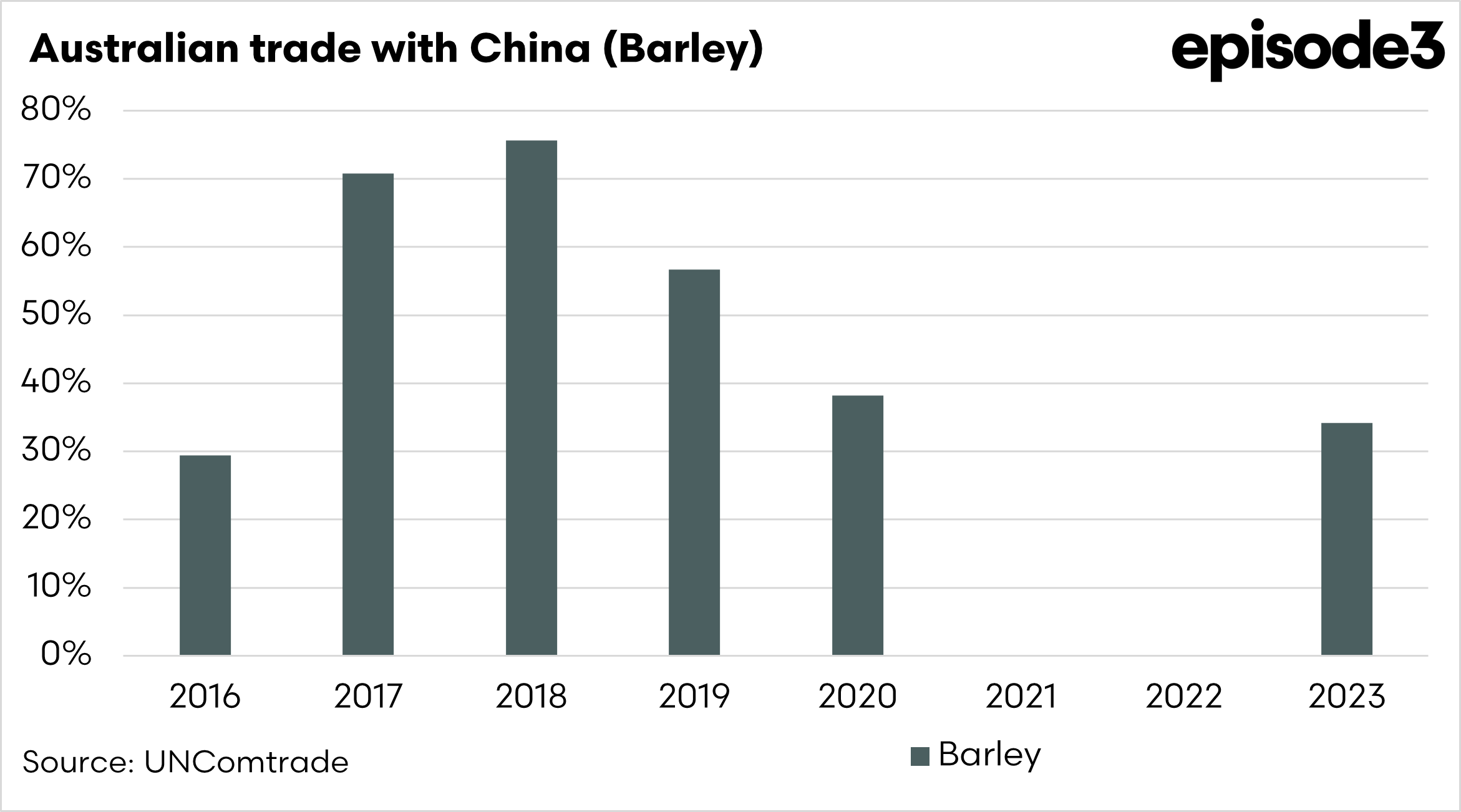

- Barley

- Skins

- Malt extract

Of these commodities, wood, wine, beef, crustaceans and barley had major issues in China during that time.

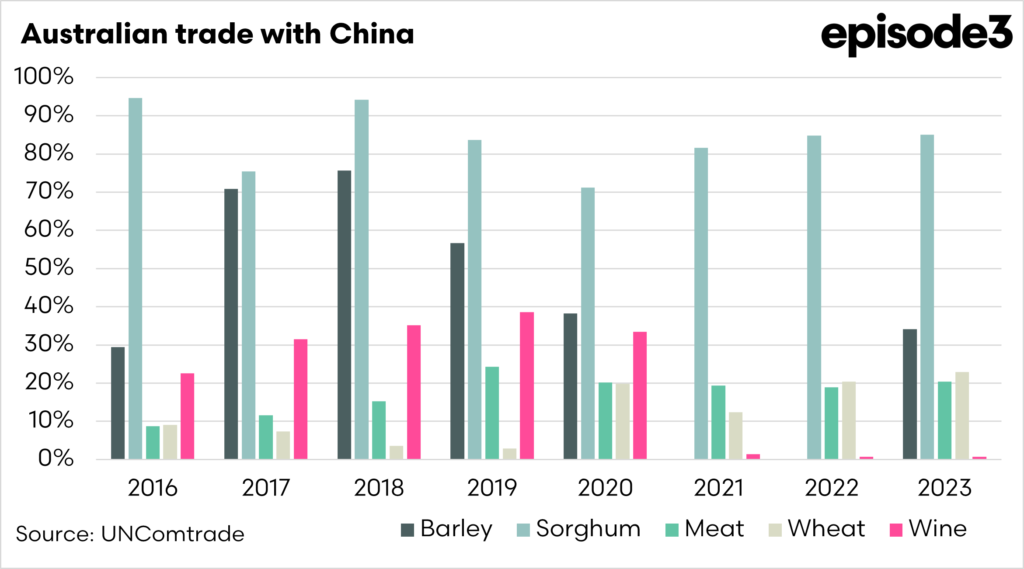

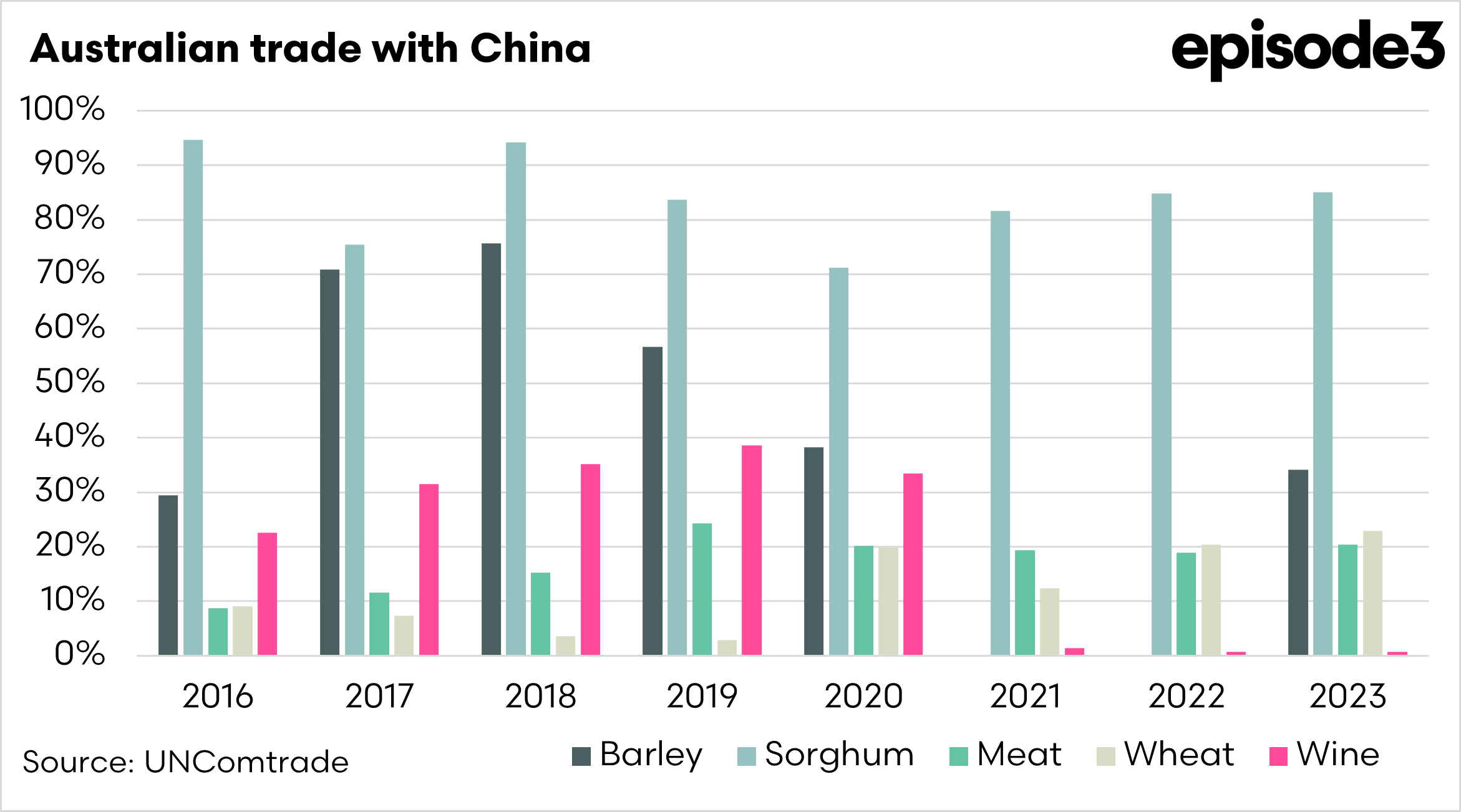

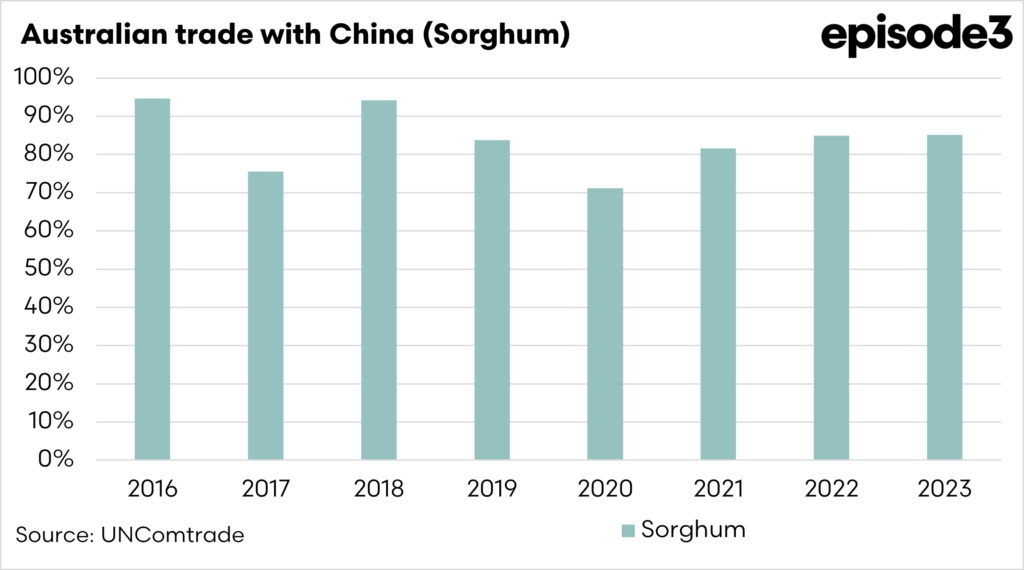

I have placed a few charts below. In these charts, I have selected five commodities in which we trade significant volumes into China, or at least have historically.