Post Covid Food Inflation

Market Morsel

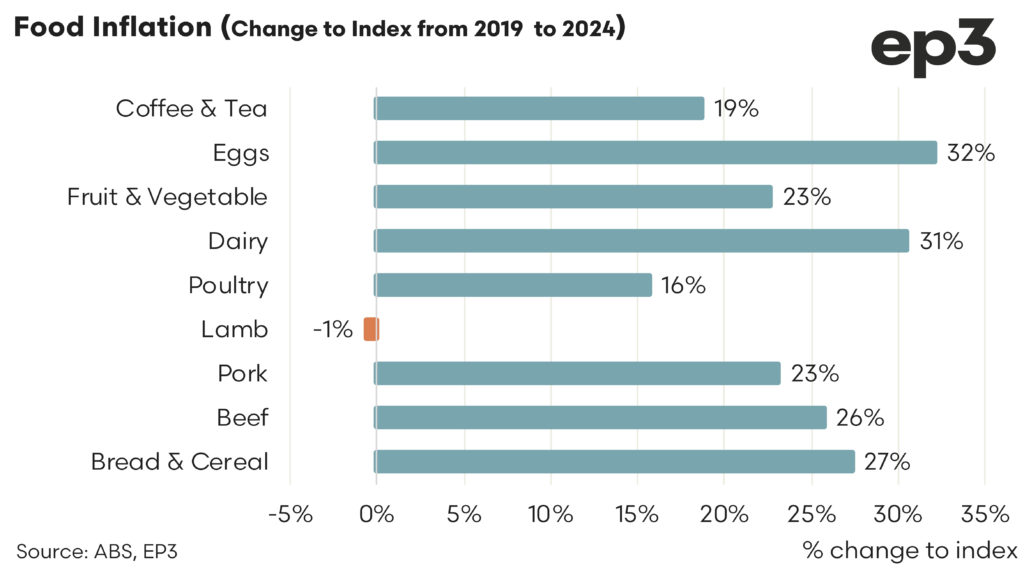

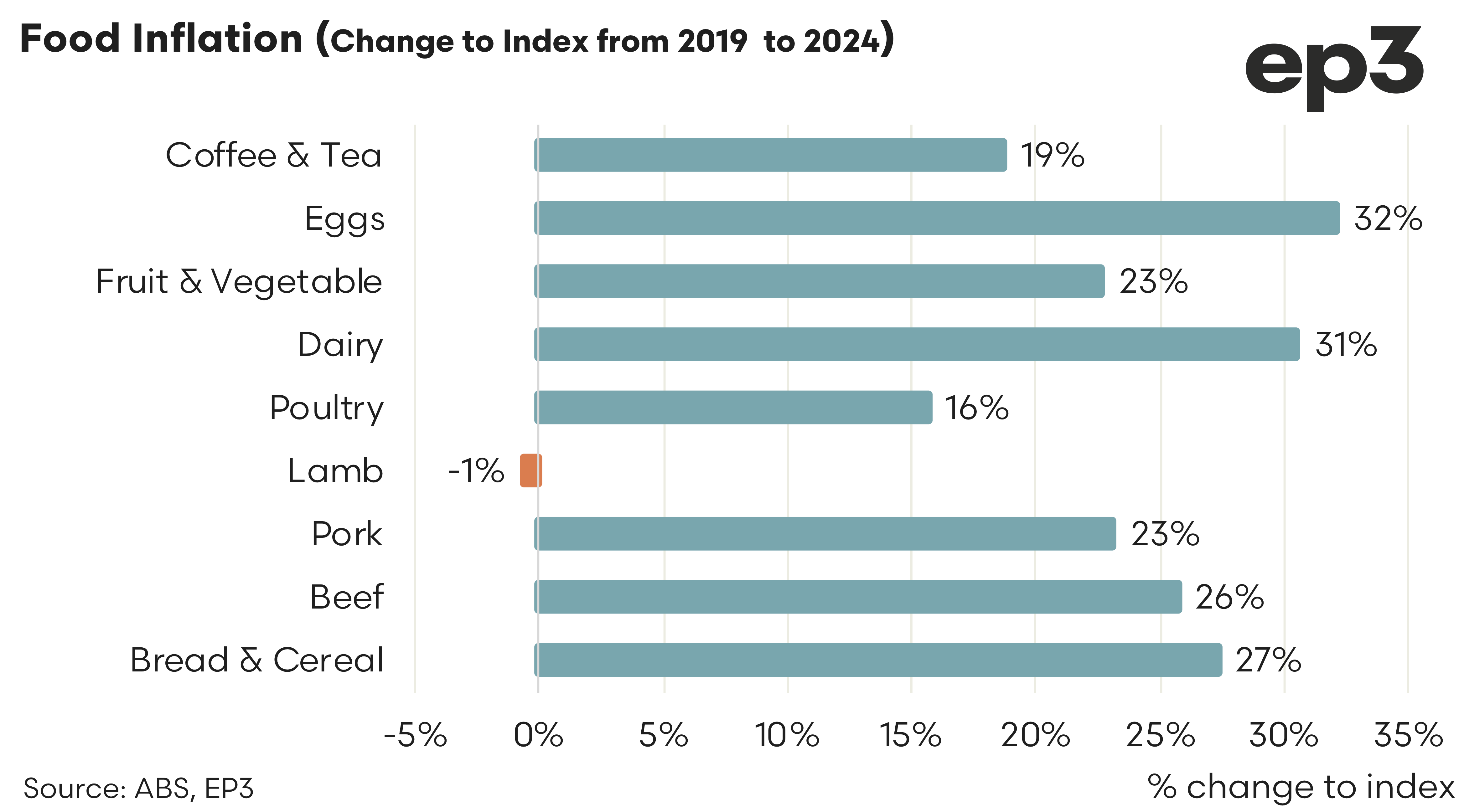

A request from ABC Country Hour Victoria host, Warwick Long, to take a look at food inflation from pre to post Covid returned some interesting price trends. Quarterly consumer price index data from the Australian Bureau of Statistics (ABS) as used to measure price changes from the June 2019 quarter to the June 2024 quarter.

The Eggs category have seen the most price growth over the last five years with prices rising by 32%, on average, across the country. The rising egg prices in Australia from 2019 to 2024 can be attributed to several factors. Higher feed grain costs, particularly due to increased international grain prices, significantly impacted production expenses. The COVID-19 pandemic further strained supply chains, labour availability, and spiked consumer demand, leading to price hikes. Shifts toward more sustainable and ethical farming practices, such as free-range and organic egg production, added to costs, as did regulatory changes enforcing stricter animal welfare standards. In more recent times outbreaks of avian flu and biosecurity threats have increased costs for producers and reduced supply, leading to shortages in some supermarkets.

Dairy has also seen a significant lift in pricing following closely behind Eggs with a 31% lift since 2019. Australian milk production has fallen by nearly 20% over the last decade and by about 8% since 2019 so it seems a picture of tightening supply and increased demand underpinning the firm increase to dairy prices over the last five years.

In terms of meat pricing there have been some curious results. Beef and pork pricing have demonstrated the strongest inflationary pressures with price gains of 26% and 23%, respectively. Poultry, has continued to leverage off its production efficiency gains and has delivered just 16% worth of inflationary pressures to the consumer. However, the biggest surprise was lamb prices at the retail level which has been the only category to record a deflationary trend over the last five year, albeit marginal. Compared to June 2019 the current average retail lamb prices, as per the June 2024 CPI data, is 1% softer.