Oh, for foods sake

The Snapshot

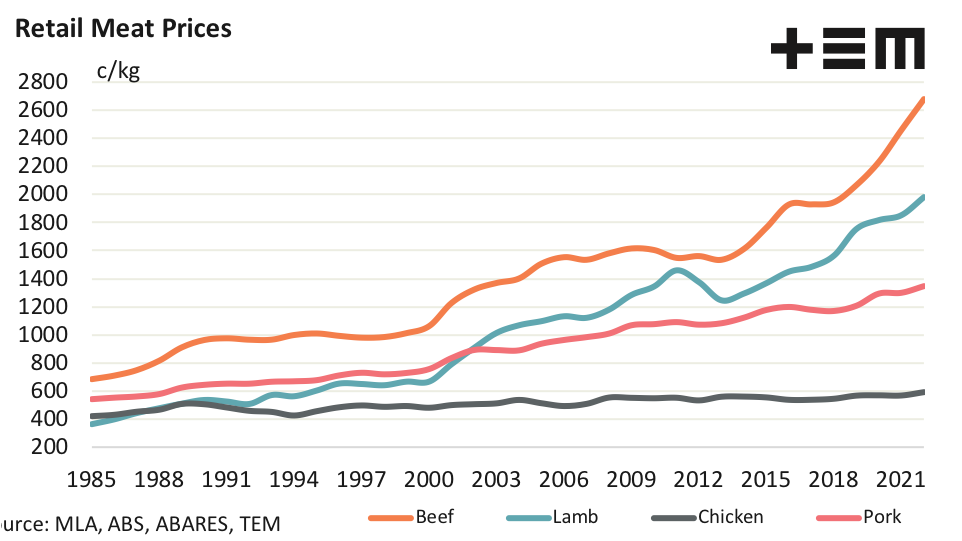

- The first quarter CPI for March 2022 shows retail beef now sits at an average price of $26.76/kg, retail lamb is at $19.83/kg, pork at $13.48/kg and chicken comes in at $5.89/kg.

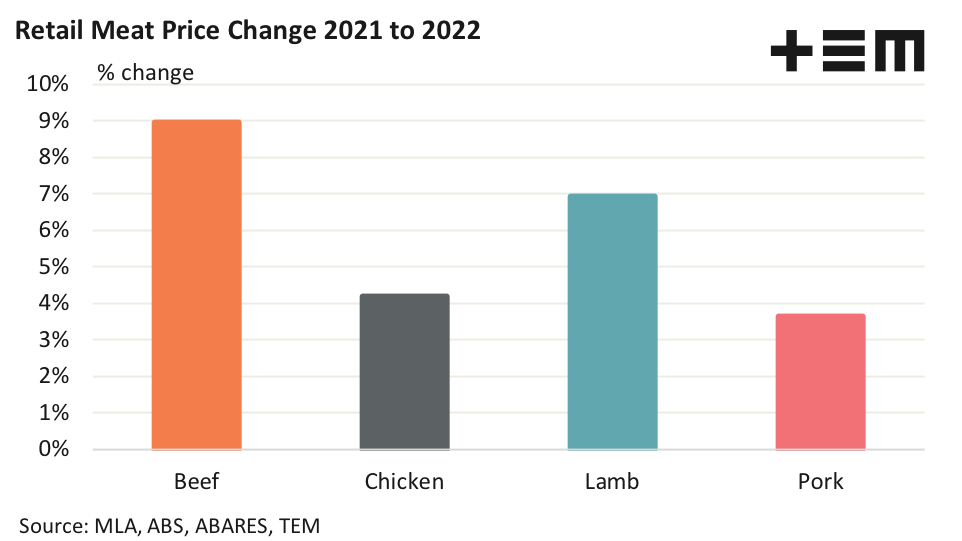

- Current beef prices have gained nearly 9% from 2021 levels and lamb has managed a lift of almost 7%.

- Chicken prices have increased 4.2% from last year and pork has been the most resilient to inflationary pressures, up by just 3.6%.

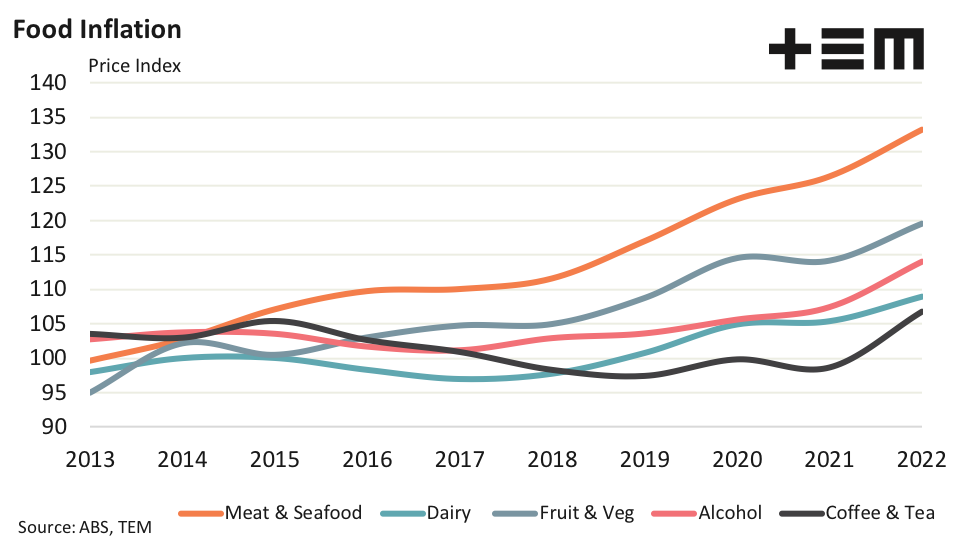

- The meat & seafood CPI category has increased by more than a third from levels seen in 2013.

The Detail

The first quarter Consumer Price Index (CPI) data was released today for 2022 and it highlights some strong price gains across multiple food and drink categories. In the retail meat segment all four main meat items of beef, lamb, chicken and pork have seen increases to retail price levels from 2021 values. Last year retail beef averaged prices of $24.56 per kilogram. Meanwhile it’s red meat competitor, lamb, was averaging retail prices at $18.54/kg. In the white meat space, pork prices averaged $13.01/kg in 2021 and chicken was the value buyers choice at an average retail price of just $5.65/kg.

The first quarter CPI for March 2022 shows retail beef now sits at an average price of $26.76/kg, retail lamb is at $19.83/kg, pork at $13.48/kg and chicken comes in at $5.89/kg.

A percentage change comparison from this year’s pricing to last season highlights that beef is leading the way higher in the meat sector. Current beef prices have gained nearly 9% from 2021 levels and lamb has managed a lift of almost 7%. Chicken prices have increased 4.2% from last year and pork has been the most resilient to inflationary pressures, up by just 3.6%.

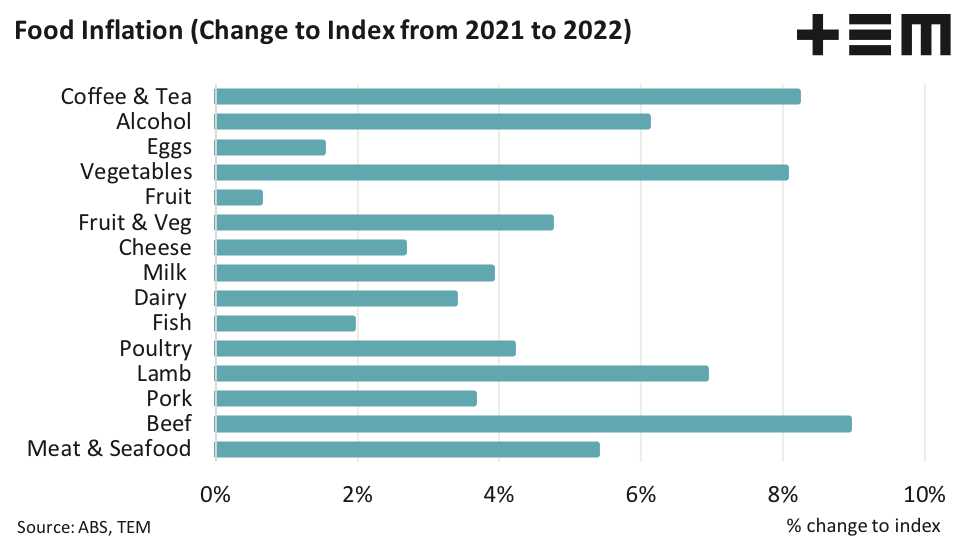

A selection of other food and beverage price indicators shows that meat products have been exhibiting the most inflationary pressures over the last decade. The meat & seafood category has increased by more than a third from levels seen in 2013. Fruit & vegetables have also shown significant price pressure with the index lifting by just over a quarter over the last decade.

Alcohol prices were relatively stable through the first half of the last decade, but the index has lifted by about 15% in the past five years. Meanwhile dairy and coffee/tea had been exhibiting a deflationary trend for much of the last decade. Dairy has seen some price gains since 2018 and coffee/tea has seen most of the price increase over the last decade occurring during the 2021 to 2022 season.

The Coffee & Tea category saw an 8.2% increase in the index from 2021 to 2022, which rivals the strong inflationary pressures exhibited by beef (8.9% increase) and vegetables (8% increase).