Market Morsel: Enjoy your easter egg – whilst they are cheap.

Market Morsel

It’s the easter long weekend, and on Sunday, many of us will be waking up to easter eggs. Next year, they might be a little more costly.

The cocoa market is much like our grain markets; it has a physical and a futures market. The driving force of cocoa pricing is the same as any other market, it is supply and demand.

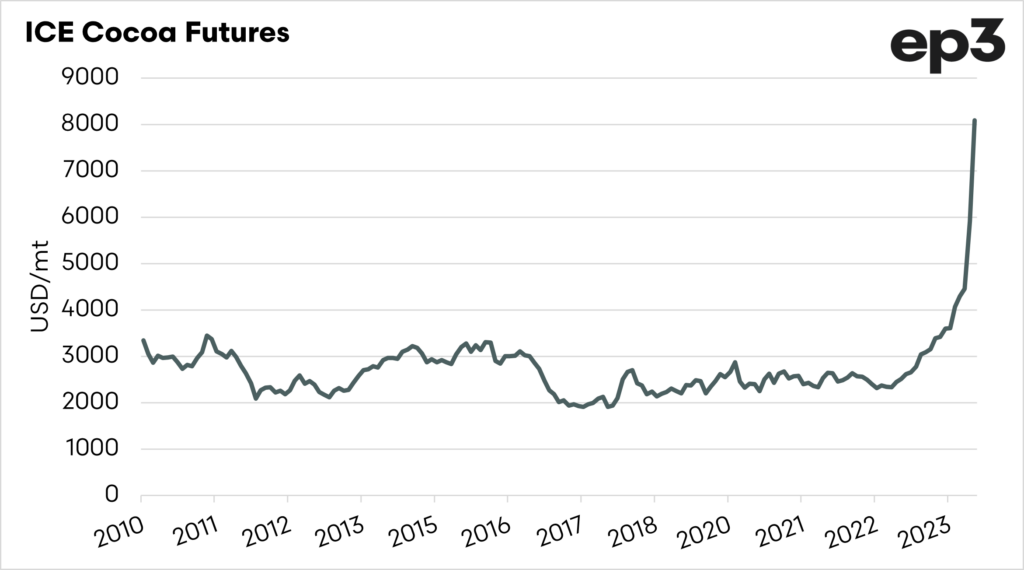

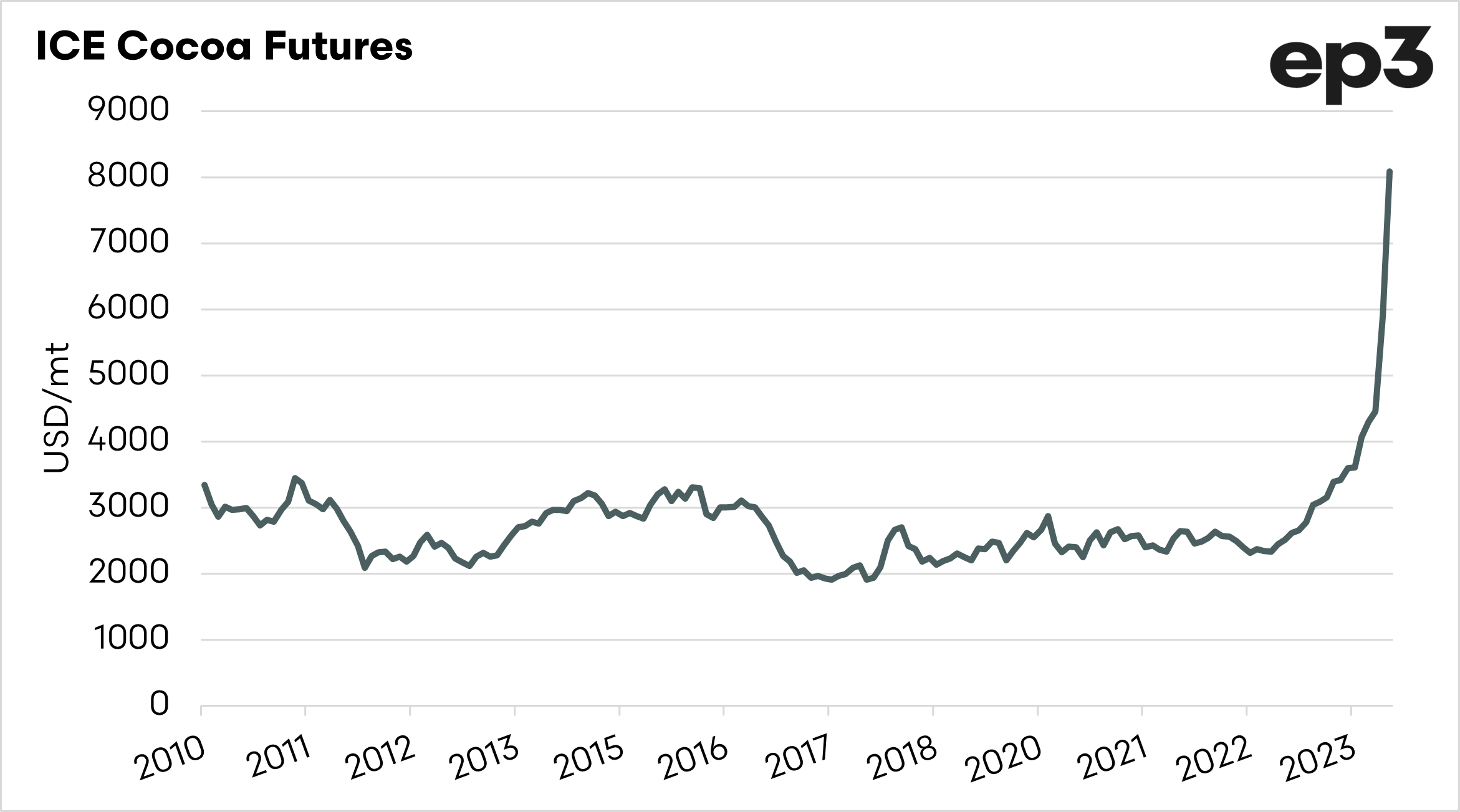

The chart below shows ICE cocoa futures from 2010 to the present (monthly average). The rise has been quite astronomical, from US$4456/t in January to US$8090/t in April.

So what is causing this huge increase in price? Are people eating more chocolate?

Two of the major cocoa-growing nations are, Ivory Coast and Ghana, are having major issues with production, and it’s varied:

- Illegal gold mining has seen cocoa plantations bulldozed

- Disease (Swollen shoot) has seen yields drop, and ultimately trees die.

- Expectations of suitable growing area to decline in Ivory coast due to changing climates.

When I look at charts like this, you think it’s a little top-heavy, and it probably is. High prices are the cure for high prices after all. The issue is that cocoa trees take around 5 years to become productive, so it’s not like grain and oilseeds, where farmers can quickly react to price incentives.

Should we be growing more cocoa in Australia? The problem is that cocoa requires a very specific growing environment, and northern Queensland is the only area conducive to production.

It will be interesting to see the impact that this increase on cocoa pricing has on retail pricing for our chocolate bars. Cocoa, like barley or wheat, is a small part of the overall cost of the end food product, with marketing and distribution being huge elements.

If wheat or barley prices increase, it shouldn’t have a massive impact on the price of bread or beer. Will the same apply with cocoa?